HAPPY TUESDAY TO THE STREET

Tesla $TSLA ( ▼ 1.49% ) CEO Elon Musk aimed for 250,000 Cybertrucks a year. Reality aimed lower. US sales fell sharply in 2025, with demand dropping off a cliff by year-end. The truck that once racked up over a million reservations is now running into a familiar problem. Bold designs get attention, but they don’t necessarily close deals.

🟥 | US stocks slipped today despite the December CPI coming in below expectations once again, as markets predicted the Fed’s mind is already made up for its policy meeting later this month.

📈 | One Notable Gainer: Boeing $BA ( ▼ 0.82% ) shares rose after it outsold Airbus $EADSY ( ▼ 1.77% ) in 2025, logging 174 net December orders.

📉 | One Notable Decliner: Travere Therapeutics $TVTX ( ▲ 0.24% ) slid after the FDA sought more data on a kidney drug’s clinical benefit.

— Brooks & Cas

Presented by VisionWave

VisionWave Holdings (NASDAQ: VWAV) is carving out a differentiated role in defense technology by combining AI-driven sensing, RF imaging, and autonomous decision-making into a single edge-ready platform.

Unlike cloud-dependent AI, VWAV’s Evolved Intelligence architecture operates in real time within contested environments, enabling autonomous drones, vehicles, and radar systems to act without constant human oversight. These capabilities have been validated through live-fire tests and Tier-1 defense pilots.

With defense radar and autonomy markets expanding, recent advisory additions, platform acquisitions, and a clean balance sheet position VWAV to convert pilots into longer-term contracts.

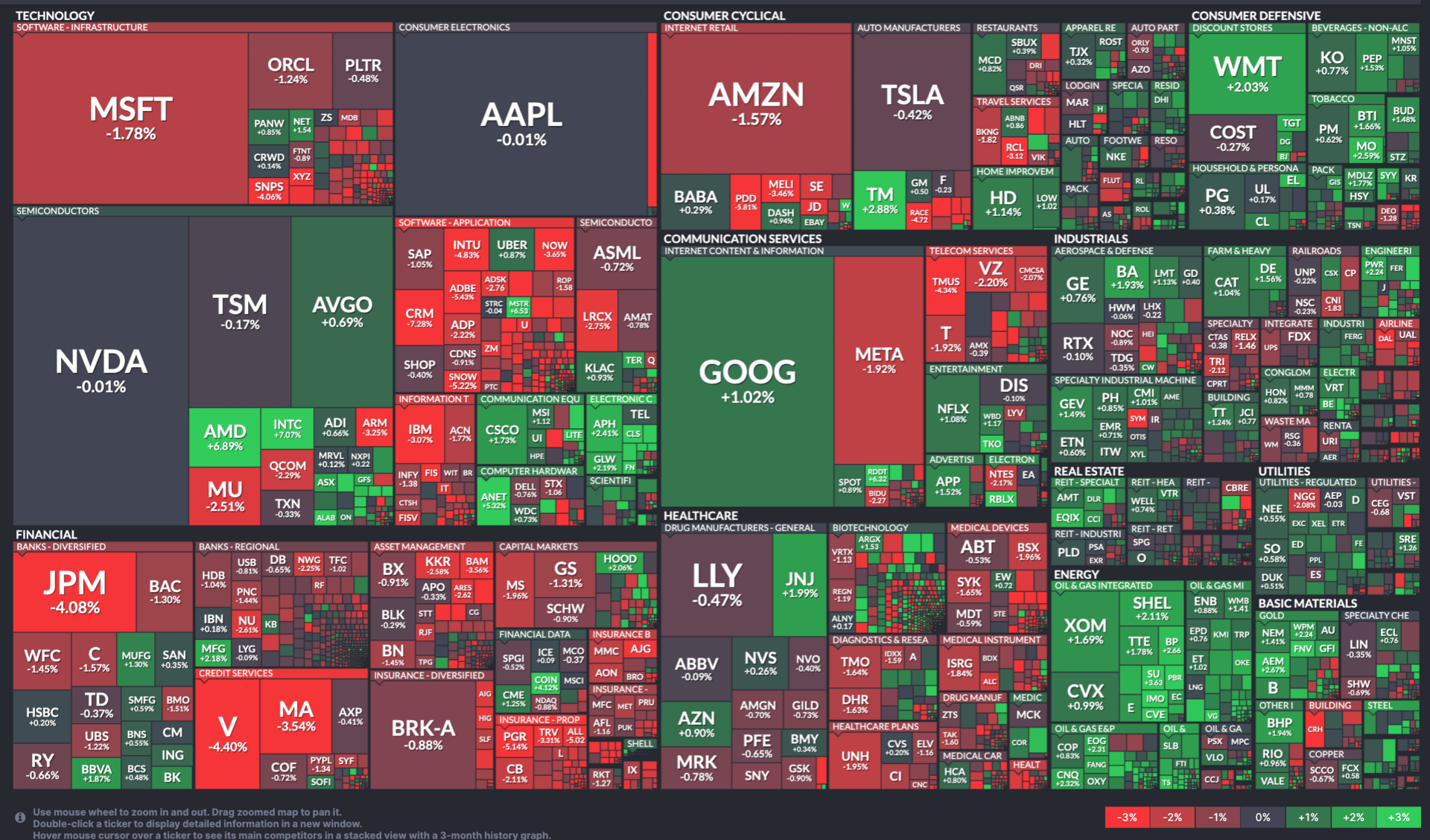

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

JPMORGAN, CHIPOTLE, MODERNA

JPMorgan $JPM ( ▼ 1.9% ) fell after investment banking fees missed expectations and the bank flagged potential industry pushback on proposed credit card rate caps.

