HAPPY MONDAY TO THE STREET LEAF

Black Friday, meet Buy Canadian.

The Business Development Bank of Canada forecast that $11 billion would be injected into Canada’s economy on Black Friday, thanks to shoppers who are newly eager to buy Canadian-made products.

But economists were torn on whether the movement can withstand these high expectations. PwC found that Canadians planned to spend 10% less this year than last, but nearly half were willing to spend more on a Canadian product than an imported one.

Because Canadians do about 20% of their annual shopping on Black Friday, the stakes are high in this test of Buy Canadian’s power.

Once the dust settles, what will be more aplenty: domestic inflows, or gifts under the tree?

— William D.

Presented by Street Sheet Research

And for just one more day…

We’re offering exclusive access to our best deal all year.

Today only, get 70% off Street Sheet Research’s top-shelf market reports, delivered directly to your inbox each week, plus one additional deep dive into an unsung stock every month.

And that includes the one we just sent out this morning. It’s a critical minerals play like no other. And it might just be the ideal hedge against US threats to Canada’s domestic control.

But it’s just the latest million-dollar idea behind the closed boardroom doors to which Street Sheet Research affords unique access.

$1 million ideas. Less than US$100/year. 1 more day.

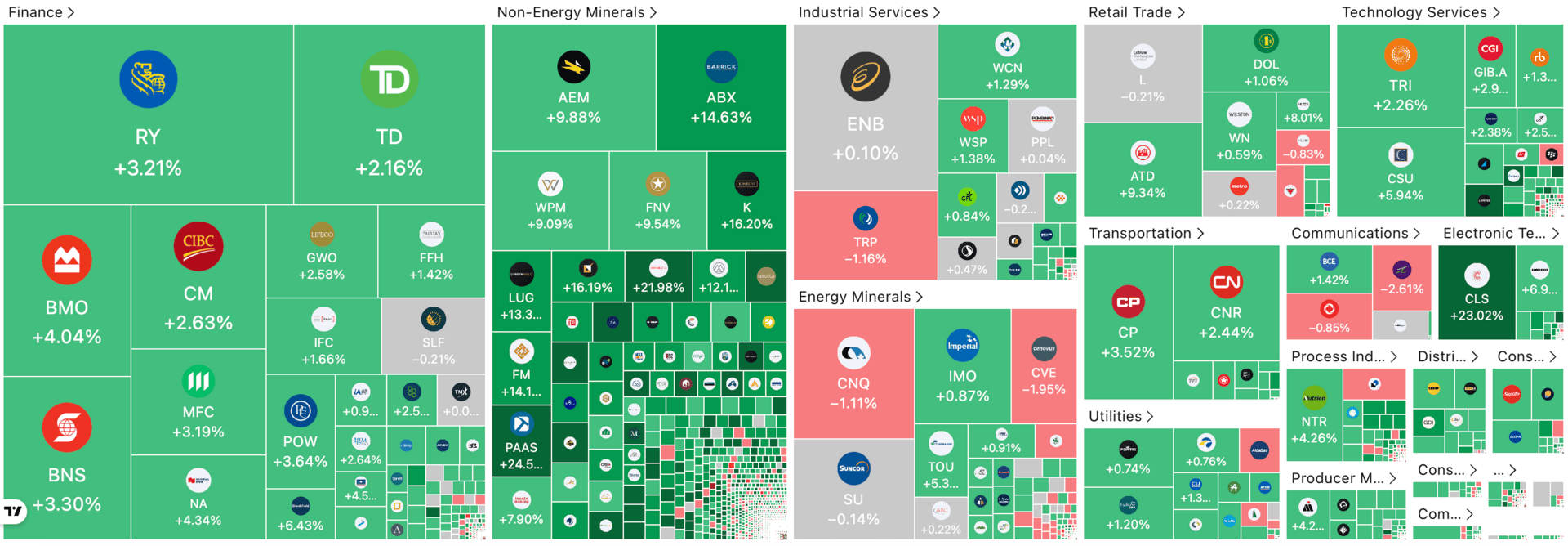

CANADIAN STOCK HEATMAP

Credit: TradingView

OVERHEARD ON BAY STREET

IE: Canada’s economy grew 2.6% in Q3, rebounding from a tariff driven slump as falling imports boosted GDP despite weak domestic demand.

