HAPPY WEDNESDAY TO THE STREET

The “hawkish cut” finally arrived. The Federal Reserve lowered rates by 25 basis points on a rare 9-3 vote, exposing fractures over how much more easing the economy can handle. The dot plot barely budged (one cut penciled in for 2026, another for 2027) while seven officials signaled they don’t want cuts at all next year.

Last cut, markets fell, because it was exactly as dovish as expected. Now, on an unmistakably hawkish note, indexes are… surging? The Street is nothing if not unpredictable. Remind us never to dabble in prediction markets.

🟩 | US stocks jumped on the Fed rate cut and new bond bus, pushing the S&P 500 toward a record close.

📈 | One Notable Gainer: EchoStar $SATS ( ▼ 3.9% ) rose after Morgan Stanley $MS ( ▲ 0.6% ) upgraded the stock to Overweight, citing favorable spectrum-related risk and reward dynamics.

📉 | One Notable Decliner: Instacart-parent Maplebear $CART ( ▲ 1.93% ) fell after Amazon $AMZN ( ▲ 2.56% ) expanded its same-day perishable grocery delivery to 2,300 cities.

— Brooks & Cas

Presented by Venture Trader

We all know the feeling. You watched the stock. You waited for the perfect moment. Then it ran right by you. Without you.

Genetic AI is built to change that.

Trained by a 25-year market quant to think like a trader, but with a brain capable of testing 15000+ strategies nightly, Genetic AI is designed to recognize the earliest signals in microcaps.

From there, it delivers premarket alerts with exact entry and exit levels, to help everyday traders act early instead of reacting late.

If you want fewer regrets and more conviction, this is the tool that shifts momentum in your favor.

