HAPPY WEDNESDAY TO THE STREET

The splashiest CES announcement didn’t come from a chipmaker, tech giant, or any other AI-adjacent play. It came from a toymaker.

Lego debuted a Smart Brick at the conference that lets Lego sets respond dynamically to how they’re built and moved, without apps or internet connections. It is ambitious, expensive, and very different from anything Lego has done before.

For a brand built on simplicity, it’s a bold move… and possibly the biggest shift Lego has made since it figured out studs should snap.

🟨 | US stocks were mixed while refiners rose on Venezuela headlines, crude slid, and banks gave back gains.

📈 | One Notable Gainer: Ventyx Biosciences $VTYX ( ▲ 0.07% ) shares surged after reports said Eli Lilly $LLY ( ▼ 1.55% ) was in takeover talks near $1B.

📉 | One Notable Decliner: Deckers Outdoor $DECK ( ▲ 2.34% ) shares fell after analyst downgrades from Robert W Baird and Piper Sandler.

— Brooks & Cas

Presented by Wall Street Zen

The headline pretty much says it all. Wall Street Zen is offering free and immediate access a new special report:

The sad fact is that most Wall Street analysts are very bad stock pickers. On average their recommendations do a whopping 26% worse than the S&P 500.

Gladly, with access to the right data we can measure the performance of all analysts. This led us to discovering an elite group whose Buy rated picks actually beat the market by 98.4% last year.

If you want to know what they are recommending now, just click the link below...

