GREETINGS TO THE STREET.

We like to keep it light in our intros, but today, we’re taking a brief break from the levity to reflect on the devastating events of 24 years ago.

We all remember where we were on September 11, 2001. Let us also forever remember those lives lost in the tragic attacks, and in the heroic acts that followed.

Never forget.

🟩 | US stocks rose today as mixed CPI data kept Fed cut hopes alive, with all three indexes closing at fresh records.

📈 | One Notable Gainer: Meme trader fav Opendoor $OPEN ( ▲ 7.53% ) rocketed after naming Shopify $SHOP ( ▲ 1.94% ) exec Kaz Nejatian as its new CEO.

📉 | One Notable Decliner: Delta $DAL ( ▲ 2.97% ) dipped after reporting a lag in main cabin demand and unveiling a slew of new premium offerings.

Finally, read to the end for the quote hinting at a record-breaking IPO season.

— Brooks & Cas

Partner Content

If you’ve got $5,000+ in savings, stop settling for low interest.

Find high-yield accounts that pay you more, fast.

Tap here or below to compare rates and boost your savings today.

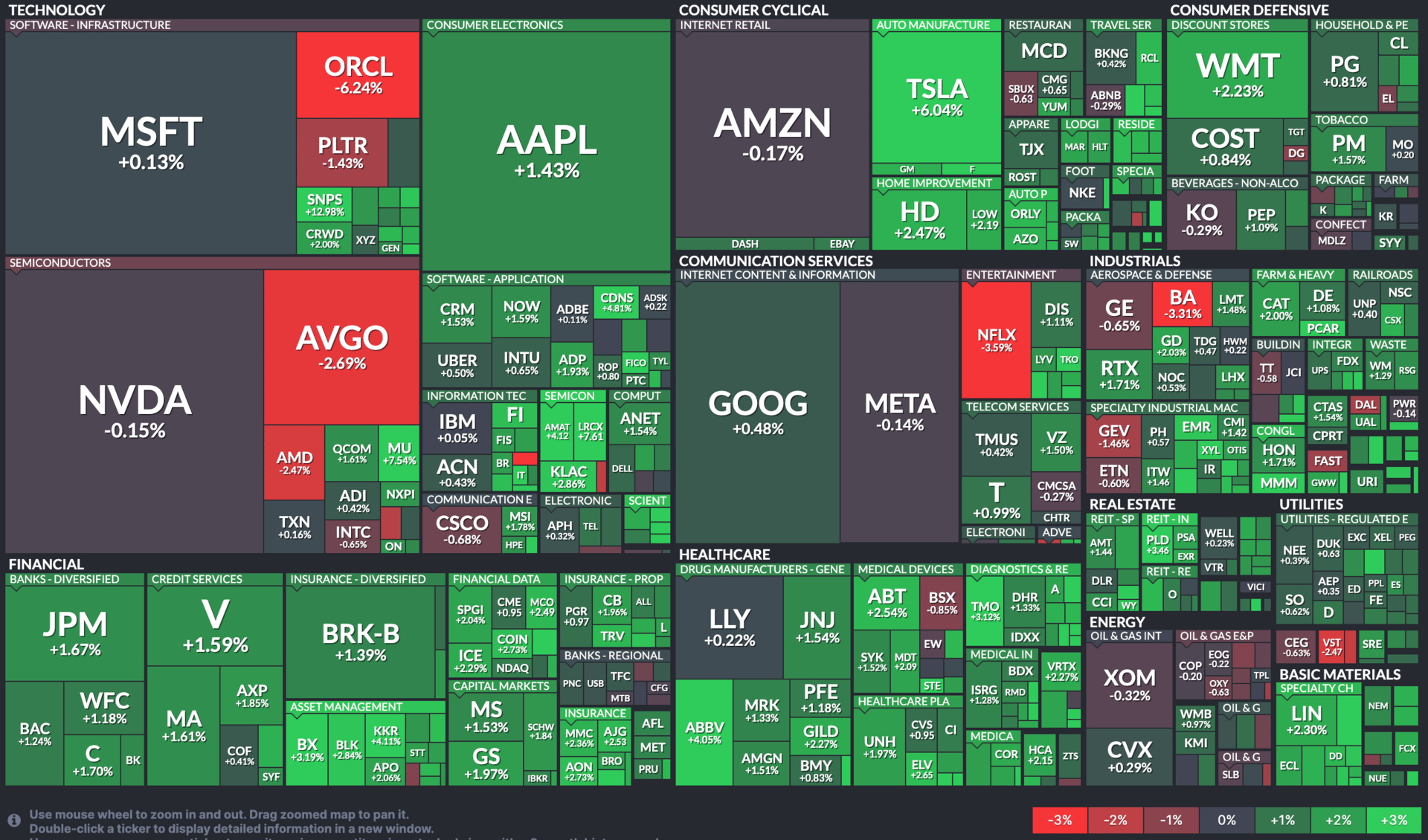

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

REVOLUTION MEDICINES, MICRON TECHNOLOGY, CENTENE

$RVMD ( ▼ 0.89% ) Revolution Medicines: Shares Soar On Pancreatic Cancer Study Win - I'm Sold (SeekingAlpha)

