HAPPY THURSDAY TO THE STREET

It was the age-old story. Nvidia $NVDA ( ▲ 1.02% ) crushed expectations. Wall Street cheered. Then Michael Burry did.

Shortly after the $4T chipmaking giant’s latest beat, Burry (of The Big Short fame) accused Nvidia’s biggest customers of inflating true demand, warned that aging chips aren’t the profit engines the company suggests, and highlighted dilution despite over $100 billion in buybacks.

Ultimately, the stock gave up its earlier gains, finishing the day sharply down. Two retail favs entered the ring. Only one walked away unscathed.

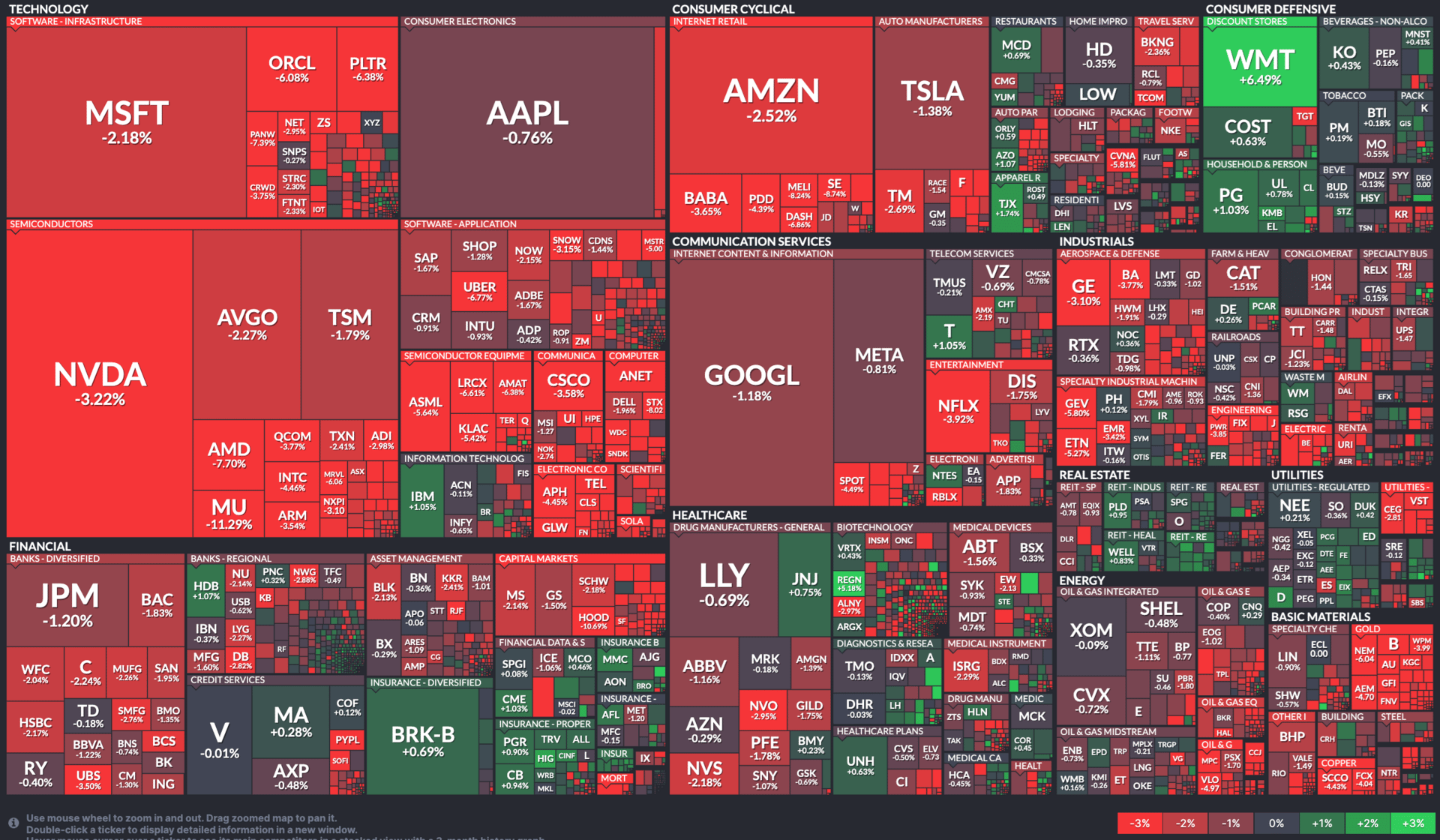

🟥 | US stocks fell, reversing course as an AI-fueled rally fizzled and the odds of a December Fed cut seemed to fade.

