HAPPY WEDNESDAY TO THE STREET.

Is there such a thing as a “lame duck” Fed Chair? President Trump sure seems to be central-banking on it.

After the president’s attempts to “fire” Federal Reserve Chair Jerome Powell stalled, it looks like Powell will be steering the US economy for the foreseeable future. But his term is up in May 2026, and now Trump is reportedly weighing the possibility of naming a predecessor sooner than later, to serve as a “shadow chair” in the interim.

It’s been a bumpy ride, but all things told, I think I’m going to miss good old Pumpin’ Powell. Blowin’ Up Bessent just doesn’t have the same ring to it.

🟥 | US stocks ticked down despite soft inflation data and trade progress with China.

📈 | One Notable Gainer: Nvidia’s $NVDA ( ▲ 1.02% ) GTC conference was a major catalyst — just not for AI stocks. CEO Jensen Huang said quantum computing is nearing an inflection point, sending Rigetti $RGTI ( ▼ 4.1% ) soaring.

📉 | One Notable Decliner: Meanwhile, Intel $INTC ( ▼ 1.14% ) caught strays at the event, as Nvidia said the legacy chipmaker is not its chief 6G rival, pointing instead to China’s Huawei.

— Brooks & Cas

Sponsored by The Rundown AI

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

STOCK HEATMAPS

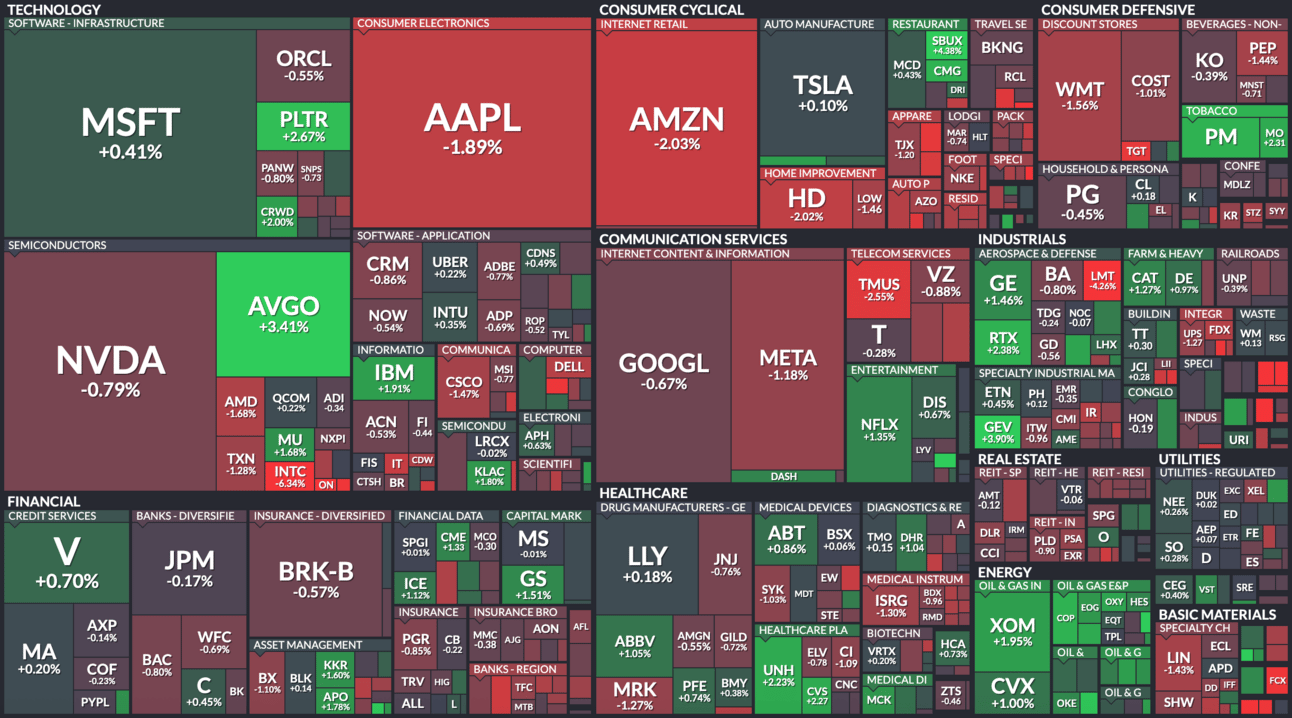

S&P 500 Heatmap. Credit: Finviz

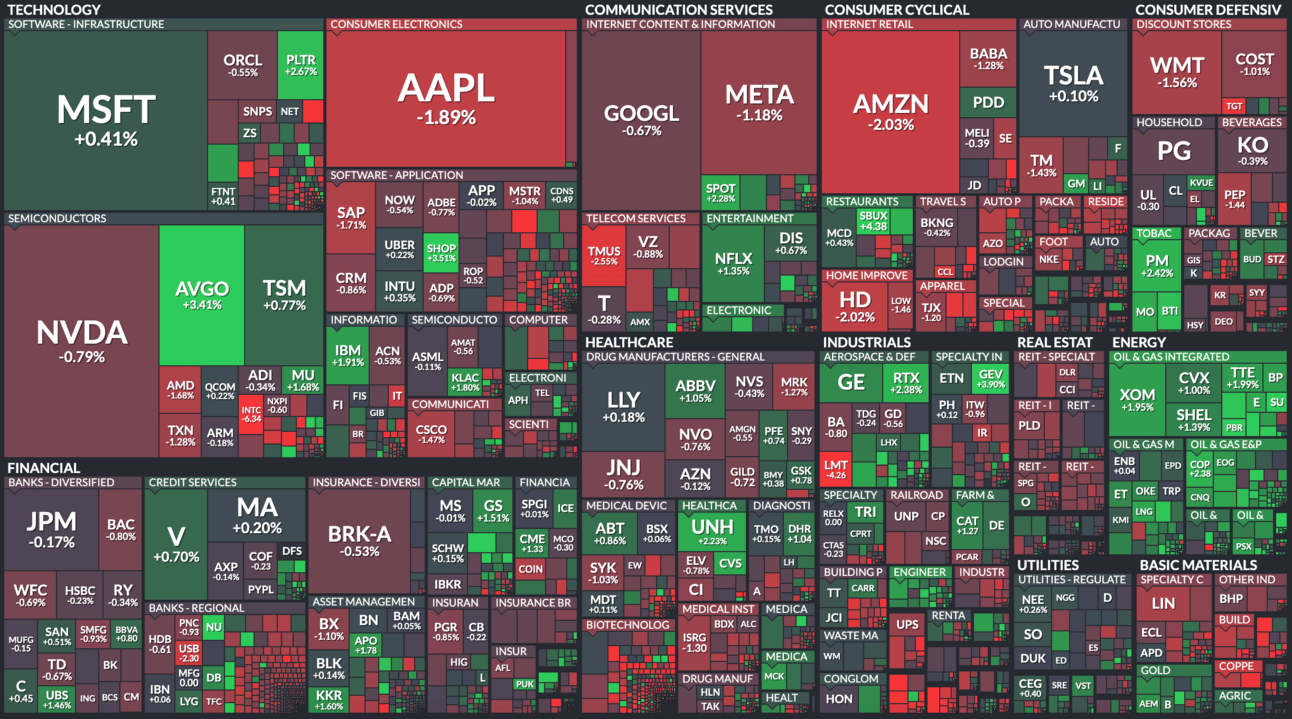

All Stock Heatmap. Credit: Finviz

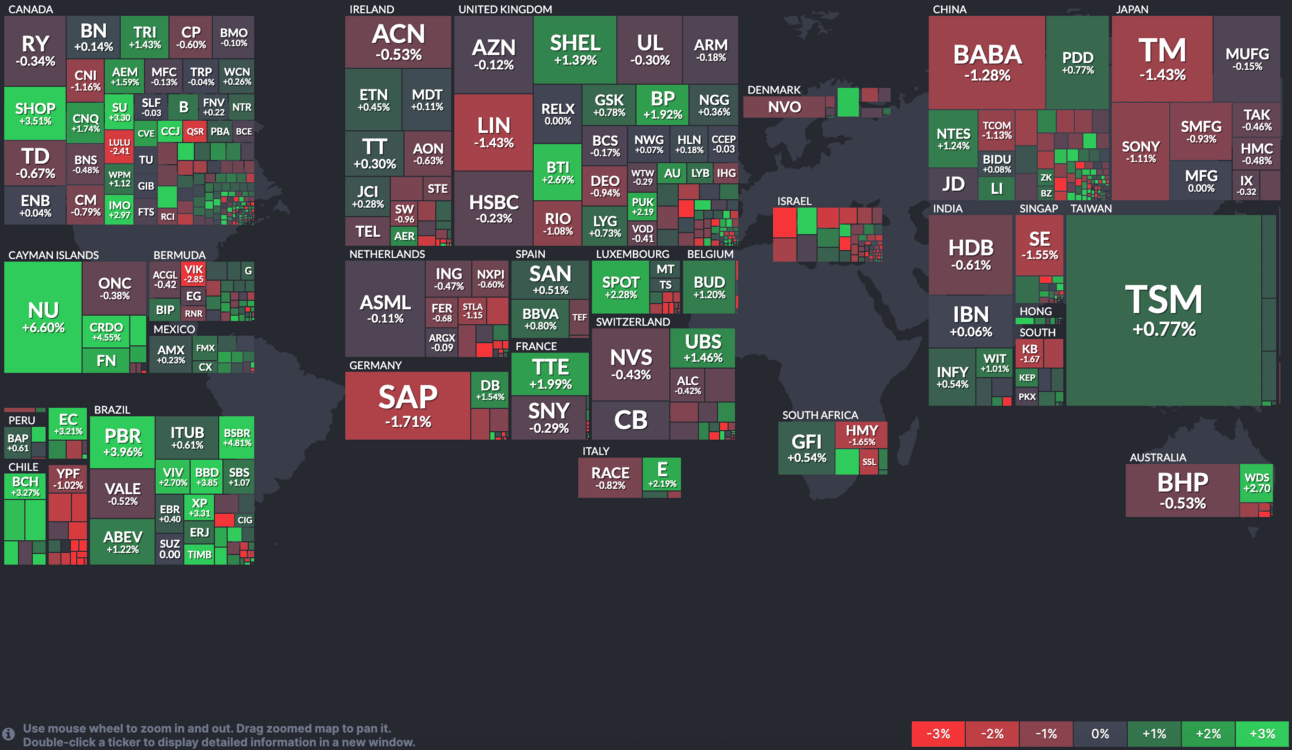

Global ADR snapshot. Credit: Finviz

Market Movers

STARBUCKS, DELTA, SHOPIFY

$SBUX ( ▲ 1.76% ) Starbucks to roll out Microsoft Azure OpenAI assistant for baristas (CNBC)

$DAL ( ▲ 2.97% ) Venture Global withdraws application to build Delta LNG plant, filing shows (Reuters)

$SHOP ( ▲ 1.94% ) Sezzle files anti-trust lawsuit against Shopify (SeekingAlpha)

