HAPPY MONDAY TO THE STREET

If Nvidia $NVDA ( ▲ 1.02% ) needs one thing ahead of its earnings call, it’s higher expectations. And CEO Jensen Huang is all too happy to deliver.

Speaking at the company’s GTC conference, Huang said Nvidia has $500B worth of AI-chip orders lined up across 2025 and 2026. Analysts say that implies meaningfully higher 2026 revenue than anyone had penciled in, even after a four-year run that’s already seen quarterly sales surge nearly 600%.

However, with AI anxiety nearing a tipping point, a much higher bar could turn into a much further fall.

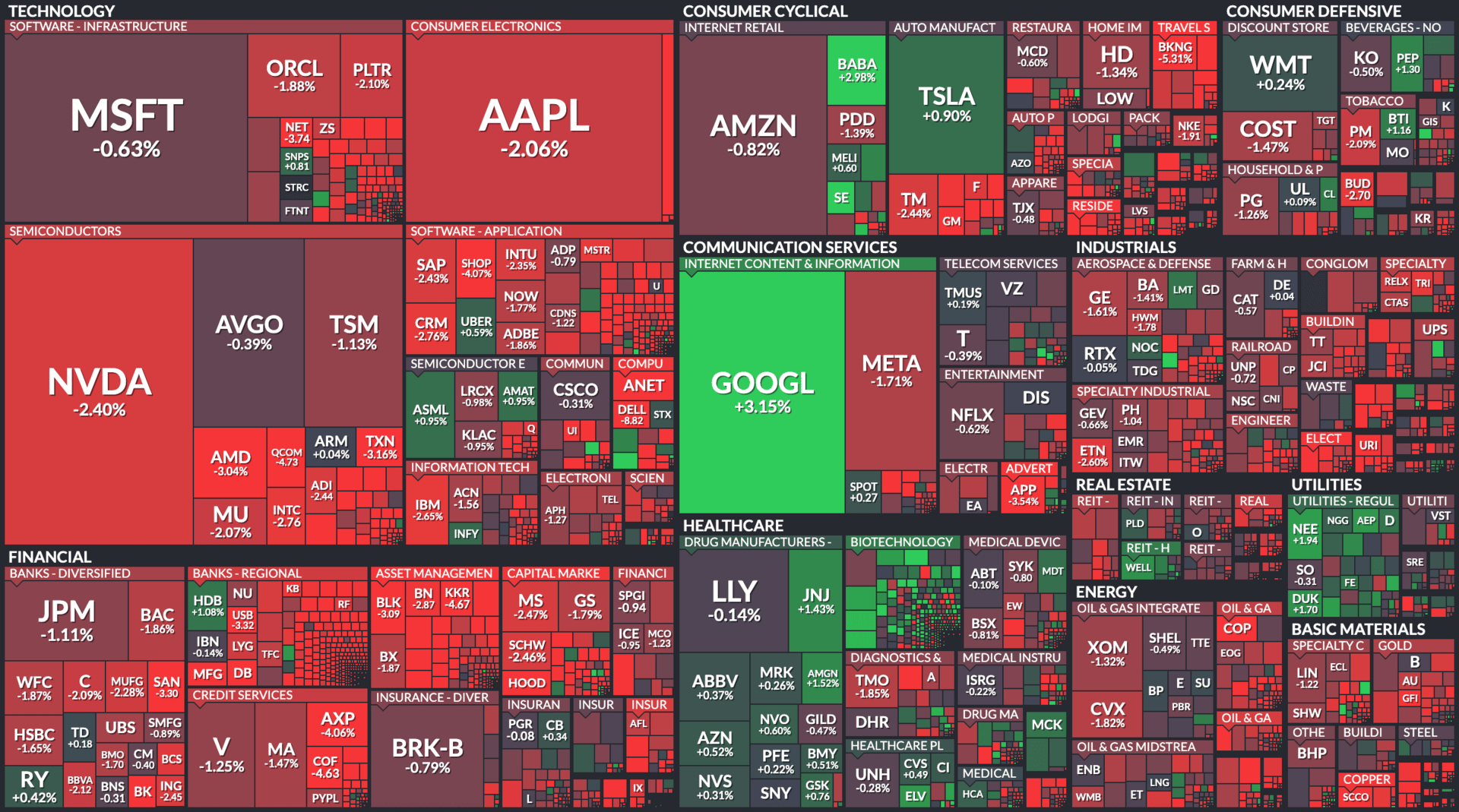

🟥 | US stocks fell today as tech valuation jitters resumed ahead of the aforementioned $4T mega-cap’s quarterly report.

📈 | One Notable Gainer: Vita Coco $COCO ( ▲ 4.25% ) (which we wrote about on Sunday) climbed after slashing its projected tariff impact.

📉 | One Notable Decliner: Coinbase $COIN ( ▲ 3.26% ) slumped as crypto warning signs intensified.

Plus, Bill Ackman diversifies into dating advice. Scroll down for more.

— Brooks & Cas

Sponsored by Paladin Power

AI data centers are overwhelming America’s power grid.

Paladin Power’s US-engineered Energy Storage System (ESS) delivers 10X more power than Tesla’s Powerwall — without fire risk or inflated cost.

Its patented inverter powers entire homes from one sleek, compact unit — 80% smaller than traditional setups.

