HAPPY MONDAY TO THE STREET LEAF

Is greenwashing getting washed away?

Canada’s latest federal budget puts its rules regarding greenwashing, or the practice of showing illusory progress toward decarbonization, in the crosshairs.

But that won’t necessarily be a net negative for the environment. Critics argue that some greenwashing provisions actually make decarbonization more cumbersome.

The real test will be whether looser rules spark honest progress, or simply give companies more room to stretch the truth.

— William D.

Presented by Street Sheet Research

Most retail investors start their days wrong.

Here’s the wrong way: tabbing between half a dozen websites scrounging for tips; refreshing your investing app instead of seeking new actionable info; scrolling Facebook, Reddit, or X and telling yourself it counts as “research”.

Here’s the right way: sitting down with a cup of coffee and a single report, compiled by a trusted financial partner, with the most valuable information for your portfolio distilled into its most digestible form.

Institutional investors start their days right. With resources and access at their fingertips, it’s easy to.

Now we’ve made it easy for you too.

Every Saturday, Street Sheet Research subscribers receive an institutional-quality PDF outlining all the important happenings on Wall Street over the past week, plus dozens of potential ways to play them.

“Self-directed” should be a superpower, not an excuse. You already have the flexibility and intuition to outpace the institutions.

You just need to start your day right.

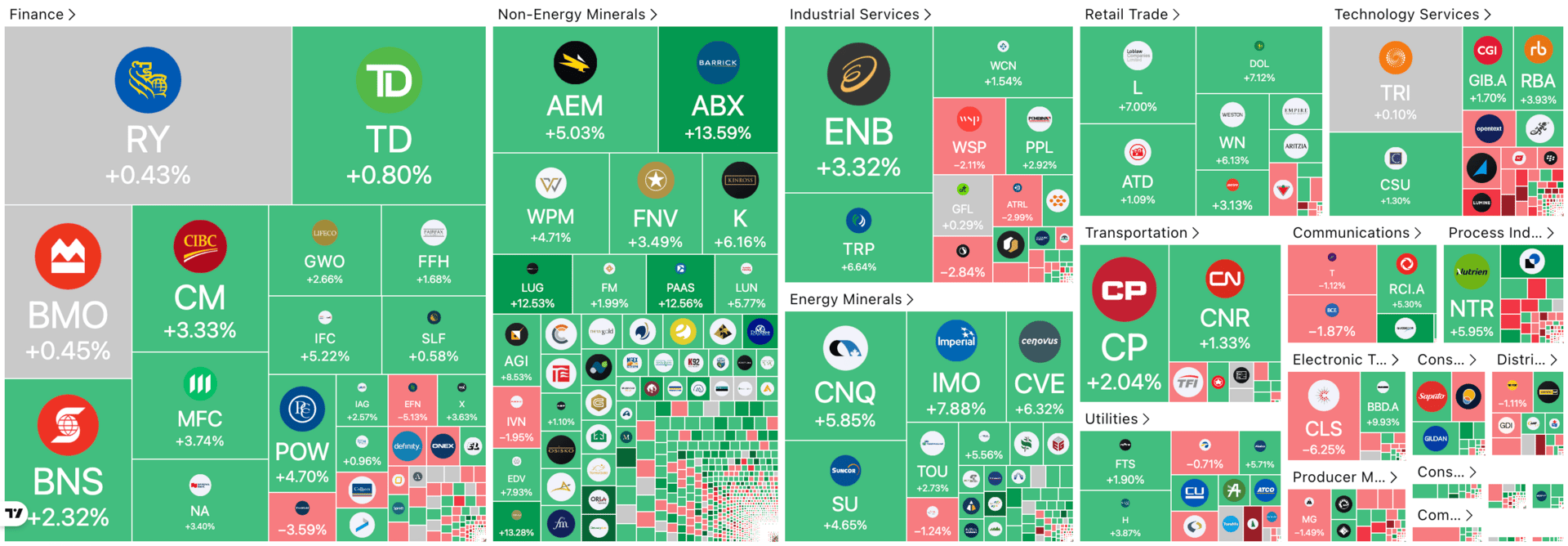

CANADIAN STOCK HEATMAP

Credit: TradingView

OVERHEARD ON BAY STREET

IE: Canadian manufacturing sales rose 3.3% to $72.1B in September, driven by strong auto and energy sector gains.

