HAPPY THURSDAY TO THE STREET

Love in the time of AI could come with a $50K price tag.

Keeper, a new AI matchmaking platform with ties to the pronatalist movement, claims it can analyze SAT scores, net worth, personality tests, and even “general attractiveness” to find a soulmate.

The catch: men pay $5,000 per date, and sign a $50,000 “marriage bounty” if the match ends in a wedding. Venture capitalists just poured $4M into the idea. What can we say? We’ve seen stranger customer-acquisition models.

🟨 | US stocks were mixed, but both the DJIA and S&P 500 closed at record highs, as investors rotated from pricey tech to cyclicals.

📈 | One Notable Gainer: Vail Resorts $MTN ( ▼ 0.3% ) went sky-high after Q1 mountain revenue beat estimates handily.

📉 | One Notable Decliner: Oracle $ORCL ( ▼ 5.4% ) plummeted after reporting Q2 revenue below expectations, prompting a slew of price target cuts.

— Brooks & Cas

Sponsored by Money Pickle

Many retirees are surprised to learn how much taxes can eat into their income, even after they stop working. But with the right planning, it doesn’t have to be that way.

Money Pickle connects you with fiduciary financial advisors who specialize in retirement tax strategy. These advisors offer a free second opinion on your current plan, including how to reduce unnecessary tax burdens on your Social Security, RMDs, or investment withdrawals.

You’ll get objective insights, not a sales pitch. And because they’re fiduciaries, they’re required to act in your best interest, not push products.

A small change in how you withdraw or allocate funds could save you thousands.

