HAPPY THURSDAY TO THE STREET.

President Donald Trump and Mark Cuban finally agree on something: cutting out the middleman. The former announced deals with Eli Lilly $LLY ( ▼ 1.34% ) and Novo Nordisk $NVO ( ▼ 2.13% ) to lower the cost of popular GLP-1 drugs, with monthly prices starting between $150 and $250.

Even longtime critic Cuban praised the plan as “great,” saying it mirrors his own direct-to-consumer model that cuts pharmacy benefit managers out of the supply chain. Cuban recently unveiled his own price cut with his firm Cost Plus Drugs, slashing a top autoimmune drug from $80,000 a year to about $1,400.

Let’s take a moment to appreciate an economic move with “no downside for anyone” — and an increasingly rare bit of bipartisan consensus.

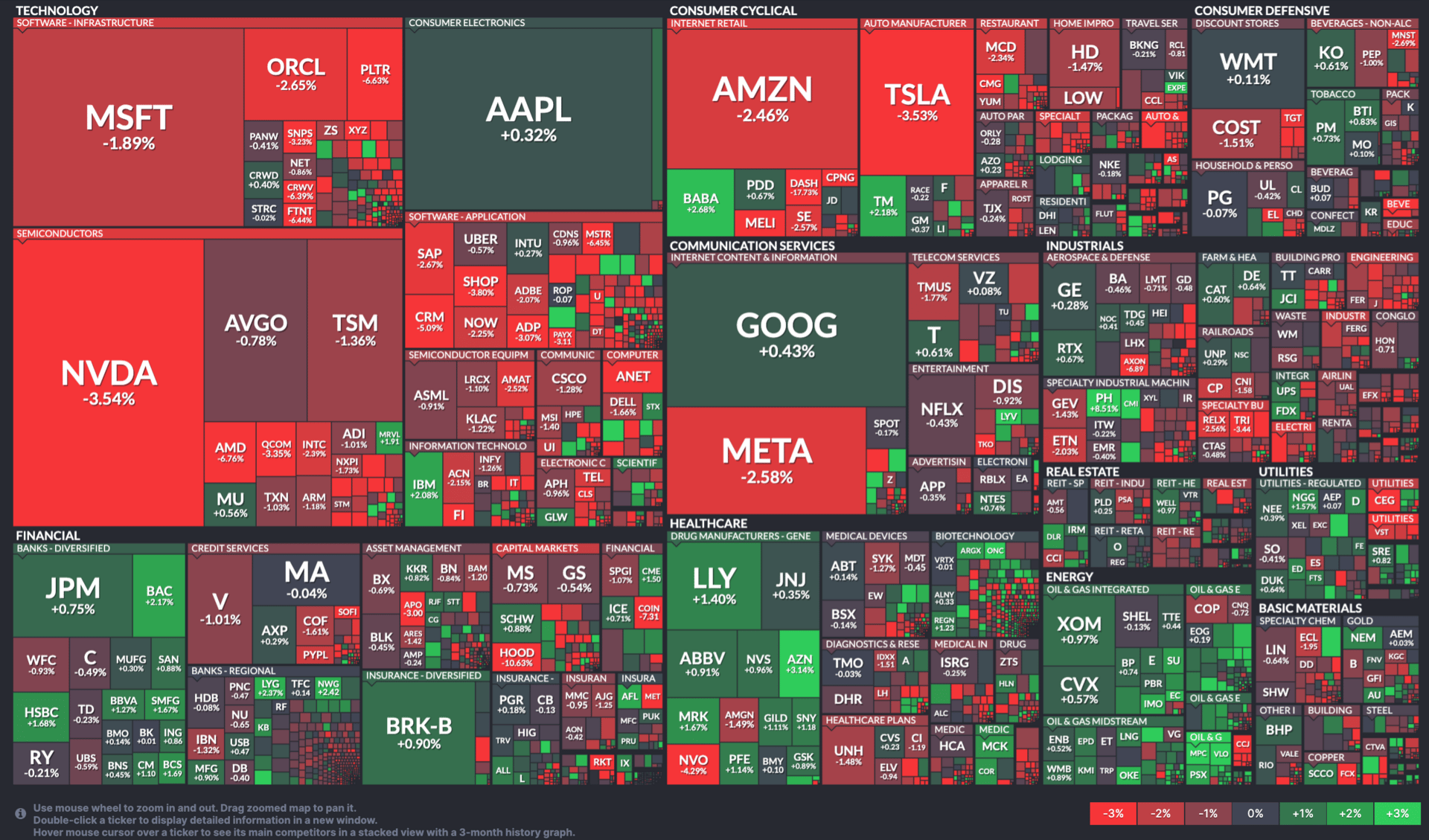

🟥 | US stocks fell today as AI high-fliers sank on stretched valuations and rising layoff alerts.