The Globe and Mail: Leveraged ETFs surged to $12.2B in Canada, even as their high-risk structures caused major losses and raised investor warnings.

YF: RBC said Ontario spending jumped in October as the Blue Jays’ World Series run fueled a 12.2% surge in entertainment purchases.

One Trend To Watch

A NEW BATCH OF NATION-BUILDING

On Thursday, Prime Minister Mark Carney traveled to British Columbia to announce a second round of what he called “nation-building projects” intended to boost Canada’s economy and make it less reliant on imports.

From a critical minerals mine in New Brunswick, to a nickel mine in Ontario, to a liquefied natural gas plant in BC, to a hydroelectric project in Iqaluit, the projects are geographically and economically diverse.

Carney also announced the furtherance of the North Coast Transmission Line, lending more momentum to the $6 billion, 450-km hydrocorridor.

The transmission line was part of Carney’s first round of infrastructure projects, announced in October. The government predicts these projects will net $60 billion in revenue for Canada’s economy, while creating tens of thousands of jobs.

Thursday’s announcement didn’t include any new pipelines. But it could potentially still be a bullish signal for oil and gas firms.

Alberta’s Premier Danielle Smith says she is in talks with the federal government to create a “memorandum of understanding” to roll back anti-development policies enacted by the Trudeau government, and therefore pave the way for more energy infrastructure.

Presented by Street Sheet Research

Hurricane-strength headwinds are gathering for global trade. They could potentially leave some of the biggest operators capsized. But those with flexible fleets may be able to weather this storm — and emerge with the wind at their backs.

In our November report, we’ve identified one small-cap stock with disruptive potential.

There’s still time to ride this rogue wave before it breaks — but maybe not for long. Unlock our latest monthly Street Sheet Research to act on this institutional-grade information while you can.

This Week’s Trade Idea

CAN’T GO GREEN WITHOUT GRAPHITE

Supercharge Graphite Demand

Nouveau Monde Graphite $NOU.TSX ( ▼ 1.33% ) shares ticked up this week on news of fresh supply deals and progress on its phase-2 Matawinie graphite project in Quebec. But that might not be the only catalyst on the horizon for the critical mineral company.

Graphite is a key material for electric vehicles, because of its role as the main anode material. In fact, each EV has over 66 kilograms of graphite on average, compared to virtually no graphite in gas-powered cars.

With global sales of EVs expected to hit 13.33 million by 2027, up sharply from 4.6 million in 2021, the EV transition could be a significant catalyst for graphite demand.

The same goes for solar panels. Graphite is crucial to the manufacturing of the panels, as its ability to withstand high temperatures allows it to provide thermal insulation for creating liquid silicon at around 1,500 degrees Celsius. Solar panel manufacturing is expected to consume $2.5 billion worth of graphite by 2033.

The Geopolitics of Graphite

China controls most of the global supply of rare earth metals, as its recent trade war salvoes with the US recently reminded the world. And the Asian nation has proved unafraid to wield that as a geopolitical cudgel.

Indeed, China is the lead supplier of graphite, too. At least, for now. But policymakers in both Canada and America are working to change that through tax incentives and new supply chains.

Nouveau Monde Graphite’s freshly inked deals with Panasonic Energy and Traxys North America, as well as the support it enjoys from Canada’s government, are a testament to Canada’s commitment to securing a stable and domestic supply of graphite. And the firm itself appears central to those efforts.

A Look Under the Hood

Investors have already taken notice. The company’s shares are up more than 90% year-to-date, leaving even the Toronto Stock Exchange’s energetic 2025 returns in the dust.

Can the stock keep up its momentum? The company has no significant revenue and is unprofitable. So, as a volatile microcap, caution and risk management must be front and center to anyone seeking to buy shares.

Analysts may forecast significant growth for the company if its projects launch. But even with the government’s favor, that’s still a big “if.”

LAST WEEK’S POLL RESULTS

Are you bullish or bearish on precious metals over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Big increase in materials sector activities in 2025 over and above gold, copper, and silver mining ”