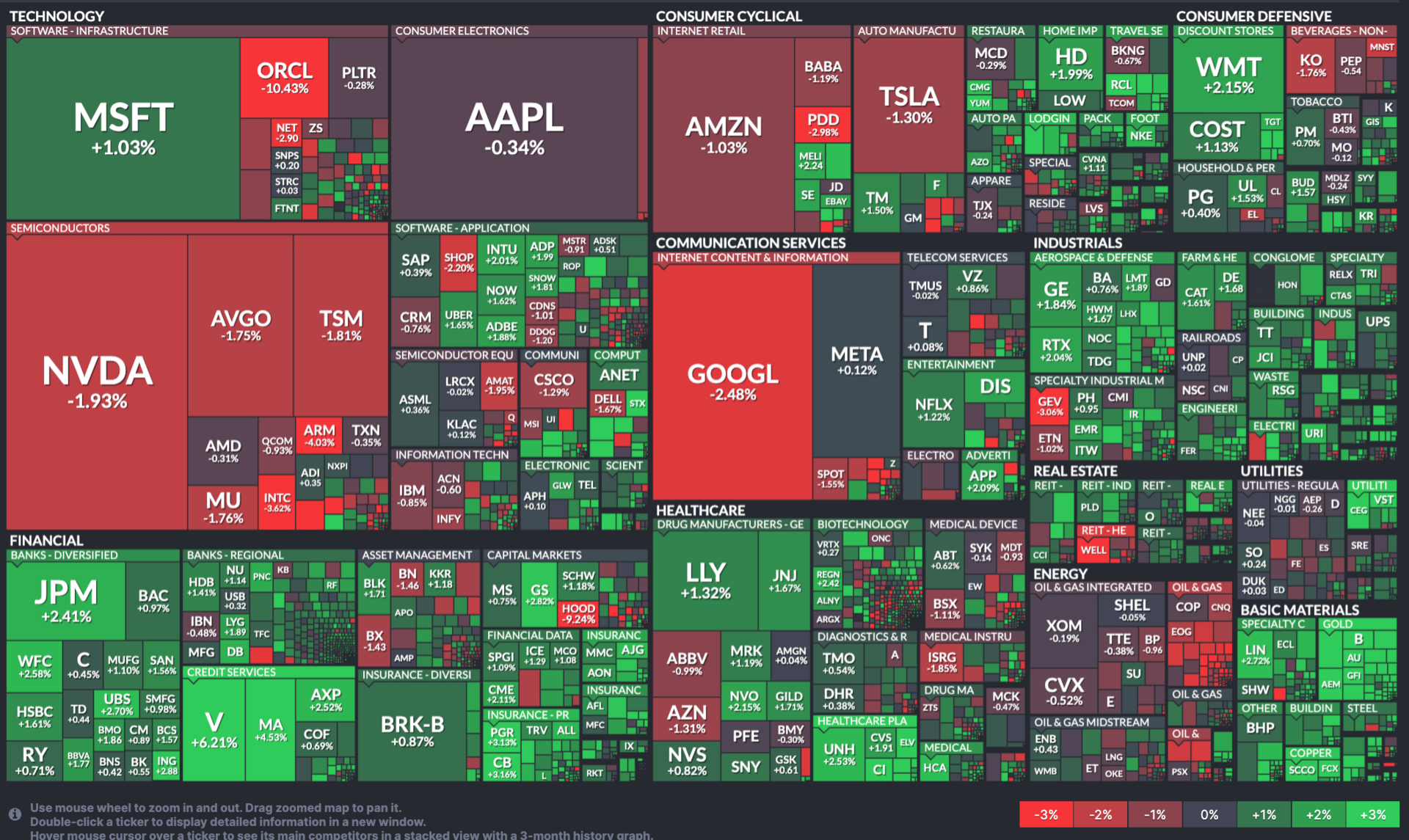

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

GE VERNOVA, ELI LILLY, VISA

GE Vernova $GEV ( ▼ 0.51% ) fell after Seaport downgraded the stock to Hold.

Eli Lilly $LLY ( ▼ 1.34% ) saw strong late-stage trial results for its next-gen obesity drug.

Visa $V ( ▲ 0.63% ) was named a top pick for 2026 by Truist.

Oxford Industries $OXM ( ▲ 5.35% ) issued weak guidance and cut its full-year outlook.

Gemini Space Station $GSS ( ▲ 0.26% ) won a US license to offer prediction markets.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

JEFFERIES SAYS GO SMALL IN 2026

Small Caps Finally Catch a Tailwind

Jefferies $JEF ( ▲ 0.49% ) says the setup favors small caps in 2026. Strategist Steven DeSanctis set a 2,825 target for the leading small-cap index Russell 2000 $RUT ( 0.0% ), which implies a rise of nearly 10% from current levels.

His view is that growth is broadening, GDP is holding above 2%, and that these trends will accelerate next year. A firmer backdrop could lift earnings by more than 14% and give smaller names a rare chance to outrun their large-cap peers.

M&A Turns Into a Real Catalyst

Small caps have trailed for years as inflation, tariffs, and tight financial conditions pushed investors into safer giants.

Now, DeSanctis argues that the cycle is shifting. He notes that the smallest companies look extremely cheap relative to history, and tend to outperform when the equity market widens out.

Lower interest rates could reinforce the trend. A steeper yield curve tends to help smaller borrowers, and DeSanctis expects that dynamic to reappear as policy loosens.

Deal activity is another driver. DeSanctis says the past 11 months mark the second strongest period for M&A since 2016. Companies under a $1 billion market cap now make up more than 60% of active deal flow. He sees that as a clear sign of value.

How to Play the Pivot

According to Jefferies, these conditions make small caps attractive takeover candidates. They also increase the odds that investors finally rotate out of mega caps and into overlooked corners of the market.

The simplest way to gain exposure is through the iShares Russell 2000 ETF $IWM ( ▲ 0.0% ). It is up 16% this year, but still trails the S&P 500. However, if DeSanctis is right, 2026 could be the first year in a long time when small caps lead the charge.

That could mean abundant opportunities in the new year, for investors willing to look past the most obvious ones.

Which type of stocks do you think will outperform in 2026?

Sponsored by Money Pickle

Don't let it go to waste next week.

In the world of finance, growing your wealth is only half the battle. It's just as much work to maintain it.

That’s why financial advisors play a core part in the strategies of most successful investors. But you don't have to be ultra-wealthy to get one in your corner.

Money Pickle connects everyday investors with trusted advisors. No obligation. No cost. Just a 30-second quiz to redeem your free call with a financial advisor.

OVERHEARD ON THE STREET

BI: Disney $DIS ( ▼ 0.4% ) will invest $1B in OpenAI and license Sora characters as part of a push to engage younger audiences.

AP: A congressional report said Trump’s tariffs cost US households about $1,200 this year, totaling roughly $159B paid by consumers.

Investing.com: Ford $F ( ▲ 1.67% ) and SK Innovation agreed to dissolve a US battery joint venture.

CNBC: OpenAI unveiled GPT 5.2, its most advanced model yet, designed to improve professional tasks.

Bloomberg: JetBlue $JBLU ( ▲ 1.1% ) will launch its first airport lounge, BlueHouse, at JFK on Dec 18.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Twilio $TWLO ( ▲ 1.97% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “The 'numbers' look pretty good; as long as they can continue to facilitate their offerings, more upside seems inevitable.”

🐻 Bearish — “No news is bad news.”