Happy Monday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

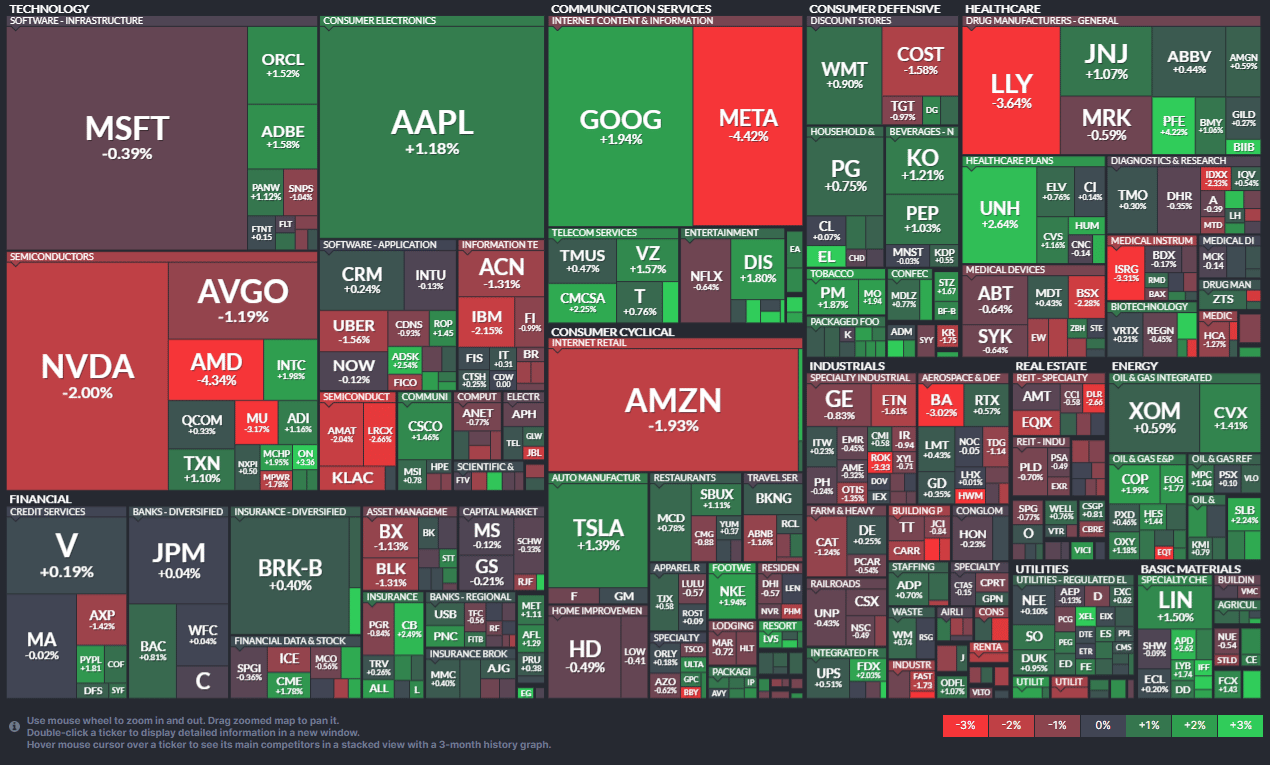

🟥 | US stocks fell slightly on Monday. The S&P 500 and Nasdaq Composite slipped less than 1%, while the Dow flickered around flat. This comes after a losing week for the S&P and Nasdaq that pulled the two indexes off all-time highs.

📈 | One Notable Gainer: Shares of crypto exchange Coinbase surged 4% to the highest since 2021 as Bitcoin broke $72,000. However, Coinbase ended the day down roughly 1% after news broke that the CEO of Ark Invest sold $150M of Coinbase shares.

📉 | One Notable Decliner: Boeing shares dropped 3% amid a spate of plane malfunctions and a recently opened DOJ investigation.

💪 | Tomorrow's Trade: Small but Mighty. Scroll down for more.

