HAPPY THURSDAY TO THE STREET.

Another week, another “historic” trade truce. President Trump and China’s Xi Jinping agreed to a year-long cooling-off period on rare earths and tariffs. China gets breathing room, the US gets soybeans, and investors get whiplash.

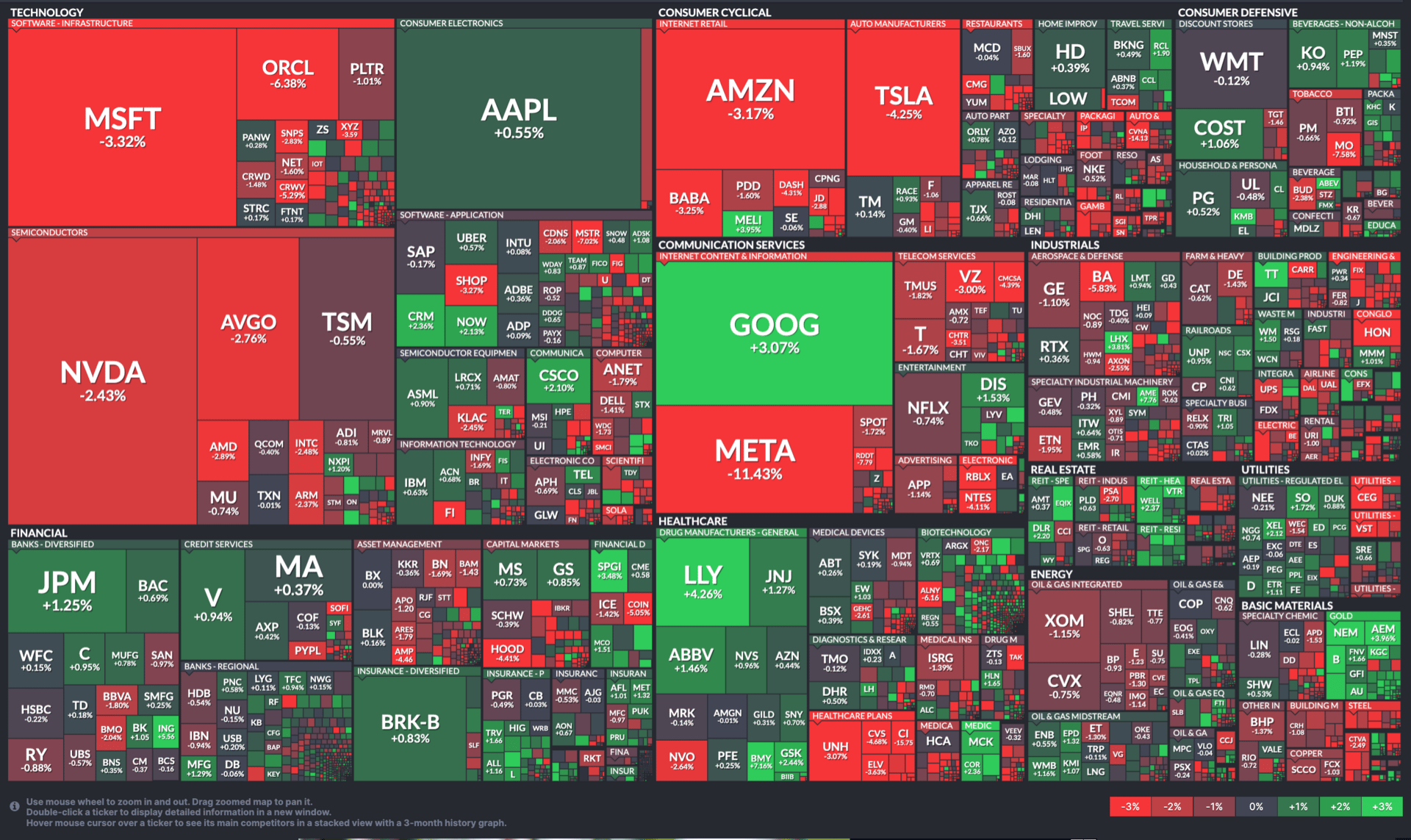

🟥 | US stocks fell as investors digested Big Tech earnings and the Trump–Xi meeting wrapped, with growth names leading declines.

📈 | One Notable Gainer: Metsera $MTSR ( ▼ 0.35% ) jumped after receiving a takeover offer from Novo Nordisk $NVO ( ▼ 2.13% ).

📉 | One Notable Decliner: Meta $META ( ▲ 1.69% ) fell after boosting its AI-related capital spending forecast, overshadowing stronger Q3 results.

Plus, a storm is gathering for global trade. Scroll down for more.

— Brooks & Cas

Presented by Venture Trader

A 25-year market quant’s AI model just flipped a switch inside the market — where early money is flooding a sector no one is talking about.