BNN Bloomberg: A new poll found 3 in 5 Canadians are more concerned with domestic control of critical minerals over development speed.

YF: Economists said Canada’s 2.6% Q3 GDP jump masked weak domestic demand as falling imports, not broad strength, drove the surprise rebound.

One Trend To Watch

TAKING AIM AT ‘NINE BAD LAWS’

Prime Minister Mark Carney and Alberta Premier Danielle Smith met in Calgary last week to sign a memorandum of understanding to allow the export of oil from Ottawa to Asian markets, and “adjust” a tanker ban if necessary.

In the ceremony, Smith heralded the cracks forming around the “nine bad laws,” as she calls them, that have stymied energy investment in Canada. Among them are clean energy regulations and the federal emissions cap, which Ottawa will be exempted from under the memorandum of understanding.

The proposed pipeline, built and financed by the private sector, would transport one million barrels of oil per day. Clearance from Ottawa is still contingent on the pipeline being approved as a project of national interest, and providing “opportunities for Indigenous co-ownership and shared economic benefits.”

An application for the pipeline project will be submitted by July 1, and it could be the first of several, with the memorandum of understanding calling for one “or more” new pipelines to follow the Trans Mountain expansion.

It’s the latest sign that the Prime Minister is serious about the “all of the above” energy approach that was successfully pitched to him by 38 Canadian energy companies last summer. And it’s still more evidence that emissions policies are taking a backseat to Carney’s “nation-building” vision.

Presented by Street Sheet Research

But, today at least, it won’t take much.

Street Sheet Research gives investors like yourself access to the in-depth market reports typically reserved for institutions.

And, for Cyber Monday only, you can invest in an annual subscription at an unbeatable entry point.

Get a year’s worth of institutional-grade research for 70% off: now just US$59.

How’s that for enterprise value?

This Week’s Trade Idea

ONE ‘PATHWAYS ALLIANCE’ PARTNER TO WATCH

Feeling the (Canadian) Energy

The aforementioned memorandum of understanding requires Alberta and Ottawa to work with the “Pathways Alliance” partner companies to find emissions-reductions projects to build alongside the new pipeline. These include Canadian Natural Resources $CNQ.TSX ( ▲ 1.53% ), Cenovus $CVE.TSX ( ▲ 2.83% ), ConocoPhillips Canada $COP ( ▲ 4.21% ), Imperial Oil $IMO.TSX ( ▲ 1.71% ), and Suncor $SU.TSX ( ▲ 2.6% ).

Of the “Pathways Alliance” firms, Canadian Natural Resources $CNQ.TSX ( ▲ 1.53% ) stands out. That’s largely thanks to the strength of its balance sheets, strong earnings growth, and impressive history of rewarding shareholders through prodigious dividend growth and share buybacks.

+21% Per Year, For 25 Years

Canadian Natural Resources has grown its dividend by an average of 21% each year since 2000. This uninterrupted 25-year streak of increasing dividends is a testament to the company’s ability to withstand all kinds of economic environments and macro headwinds.

For context, even a 0.1% yield that grows by 21% a year will turn into an 11.7% yield on cost after 25 years. Today, Canadian Natural Resources yields 5%, and has returned $6.2 billion to shareholders year-to-date, with $4.9 billion in dividends paid out and $1.3 billion in share repurchases.

Even If Oil Collapses…

With the US continuing to smash oil production records, as OPEC increases production and other governments follow Carney’s “all the above” energy example, concerns of an oil supply glut driving down prices have weighed on the sector.

It could take an historic price collapse to threaten Canadian Natural Resources’ profitability, however. The company enjoys an industry-leading operating cost of about $21/barrel, which allowed it to raise its dividend even in 2014, the last year an oil supply glut roiled markets.

Of course, cratering oil prices could still drive down the company’s earnings and share price, at least in the short term. But energy prices are cyclical. Should a supply glut hit the sector in 2026, a company with $4.3 billion in liquidity may well weather the storm and emerge stronger, even as its competitors fold.

LAST WEEK’S POLL RESULTS

Are you bullish or bearish on Quebecor $QBR.TSX ( 0.0% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish