HAPPY MONDAY TO THE STREET LEAF.

Lithium Americas $LAC.TSX ( ▼ 1.9% ) nearly doubled this week, on news that the US government is taking a 5% stake in the company, while taking an additional 5% stake in a joint venture with General Motors $GM ( ▲ 0.05% ), set to establish the biggest lithium source in the Western Hemisphere.

It’s a big deal — but did the bulls take it too far? Canaccord Genuity thinks so. The firm’s latest price target for $LAC implies nearly 50% downside from Friday’s close. Take a look at the fine print, its analysts say. The deal might not be as good for Lithium Americas itself as investors seem to think…

— William D.

Presented by Street Sheet Research

We just released our first-ever premium monthly report: a deep dive into a mega-trend reshaping some of America’s biggest sectors. Subscribers got institutional-quality deep dives into two stocks to watch with this paradigm shift in mind.

If you haven’t joined Street Sheet Research yet, you’re already behind. But it’s not too late to change that. Subscribe today to get this report — your chance to ride a massive wave before it breaks.

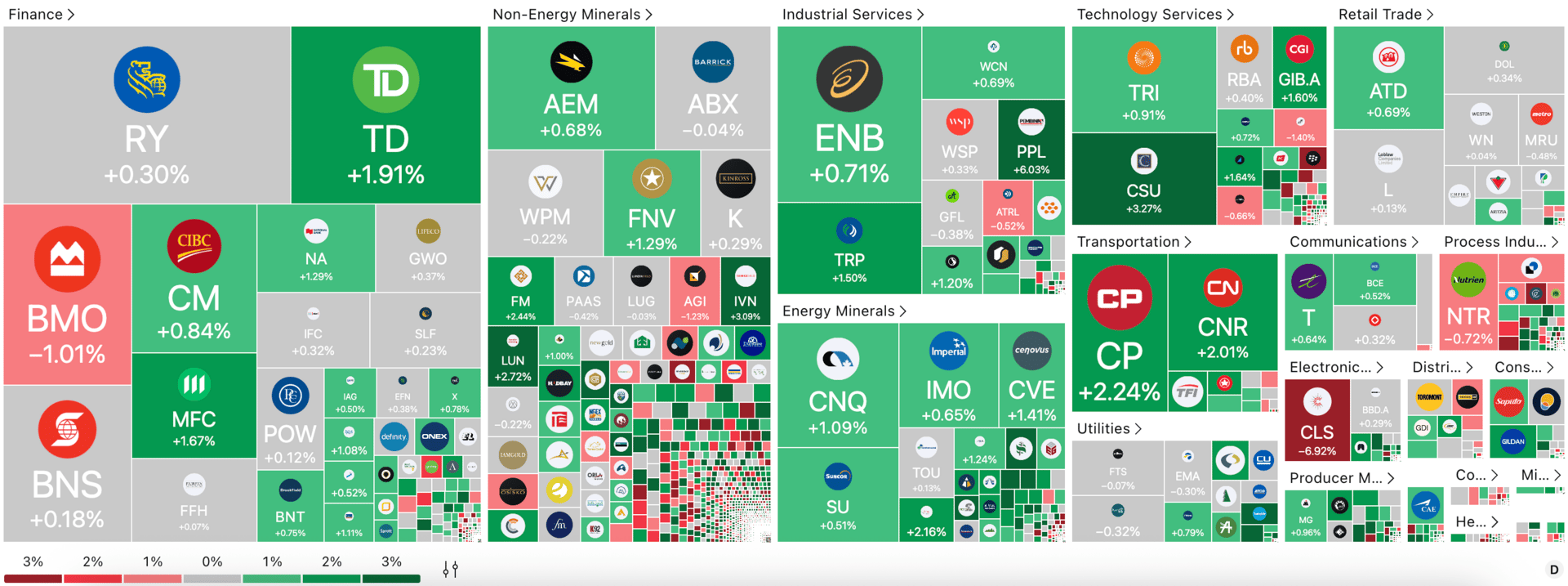

CANADIAN STOCK HEATMAP

Credit: TradingView

OVERHEARD ON BAY STREET

The Globe and Mail: Canadian PM Carney plans a second White House trip to meet US President Trump next week as Canada seeks tariff relief.

