Happy Thursday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

🟩 | US stocks rose on the first trading day of May on surprisingly bullish earnings from several tech giants.

📈 | One Notable Gainer: Meta Platforms’ $META ( ▲ 1.69% ) stock climbed after its positive report reignited AI optimism.

📉 | One Notable Decliner: Chipmaker Qualcomm $QCOM ( ▲ 1.14% ) didn’t benefit from the rise in sentiment. Its stock fell following a light revenue forecast.

Sponsored by Pacaso

Spencer Rascoff co-founded Zillow, scaling it to a $16B valuation. But everyday investors couldn’t invest until the IPO, missing early gains.

"I wish we had done a round accessible to retail investors prior to Zillow's IPO," Rascoff later said. Now he’s fixing that with Pacaso, his new company disrupting the $1.3T vacation home market. Unlike Zillow, you can invest in Pacaso as a private company.

Firms like SoftBank and Maveron are already on board – and you can join them for $2.80/share.

Disclaimer: This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

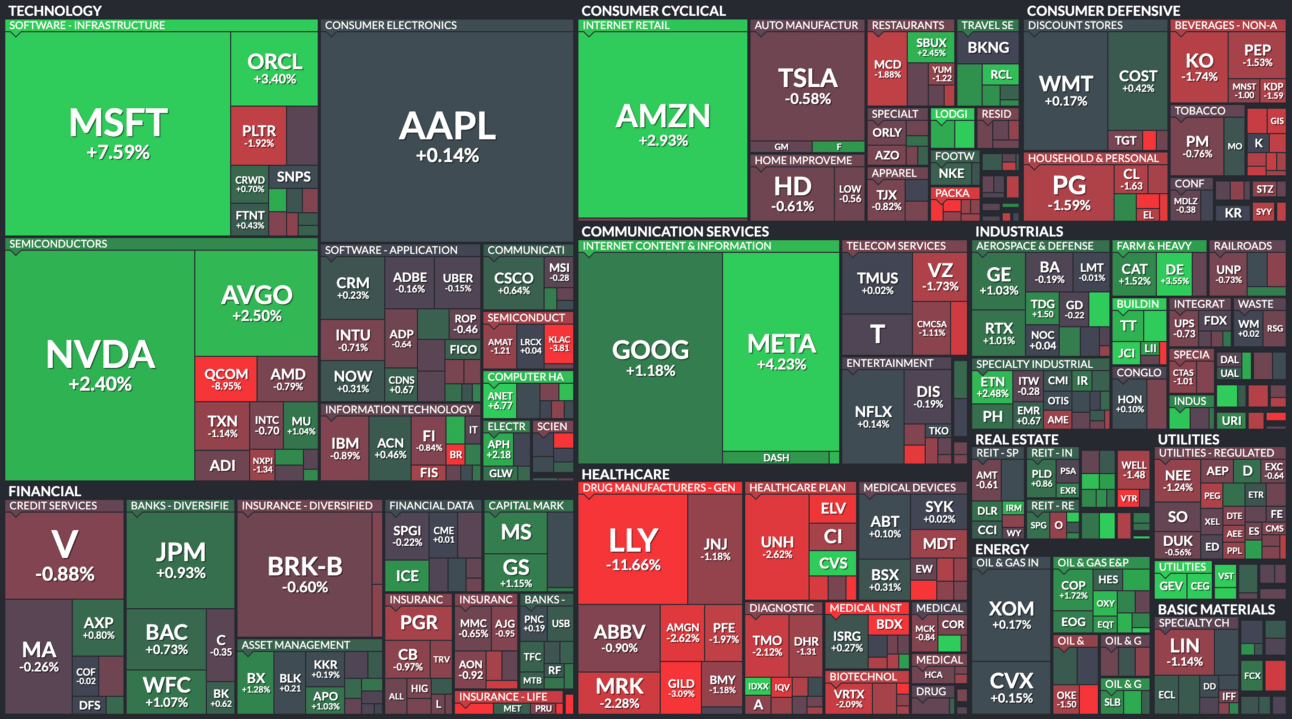

S&P 500 Heatmap. Credit: Finviz

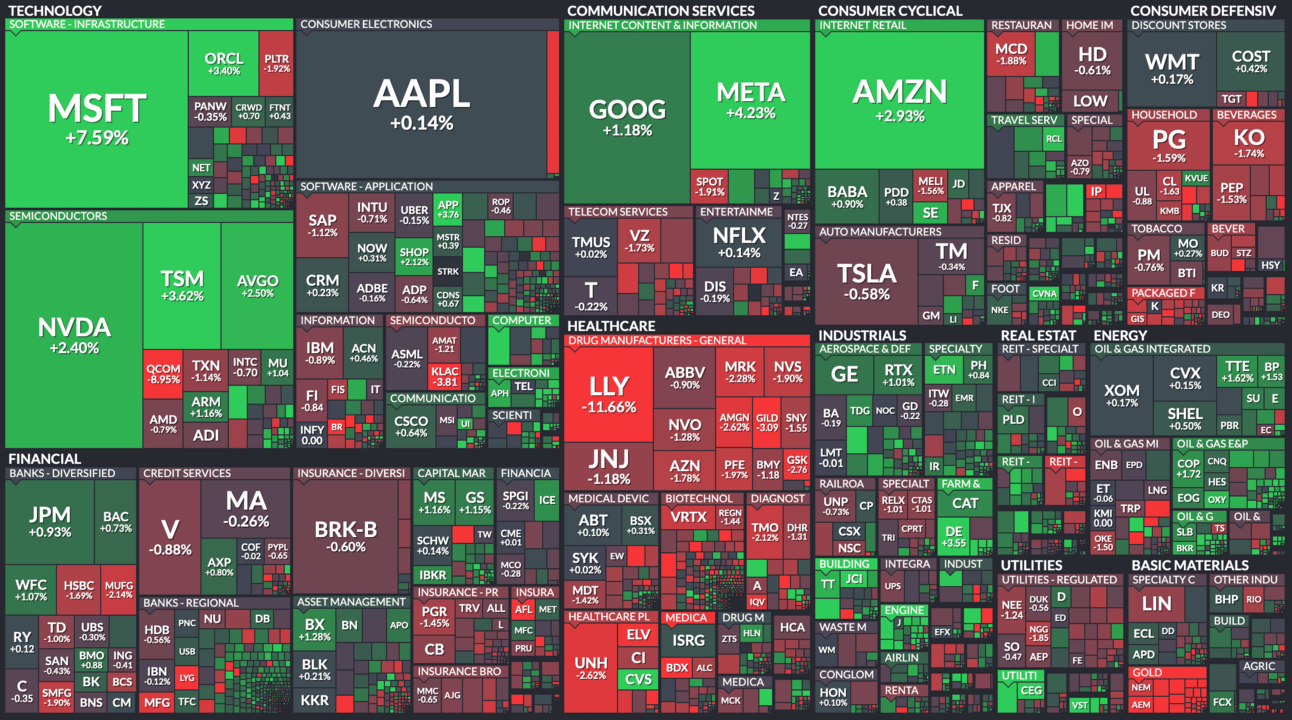

All Stock Heatmap. Credit: Finviz

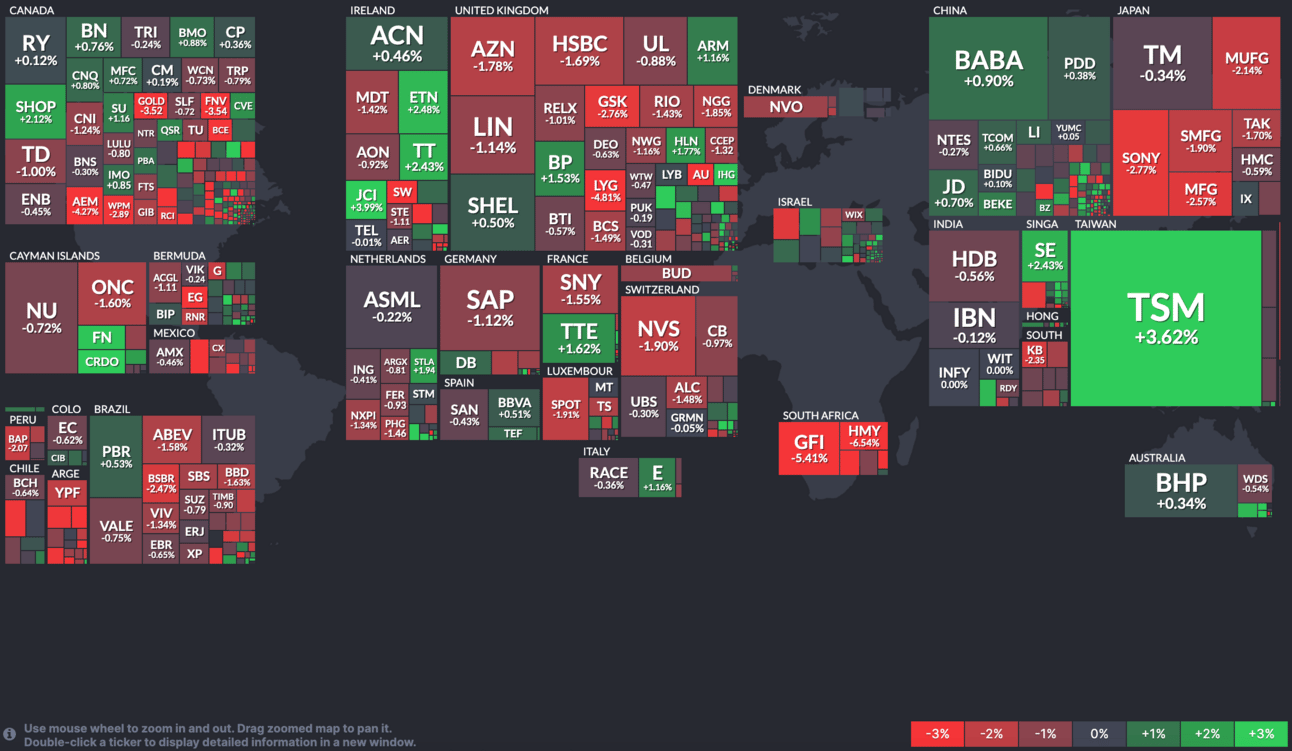

Global ADR snapshot. Credit: Finviz

MARKET MOVERS

CVS, Eli Lilly, Microsoft

$CVS ( ▼ 0.82% ) CVS tops estimates, hikes guidance as insurance business shows some improvement (CNBC)

$LLY ( ▼ 1.34% ) Eli Lilly downplays CVS move to drop Zepbound coverage, shares plunge (Reuters)

$MSFT ( ▼ 0.31% ) Why Microsoft’s stock is seeing an unusually large gain after earnings (MarketWatch)