S&P 500 Heatmap. Credit: Finviz

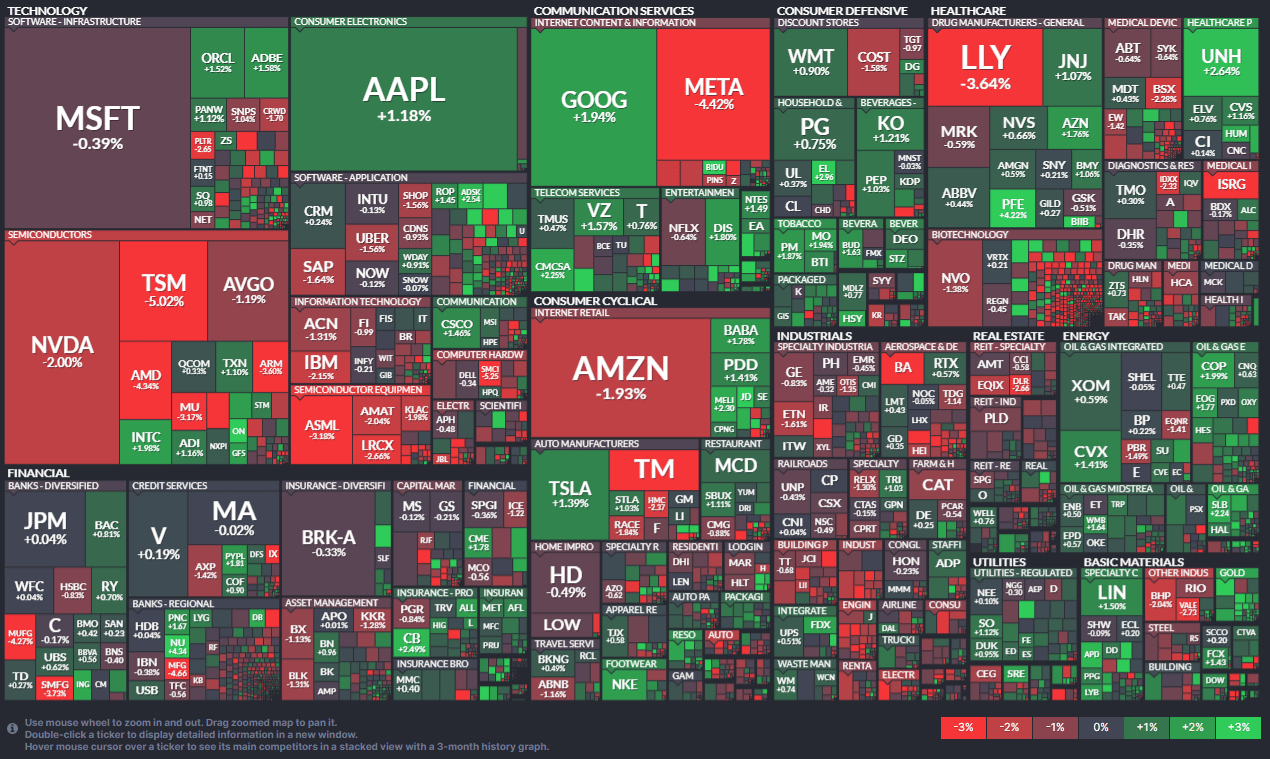

All stocks on US exchanges. Credit: Finviz

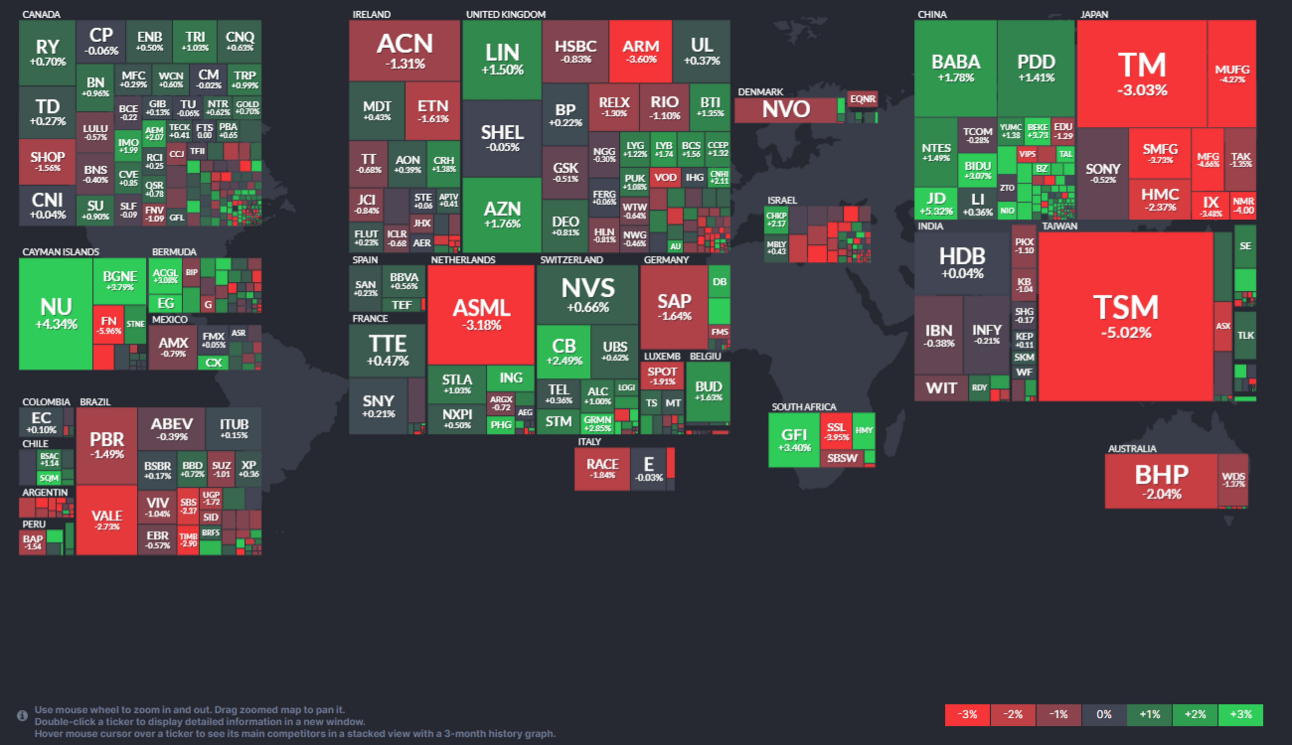

Global ADR snapshot. Credit: Finviz

MARKET MOVERS

BALY (+28%) Shares of casino operator Bally skyrocketed upon news that Standard General offered to buy all outstanding shares for $15/share (WSJ)

META (-4%) Meta’s stock slipped after Trump told a CNBC reporter that he considered Facebook to be “an enemy of the people” (WSJ)

LLY (-4%) Eli Lilly shares dropped despite no corporate-specific news, meaning it’s likely fallout from last week’s FDA delay on its Alzheimer’s drug (BI)

NEM (+4%) Shares of gold producer Newmont Corp have risen after a recent acquisition that made it twice as large as its next closest competitor (YF)

NKE (+2%) Guggenheim analyst lists Nike as a top stock pick, believing its losing streak will come to an end ahead of earnings next week (Barron’s)

POWERED BY CBOE

OVERHEARD ON THE STREET

The Guardian: Bitcoin hits record high above $72,000 as the UK opens the door to crypto exchange-traded products.

CNBC: Lara Rhame, chief US economist at FS Investments, believes markets are probably still too optimistic about the Fed’s ability to cut rates in 2024.

Forbes: Plus, The Consumer Price Index data for February is expected to show relatively high monthly inflation based on nowcast estimates.

Bloomberg: Biden unveiled his $7.3 trillion fiscal 2025 budget proposal that forecasts a rise in US debt from $28 trillion today to $45 trillion in 10 years.

YF: Business intelligence provider MicroStrategy led the Bitcoin rally, purchasing 12,000 bitcoins for $821.7M over the past two weeks.

A MESSAGE FROM OUR PARTNERS

TOMORROW’S TRADE IDEA, TODAY

Less Than Magnificent

The Magnificent Seven wasn’t looking too magnificent last week. All of the stocks in the group fell, excluding Nvidia (NVDA) and Meta (META).

Apple (AAPL) and Tesla (TSLA) are down 6% and 12%, respectively.

