HAPPY THURSDAY TO THE STREET.

Hydration, but make it a Ponzi. The DOJ and SEC say two men behind Water Station Management raised $200M on water-vending dreams, then allegedly recycled investor cash instead of profits. An indictment names Ryan Wear and advisor Jordan Chirico, with many investors reportedly retail savers and military veterans. Bottom line: the only thing flowing was the money.

🟨 | US stocks were relatively unchanged following a dour wholesale inflation print, which dimmed cut hopes, though dip buyers lifted the S&P 500 to a 0.03% gain while the Nasdaq and Dow closed fractionally lower.

📈 | One Notable Gainer: Miami International Holdings $MIAX ( ▼ 0.27% ) soared in its NYSE debut, priced at $23 and trading above $31.

📉 | One Notable Decliner: Amcor $AMCR ( ▲ 1.94% ) fell following its Q4 miss and soft guidance.

— Brooks & Cas

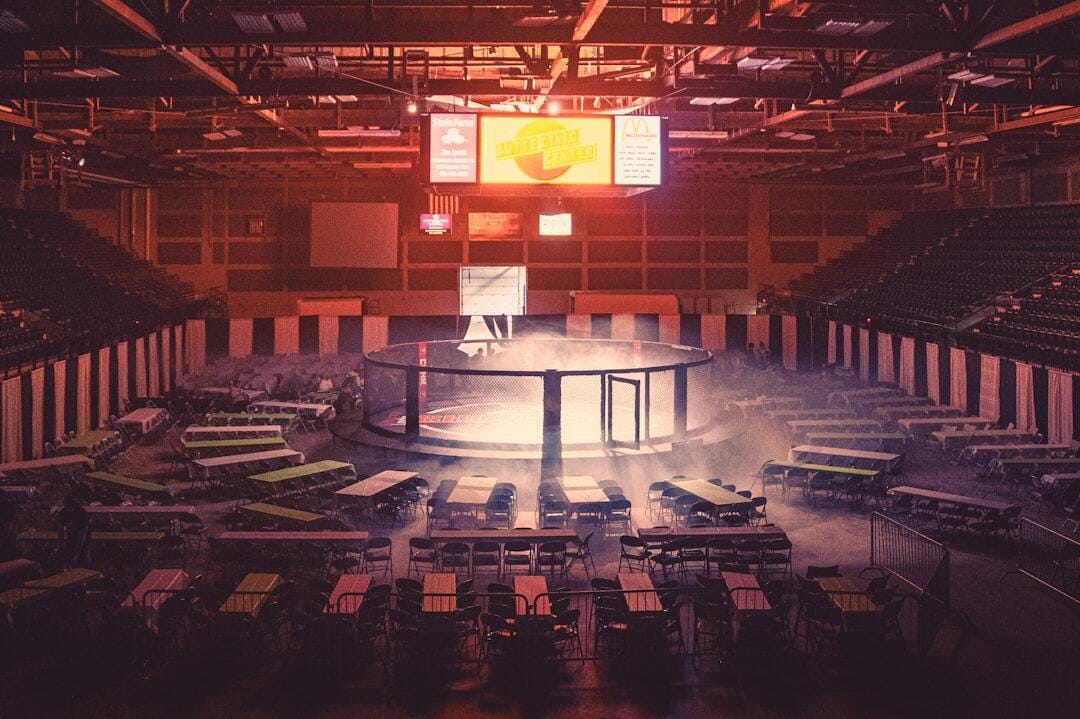

Sponsored by MMA

The martial arts industry is booming yet remains fragmented, analog, and underserved. Mixed Martial Arts Group Limited (NYSE: MMA) is changing that, building a scalable digital ecosystem for 18,000+ gyms across 16 countries. Their platform unites gym management, content monetization, and fan engagement, targeting recurring revenue through SaaS, payments, and events.

Expansion in Latin America via BJJLink could add $15M+ in annual recurring revenue. With 50,000+ students, 5M+ followers, and a debt-free, acquisition-driven model, MMA.INC has a first-mover advantage. They aim to be the digital backbone of combat sports.