$BDX ( ▲ 1.6% ) Medical-products maker Becton Dickinson says cuts in global research funding have hurt sales (Morningstar)

$CARR ( ▲ 1.94% ) Carrier Global Fully Mitigates Tariffs Through Price Increases (Bloomberg)

OVERHEARD ON THE STREET

CNBC: Weekly jobless claims rose to a higher-than-expected 241,000 last week, while continuing claims hit their highest level since November 2021.

Reuters: US manufacturing shrank for a second consecutive month in April as tariffs intensified.

WSJ: Amid falling profits and stock prices, Tesla’s $TSLA ( ▲ 0.03% ) board is reportedly searching for a CEO to succeed Elon Musk.

Axios: President Trump threatened sweeping new sanctions on China and any other country that purchases oil from Iran.

FOX: Kohl’s $KSS ( ▼ 2.49% ) fired its CEO after finding he directed the company to engage in vendor deals involving conflicts of interest.

TOMORROW’S TRADE IDEA, TODAY

Spending Slower? I Hardly Know Her!

AI Spending Defies Tariff Fears

Reports of the AI trade’s demise were greatly exaggerated.

Despite investor concerns and looming tariffs on imported data center components, Microsoft $MSFT ( ▼ 0.31% ) and Meta $META ( ▲ 1.69% ) reaffirmed their commitment to massive AI infrastructure investments. Their latest earnings reports show significant capex, with Microsoft raising its figure 53% to nearly $17 billion.

Wall Street reacted positively to the news, and both stocks rallied today. Analysts are confident that their strong commitment to investment in the AI space is a bullish signal for continued development. Here are some names that stand to benefit.

