HAPPY TUESDAY TO THE STREET.

September gets a bad rap on Wall Street.

Well, for 6 years, The Street Sheet has worked to transform the stock market. So, we may as well try to redeem September, too.

That’s why we’ve chosen Sept. 13 to launch our most ambitious project yet. Secure free, early access here.

🟥 | US stocks tumbled to start the short week, after a federal appeals court found Trump’s tariffs illegal, potentially forcing the US government to refund billions in duties.

📈 | One Notable Gainer: Frontier $FRNT ( ▲ 2.65% ) took off after rival air carrier Spirit $SAVEQ ( ▲ 0.43% ) filed for bankruptcy — again.

📉 | One Notable Decliner: Kraft Heinz $KHC ( ▲ 1.71% ) shares spoiled after the company officially announced its plan to split in two — a move key shareholder Warren Buffett called “disappointing”.

Finally, read to the end for the most cursed 28x return in history…

— Brooks & Cas

Sponsored by Pacaso

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from Maveron, Greycroft, and more. They even reserved the Nasdaq ticker PCSO.

And you can join them for just $2.90/share. Just don’t wait. Pacaso’s opportunity officially ends September 18.

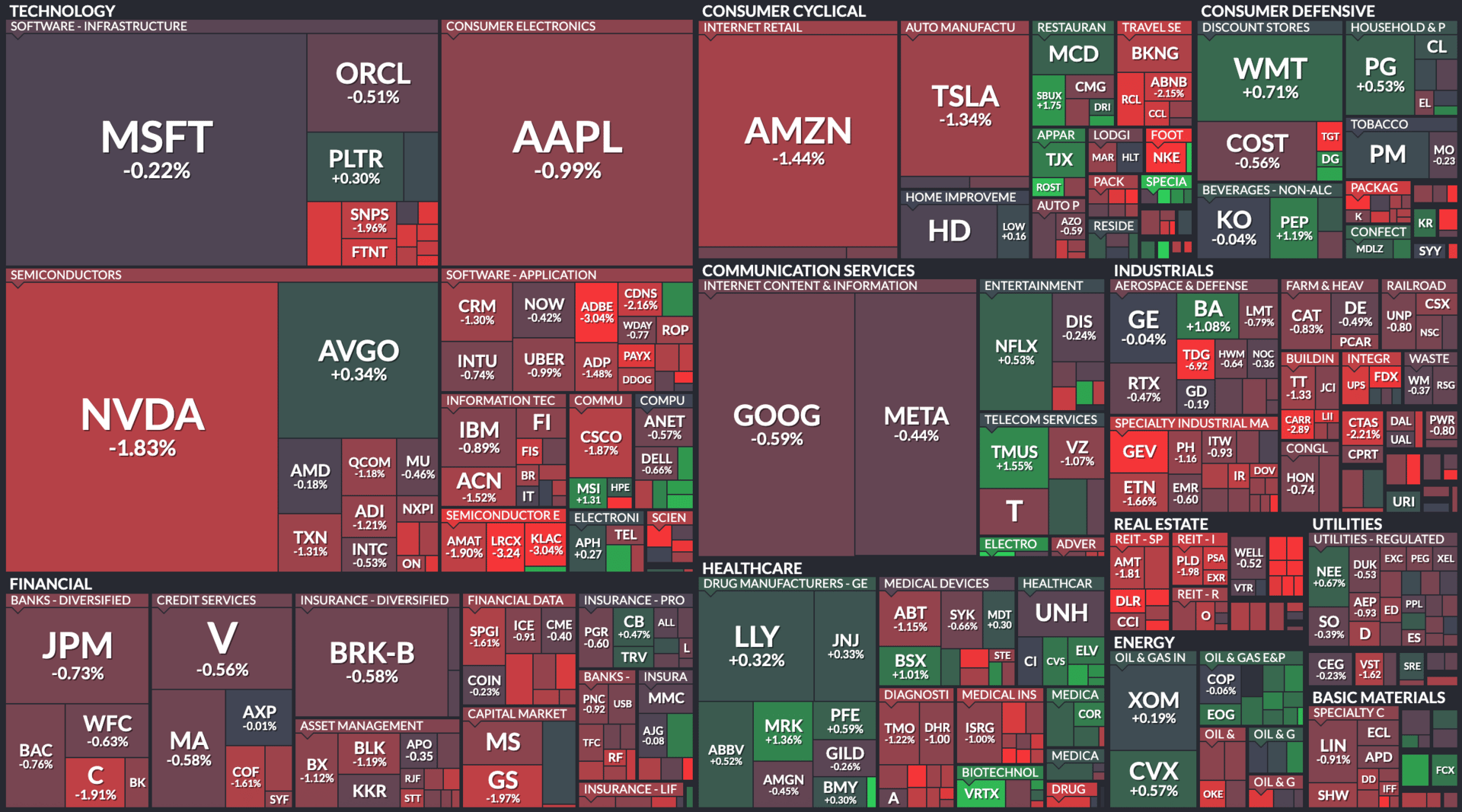

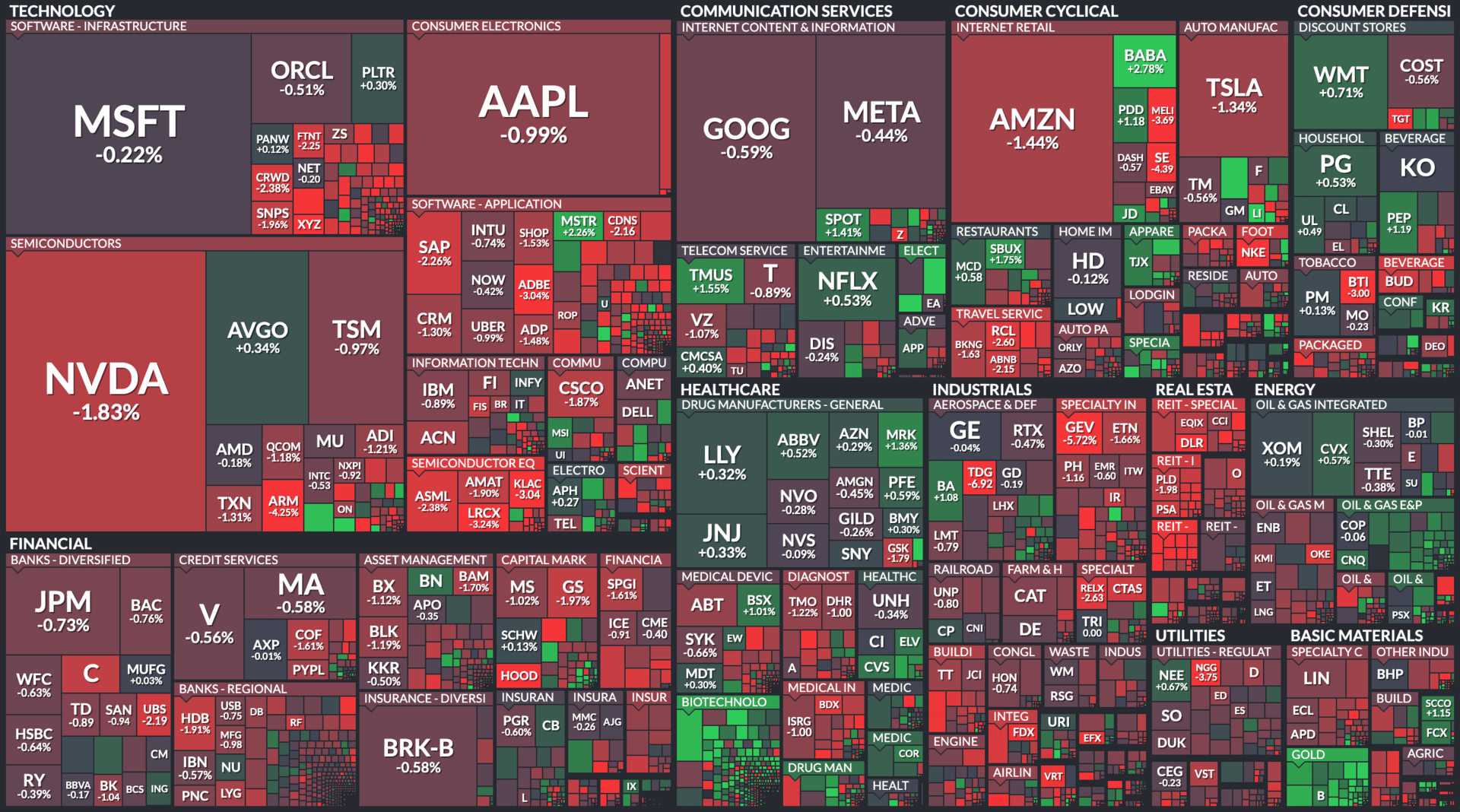

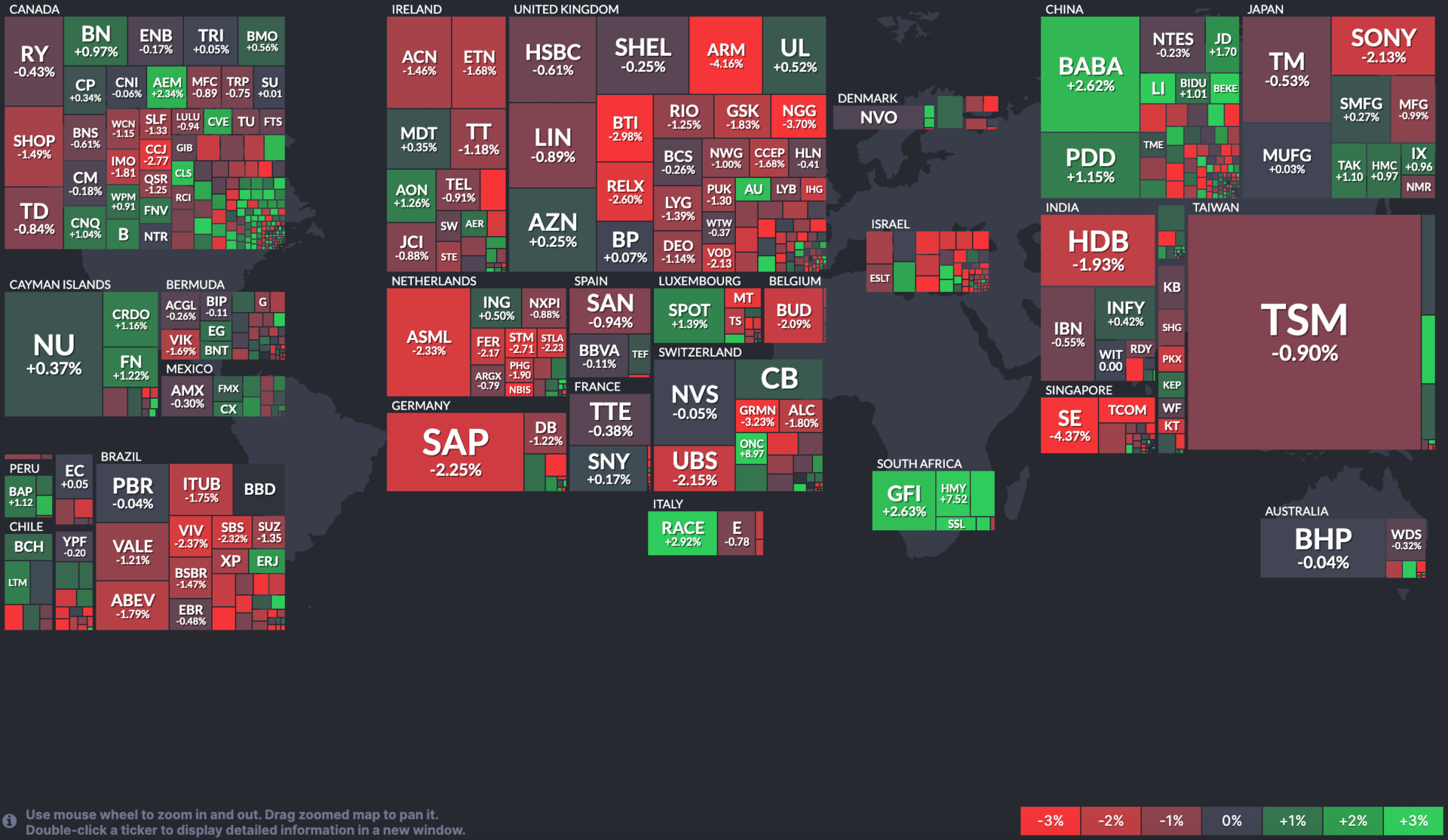

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

CONSTELLATION BRANDS, PEPSICO, NIKE

$STZ ( ▲ 1.15% ) Constellation Brands Cuts Outlook on Weak Beer Demand (WSJ)

$PEP ( ▲ 0.21% ) Pepsi shares jump as activist Elliott takes $4 billion stake, sees ‘historic’ value opportunity (CNBC)

$NKE ( ▼ 0.32% ) Nike to lay off less than 1% of corporate team (Retail Dive)

$UTHR ( ▼ 1.48% ) United Therapeutics posts Tyvaso trial win (SeekingAlpha)

$XYZ ( ▲ 0.62% ) Block, Inc. shares fall after BNP Paribas Exane downgrades to Neutral from Outperform. (AInvest)

OVERHEARD ON THE STREET

Fortune: UBS $UBS ( ▲ 0.57% ) warned of a 93% recession probability based on hard data, projecting a “soggy” US economy ahead.