📈 | One Notable Gainer: Exact Sciences $EXAS ( ▲ 0.14% ) jumped after Abbott agreed to buy the company for $105 per share in a $21B deal.

📉 | One Notable Decliner: Bath & Body Works $BBWI ( ▲ 1.84% ) fell after missing Q3 estimates with $0.35 EPS and $1.59B in revenue.

— Brooks & Cas

Sponsored by RAD Intel

Meet the ChatGPT of Marketing. 10k+ investors, 4,900% growth, F- 1000 clients, backed by Adobe. Shares still just $0.81- until 11:59pm PST Tonight.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

REGENERON, PALO ALTO, WALMART

Regeneron $REGN ( ▼ 0.23% ) rose after the FDA approved its eye treatment.

Palo Alto Networks $PANW ( ▼ 1.52% ) announced a $3.35B deal to buy Chronosphere.

Walmart $WMT ( ▼ 1.51% ) beat Q3 expectations and raising its full-year sales outlook.

Jacobs Solutions $J ( ▼ 0.73% ) beat Q4 expectations and issuing stronger 2026 guidance.

Oddity $ODD ( ▲ 4.61% ) posted a Q3 beat and raising its full-year earnings outlook.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

ONE ANALYST ISN’T BUYING NVIDIA’S SURGE

A Lone Voice on the Street

Nvidia $NVDA ( ▲ 1.02% ) just delivered another blockbuster quarter. Revenue and earnings blew past expectations. Data center sales jumped 66% year-over-year. Guidance came in strong. Nearly every major bank responded with another bullish call.

Except one.

Deutsche Bank $DB ( ▲ 2.57% ) remains the only bulge bracket firm with a Hold rating. Analyst Ross Seymore kept his $215 price target, implying just 16% upside from current levels. Every other large bank has a Buy-equivalent rating. Several see far more room to run.

Priced for Perfection

The bank isn’t bearish per se. But Seymore’s reticence echoes a growing sentiment on the Street that the time has come to tap the brakes on Nvidia’s stratospheric rise. His neutral stance suggests future growth is already baked into the price.

According to the analyst, Nvidia would need to deliver roughly 85% revenue growth over the next two years to justify the valuation embedded in his 2027 estimates. That already puts the shares at about 23x his forward earnings forecast.

Seymore praised Nvidia’s strength across AI compute, networking, software, and systems. In his view, Nvidia’s lead over competitors looks more likely to widen than narrow. But the stock’s sharp climb has made it harder to argue that investors are missing the story.

Still a Bullish Picture

The analyst also flagged a few pressure points. Operating expenses are rising quickly. China revenue continues to lag. Gaming sales slipped in what is usually a seasonally strong quarter.

Despite the caution, the analyst reiterated his long-term optimism. He expects a positive reaction to the results and believes Nvidia shares should maintain a constructive bias from here.

But the gap between his rating and the Street’s broader enthusiasm reflects a significant divide. Most analysts see more fuel in the tank. Deutsche Bank sees a great company priced like an exceptional one.

Sponsored by RAD Intel

Meet the ChatGPT of Marketing. 10k+ investors, 4,900% growth, F- 1000 clients, backed by Adobe. Shares still just $0.81- until 11:59pm PST Tonight.

OVERHEARD ON THE STREET

AP: US employers added 119K jobs in September, beating forecasts, though prior months were revised sharply lower.

Reuters: Verizon $VZ ( ▲ 1.25% ) said it will cut over 13K jobs and convert 179 stores to franchises as part of a major cost reduction plan.

CNBC: Google $GOOGL ( ▲ 4.01% ) launched Nano Banana Pro, an image tool built on Gemini 3 Pro, boosting shares on its expanded editing capabilities.

Axios: A third fire hit Novelis’ Oswego plant, which supplies 40% of US auto aluminum, posing new risks after Ford $F ( ▲ 1.67% ) projected $2B in losses.

TechCrunch: OpenAI launched global group chats in ChatGPT, letting up to 20 users collaborate in shared conversations across all plans.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on DoorDash $DASH ( ▲ 0.06% ) over the next 12 months?

▇▇▇▇▇▇ 🐻 Bearish

▇▇▇▇▇▇ 🐂 Bullish

And, in response, you said:

🐂 Bullish — “My recent Best Buy delivery will come via DoorDash. That got my attention; same/next day local ecommerce delivery could be a game changer with the right partners.”

🐻 Bearish — “They have too much of a premium for a food delivery/logistics company.”