HAPPY WEDNESDAY TO THE STREET.

Disney $DIS ( ▼ 0.4% ) has turned from Cinderella to Evil Stepmother — in the eyes of many fans, at least.

Ten million YouTube TV $GOOGL ( ▲ 4.01% ) subscribers lost ESPN and ABC this week after a carriage dispute with Disney — the latest headache for a company already juggling price hikes, culture battles, and PR blowback. Fans aren’t buying the “blame YouTube” narrative either.

The happiest brand on Earth is learning what happens when Mickey turns heel.

🟩 | US stocks rose as Supreme Court skepticism on tariffs lifted sentiment and AI names rebounded from valuation jitters.

📈 | One Notable Gainer: SolarEdge $SEDG ( ▲ 8.41% ) jumped after posting a smaller-than-expected Q3 loss.

📉 | One Notable Decliner: Trex $TREX ( ▲ 0.51% ) plunged after the decking maker slashed its full-year sales outlook.

Plus, are eVTOLs ready for takeoff? Scroll down for more.

— Brooks & Cas

Sponsored by Hands-Off Investing

For investors tired of market swings, Hands-Off Investing offers a refreshing alternative.

Their secured real estate debt portfolios are designed to deliver 6-10.5% annualized returns with monthly distributions and flexible 12-48 month terms.

Every investment is backed by tangible collateral and professionally managed — so your capital works for you, not the other way around.

If you’re an accredited investor looking for stability and strong yield, this is worth a serious look.

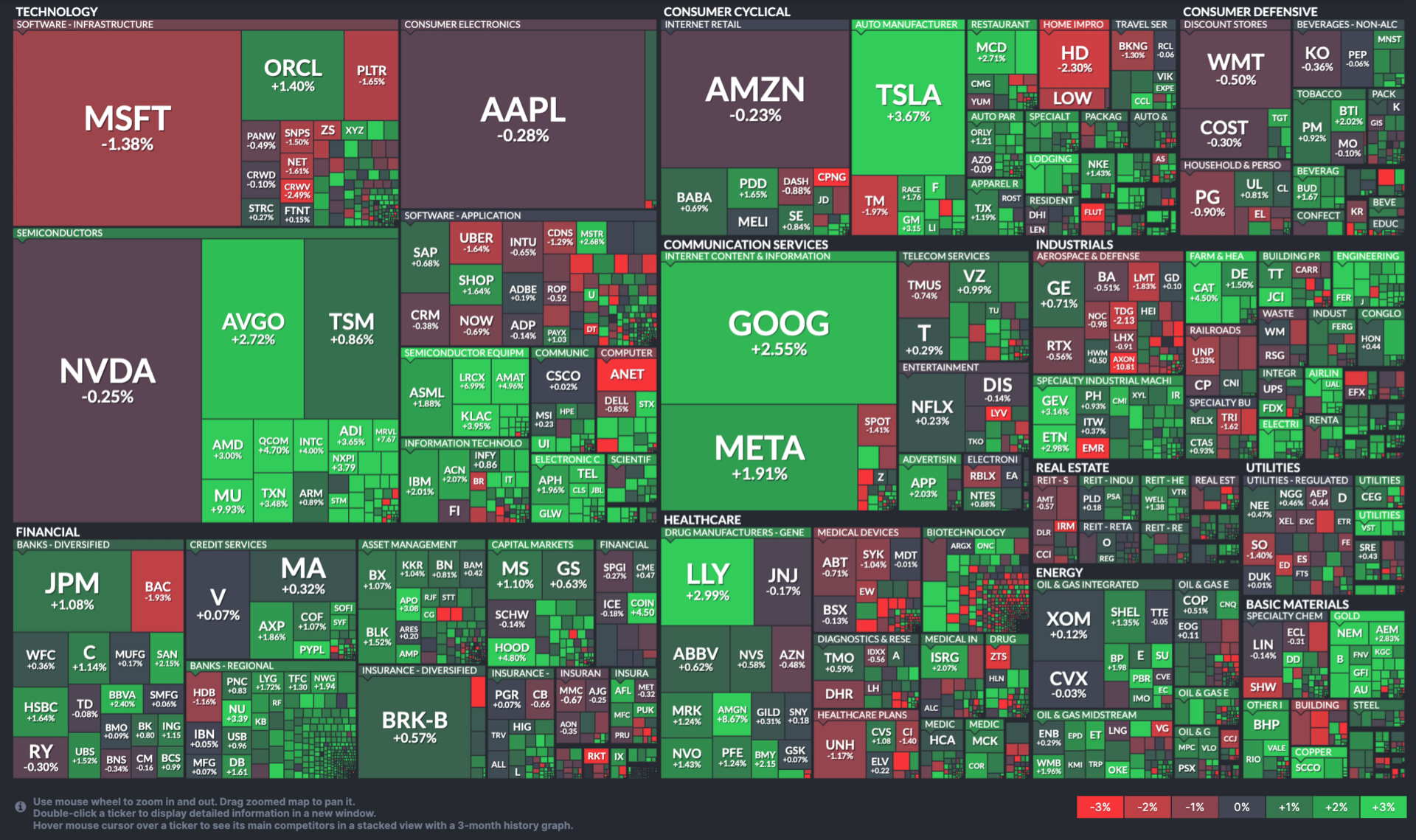

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

ALLEGIANT, HUMANA, RIVIAN

Allegiant Travel $ALGT ( ▲ 3.3% ) raised its full-year earnings outlook above prior guidance.

