HAPPY MONDAY TO THE STREET.

Two winners, one jackpot, and two very different tax bills.

The $1.8B Powerball prize will be split between Texas and Missouri. The Texas winner will only pay federal taxes. The Missouri winner? Add millions in state taxes.

Never underestimate the importance of the geographic lottery…

🟩 | US stocks rose today, bringing the Nasdaq Composite to a fresh record high, following a slew of tech news and rate cut optimism.

📈 | One Notable Gainer: Applovin $APP ( ▲ 1.62% ) and Robinhood $HOOD ( ▲ 0.61% ) popped on news that they will join the S&P 500, set to take effect before the bell on Monday, Sept. 22.

📉 | One Notable Decliner: Summit Therapeutics $SMMT ( ▲ 0.44% ) plummeted on disappointing phase 3 trial results for its lung cancer drug.

Finally, read to the end for an unexpected credit card killer…

— Brooks & Cas

Sponsored by Pacaso

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, up 89,900%. No wonder thousands are taking the chance on Pacaso.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay also backed Pacaso.

And you can join them as an early-stage investor for just $2.90/share.

Just don’t wait. Pacaso’s opportunity officially ends September 18.

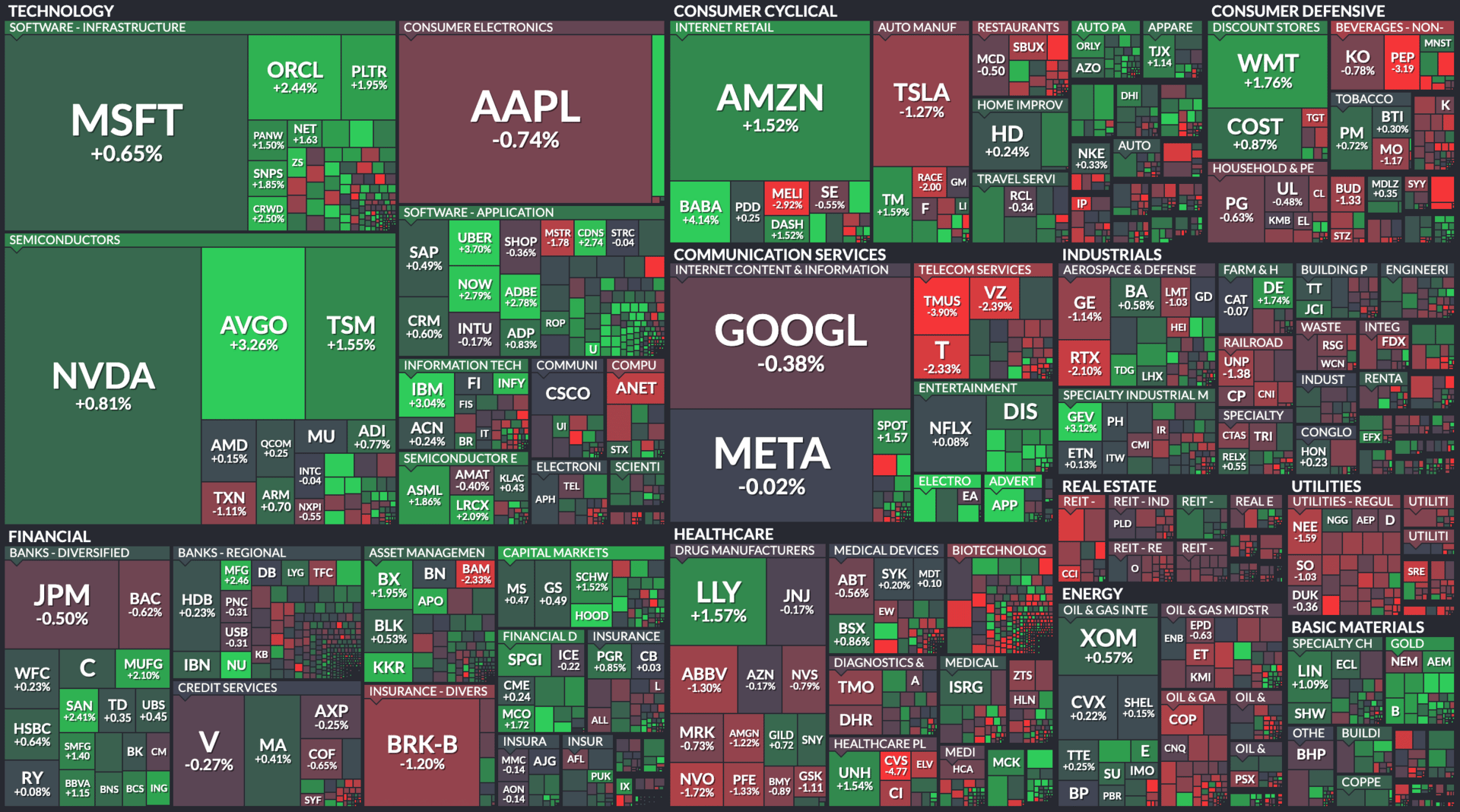

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

ALIBABA, BROADCOM, CVS

$BABA ( ▲ 0.12% ) Alibaba leads $100 million investment in Chinese humanoid robot startup (CNBC)