Riding the Wave

Microsoft and Meta’s robust spending is fueling optimism across the semiconductor and hardware supply chains. Citi $C ( ▲ 0.39% ) analyst Christopher Danely believes this could be great news for companies like Broadcom $AVGO ( ▼ 0.4% ), AMD $AMD ( ▼ 1.58% ), and Micron $MU ( ▲ 2.59% ).

Broadcom reported more than $4 billion in AI revenue last quarter, a 77% year-over-year increase. Analysts from JPMorgan $JPM ( ▲ 0.89% ) and Barclays $BCS ( ▲ 1.51% ) emphasized that these huge earnings should dispel fears of an AI investment slowdown and bolster the industry’s strength.

Cloud Networking Could Benefit

With cloud giants doubling down on AI, the companies that support their infrastructure stand to gain, too. That could include firms like Arista Networks $ANET ( ▼ 3.24% ), Amphenol $APH ( ▼ 0.11% ), and Coherent $COHR ( ▲ 6.75% ).

Arista appears to be a favorite among analysts, due to its deep ties with Microsoft and Meta, which accounted for around 35% of its revenue in 2024. Microsoft is currently sourcing over 60% of its switching gear from Arista. Experts believe broader Ethernet adoption and accelerating cloud demand should serve as further catalysts for growth.

Despite macroeconomic uncertainty, companies haven’t slowed their spending on AI. Investors have already sped up their spending on related stocks as a result.

Sponsored by Pacaso

Spencer Rascoff co-founded Zillow, scaling it to a $16B valuation. But everyday investors couldn’t invest until the IPO, missing early gains.