Humana $HUM ( ▼ 0.35% ) reported lower profit and cut its full-year outlook.

Rivian $RIVN ( ▼ 2.05% ) beat Q3 estimates and reaffirmed its R2 launch timeline.

Pinterest $PINS ( ▲ 5.96% ) missed Q3 earnings expectations.

Teradata $TDC ( ▼ 3.77% ) soared on a strong Q3 beat and higher full-year revenue forecast.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

BofA raised Expeditors $EXPD ( ▲ 3.72% ) to Neutral from Underperform

Evercore ISI upgraded Tractor Supply $TSCO ( ▲ 1.93% ) to Outperform from In Line

Craig-Hallum lifted Babcock & Wilcox $BW ( ▼ 6.64% ) to Buy from Hold

📉 Downgrades

Gordon Haskett cut Burlington Stores $BURL ( ▲ 0.79% ) to Hold from Buy

Monness Crespi lowered Pinterest $PINS ( ▲ 5.96% ) to Neutral from Buy

Benchmark downgraded Denny’s $DENN ( ▼ 0.16% ) to Hold from Buy

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

YUM BRANDS’ SLICE OF OPTIMISM

Slimming Down the Menu

Sometimes less really is more.

Evercore ISI $EVR ( ▲ 0.39% ) upgraded Yum Brands $YUM ( ▲ 0.37% ) to Outperform after the fast-food conglomerate said it’s exploring strategic options for its struggling Pizza Hut business, including a potential sale. The firm raised its price target to $180, implying 21% upside from today’s close.

Analyst David Palmer wrote that, while selling Pizza Hut would trim Yum’s near-term earnings, it could create a cleaner, faster-growing company.

Taco Bell Takes Center Stage

Taco Bell remains Yum’s standout performer, capturing market share even as inflation squeezes consumers.

The chain continues to post growth across all income brackets, particularly among families and younger diners. Despite double-digit beef inflation, Evercore expects company-owned margins to hit 24% this year.

Palmer called Taco Bell’s momentum “a powerful offset” to Pizza Hut’s stagnation, while KFC maintains stable international strength.

Fast-Food Focus

Most analysts remain neutral, with 21 of 32 rating the stock a Hold — but that could change if the Pizza Hut divestiture proceeds smoothly.

“With a low-capital business and potential proceeds from a Pizza Hut sale — our base case is a $3 billion valuation — Yum Brands can meaningfully accelerate share repurchases,” Palmer said.

For Yum, shedding its weakest link could unlock capital, simplify operations, and put growth back on the menu. Investors betting on the comeback may find this combo meal worth ordering early.

Sponsored by Hands-Off Investing

Hands-Off Investing is changing how accredited investors participate in real estate.

Instead of chasing tenants or flipping properties, investors stand to earn steady 6-10.5% returns through secured real estate debt — with monthly distributions and no day-to-day management.

It’s real estate income without the real estate headaches.

For those looking to diversify beyond stocks and bonds with something secure and cash-flowing, this is a compelling option.

OVERHEARD ON THE STREET

CBS News: Starbucks $SBUX ( ▲ 1.76% ) Unionized workers plan to strike on Nov. 13, the chain’s Red Cup Day, unless a labor contract is reached by then.

QZ: McDonald’s $MCD ( ▲ 0.65% ) earnings showed strong global demand but flat US sales, as lower-income diners continue to pull back despite $5 Meal Deals.

Reuters: Google $GOOGL ( ▲ 4.01% ) and Epic Games $EPIC ( 0.0% ) reached a settlement over Android app store rules, paving the way for lower fees and more developer choice.

CNBC: The Trump administration’s $80B plan to fund new Westinghouse nuclear plants could make the US an 8% shareholder if the firm goes public.

Axios: Amazon $AMZN ( ▲ 2.56% ) is testing a robot-powered “store within a store” at a Philadelphia-area Whole Foods, merging organic groceries with its own brands.

Join Street Sheet Research

RESEARCH REVIEW: BIG TECH, BIGGER QUESTIONS

Didn’t receive our Street Sheet Research report last weekend?

Here are some of the pressing topics we covered:

Why eVTOLs may be ready for takeoff

A tech giant’s unsung “second monopoly”

Nvidia’s quantum leap

And much more. Get these answers, along with instant access to our source for real-time investing info, The Street Feed, and our latest Equity Research Report, Trading the Tides.

STREET TWEET

AI lenders are already hedging their bets.

Deutsche Bank’s $DB ( ▲ 2.57% ) reportedly protecting itself from potential defaults in the data center boom — using the same playbook that fueled every credit cycle before it.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on Bank of America $BAC ( ▲ 0.55% ) over the next 12 months?

▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “They are focused now on the right metrics to deliver strong ROE. ROA, with a nice tail wind from the bond portfolio starting to run off and have those proceeds redeployed into higher earning assets!”

🐻 Bearish — “The mortgage hole is too deep to expect good performance from BofA for at least two more years.”