$AVGO ( ▼ 0.4% ) Broadcom Stock Is Spiking Again. It’s Today’s Top Performer in the S&P 500. (Barron’s)

$CVS ( ▼ 0.82% ) CVS Drops on Investor Worries About Government Ratings (Bloomberg)

$CNK ( ▲ 0.49% ) Cinemark Scares Up Second-Biggest Domestic Horror Film Opening Weekend of All Time with The Conjuring: Last Rites (YF)

$GOOS ( ▲ 0.89% ) Canada Goose Soars 15% As TD Cowen Upgrades Stock To ‘Buy’ On Year-Round Product Strategy (Stocktwits)

OVERHEARD ON THE STREET

AP: The US Supreme Court allowed President Trump to remove a Federal Trade Commission member, pending further Supreme Court review.

Bloomberg: Klarna is reportedly guiding investors that its $1.3B IPO will likely price at or above the $35–$37 range.

CNBC: Elon Musk’s SpaceX agreed to buy $17B in wireless spectrum from EchoStar to expand Starlink’s 5G and direct-to-cell services.

Reuters: China’s Unitree Robotics is preparing an IPO targeting a $7B valuation after global buzz over its humanoid robots.

FT: Stablecoin giant Tether plans to invest in the gold supply chain, sending gold mining stocks Harmony $HMY ( ▲ 3.21% ) and Hecla $HL ( ▲ 5.4% ) higher.

Tomorrow's Trade Idea, Today

VEEVA LA REVOLUCIÓN

A Fresh Upgrade

Veeva Systems $VEEV ( ▼ 1.24% ) is winning new fans on Wall Street. JPMorgan’s Alexei Gogolev upgraded the cloud software provider to Overweight from Neutral, lifting his price target to $330 — about 17% above today’s close.

The analyst cited market share gains, steady revenue growth, and new opportunities from a recently announced partnership. Shares are up more than 34% this year, helped by an August earnings report that topped expectations.

Analysts at UBS $UBS ( ▲ 0.57% ) and Piper Sandler $PIPR ( ▼ 0.11% ) also raised their targets following the results. Most covering the stock now rate it a Buy or Strong Buy, according to LSEG data.

Data, Dollars, and Demand

Veeva focuses on helping life sciences firms manage data and regulatory compliance. Gogolev estimates its total addressable market at $20 billion, with Veeva growing revenue at about 20% annually over the past five years — far faster than the mid-single-digit pace of the broader industry.

Looking ahead, JPMorgan expects revenue growth to average 13% annually over three years, supported by free cash flow margins above 40%. Gogolev pointed to the company’s “competitively differentiated platform” and breadth of offerings as advantages over rivals such as Salesforce $CRM ( ▼ 0.07% ).

Truce Tailwind

A key development is Veeva’s new long-term partnership with clinical research services provider Iqvia $IQV ( ▼ 2.21% ).

The two companies, once locked in legal disputes, will now allow their data and services to interoperate, creating fresh monetization opportunities. JPMorgan said this collaboration, combined with Veeva’s investments in agentic AI, could accelerate growth.

Consensus targets still leave room for upside. The average sits near $313, with the highest at $355. Whether Veeva can keep beating expectations may hinge on how well it capitalizes on its new partnership — and on how long-lived its lead in life sciences cloud software proves to be.

Sponsored by Pacaso

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from Maveron, Greycroft, and more. They even reserved the Nasdaq ticker PCSO.

And you can join them for just $2.90/share. Just don’t wait. Pacaso’s opportunity officially ends September 18.

ON OUR RADAR

Reuters: A New York Fed survey showed Americans see higher job-loss risks, with reemployment odds dropping to the lowest since 2013.

WSJ: Congress received Epstein’s 50th birthday book, containing a letter with Trump’s signature, contradicting his past denials.

Bloomberg: A US immigration raid at Hyundai’s $HYMTF ( ▼ 7.44% ) Georgia battery plant exposed flaws in Trump’s Made-in-USA jobs strategy.

AP: China’s exports rose 4% in August to $322B, slowing from July as US tariffs and trade tensions weighed.

The Verge: Modest design changes at Apple’s $AAPL ( ▲ 1.54% ) iPhone 17 event — slated for tomorrow — could still be enough to attract upgrades from aging device owners.

STREET TWEET

Cash is king?

Even with interest rates set to fall, no one wants more debt right now…

FRIDAY’S POLL RESULTS

Are you bullish or bearish on E.l.f. Beauty $ELF ( ▲ 3.17% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals. Past performance is not indicative of future results. Comparisons to other companies are for informational purposes only and should not imply similar success.

17(b) Disclosure: This message is a paid advertisement for Pacaso. The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Pacaso is a client of Dealmaker who has contracted Tag The Flag LLC dba The Street Sheet. Through Dealmaker, Pacaso agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $10,000 in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.