YF: Canada Post’s ongoing strike by 55K workers has disrupted small businesses, adding costs and delays as Ottawa pushes major postal reforms.

Bloomberg: Canadian funds increased bets on infrastructure as PM Carney pushes nation-building projects to offset US tariffs and tensions.

IE: Deloitte forecasts Canada will avoid recession in 2025, with 1.3% growth despite US tariffs weighing on manufacturing.

BNN Bloomberg: Trump imposed a 10% tariff on Canadian softwood lumber and a 25% levy on kitchen cabinets and vanities.

One Trend To Watch

CANADIAN STOCKS OUTSHINE AMERICA

Despite signs of a troubled labor market, and the wild card of tariffs, Canada’s stock market outshined America’s over the last quarter.

Morningstar’s Canada Index gained nearly 13% in Q3, compared to a little more than 8% for its US Market Index.

Analysts find the performance striking, given stalling economic growth and rising unemployment. But perhaps the rally can be attributed to low valuations, a boom in precious metals, and a shift to materials and financials, which are heavily weighted on the Toronto Stock Exchange.

There’s also the fact that US stocks are facing headwinds that their Canadian counterparts aren’t. The US government’s challenge to the Federal Reserve’s independence rattled investor confidence in US markets, and the ongoing government shutdown and debt ceiling brinksmanship haven’t helped sentiment.

According to Phillip Peterusson, chief investment strategist at IG Wealth Management, the S&P 500 is falling out of favor after a desire for stability and lower valuations may have “finally put the spotlight on the rest of the world.”

Presented by Street Sheet Research

By 2040, 80 million Americans will be over 65. Healthcare costs are projected to hit $7.2 trillion by 2031.

The numbers don’t lie: the Silver Tsunami is coming. Our inaugural research report broke down exactly why subscribers should be watching $UNH and $LTC as the top stocks poised to ride the wave.

If you’re not a Street Sheet Research subscriber, you didn’t see them. Fix that now while the information is still fresh.

This Week’s Trade Idea

CANADA’S UNSUNG AI PLAY

An AI Play? In Canada?

Few investors associate Canada’s stock market with AI opportunities. Even David Rosenberg, head of the Toronto-based Rosenberg Research, prefaces his bullish Canadian forecasts by saying the nation’s market “might not be an artificial-intelligence play.”

But those traders may be forgetting the lesson from the California Gold Rush, where fortunes were made by selling mining equipment, not looking for gold.

Energy Breakthrough

OpenAI CEO Sam Altman has called for an “energy breakthrough” to meet the energy needs of power-hungry AI data centers.

That potentially leaves a massive opening for Tourmaline Oil $TOU.TSX ( ▼ 0.11% ), the biggest natural gas producer in Canada, and Canadian Natural Resources $CNQ.TSX ( ▼ 0.4% ), an energy stock with a 5.2% dividend, which could look even more enticing if interest rates continue to fall as expected.

Income and Growth at Bargain Prices

The 12.75% run for Canadian stocks last quarter makes value plays somewhat harder to find.

But it’s worth noting that Tourmaline and Canadian Natural Resources trade at 11.7x earnings and 11.6x earnings, potentially landing them in the “value play” category, even as they deliver high dividend yields and robust growth.

That makes them well worth a look for any investors interested in a non-tech, pick-and-shovel way to play the Age of AI.

Which stock do you think will outperform over the next 12 months?

LAST WEEK’S POLL RESULTS

Are you bullish or bearish on First Majestic Silver $AG ( ▲ 11.18% ) over the next 12 months?

▇▇▇▇▇▇ 🐻 Bearish

▇▇▇▇▇▇ 🐂 Bullish