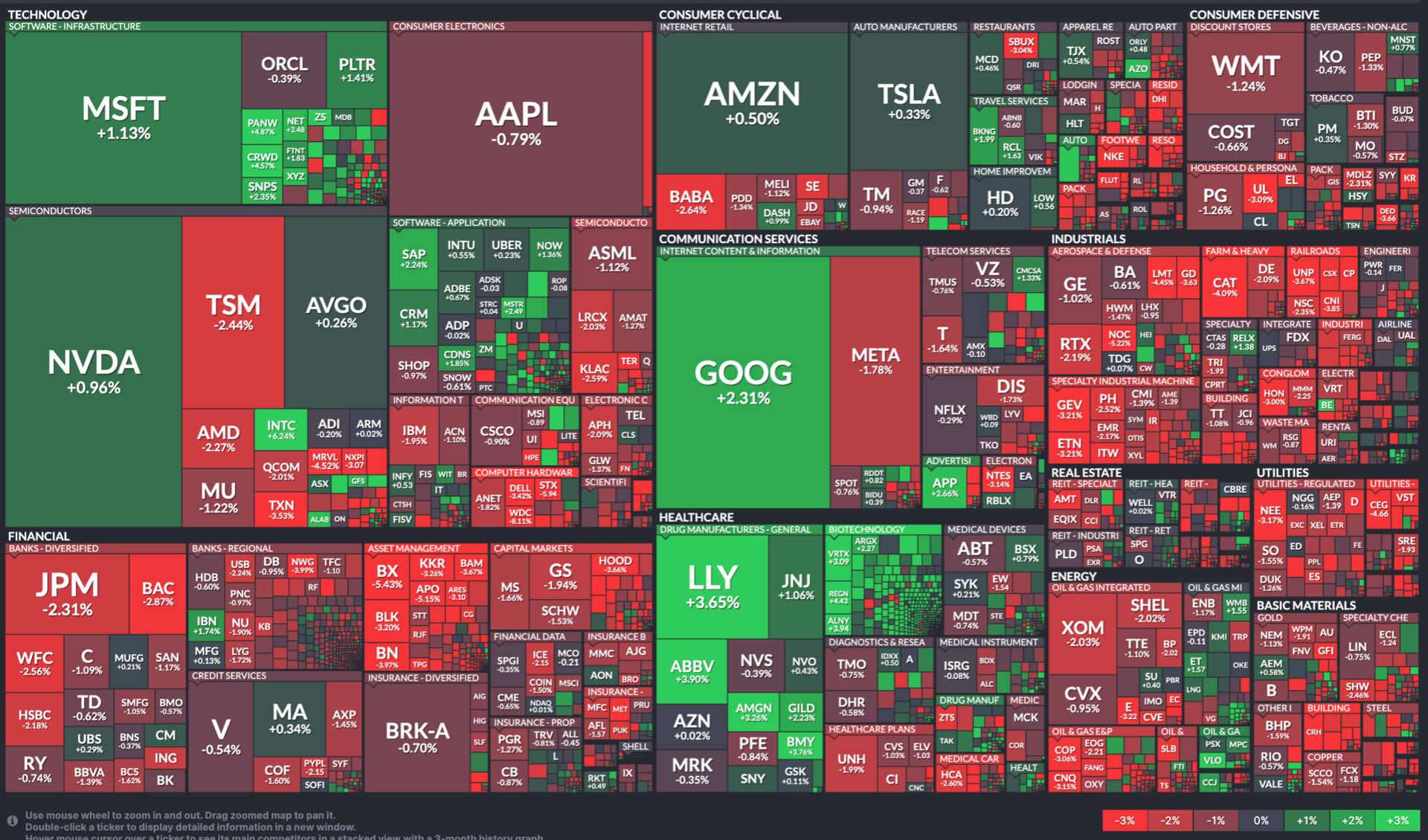

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

AMGEN, GAMESTOP, FIRST SOLAR

Amgen $AMGN ( ▲ 0.91% ) agreed to buy Dark Blue Therapeutics for $840M.

GameStop $GME ( ▲ 0.55% ) unveiled a CEO compensation plan tied to a $100B growth objective.

First Solar $FSLR ( ▲ 0.44% ) fell after Jefferies downgraded the stock to Hold.

Strategy $MSTR ( ▲ 0.73% ) gained after MSCI backed away from removing digital asset treasury firms from its indexes.

Western Digital $WDC ( ▼ 3.51% ) and Seagate $STX ( ▼ 2.79% ) slipped following a sharp prior-session rally.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

ALBEMARLE STILL HAS CHARGE LEFT

Is the Big Run Unfinished?

Albemarle $ALB ( ▲ 5.24% ) already delivered a powerful rally, but Wall Street isn’t ready to step aside. Baird upgraded the lithium producer to Outperform, arguing that recent moves in pricing and demand change the near-term outlook.

The upgrade comes after lithium prices jumped above $15 per kilogram, up sharply from recent lows. Baird says the move reflects a tightening supply backdrop and resilient demand, particularly from energy storage markets.

Even after the stock’s run of 80% over the past 12 months, the firm believes the setup still favors higher prices and stronger earnings leverage.

Storage Demand Does the Heavy Lifting

The key driver is stationary storage. Baird does not see a slowdown in that end market and notes Albemarle has significant operating leverage to higher lithium prices following recent cost-cutting efforts.

China also plays a role. Supply rationalization has helped firm up pricing, while Albemarle’s exposure gives it insight and access across global markets. The result is a more balanced supply-demand picture than investors saw earlier in the cycle.

That matters because lithium pricing tends to move fast once conditions tighten. Albemarle sits near the center of that dynamic, with scale and diversified assets that smaller players lack.

More Than Just A Lithium Story

Baird also highlights Albemarle’s non-lithium businesses. Its catalyst products continue to show steady demand, adding stability when battery markets swing, and it commands massive pricing power in its bromine segment as well, per the firm.

Taken together, Baird sees implied upside of 30% from current levels. With improving lithium fundamentals and support from specialty businesses, the stock may still have charge left as the cycle evolves.

Presented by Wall Street Zen

The headline pretty much says it all. Wall Street Zen is offering free and immediate access a new special report:

The sad fact is that most Wall Street analysts are very bad stock pickers. On average their recommendations do a whopping 26% worse than the S&P 500.

Gladly, with access to the right data we can measure the performance of all analysts. This led us to discovering an elite group whose Buy rated picks actually beat the market by 98.4% last year.

If you want to know what they are recommending now, just click the link below...

OVERHEARD ON THE STREET

YF: Alaska Airlines $ALK ( ▲ 3.71% ) placed its largest-ever order, buying 105 Boeing $BA ( ▲ 1.28% ) 737-10s and five 787s.

CNBC: Anthropic signed a $10B funding term sheet valuing the company at $350B, led by Coatue and GIC.

Axios: Private sector data showed US job growth stabilized in December, easing fears as hiring rebounded and layoffs remained muted.

TechCrunch: Caterpillar $CAT ( ▲ 1.56% ) piloted AI-powered machinery using Nvidia $NVDA ( ▲ 0.68% ) technology.

CNN: Warner Bros. Discovery $WBD ( ▲ 0.8% ) rejected Paramount’s $PSKY ( ▼ 1.61% ) takeover bid, favoring its existing agreement with Netflix $NFLX ( ▲ 2.66% ) instead.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on Brunswick $BC ( ▲ 0.53% ) over the next 12 months?

▇▇▇▇▇▇ 🐻 Bearish

▇▇▇▇▇▇ 🐂 Bullish

And, in response, you said:

🐂 Bullish — “Not really sure about this one, but there could be upside if consumer confidence rebounds, along with rates moving in their favor. Btw, if the seas are 'choppy' enough, yachts feel it too....”

🐻 Bearish — “Most materials that go into building boats come from overseas. It is going to be hard for them to absorb the increased cost of materials due to tariffs and the devaluation of the dollar. In any case, neither the market nor the margin for boatbuilding is very high.”