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

PARAMOUNT SKYDANCE, LI AUTO, TAPESTRY

$PSKY ( ▼ 2.1% ) Paramount Skydance Stock Plunges After Big Gains. Here’s Why. (Barron’s)

$LI ( ▼ 0.22% ) J.P. Morgan Downgrades Li Auto Stock on ‘More Conservative Volume’ Expectations (TipRanks)

$TPR ( ▲ 3.15% ) Coach parent company expects to lose $160 million to tariffs this year (QZ)

$DE ( ▲ 0.07% ) John Deere forecasts $600 million in tariff impacts this year (CNBC)

$IBTA ( ▲ 2.78% ) Ibotta shares nosedive 31% after earnings miss and price target cuts (Invezz)

OVERHEARD ON THE STREET

Barron’s: Target $TGT ( ▲ 0.89% ) and Ulta $ULTA ( ▼ 1.43% ) expand shop-in-shop partnership, deepening their beauty push.

Reuters: Eli Lilly $LLY ( ▼ 1.34% ) to raise UK Mounjaro list prices by 170%, escalating the obesity-drug battle.

CNBC: Apple $AAPL ( ▲ 1.54% ) restores Watch blood-oxygen features after patent shifts, expanding health capabilities.

QZ: Supreme Court lets Mississippi require age checks for social media, affecting Facebook $META ( ▲ 1.69% ) and X.

CNBC: Cisco $CSCO ( ▲ 0.82% ) will use AI to boost efficiency—not cut jobs, says CEO Chuck Robbins.

Tomorrow's Trade Idea, Today

PHREESIA’S DIGITAL PRESCRIPTION FOR GROWTH

Market Leader in Patient Intake and Engagement

Phreesia $PHR ( ▲ 1.03% ) has emerged as a leading provider of patient intake automation and digital engagement tools, serving more than 4,400 healthcare clients and facilitating 170 million patient visits in 2023.

Its platform modernizes the entire care journey, from scheduling to payment processing, with nearly half of its revenue coming from predictable subscription fees and another quarter from payment solutions. Recent AI integration promises to enhance client value and investor returns. Additionally, its network solutions group leverages anonymized patient data for targeted, compliant pharmaceutical advertising.

Financial Momentum and Growth Outlook

Its financial performance is on an upswing, with Q1 revenue up 15% year-over-year to $116 million and trailing-12-month adjusted EBITDA hitting $54 million, reversing a prior-year loss.

Operational efficiencies have boosted margins, as well, and FY 2026 adjusted EBITDA is projected between $85 million and $90 million - up 138% from last year.

Analysts believe sustained double-digit growth is possible, aided by untapped pharmaceutical advertising revenue. With a $10 billion addressable market and favorable healthcare digitization trends, Phgreesia’s fundamentals are strengthening, supported by a solid balance sheet and newly authorized share repurchase program.

Technical & Fundamentals

The stock currently trades at 27.7 times forward earnings for FY 2026 and just 20.2 times for 2027. Analysts believe this is reasonable given its growth trajectory, and highlight its upside potential with price targets up to $43 by mid-2026 if its resistance of $30 is broken.

While competition from smaller vendors and large EHR providers poses risks, it stands out as a pure-play leader with a proven innovation track record. Execution missteps or slowing growth could hurt the stock, but for now, its digital-first strategy and improving profitability make it a compelling small-cap tech investment.

Sponsored by MMA

Martial arts and combat sports are surging worldwide, yet most gyms still operate without modern tools. Mixed Martial Arts Group Limited (NYSE: MMA) is closing that gap with a tech platform connecting gyms, coaches, and fans. Active in 16 countries and partnered with 18,000+ gyms, MMA.INC is driving growth through subscription revenue, digital coaching, tournament infrastructure, and payment processing.

Their Latin America expansion via BJJLink targets 300+ gyms and millions in annual recurring revenue. Debt-free with a proven acquisition strategy, MMA.INC is positioned to unify a fragmented $18.6B market.

Disclaimers (if applicable)

ON OUR RADAR

QZ: Bitcoin slides after Treasury rejects a crypto “strategic reserve”, cooling bullish sentiment.

POLITICO: White House launches AI across federal agencies, standardizing tools and oversight.

AP: U.S. producer price inflation ticks higher as Trump tariffs add cost pressures.

NPR: Trump intensifies pressure on corporate America and capitalism, challenging business norms.

QZ: Treasury’s Scott Bessent flags potential Fed rate cuts as tariffs weigh on growth.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Clearwater (CWAN) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

17(b) Disclosure: This message is a paid advertisement for Mixed Martial Arts Group Limited (NYSE: MMA). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Mixed Martial Arts Group Limited (NYSE: MMA) is a client of Sideways Frequencies who has contracted Tag The Flag LLC dba The Street Sheet. Through Sideways Frequencies Mixed Martial Arts Group Limited (NYSE: MMA) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $1500 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.