More importantly, it shows how AI is redefining market edges — giving everyday investors the speed to spot new rotations as they happen.

Trained on decades of market data, this new “genetic AI” evolves thousands of trading rules until only the strongest survive.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

CARVANA, MICROSOFT, EBAY

Carvana $CVNA ( ▲ 1.15% ) reported net income below analyst expectations.

Microsoft’s $MSFT ( ▼ 0.31% ) CFO said capital spending will accelerate this fiscal year.

eBay $EBAY ( ▲ 3.92% ) issued weak Q4 guidance following an earnings beat.

Eli Lilly $LLY ( ▼ 1.34% ) topped estimates and raised its full-year revenue outlook.

Chipotle $CMG ( ▼ 1.13% ) cut its same-store sales forecast for the third straight quarter.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

Nomura raised ASE Technology $ASX ( ▲ 3.37% ) to Buy

DZ Bank upgraded Mondelez $MDLZ ( ▲ 0.27% ) to Buy from Sell

Telsey Advisory Group lifted Steven Madden $SHOO ( ▲ 1.89% ) to Outperform

📉 Downgrades

Argus cut Fiserv $FI ( ▼ 0.1% ) to Hold

Barclays lowered FMC $FMC ( ▼ 1.62% ) to Equal Weight

Barclays downgraded Avantor $AVTR ( ▼ 1.95% ) to Equal Weight

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

PANDEMIC DARLING TO VALUE PLAY

A Safer Kind of Tech Story

According to Wall Street veteran Michael Khouw, Zoom Video Communications $ZM ( ▼ 0.74% ) has transformed from one of Wall Street’s riskier trades to a balance-sheet powerhouse.

The company’s latest quarter showed 4.7% year-over-year revenue growth — its best in nearly three years — and adjusted EPS of $1.53, up 39% from a year ago. Free cash flow climbed to $508 million, with margins north of 40%.

Zoom’s pandemic hypergrowth days may be gone. But Khouw says the company that remains is a hybrid-work essential — steady, profitable, and undervalued.

The Cash Cushion

The legendary trader says Zoom’s transformation lies in its mix.

Enterprise clients now make up more than 60% of total revenue, giving Zoom a stickier and more profitable customer base. At roughly 12x estimated operating income, the stock trades at a valuation more typical of a utility than a tech firm.

Meanwhile, with roughly 30% of its market cap in net cash, each share effectively carries a built-in safety net. If shares were to revisit their $66 lows from April, that cash backing would jump to nearly 38%, per Khouw.

Zoom is projected to hold about $8 billion in net cash by year-end, giving investors downside protection few tech names can match.

Beyond the Buzz

That balance-sheet strength also reshapes Zoom’s options pricing: downside puts are less risky and cheaper to sell. Khouw argues that this makes Zoom an appealing vehicle for income-oriented investors through covered-put strategies.

Zoom may never reclaim its 2020 hype. According to Khouw, that’s a bug, not a feature. The hybrid-work economy isn’t going anywhere — and neither is Zoom’s cash flow.

Presented by Venture Trader

In a head-to-head test against the S&P 500, one AI system outperformed the market by 6X — the creation of a 25-year market quant who taught his model to think like a trader.

This “Genetic AI,” trained on decades of data, pressure-tests thousands of trading rules until only the strongest survive — delivering fewer, smarter setups, cleaner entries, and measurable market edges that separate signal from noise.

OVERHEARD ON THE STREET

MorningStar: Long-term municipal bonds rebounded after months of underperformance, with yields rising to multiyear highs.

Axios: Business lobbies urged Congress to end the 30-day shutdown, warning of lasting economic harm and $3B in weekly losses for small contractors.

CNBC: The average 30-year fixed rate mortgage jumped to 6.33% after the Federal Reserve’s rate cut, as bond markets reacted to hawkish commentary.

Bloomberg: Comcast $CMCSA ( ▼ 0.13% ) lost 104K broadband customers in Q3, its 10th straight quarterly decline.

TechCrunch: Figma $FIG ( ▲ 0.89% ) acquired AI image and video startup Weavy, rebranding it as Figma Weave, with plans to integrate its editing and generation tools.

Join Street Sheet Research

RESEARCH PREVIEW: TRADING THE TIDES

Hurricane-strength headwinds are gathering for global trade. They could potentially leave some of the biggest operators capsized. But those with flexible fleets may be able to weather this storm — and emerge with the wind at their backs.

In our November report, we’ve identified one small-cap stock with disruptive potential. There’s still time to ride this rogue wave before it breaks — but maybe not for long. Our latest monthly Street Sheet Research report drops Saturday, Nov. 1.

WEDNESDAY POLL RESULTS

Which stock do you think will outperform over the next 12 months?

▇▇▇▇▇▇ Magnite $MGNI ( ▲ 0.16% )

▇▇▇▇▇▇ Blend Labs $BLND ( ▼ 1.16% )