"I wish we had done a round accessible to retail investors prior to Zillow's IPO," Rascoff later said. Now he’s fixing that with Pacaso, his new company disrupting the $1.3T vacation home market. Unlike Zillow, you can invest in Pacaso as a private company.

Firms like SoftBank and Maveron are already on board – and you can join them for $2.80/share.

Disclaimer: This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

ON OUR RADAR

WSJ: Trump removed National Security Adviser Mike Waltz following the Signal group chat military leak.

CNBC: NVIDIA $NVDA ( ▲ 1.02% ) criticized Anthropic’s support for US export restrictions, calling claims of Chinese AI chip smuggling “tall tales”.

AP: The US and Ukraine signed a deal granting America access to Ukraine’s rare earth minerals.

CNN: A proposed federal law would require Apple $AAPL ( ▲ 1.54% ) and Google $GOOGL ( ▲ 4.01% ) to verify users' ages.

BI: Here are the “smartest things” economists are saying about a potential recession.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Brinker International (EAT) over the next 12 months?

🟨🟨🟨🟨🟨⬜ 🐂 Bullish

🟩🟩🟩🟩🟩🟩 🐻 Bearish

And, in response, you said:

🐂 Bullish — “They seem to be in a good space right now; especially w/ the Chili's brand, plus there's some astute marketing going on as well. Value proposition in high gear.”

🐻 Bearish — “When things get tight, you don’t go out to eat!”

Last Words From Our Sponsors

We value it highly. It’s why we spend our time distilling everything you need to know about Wall Street into five minutes of free content each day.

And if you’re a financial advisor or wealth manager, we can save you even more time by booking qualified calls on your calendar, guaranteed.

Want to take outreach, follow-up, and scheduling off your plate? Tired of paying for no-shows? Ready to match with your dream client, with no extra work on your end?

This message is a paid advertisement for Pacaso. The Street Sheet (SS) receives a flat fee from Investing Channel totaling up to $500. Other than the compensation received for this advertisement sent to subscribers, The Street Sheet and its principals are not affiliated with Pacaso. This advertisement is sponsored by a third-party Reg A crowdfunding issuer and is for informational purposes only. The Street Sheet does not endorse or recommend any specific offering, and this advertisement should not be construed as a recommendation to invest. Investing in securities, including those offered through Reg A crowdfunding, involves risk, including the potential loss of principal. These investments are speculative, illiquid, and may involve a higher degree of risk compared to more traditional investments. The Street Sheet has not verified the information provided by the advertiser, and we encourage readers to conduct their own due diligence and consult with a licensed financial advisor or other qualified professional before making any investment decision. By engaging with this advertisement, you acknowledge that The Street Sheet and its affiliates are not responsible for any decisions or actions taken based on the information provided in this advertisement. All investments carry risks, and past performance is not indicative of future results. Readers should carefully review all information provided by the issuer, including the offering circular and any other available materials, prior to investing. The Street Sheet may receive compensation from the advertiser for promoting this offering. The Street Sheet and its principals do not own any of the stocks or shares mentioned in this email or in the article that this email links to. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information provided in this newsletter is not guaranteed as to its accuracy or completeness. Each user of SS chooses to do trades at their sole discretion and risk. SS is not responsible for gains/losses that may result in the trading of these securities. This newsletter includes paid advertisements. The source of all third-party content in which SS receives some sort of compensation is clearly and prominently identified herein as "ad", "Sponsored", or “Together With”. Although we have sent you these advertisements, SS does not specifically endorse any third-party product nor is it responsible for the content, the accuracy, or the completeness of the advertisement or the experience with the third-party advertiser. Furthermore, we make no guarantee or warranty about what is in the advertisement. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. This communication from The Street Sheet is for informational purposes only. It is not intended to serve as a recommendation to buy, sell, or hold any security and is not an offer or sale of a security. Information contained within should not be perceived as a research report and is not intended to serve as the basis for any investment decision. Any third-party views reflected herein do not reflect the opinion of The Street Sheet. All investments involve risk and the past performance of a security does not guarantee future results or returns. There is always the potential for financial loss when investing in securities or other financial products. The information contained in this newsletter is subject to change without notice, and we do not undertake any obligation to update it. Readers are encouraged to conduct their own research and due diligence and seek advice from licensed professionals regarding their specific financial needs and circumstances. By reading this newsletter, you agree to hold us harmless from any and all losses, liabilities, costs, or expenses arising from your use or reliance on the information provided. There is no warranty as to the accuracy or completeness of the factual matters included in any advertisement or sponsored content in the newsletter. You have not performed any research on any entity, or its business, that advertises or submits any sponsored content. The Street Sheet is reader-supported. When you buy through links on our site, we may earn a commission.