HAPPY TUESDAY TO THE STREET

College football’s top player has a LinkedIn $MSFT ( ▼ 0.31% ) page as impressive as his highlight reel.

Indiana QB Fernando Mendoza stepped into the national spotlight this weekend after upsetting Ohio State for the Big Ten title. But his professional track record is equally impressive.

Haas degree. Real-estate investment internships. A strict budgeting habit. And no social apps besides LinkedIn and YouTube $GOOGL ( ▲ 4.01% ). Is the Heisman finalist prepping for the NFL? Or Wall Street?

🟨 | US stocks rose as traders awaited the Fed’s rate call, with odds favoring another cut and risk appetite steadier into month-end.

📈 | One Notable Gainer: Staar Surgical $STAA ( ▼ 0.67% ) jumped after Alcon $ALC ( ▼ 0.71% ) raised its takeover offer.

📉 | One Notable Decliner: Gogo $GOGO ( ▼ 0.45% ) fell after announcing an undisclosed investment in satellite communications firm Farcast.

— Brooks & Cas

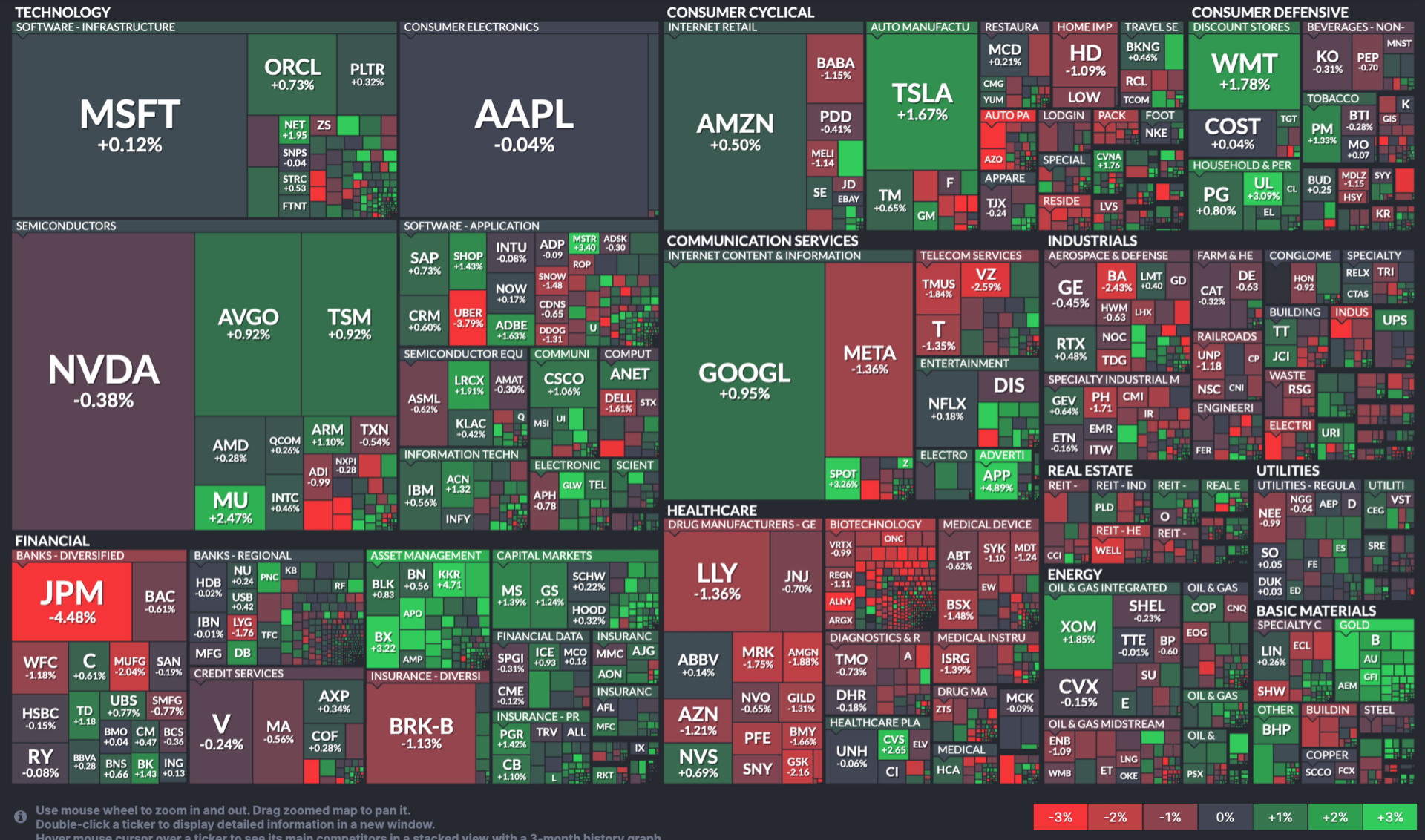

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

EXXON MOBIL, CVS, SLM

Exxon Mobil $XOM ( ▼ 2.44% ) updated its long-term plan and projected stronger earnings and cash flow through 2030.

CVS $CVS ( ▼ 0.82% ) issued 2026 profit guidance above Wall Street expectations.

SLM $SLM ( ▼ 3.46% ) fell on a Morgan Stanley downgrade.

Teleflex $TFX ( ▲ 3.27% ) announced the sale of three business units.

Ares Management $ARES ( ▼ 5.15% ) will be added to the S&P 500.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

THE OBESITY DRUG BET WELLS FARGO LIKES

New Name In The Weight-Loss Race

Wave Life Sciences $WVE ( ▲ 2.51% ) just jumped into the obesity business. And, boy, is business booming.

The Singapore-based biotech more than doubled in a single session after early data from its RNA obesity shot. Wells Fargo $WFC ( ▲ 1.29% ) says the spike was warranted.

What’s more, the bank still sees room for gains.

A Different Way To Lose The Weight

The bank kept an Overweight rating and raised its target from $16 to $29, implying upside of 36% from today’s close. Wave is now up 60% this year, with most of that move coming after Monday’s Phase 1 readout showed fat loss without muscle loss.