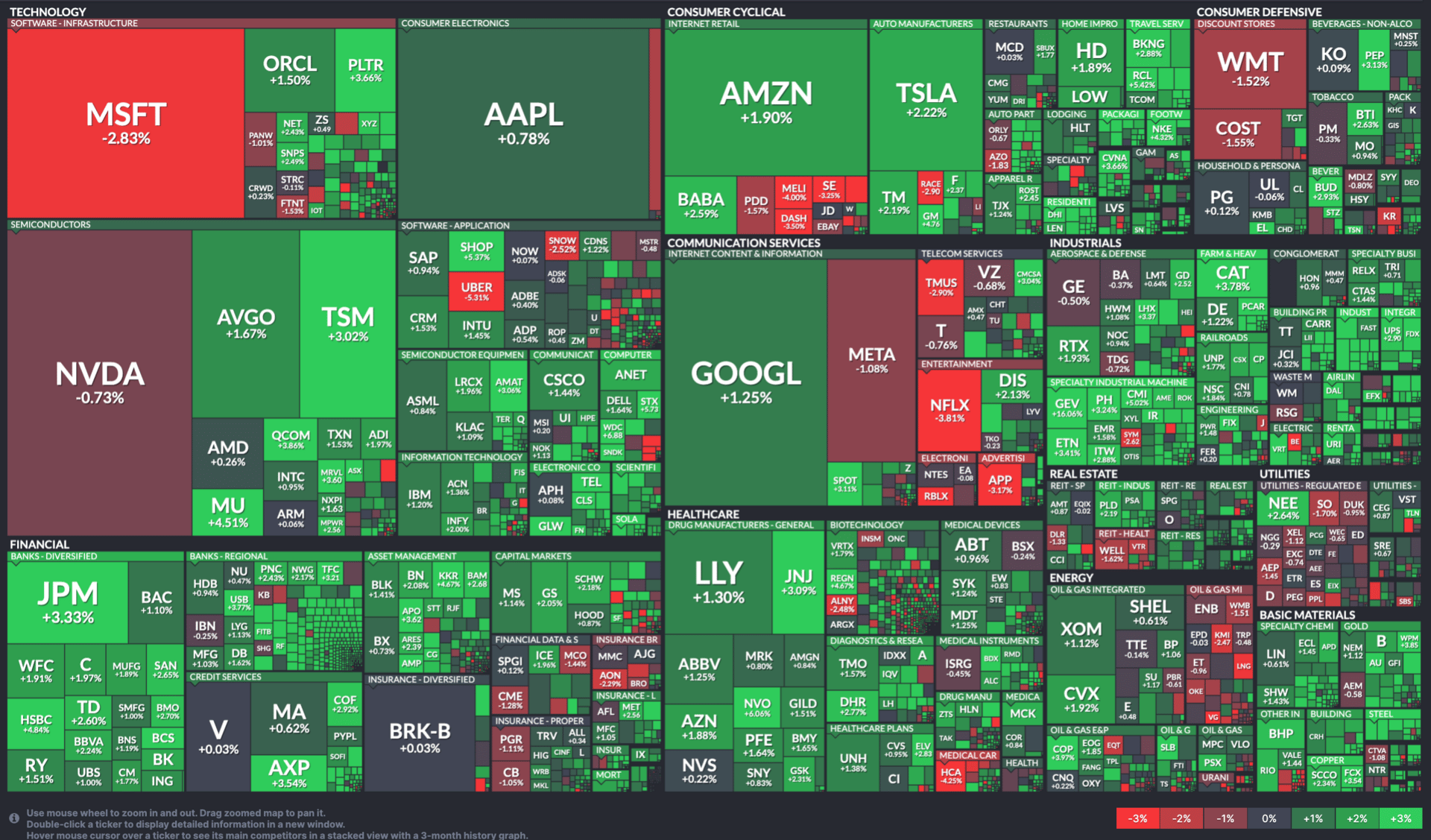

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

UNITED NATURAL FOODS, DAVE & BUSTER’S, AEROVIRONMENT

United Natural Foods $UNFI ( ▲ 0.16% ) issued long-term sales targets calling for low single-digit growth through 2028.

Dave & Buster’s $PLAY ( ▼ 1.16% ) reported Q3 adjusted EBITDA ahead of expectations.

AeroVironment $AVAV ( ▼ 6.05% ) missed fiscal Q2 earnings estimates.

GE Vernova $GEV ( ▼ 0.51% ) said 2025 revenue is tracking toward the high end of its guidance and doubled its dividend.

GameStop $GME ( ▼ 1.97% ) reported lighter-than-expected Q3 revenue.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

HOLD THIS CLOUD MESSAGING WINNER

More Than Just A One-Off Pop

Twilio $TWLO ( ▲ 1.97% ) has rewarded patient investors. Since early September, the company, which sells B2C communication tools, has climbed 20%, helped by a strong third quarter and a cleaner growth story.

To that, Barron’s says, “Hold on.”

Management thinks the market for Twilio’s services can top $100 billion by 2028. The company doesn’t need to own the whole category, either; just to retain a solid slice while expanding margins.

Where Growth Meets Operating Leverage

Revenue grew about 14% year over year to $1.3 billion, ahead of expectations and faster than the prior quarter.

But the quality of growth may matter even more than the headline number. Twilio is landing new customers, selling them multiple products, and pushing through price increases without seeing many defections.

Then there’s the AI layer. Twilio is leveraging AI technology to understand conversations faster and make customer interactions more efficient, which can deepen relationships without much extra sales spend.

Why The Valuation Gap Could Narrow

Despite the rally, Twilio still trades at a discount to many software peers. The stock is valued at roughly 3.7x forward sales, compared with more than 8x for a broad software ETF.

If Twilio can maintain double-digit revenue growth and keep expanding free cash flow, that gap could narrow. For growth-minded investors, Barron’s argues, the playbook is simple. Hold positions, add on pullbacks, and let earnings do the work.

Presented by Venture Trader

Timing is everything in microcaps. Genetic AI helps you get ahead of the move.

It processes millions of data points each night and flags stocks with early signs of potential momentum, netting 8% returns in the last 2 months.*

You receive the plan before the market opens. Plenty of time left to act.

OVERHEARD ON THE STREET

QZ: SpaceX is reportedly preparing a 2026 IPO that could raise over $30B and target a valuation near $1.5T.

Reuters: Homeland Security plans to spend nearly $140M on Boeing $BA ( ▼ 0.72% ) 737 jets for deportation flights.

CNBC: Southwest $LUV ( ▲ 0.02% ) is exploring airport lounge openings with Chase $JPM ( ▲ 0.89% ) as it pursues more premium travel offerings.

TechCrunch: Rivian $RIVN ( ▼ 2.05% ) is developing a vehicle-integrated AI assistant, expected to debut around its upcoming AI and Autonomy Day.

CNN: Instacart reportedly used AI to vary prices up to 20% among shoppers, charging based on perceived price sensitivity.

TUESDAY’S POLL RESULTS

Are you bullish or bearish Wave Life Sciences $WVE ( ▲ 2.51% ) over the next 12 months?

▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Cautiously bullish. A lot depends on what exact mechanism the RNA targets. Also, RNA is way more fragile than peptides, so logistics may prove challenging.”

🐻 Bearish — “Too many products to think about.”

*IMPORTANT DISCLAIMERS: Educational Publisher Notice: Venture Trader is an educational publisher—not a broker-dealer or investment adviser. We provide educational content and trading insights for informational purposes only. Risk Warning: Micro-cap stocks can be highly volatile and illiquid. Only invest capital you can afford to lose. Trading stocks involves risk, and you should carefully consider your investment objectives, level of experience, and risk appetite. Performance Disclaimer: Results reflect fixed trading rules tested on historical market data. These are hypothetical, not live trades, and real results may vary. Past performance is not indicative of future results. Individual results will vary. Not Financial Advice: Nothing on this page should be considered personalized financial advice. Always consult with a licensed financial professional before making investment decisions.