📈 | One Notable Gainer: Golden Entertainment $GDEN ( ▲ 0.9% ) jumped after agreeing to be taken private by Blake Sartini.

📉 | One Notable Decliner: Marriott Vacations Worldwide $VAC ( ▲ 0.34% ) sank after cutting its full-year EBITDA forecast.

Plus, read to the end for the closest thing to jobs data we’ll get all week...

— Brooks & Cas

Sponsored by RAD Intel

Own the AI powering Fortune 1000 brands with recurring 7-figure contracts in place. 4,900% growth, 10,000+ investors, backed by Adobe & Insiders @Google. $0.81/share, price changes 11/20.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

QUALCOMM, UNDER ARMOUR, SNAP

Qualcomm $QCOM ( ▲ 1.14% ) warned it may lose Apple $AAPL ( ▲ 1.54% ) as a modem customer.

Under Armour $UAA ( ▲ 5.58% ) slipped even after beating earnings and revenue estimates.

Snap $SNAP ( ▲ 2.8% ) unveiled a $500M buyback and announced a $400M AI partnership with Perplexity.

Duolingo $DUOL ( ▲ 1.65% ) issued weaker bookings guidance despite topping Q3 sales estimates.

DoorDash $DASH ( ▲ 0.06% ) reported mixed Q3 results with weaker earnings but stronger revenue.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

Morgan Stanley raised Brighthouse Financial $BHF ( ▲ 0.39% ) to Equal Weight

Guggenheim upgraded Datadog $DDOG ( ▼ 4.1% ) to Neutral

Argus lifted Super Micro $SMCI ( ▲ 0.81% ) to Buy

📉 Downgrades

JPMorgan cut CarMax $KMX ( ▼ 0.18% ) to Underweight

UBS lowered Eversource $ES ( ▼ 0.15% ) to Neutral from Buy

Lake Street downgraded Honest Company $HNST ( ▲ 3.18% ) to Hold from Buy

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

MIRACLE-GRO-WTH?

Planting Seeds of a Recovery

Scotts Miracle-Gro $SMG ( ▲ 1.17% ) is back in Wall Street’s good graces.

Stifel upgraded the fertilizer and lawn-care company to Buy after a better-than-expected fourth quarter and stronger earnings guidance for fiscal 2026.

Analyst W. Andrew Carter kept his $70 price target, roughly 32% above current levels, as Scotts is starting to trade more like its consumer-staples peers again.

Margins Take Root

While shares have fallen 14% this year, the company’s latest results gave the analyst reasons for optimism.

Adjusted losses of $1.96 per share came in narrower than forecasts, and management’s 2026 EPS outlook topped expectations. Carter said the firm’s gross margin trajectory is “above our expectations,” helped by cost controls and improved shipment efficiency across the supply chain.

Stifel raised its earnings forecast to $4.26 per share for 2026, up from $4.07, adding that the company’s leading position in the home and garden segment remains intact. Retailers continue to depend on its flagship Miracle-Gro and Ortho brands even amid sluggish home-improvement spending.

A Seasonal Turnaround

Though the environment is still imperfect, Carter argued that Scotts’ performance “validates the category’s resilience.”

With more disciplined operations, a cleaner balance sheet, and steady retailer demand, the stock could finally be turning a corner.

If the company executes through the next growing season, investors may find that Scotts’ fertilizer isn’t just for lawns, but also margins.

Sponsored by RAD Intel

Own the AI powering Fortune 1000 brands with recurring 7-figure contracts in place. 4,900% growth, 10,000+ investors, backed by Adobe & Insiders @Google. $0.81/share, price changes 11/20.

OVERHEARD ON THE STREET

Reuters: Microsoft $MSFT ( ▼ 0.31% ) is launching the MAI Superintelligence Team to develop AI systems that surpass human capabilities.

NYT: ESPN $DIS ( ▼ 0.4% ) ended its PENN $PENN ( ▼ 2.33% ) partnership and named DraftKings $DKNG ( ▼ 0.8% ) its exclusive sportsbook provider.

CBS News: Starbucks’ $SBUX ( ▲ 1.76% ) $30 “bearista” mug, shaped like a honey bear, sold out instantly and is now reselling on eBay $EBAY ( ▲ 3.92% ) for up to $300.

CNBC: Meta $META ( ▲ 1.69% ) reportedly made about $16B from scam and banned product ads in 2024.

AP: Boeing $BA ( ▼ 0.72% ) avoided criminal charges over the 737 Max crashes after a judge approved a deal requiring $1.1B in fines, payouts, and safety reforms.

STREET TWEET

The future of work, apparently, is less work.

Job cuts surged to 20-year highs last month, led by tech and logistics. Not the best news, but hey. It’s the second month in a row without a federal jobs report. We’ll take our labor data dopamine wherever we can get it.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Yum Brands $YUM ( ▲ 0.37% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Fast Food will rule next several quarters.”

🐻 Bearish — “It’s not going anywhere but down.”