$MU ( ▲ 2.59% ) Micron Technology Stock Jumps on Price Target Increase From Citi (Investopedia)

$CNC ( ▼ 1.01% ) Centene climbs after reaffirming 2025 earnings guidance above consensus (Investing.com)

$OXM ( ▲ 5.35% ) Tommy Bahama Owner Oxford Stock Pops on Strong Profit, Positive Q3 Same-Store Sales (Investopedia)

$ORCL ( ▼ 5.4% ) Oracle's blockbuster surge shows AI trade's growing influence on market (Reuters)

OVERHEARD ON THE STREET

Reuters: Per the August CPI report, US consumer inflation rose at the fastest pace in seven months while jobless claims hit a four-year high.

CNBC: Medical costs rose 4.2% in August, with large employers projecting a 9% jump in health spending for 2026.

Axios: Meanwhile, grocery prices rose at the fastest rate since 2022 last month, as Trump’s tariffs drove up food and supply costs.

IBD: The FTC ordered OpenAI, Meta $META ( ▲ 1.69% ), Google $GOOG ( ▲ 3.74% ), xAI $XAI ( 0.0% ), Snap $SNAP ( ▲ 2.8% ), and Character.A I to disclose how children use their chatbots.

CNN: The DOJ sued $UBER ( ▲ 1.26% ), alleging drivers discriminated against disabled passengers with refusals, surcharges, and mistreatment.

Tomorrow's Trade Idea, Today

COIN OVER COIN

Beyond the Bitcoin Plateau

Bitcoin $BTC.X ( ▲ 0.05% ) has hovered above $100,000 for months, a historic first. ETFs tied to the cryptocurrency have logged steady inflows, and Wolfe Research says the flagship coin could retest its $124.5K peak.

Still, analyst Read Harvey noted that attention has shifted to other coins and, increasingly, to crypto stocks. Recently, Harvey wrote that equities tied to the sector “have actually outperformed since April.”

While bitcoin has surged more than 33% over that period, Wolfe highlighted sharper moves in crypto-linked names. The firm believes investors may find more near-term opportunities outside the token itself.

Stocks in the Spotlight

Wolfe pointed to three companies as “intriguing setups”: digital asset platform Bit Digital $BTDR ( ▼ 2.02% ), mega-exchange Coinbase $COIN ( ▲ 3.26% ), and bitcoin mining firm Terawulf $WULF ( ▼ 2.97% ). Since April, Bit Digital is up about 37%, Coinbase has popped 77%, and Terawulf has surged a whopping 257%.

Coinbase, the biggest name of the bunch, has drawn ample analyst attention. The stock rallied after joining the S&P 500 in May and has since traded around $300. Wolfe says a breakout above its 50-day moving average near $340 could signal further upside.

Harvey added that he “would not be taking off any crypto equity exposure in favor of bitcoin” at this point.

Momentum and Uncertainty

Crypto stocks’ outperformance comes as other blockchain ecosystems such as Ethereum $ETH.X ( ▲ 0.68% ) and Solana $SOL.X ( ▲ 0.64% ) gain traction. Wolfe says that while bitcoin has reclaimed some leadership recently, whether it can sustain that role remains uncertain.

For now, Harvey’s team views crypto equities as better positioned than bitcoin itself. As with the sector overall, though, the ride is likely to stay volatile — and investor conviction will be tested each time momentum shifts.

Which stock do you think will outperform over the next 12 months?

Partner Content

If you’ve got $5,000+ in savings, stop settling for low interest.

Find high-yield accounts that pay you more, fast.

Tap here or below to compare rates and boost your savings today.

ON OUR RADAR

CBS: Median monthly homeownership costs rose 4% to $2,035 in 2024, driven by higher mortgage rates, insurance, and fees.

FOX Business: JPMorgan $JPM ( ▲ 0.89% ) CEO Jamie Dimon warned the US economy is weakening and said Trump’s tariffs and policies create major uncertainty.

CNBC: The US will split profits with Japan on $550B in tariff-funded projects until recouped, then shift to a 90/10 split.

WSJ: The ECB held rates at 2% as euro zone inflation nears target, but global uncertainty from Trump’s tariffs lingers.

TechCrunch: A California bill nearing passage would restrict AI companion chatbots, require warnings, and allow lawsuits for violations.

STREET TWEET

Blackstone’s IPO pipeline is stuffed.

If even a fraction of it converts, 2026 could shatter issuance records. But is that really such a good thing?

Historically, a slew of new issuances has preceded several sharp downturns, including the 1929 crash and the dotcom bubble burst.

Past performance is no guarantee of future results. But with AI-driven valuations already drawing side-eyes, investors might be wise to keep any IPO optimism sufficiently cautious…

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Cameco $CCJ ( ▲ 1.95% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Cameco is a giant in the uranium business and a company run by very competent people.”

🐻 Bearish — “That level of vertical integration is tough... And in a tough industry. They would do better to focus on what they are good at.”