CNBC: Amazon $AMZN ( ▲ 2.56% ) will end its Prime Invitee Program on Oct. 1, limiting free shipping sharing to same-household members only.

WSJ: Klarna launched its New York IPO, seeking to raise up to $1.5B at a valuation of about $14B.

AP: McDonald’s $MCD ( ▲ 0.65% ) will cut combo meal prices starting Sept. 8, launching $8 Big Mac and $5 Sausage McMuffin deals nationwide.

Reuters: Nestle $NSRGY ( ▼ 0.12% ) fired CEO Laurent Freixe for concealing a workplace romance, deepening its leadership crisis amid weak sales and tariffs.

Tomorrow's Trade Idea, Today

APTIV’S SPLIT DECISION

Splitting the Circuit

Warren Buffett called Kraft Heinz’s split, announced today, “disappointing”. But there’s another major company planning a breakup — and investors may be much less disappointed in its outcome.

Aptiv $APTV ( ▼ 1.11% ) is betting a split will shift how investors view its ineffable stock. The auto-tech firm plans to spin off its electrical-distribution-systems business, allowing the RemainCo to focus solely on safety and software solutions.

Management argues that the separation will let each allocate capital more effectively and pursue growth at its own pace.

Driving New Narratives

Barron’s notes that, despite a broad and diverse business, Aptiv’s stock has struggled to escape the label of a traditional auto-parts supplier. Shares once fetched 36x forward earnings during the EV boom, but today trade closer to 10x. By creating a standalone safety-and-software company with higher margins, Aptiv aims to reset those perceptions.

The planned spinoffs highlight a striking difference in performance. In 2024, electrical distribution brought in $8.3 billion in sales with margins just under 10%, while safety and software generated $12.2 billion with nearly 19% margins. Baird analyst Luke Junk said the split is about “orienting the company toward higher return opportunities overall.”

The new Aptiv will sell sensors, electronics, and communications systems across autos, aerospace, and other industries. It has already pushed beyond cars with its 2022 acquisition of Wind River, a software firm. Post-spin, Barron’s estimates roughly a quarter of its business may be nonautomotive, compared with higher mixes at peers like TE Connectivity $TEL ( ▲ 1.31% ) and Amphenol $APH ( ▼ 0.11% ).

Shifting Perceptions

RBC Capital Markets $RY ( ▲ 1.04% ) analyst Tom Narayan says the auto supply outlook is stronger than feared, and the spinoff could help improve margins through automation and manufacturing changes. He rates the stock Outperform with a $92 target, about 17.5% above today’s close.

Spinoff specialist Jim Osman calls the move “a strategic shift” rather than a corporate shuffle. Whether investors agree may determine whether Aptiv’s shares move closer to triple digits or fall back toward prior lows. As past examples from GE and BorgWarner show, the market’s verdict on breakups often comes with surprises.

Sponsored by Pacaso

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, up 89,900%. No wonder thousands are taking the chance on Pacaso.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay also backed Pacaso.

And you can join them as an early-stage investor for just $2.90/share.

Just don’t wait. Pacaso’s opportunity officially ends September 18.

ON OUR RADAR

CNN: Gold surged to a record $3,509 per ounce as a weaker dollar and expected Fed rate cuts boosted demand.

Bloomberg: Apple’s $AAPL ( ▲ 1.54% ) lead AI robotics researcher left to join Meta $META ( ▲ 1.69% ), marking another high-profile AI talent exit.

WSJ: A federal judge ruled Trump’s deployment of troops in Los Angeles unlawful, citing violations of the Posse Comitatus Act.

Reuters: Disney $DIS ( ▼ 0.4% ) agreed to pay $10M to settle FTC claims it unlawfully allowed children’s data collection on YouTube videos.

BI: Some Silicon Valley technologists are spending savings on bunkers and survival gear, fearing AI could soon threaten humanity.

STREET TWEET

SBF: terrible fiduciary, incredible investor.

A half-billion punt on Anthropic turned into $1.3B for creditors. If he’d held, it’d be $14B+.

Proof you can, simultaneously, be both right and ruinous.

FRIDAY’S POLL RESULTS

Are you bullish or bearish on QXO $QXO ( ▼ 2.59% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “There seems to be a 'building' consensus for support around this stock.”

🐻 Bearish — “Not something I’m interested in.”

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals. Past performance is not indicative of future results. Comparisons to other companies are for informational purposes only and should not imply similar success.

17(b) Disclosure: This message is a paid advertisement for Pacaso. The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Pacaso is a client of Dealmaker who has contracted Tag The Flag LLC dba The Street Sheet. Through Dealmaker, Pacaso agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $10,000 in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.