HAPPY MONDAY TO THE STREET.

6,300. The redline RPM for a General Motors $GM ( ▲ 0.05% ) Atlas engine. The population density per square mile of Hong Kong. The high-range calorie count for a Luther Burger. (Well, kilojoules, not calories, but still.) And, as of today, the S&P 500’s record close.

If it gets much higher, I’m going to have to look for a meal less healthy than a slab of red meat on a donut. Not sure I want to go down that road…

🟩 | US stocks set records once again ahead of a packed week of tech earnings. Both the S&P 500 and Nasdaq Composite closed at ATHs.

📈 | One Notable Gainer: Block $XYZ ( ▲ 0.62% ) surged as the Jack Dorsey-founded digital payment firm prepares to officially join the S&P 500 on Wednesday.

📉 | One Notable Decliner: EQT Corp $EQT ( ▲ 1.22% ), the largest American national gas producer, sold off after its CEO criticized the US’s red tape and predicted China will win the race for AI dominance.

Finally, read to the end for a shocking $7M market catalyst…

— Brooks & Cas

Sponsored by iTrust Capital

Most IRAs are stuck in the past, limited to mutual funds, stocks, and bonds.

Aren’t you supposed to be planning for the future?

With iTrustCapital, your IRA can hold modern assets like crypto and precious metals. The platform lets you invest in over 70 cryptocurrencies, plus physical gold and silver, all within your existing Traditional, Roth, or SEP IRA.

The result? Tax-advantaged growth with a mix of modern and time-tested assets.

If you’ve been curious about crypto but want a secure, long-term strategy, this is your solution. And if you’re nearing retirement, it’s not too late to take advantage of powerful tax benefits that could preserve more of your gains.

A better IRA is here.

