HAPPY MONDAY TO THE STREET.

AI spending keeps climbing, even as returns remain elusive.

Tech giants told investors they’ll boost AI capex again next year, pushing combined spending past $400 billion. Analysts warn that valuations, data center costs, and investor impatience are creating bubble conditions.

But FOMO is a powerful thing, and for now, no one wants to be the first to slow down.

🟨 | US stocks were mixed as AI deal buzz lifted the Nasdaq and S&P, while weak breadth pulled the Dow lower.

📈 | One Notable Gainer: Freshpet $FRPT ( ▼ 0.21% ) rose after EBITDA and revenue topped analyst estimates.

📉 | One Notable Decliner: Adeia $ADEA ( ▲ 2.59% ) fell after the tech licensing firm sued AMD for patent infringement.

Plus, read to the end for Big Tech’s bloodiest custody battle...

— Brooks & Cas

Sponsored by RAD Intel

Own the next AI breakout before Wall Street catches on. A who’s-who of Fortune 1000 clients with recurring seven-figure partnerships in place. Backed by Adobe. Nasdaq ticker reserved, $RADI.

MARKET SNAPSHOT

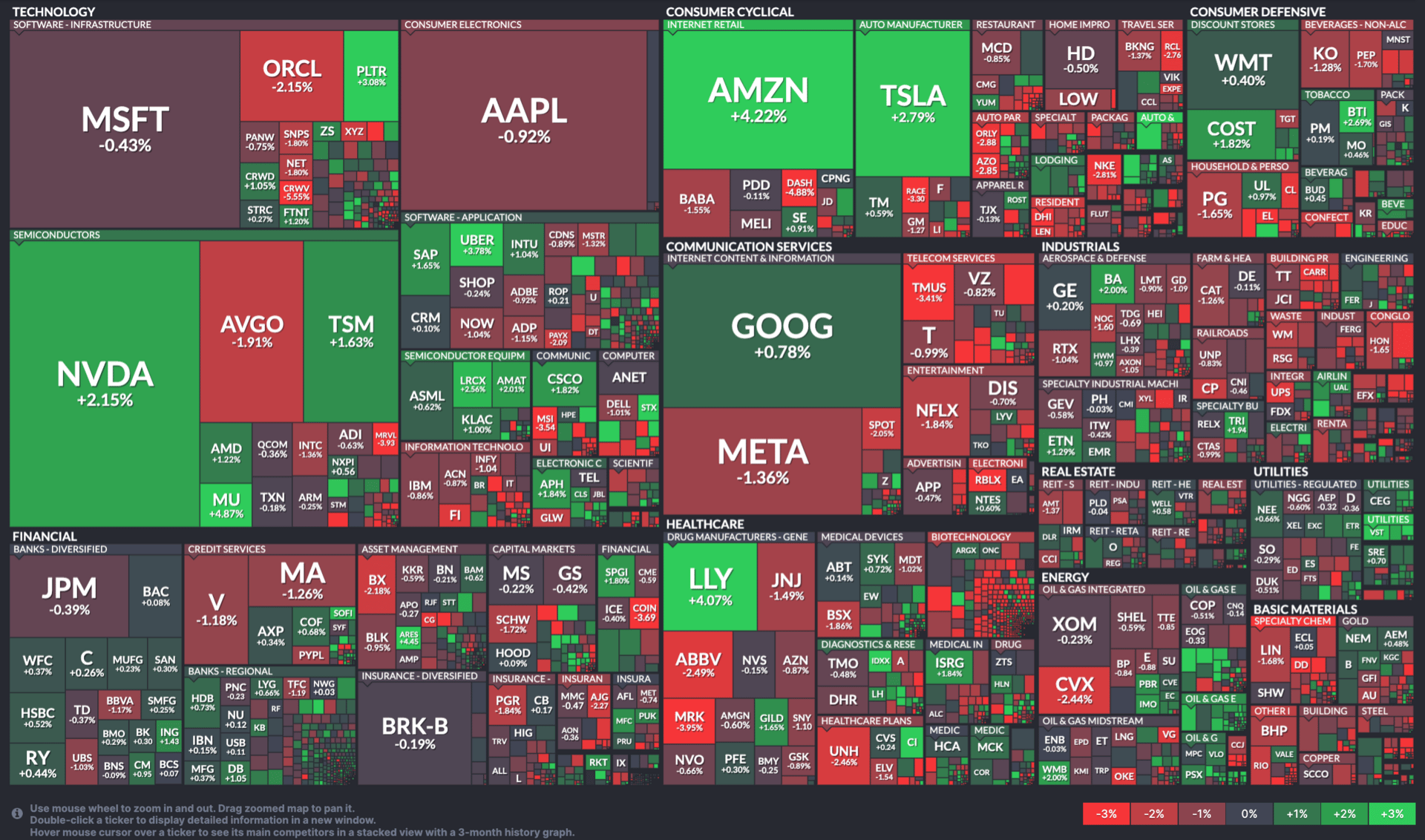

All Stock Heatmap. Credit: Finviz

Market Movers

AMAZON, BEYOND MEAT, KENVUE

Amazon $AMZN ( ▲ 2.56% ) rose after OpenAI signed a $38B cloud deal with Amazon Web Services.