The tech stocks that have driven the recent market rally are starting to cool off, but new winners are starting to emerge: small caps.

Setting Records

A strong year for small caps would not come as a surprise to many. Most investors and analysts projected that they would see a jump alongside the broader market in 2024.

They’ve lagged thus far in 2024. But the tides now seem to be turning.

The outperformance of the Russell 2000 is a good indicator. It saw its highest closing price in two years on Thursday at 2,084.74.

Stocks to Watch

Analyst Rob Ginsberg of Wolfe Research is quick to point out that this doesn’t mean all small caps are winners. The Russell’s rise has been largely driven by a few top performers.

For instance, Joint Corp (JYNT) is up nearly 25% this year, while Amylyx Pharmaceuticals (AMLX) is down over 77% in the same timeframe. The good news, according to Ginsberg, is that there is still plenty of time left for the rally to spread across the index.

For investors looking to hop on the small-cap train, Ginsberg is bullish on four stocks for the rest of 2024: Tripadvisor (TRIP), First Bancorp (FBNC), Standex International (SXI), and Astrana Health (ASTH).

POWERED BY CBOE

ON OUR RADAR

Axios: The employment rate for Americans with disabilities reached a record high of 22.5% in 2023, possibly due to remote work options and a strong labor market.

The Register: IBM is asking workers to volunteer for layoffs as the company looks to cut 80% of staff from HR, marketing, finance, and other departments.

BI: Russia’s appearance of economic resiliency is fading as company bankruptcies rise sharply, with 571 bankruptcies in January and 771 in February.

Axios: New AI job postings continue to grow in the US, with 10,404 postings in January. This marks a 42% rise from December of 2022.

BI: The number of ultra-high-net-worth individuals, defined as anyone with more than $30 million, has increased 44% in the past five years.

A MESSAGE FROM OUR PARTNERS

.