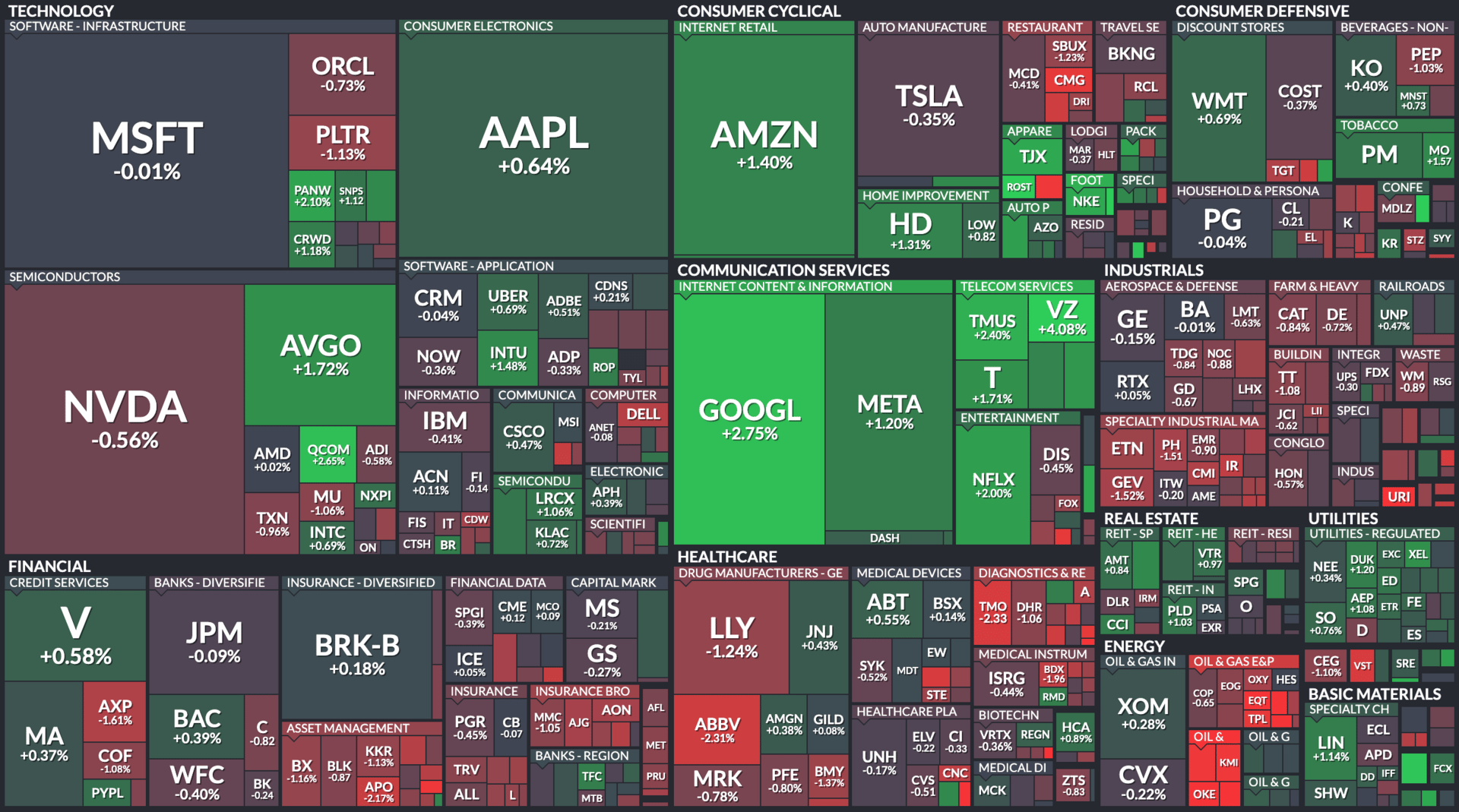

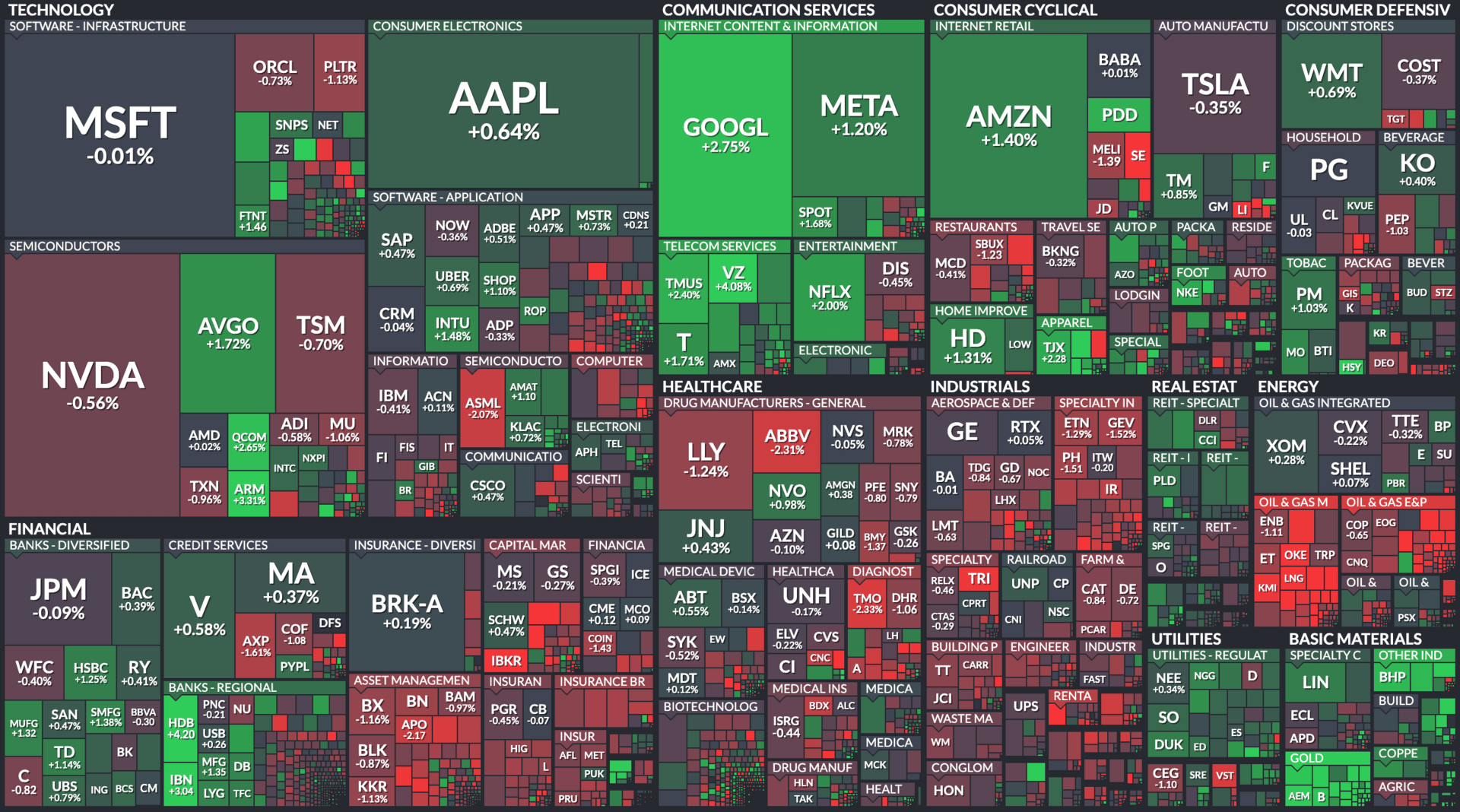

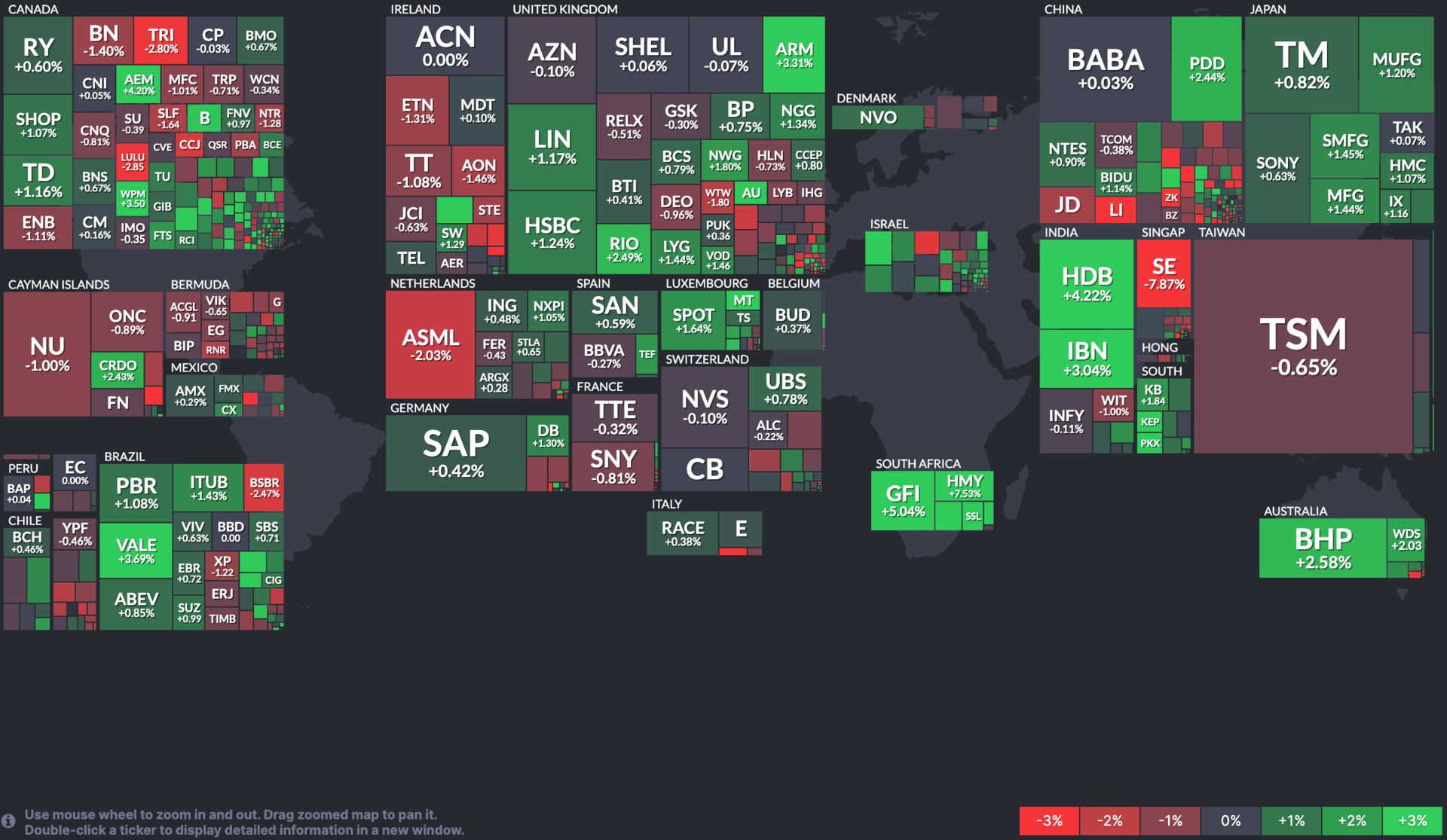

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

CLEVELAND-CLIFFS, SAREPTA, ARROWHEAD

$CLF ( ▲ 3.7% ) Cleveland-Cliffs Loves Trump Tariffs, Puts Up 'For Sale' Sign (IBD)