$CHWY ( ▲ 2.28% ) Chewy Stock Slumps Even After Earnings Beat. Here’s What We Know. (Barron’s)

$OKLO ( ▼ 5.63% ) Oklo moves closer to nuclear power agreement with US Air Force (Reuters)

OVERHEARD ON THE STREET

NPR: Trump announced on social media that a trade deal with China is "done" following two days of high-level talks in London.

CNBC: Specifically, Commerce Secretary Lutnick said tariffs on China will not change again, holding steady at 30%, plus 25% on specific products.

CBS: Consumer inflation rose 2.4% annually in May, slightly below expectations.

AP: Tesla $TSLA ( ▲ 0.03% ) CEO Elon Musk backed down from his feud with Trump, admitting on X that some of his recent posts “went too far”.

WSJ: Bojangles $BOJA ( ▼ 0.06% ) is exploring a sale, which could value the Southern biscuit chain at upwards of $1.5B.

Tomorrow's Trade Idea, Today

GME? STOP!

Greater Fools

GameStop’s $GME ( ▼ 1.97% ) stock is dropping today after reporting a sharp decline in quarterly revenue. But that doesn’t come as a surprise to Wedbush’s Michael Pachter. In fact, the analyst believes the “meme stock” has much further to fall.

Wedbush’s 12-month price target on the stock is $13.50, implying a whopping 53% downside from today’s close. Pachter said GameStop’s valuation is propped up solely by “‘greater fools’ willing to pay more than twice its asset value for its shares”. Sooner or later, he believes, they’re bound to run out.

The “Strategy” Strategy

Despite its popularity among retail investors, the analyst criticized GameStop’s lack of a clear strategy for turning around its core video game business, instead leaning on flashy announcements to drive interest.