Wells analyst Matthew Burnett argues that the results help de-risk a new mechanism of action in a large market. The candidate, WVE 007, uses RNA-based technology, a departure from the peptide design behind today’s obesity injections.

Burnett also points to the early safety profile. Management reported no gastrointestinal problems in the first study, with no obvious dose response in drug-related side effects.

What Could Go Right From Here

The “wave” is still cresting. Could it break before it reaches the shore?

Indeed, risks abound. Phase 1 trials are small. Obesity is a crowded space. And larger drugmakers will react if RNA shots work.

Even so, Burnett belives the risk-reward has shifted. A cleaner tolerability profile, the chance to preserve muscle, and a large addressable market give this program real option value.

If later studies confirm the signal, this once little-known biotech could move closer to the center of the weight loss trade.

OVERHEARD ON THE STREET

CNBC: US authorities shut down a China-linked network that allegedly trafficked over $160M in restricted Nvidia $NVDA ( ▲ 1.02% ) AI chips.

Reuters: Pfizer $PFE ( ▼ 0.78% ) licensed an experimental weight-loss treatment from China’s YaoPharma, with $150M upfront and up to $1.94B in milestones.

Forbes: Target $TGT ( ▲ 0.89% ) opened a redesigned SoHo flagship showcasing a design-led concept store.

USA Today: Mondelez $MDLZ ( ▲ 0.27% ) announced Oreo Zero Sugar Cookies, after four years of developing a sugar-free version of the classic treat.

AP: Microsoft $MSFT ( ▼ 0.31% ) committed $17.5B to expand India’s cloud and AI infrastructure.

MONDAY’S POLL RESULTS

Are you bullish or bearish on Casey's $CASY ( ▲ 0.62% ) over the next 12 months?

▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Another company will buy them.”

17(b) Disclosure: This message is a paid advertisement for MicroSectors Gold 3X Leveraged ETN (SHNY) and MicroSectors Gold -3X Leveraged ETN (DULL). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. MicroSectors Gold 3X Leveraged ETN (SHNY) and MicroSectors Gold -3X Leveraged ETN (DULL) are clients of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, MicroSectors Gold 3X Leveraged ETN (SHNY) and MicroSectors Gold -3X Leveraged ETN (DULL) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $1,500 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.