$SRPT ( ▲ 1.56% ) Sarepta Stock Is Falling. How Its Crisis Went From Bad to Worse. (Barron’s)

$ARWR ( ▼ 0.42% ) Arrowhead hits the skids due to partnership with Sarepta (SeekingAlpha)

$VZ ( ▲ 1.25% ) Verizon boosts annual forecast on demand for premium plans, tax law benefit (CNBC)

$BRKR ( ▼ 1.24% ) Bruker tumbles as preliminary Q2 results show revenue decline (Investing.com)

OVERHEARD ON THE STREET

WSJ: Despite pledging to keep prices low, Amazon $AMZN ( ▲ 2.56% ) raised prices on over 1,200 essentials, while Walmart $WMT ( ▼ 1.51% ) lowered prices on similar goods.

Fortune: Beef prices have surged, with average costs up 9% since January and steak prices rising 12.4% over the past year.

CNBC: Southwest Airlines $LUV ( ▲ 0.02% ) will officially end its open-seating policy on Jan. 27, with seat-assigned tickets available starting July 29.

Bloomberg: The CBO estimates the new GOP budget bill will add $3.4T to US deficits over 10 years.

CNN: Microsoft $MSFT ( ▼ 0.31% ) issued an alert about active zero-day attacks targeting on-premise SharePoint servers.

Tomorrow's Trade Idea, Today

FRESH POWDER, DEEP VALUE

Under-Vail-ued

Vail Resorts $MTN ( ▼ 0.3% ) is still recovering from a rocky few seasons, but analysts think the slope is finally turning.

Mizuho’s $MFG ( ▲ 0.32% ) Ben Chaiken recently gave Vail a Buy rating and a $216 price target, while Truist’s $TFC ( ▲ 1.04% ) Patrick Scholes went higher, setting a Street-high target of $244. That implies nearly 53% upside from current levels.

The ski and leisure giant has lost nearly half its value since 2021, yet analysts say its fundamentals are firming. Net income for fiscal 2025 is expected to land in the $264-$298 million range. That would mark its best year since the pandemic.

Epic Pass Carries the Load

Vail’s flagship Epic Pass program continues to drive dependable revenue, per a Barron’s analysis. The 2025 season saw 2.3 million units sold. That’s slightly below 2024, but nearly double pre-pandemic levels.

Epic Pass now accounts for 64% of total lift revenue, offering price stability and customer retention even during soft snowfall years.

Margins are also on management’s radar. The company recently launched a cost-savings plan, aiming to free up $100 million in annualized efficiencies by the end of fiscal 2026, including $65 million over the next 12 months.

Dividend With Altitude

Barron’s says the stock trades at just 10.4x forward EBITDA, a steep discount to its 10-year average of 17x. Analysts think that could be an opportunity.

The publication points out that Vail Resorts also offers investors a generous dividend, backed by $470 million in forecast free cash flow, which is more than enough to cover the company’s $332 million annual payout.

In other words, whether or not a rally kicks off before ski season, investors are getting paid to wait.

Sponsored by The Rundown AI

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

ON OUR RADAR

AP: A JPMorgan $JPM ( ▲ 0.89% ) study shows more Americans are moving money into investment-yielding accounts like money markets and CDs.

Fortune: Astronomer’s interim CEO broke his silence after replacing Andy Byron amid fallout from the recent viral scandal.

CNBC: Trump Media $DJT ( ▼ 4.35% ) has amassed a $2B bitcoin reserve, making up two-thirds of its liquid assets.

Reuters: The UK and OpenAI signed a strategic partnership to collaborate on AI security and explore investments in British AI infrasture.

WSJ: Despite tariff fears, the US economy is finding its mojo again, with sentiment rising, retail sales beating forecasts, and indexes setting records.

STREET TWEET

What are the odds?

The firm, which enables investors to bet on anything under the sun, is back in the US as the Trump administration adopts a softer stance on regulation.

Thank goodness. Now Americans don’t have to miss out on major market catalysts like the Coldplay kiss cam controversy — which drove a whopping $7M in prediction market bets last week.

FRIDAY’S POLL RESULTS

Are you bullish or bearish on the CoreWeave $CRWV ( ▼ 8.12% ) over the next 12 months?

▇▇▇▇▇⬜ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐻 Bearish —

“Data center build-out is in a bit of a bubble right now. The littler guys will feel the most acute pain.”

“The business model makes no sense. Chips are expensive and are outdated at an incredible rate.”

“Moved up too fast. It will come back to a reasonable price.”