One came as recently as last week, when the firm said it would begin making corporate bitcoin $BTC.X ( ▲ 0.05% ) purchases, similar to Strategy’s $MSTR ( ▲ 1.24% ) approach. It already purchased more than 4,000 bitcoin, worth roughly half a billion dollars.

Bitcoin Bust?

The pivot to crypto may go over well with the r/WallStreetBets crowd. But Pachter argues it has little logical appeal for investors.

“The company already trades at 2.4x cash,” the analyst pointed out. So why, he asked, would traders pay that premium for the possibility of GameStop spending its own cash on bitcoin, when they could just invest in ETFs or the tokens themselves?

There’d be no Wall Street in 2025 without so-called “dumb money”, willing to buy any stock, even if only for the meme. But Pachter believes the “smart money” shouldn’t give GameStop a second glance — unless they’re looking for short opportunities.

Sponsored by Superhuman AI

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

ON OUR RADAR

The Verge: The GOP budget bill is drawing criticism for a proposed moratorium on state AI regulation.

WSJ: China will ship rare earths as part of the trade deal, but imposed a six-month limit on US export licenses, maintaining leverage in future trade talks.

Reuters: Elon Musk is eyeing a “tentative” August launch for Tesla’s robotaxis in Austin, Texas.

BI: Disney $DIS ( ▼ 0.4% ) and NBCUniversal $CMCSA ( ▼ 0.13% ) sued AI image generator Midjourney, alleging copyright infringement.

Fortune: Are Beanie Babies back? Not exactly, but people are paying thousands of dollars for a new line of dolls. Here’s why.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on the AI sector over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “There's enough of an international market to keep it floating.”

🐻 Bearish — “It’s not really going to go up.”