Backed by $200M in proprietary patents and 3,000+ investors, Paladin is scaling fast as the ESS market hits record growth. This is a rare chance to get in early.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

ALPHABET, APPLE, ALIBABA

Alphabet $GOOGL ( ▲ 4.01% ) surged after Warren Buffett’s Berkshire Hathaway $BRK.B ( ▲ 0.25% ) took a stake in the Google parent.

Apple $AAPL ( ▲ 1.54% ) sold off for the opposite reason. Berkshire offloaded shares last quarter.

Alibaba $BABA ( ▲ 0.12% ) unveiled its latest ChatGPT-style AI tool, Qwen App.

Expedia $EXPE ( ▲ 1.86% ) fell on news that Google’s AI tool Canvas can build travel itineraries.

Albemarle $ALB ( ▲ 0.01% ), Sigma $SGML ( ▼ 8.38% ), and other lithium stocks climbed on forecasts of a 30% pop in demand for the commodity in 2026.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

HSBC upgraded Progressive $PGR ( ▲ 1.15% ) to Buy

Truist raised Block $XYZ ( ▲ 0.62% ) to Hold from Sell

TD Cowen lifted Yum! Brands $YUM ( ▲ 0.37% ) to Buy from Hold

📉 Downgrades

Deutsche Bank cut BNP Paribas $BNPQY ( ▲ 1.73% ) to Hold from Buy

Guggenheim lowered Cidara Therapeutics $CDTX ( ▲ 0.03% ) to Neutral from Buy

Stifel downgraded Sealed Air $SEE ( ▲ 0.07% ) to Hold from Buy

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

A DOUBLE DOWNGRADE FOR DELL

A Tough Call for Dell

Dell Technologies $DELL ( ▲ 2.7% ) is down sharply today. The catalyst? A rare double downgrade from Morgan Stanley $MS ( ▲ 0.6% ).

The bank turned bearish on Dell after a strong run earlier this year. It cut the stock to Underweight and set a new price target of $110, implying about 10% downside from today’s close.

Analyst Erik Woodring warned that rising component costs may hit profitability harder than investors expect. He noted that Dell is more exposed than many peers to cost swings in the memory market. Those pressures often show up quickly in gross margins, which sets the stage for potential volatility ahead.

Margins in the Crosshairs

DRAM and NAND memory can account for a wide share of costs across Dell’s major product lines. History suggests that when memory prices move sharply higher, Dell’s margins can slip in response.

Woodring pointed to an earlier cycle from 2016 through 2018. During that stretch, memory inflation drove a noticeable pullback in Dell’s gross margins. The firm believes the current cycle is showing similar early signs, and that the severity of memory pricing trends could keep pressure on margins for the next year or more.

The analyst also emphasized that companies with margin headwinds tend to underperform those with steadier profitability. That pattern supports Morgan Stanley’s more cautious view.

What Comes Next

The downgrade is especially notable given Dell enjoys broad support on the Street. Most analysts remain buyers, citing the company’s scale, customer reach, and position across enterprise and consumer markets.

But Morgan Stanley sees a different balance of risks, arguing that prolonged cost pressure could act like sand in the gears and slow Dell’s momentum. With memory markets heating up, investors may want to watch margins as closely as demand.

Sponsored by Paladin Power

AI data centers are overwhelming America’s power grid.

Paladin Power’s US-engineered Energy Storage System (ESS) delivers 10X more power than Tesla’s Powerwall — without fire risk or inflated cost.

Its patented inverter powers entire homes from one sleek, compact unit — 80% smaller than traditional setups.

Backed by $200M in proprietary patents and 3,000+ investors, Paladin is scaling fast as the ESS market hits record growth. This is a rare chance to get in early.

OVERHEARD ON THE STREET

AP: The FAA lifted shutdown flight limits, allowing airlines to resume normal schedules at 40 major US airports.

Reuters: US construction spending rose 0.2% in August, driven by home renovations despite weak single-family homebuilding.

CNBC: Novo Nordisk $NVO ( ▼ 2.13% ) cut direct-to-consumer Wegovy and Ozempic prices to $349/month and launched a $199 introductory offer for new patients.

Fortune: Amazon $AMZN ( ▲ 2.56% ) founder Jeff Bezos returned to an operational role as co-CEO of $6.2B AI startup Project Prometheus.

CNN: Target $TGT ( ▲ 0.89% ) and Starbucks $SBUX ( ▲ 1.76% ) launched an exclusive Frozen Peppermint Hot Chocolate in Target stores as both chains seek a holiday sales boost.

STREET TWEET

Bill Ackman shared some viral dating advice this weekend.

In his original tweet, the billionaire wrote:

“I hear from many young men that they find it difficult to meet young women in a public setting. […] As such, I thought I would share a few words that I used in my youth to meet someone that I found compelling. I would ask: ‘May I meet you?’ before engaging further in a conversation. I almost never got a No.”

Financial Twitter proceeded to field test the “May I meet you?” approach and came to a quick consensus: stick to capital management, Bill.

FRIDAY’S POLL RESULTS

Are you bullish or bearish on Gap $GAP ( ▲ 1.95% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Ain't nobody gonna have no cash for 7 For All Mankind or AG, etc. Peeps will buy on the cheap.”