Chipotle $CMG ( ▼ 2.18% ) reaffirmed 2025 guidance pointing to a low single-digit decline in comparable sales and naming an interim CMO.

Moderna’s $MRNA ( ▲ 3.6% ) CEO projected 2025 sales above the midpoint of prior guidance at JPMorgan’s health care conference.

L3Harris Technologies $LHX ( ▲ 2.64% ) partnered with the Defense Department to expand rocket motor capacity and outlined plans for a missile unit IPO.

Delta Air Lines $DAL ( ▼ 6.82% ) posted mixed Q4 results, with revenue coming in just below expectations.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

REDDIT’S AI MOMENT IS ARRIVING

A Strong Run, And A Fresh Call

Reddit $RDDT ( ▼ 3.6% ) already delivered an impressive year, but Evercore ISI $EVR ( ▼ 5.3% ) thinks the story is still early.

The firm initiated coverage with an Outperform rating, arguing that the market is underestimating how artificial intelligence can reshape Reddit’s revenue model.

Shares are up 58% over the past year. Evercore $EVR ( ▼ 5.3% ) calls the valuation robust but reasonable. Its thesis rests on two pillars: sustained user growth and better monetization driven by AI-powered products.

User Growth Meets Smarter Monetization

Reddit continues to add users at a healthy clip, especially outside the US. International growth is running materially faster, expanding the platform’s long-term opportunity set.

Engagement is improving as well, Evercore says. Products like Reddit Answers, an AI-powered summarization tool, help users surface relevant information faster and stay on the platform longer. Daily and weekly active users are compounding at double-digit rates.

Evercore also highlights quieter changes. Simpler onboarding, a more personalized home feed, and efforts to convert logged-out traffic into registered users. That sets the stage for higher average revenue per user, even without explosive user growth.

AI As A Revenue Product

The most underappreciated lever may be data licensing. Reddit hosts more than 2 billion posts and over 20 billion comments, a dataset that has become foundational for training large language models.

Management is now formalizing that role through licensing agreements expected to generate more than $200 million in high-margin revenue over the next few years. That is incremental upside layered onto advertising, not a replacement.

Evercore believes that combination supports sustained revenue growth in the 20% to 30% range, justifying a premium versus peers like AppLovin $APP ( ▼ 2.28% ) and Roblox $RBLX ( ▼ 3.84% ).

Presented by VisionWave

VisionWave Holdings (NASDAQ: VWAV) is emerging as a strategically positioned AI-defense company as militaries shift toward autonomous intelligence. Built around its Vision-RF and Evolved Intelligence platforms, VWAV holds more than 50 granted patents and has launched pilots across the US, Israel, India, and the Gulf region.

These programs include live-fire evaluations, US Army C-UAS submissions, and long-term collaboration frameworks. As defense radar markets expand, new advisory board additions bring command-level and procurement expertise as VWAV works to convert pilots into multi-year contracts.

Supported by a debt-free balance sheet and committed growth capital, the company is positioning for broader adoption.

OVERHEARD ON THE STREET

CNBC: Nike $NKE ( ▼ 2.77% ) signed its first pickleball deal with Anna Leigh Waters as the sport’s top-ranked star.

TechCrunch: Microsoft $MSFT ( ▼ 2.24% ) announced a community-first AI infrastructure plan, following similar expansion commitments from Meta Platforms $META ( ▼ 1.34% ).

WSJ: Percepta said Palantir $PLTR ( ▲ 0.92% ) sued to intimidate employees, denying claims of poaching and trade secret theft.

Axios: Anthropic previewed Cowork, a non-coder productivity tool largely built by its Claude AI using prompt-driven development.

QZ: Delta Air Lines $DAL ( ▼ 6.82% ) forecasted 20% earnings growth driven by premium demand, but missed Wall Street expectations.

MONDAY’S POLL RESULTS

Are you bullish or bearish on Akamai Technologies over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐻 Bearish — “None of the reasons given suggest an end to the anemic growth of the past few years.”

17(b) Disclosure: This message is a paid advertisement for VisionWave Holdings, Inc. (NASDAQ: VWAV). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. VisionWave Holdings, Inc. (NASDAQ: VWAV) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, VisionWave Holdings, Inc. (NASDAQ: VWAV) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.