Beyond Meat $BYND ( ▼ 8.23% ) fell after delaying its earnings report to account for an impairment charge.

Kenvue $KVUE ( ▲ 0.32% ) jumped after agreeing to be acquired by Kimberly-Clark $KMB for $48.7B.

Kontoor Brands $KTB ( ▲ 3.05% ) slipped after issuing weaker Q4 earnings guidance.

Cipher Mining $CIFR ( ▼ 7.28% ) gained after posting a narrower-than-expected quarterly loss.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

Brookline raised Rein Therapeutics $RNTX ( ▲ 8.04% ) to Buy from Hold

Stephens upgraded Itron $ITRI ( ▲ 0.43% ) to Overweight from Equal Weight

William Blair lifted Terns Pharmaceuticals $TERN ( ▼ 0.56% ) to Outperform

📉 Downgrades

JPMorgan cut Jamf Holding $JAMF ( ▲ 0.46% ) to Neutral from Overweight

Freedom Capital lowered Phillips 66 $PSX ( ▲ 0.22% ) to Hold from Buy

BofA downgraded Brown & Brown $BRO ( ▲ 0.25% ) to Neutral

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

IS PALANTIR SET UP FOR A BIG EARNINGS MOVE?

A Technical Breakout in Focus

Freedom Capital Markets’ $FRHC ( ▲ 6.8% ) chief market strategist Jay Woods sees Palantir $PLTR ( ▲ 0.26% ) primed for a strong post-earnings run.

The veteran NYSE insider said the stock could climb roughly 20% to $230–$240 this week following its quarterly report after the bell today. The defense software firm beat expectations on the top- and bottom-line, and issued optimistic forward guidance, all despite the ongoing government shutdown.

A substantial portion of Palantir’s business comes from government sales, a category that saw 52% annual growth last quarter.

Momentum Meets Seasonality

Beyond Palantir, Woods pointed out that November has historically been one of the market’s strongest months, with optimism building around potential Fed rate cuts into December.

The AI sector, meanwhile, remains a magnet for capital, and Palantir has been one of its most consistent technical leaders.

The stock has already surged 170% this year as investors bet on its growing government contracts and commercial AI platform. A strong print could extend that trend — and reinforce its reputation as one of the few AI names delivering both hype and profitability.

Eyes on Uber, Too

Woods also highlighted Uber $UBER ( ▲ 1.26% ) as another earnings name to watch, calling it “a slow, steady uptrend” with potential upside toward $110. The rideshare giant reports tomorrow before the bell.

For Palantir, though, the setup is clearer: strong seasonals, a bullish chart, and an earnings history that favors the upside. If the pattern holds, traders could be in for a powerful ride.

Sponsored by RAD Intel

Own the next AI breakout before Wall Street catches on. A who’s-who of Fortune 1000 clients with recurring seven-figure partnerships in place. Backed by Adobe. Nasdaq ticker reserved, $RADI.

OVERHEARD ON THE STREET

NYT: OpenAI signed a $38B, seven-year cloud deal with Amazon $AMZN ( ▲ 2.56% ) to boost its AI infrastructure, expanding beyond its Microsoft $MSFT ( ▼ 0.31% ) partnership.

Reuters: Lambda signed a multibillion-dollar deal with Microsoft $MSFT ( ▼ 0.31% ) to deploy tens of thousands of Nvidia $NVDA ( ▲ 1.02% ) GPUs for its AI cloud infrastructure.

CNBC: US and Chinese regulators expanded probes into safety issues tied to Tesla’s $TSLA ( ▲ 0.03% ) electronic door handles.

WSJ: Pfizer $PFE ( ▼ 0.78% ) sued Novo Nordisk $NVO ( ▼ 2.13% ) and Metsera $MTSR ( ▼ 0.35% ), claiming Novo’s $9B bid would illegally block competition in the fast-growing obesity drug market.

USA Today: Oreo $MDLZ ( ▲ 0.27% ) released limited-edition Thanksgiving Dinner cookies in six fudge-covered flavors.

STREET TWEET

Tech’s favorite soap opera returns.

Musk says OpenAI was stolen. Altman says it was resurrected. Somewhere between the nonprofit and the $500B valuation lies the most profitable moral high ground on Earth.

FRIDAY’S POLL RESULTS

Who do you believe will execute best on AI over the next 12 months?

▇▇▇▇▇▇ 🟠 Amazon

▇▇▇▇▇▇ 🔵 Microsoft

▇▇▇▇▇▇ 🔴 Alphabet

▇▇▇▇▇▇ 🟣 Meta

And, in response, you said:

🟠 Amazon — “Amazon with AWS is well ahead of the other three.”

🔴 Alphabet — “Gemini has the advantage of custom-built chips — it’s a full-stack play with so much more data to train models on than any other player in the market.”