HAPPY MONDAY TO THE STREET LEAF.

Canada’s steel industry is struggling under the weight of new US tariffs.

A 50% duty has erased profits on cross-border contracts, leaving producers lobbying for “Buy Canadian” measures in the next federal budget. The sector was already losing ground before the trade dispute, with offshore steel imports rising from 19% to 39% of the domestic market since 2022.

Hard to build a strong economy when every beam gets bent by Washington.

— William D.

Presented by Street Sheet Research

Hurricane-strength headwinds are gathering for global trade. They could potentially leave some of the biggest operators capsized. But those with flexible fleets may be able to weather this storm — and emerge with the wind at their backs.

In our November report, we’ve identified one small-cap stock with disruptive potential. There’s still time to ride this rogue wave before it breaks — but maybe not for long. Unlock our latest monthly Street Sheet Research to act on this institutional-grade information while you can.

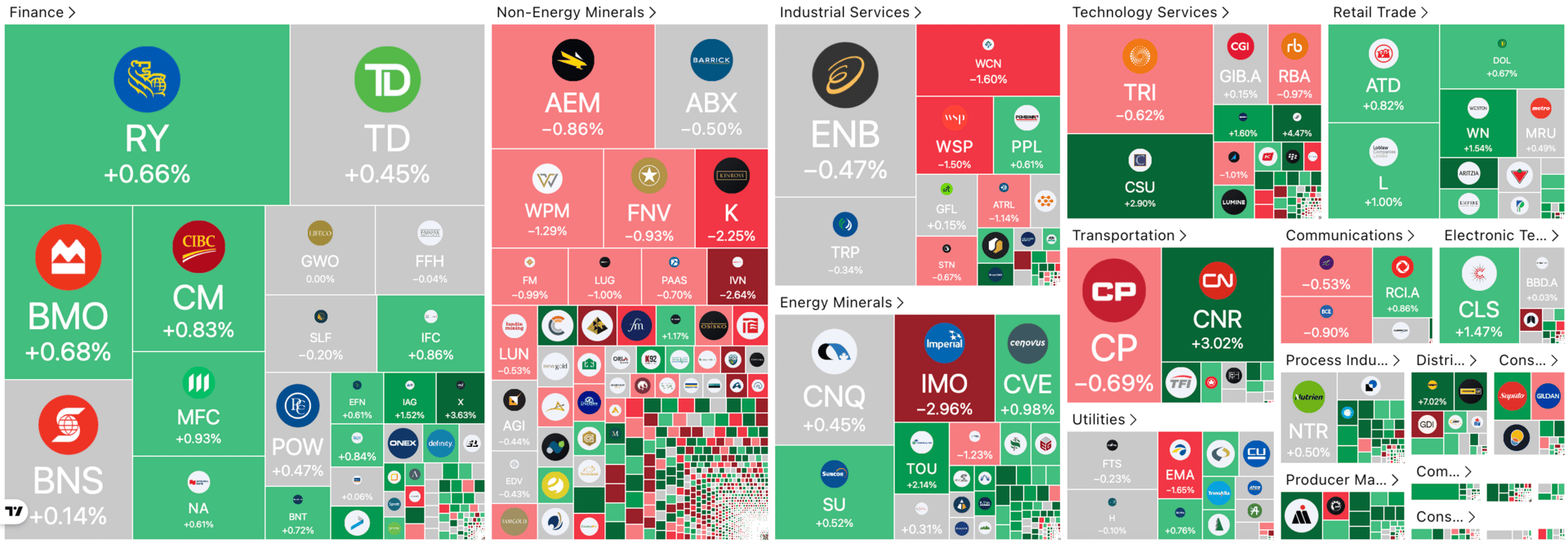

CANADIAN STOCK HEATMAP

Credit: TradingView

OVERHEARD ON BAY STREET

Reuters: The Bank of Canada cut rates 25 bps to 2.25% last week, but signaled it may pause further easing as growth forecasts weaken.

IE: Canada’s GDP fell 0.3% in August, with Q3 growth tracking just 0.4% annualized as droughts, tariffs, and strikes weighed on output.

The Globe & Mail: US President Trump said Canadian PM Mark Carney apologized for Ontario’s anti-tariff ad but ruled out resuming trade talks.

One Trend To Watch

WILL TRUMP BLINK ON TIMBER?

The US imports 40% of the timber its economy consumes, and 32% of its timber comes from Canada, which supplied 28 billion cubic meters to its neighbor in 2024.

President Trump has stated that he intends for the US to import no more than 5% of its timber needs, so even if all of that came from Canada, it would mean an 85% drop in US imports for Canada’s timber industry, which generated $27 billion of Canada’s GDP in 2023 while employing 200,000 workers.

But with 10% of housing costs attributed to timber prices, while shelter price increases account for the lion’s share of inflation, US policymakers may have less leverage than they imagine over Canada’s timber industry.

It’s also possible that US officials, in planning the tariffs on timber, haven’t reckoned with the difference in quality of Canadian and US timber, as Canadian northern pine, being lighter and more springy than US southern pine, is preferred for indoor framing.

Might the US government blink, or even agree to a one-year trade truce, as with China? Given the depressed valuations and high yields many Canadian timber stocks are now offering, it’s a question worth considering.

(Arcadian Timber $ADN.TSX ( ▼ 1.0% ), for example, sports a yield of 7.7%, and a price-to-earnings ratio of just 18.)

Presented by Street Sheet Research

Then you’re missing out. Every Saturday, Street Sheet Research subscribers receive an institutional-quality PDF outlining all the important happenings on Wall Street over the past week — and dozens of potential ways to play them.

This weekend, we covered why eVTOLs may be ready for takeoff, a tech giant’s unsung “second monopoly”, Nvidia’s quantum leap, and much more. The best part? Even if you missed it, it’s not too late.

This Week’s Trade Idea

THE THREE BIGGEST WINNERS IN A LOW-RATE ERA?

TSX Swoons on Rate Cut

The Bank of Canada’s decision to cut rates to 2.25% coincided with the US Federal Reserve’s own rate cut this week — despite the fact that inflation remains on the rise in both countries.

Similar to Fed Chair Jerome Powell’s hawkish turn, BoC Governor Tiff Macklem then signaled that further rate cuts are on hold for now. The Toronto Stock Exchange subsequently faltered in anticipation of less stimulus ahead.

However, for three Canadian stocks, 2.25% rates are low enough, argues analyst Jitendra Parashar.

Three Stocks Could Stand Tall

Parashar pointed to three stocks poised to benefit from falling rates: the Royal Bank of Canada $RY.TSX ( ▲ 0.87% ), Restaurant Brands $QSR.TSX ( ▲ 0.36% ), and Brookfield Asset Management $BAM.A.TSX ( ▲ 27.75% ).

Parashar points to above-average dividend yields ranging from 3.1% to 4.1%, and earnings growth ranging from 9% to 12%, which is defying the lowered growth forecast of 1.2% that the Bank of Canada just issued for 2025.

Specifically, Brookfield Asset Management is playing a key role in major government partnerships and infrastructure project rollouts, and could stand to gain from PM Carney’s $15 billion Canada Growth Fund. In a sign of its strong fundamentals, the company issued a 16% dividend increase last year.

Meanwhile, Restaurant Brand International just grew adjusted earnings by 9%, and could sustain that momentum as cheaper money accelerates consumer spending. The company issued a 7% dividend increase this year.

Dividend Growth to Defeat Inflation?

Finally, Royal Bank of Canada could see greater stability in its earnings from lower funding costs and eased repayment pressure on borrowers.

The bank’s 4.1% dividend yield, meanwhile, may grow even faster than the rate of inflation in the years ahead, given that it’s grown its dividend by 6% a year on average since 2022, and its earnings today are outstripping that.

Which stock do you think will outperform over the next 12 months?

LAST WEEK’S POLL RESULTS

Are you bullish or bearish on Wheaton Precious Metals $WPM ( ▲ 3.47% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish —

“I have been thinking of getting into Precious Metals and Wheaton is an excellent vehicle to do that.”

“Gold is real and not somewhere in a cloud!”