HAPPY SATURDAY TO THE STREET.

And welcome back to Street Tweets from The Street Sheet!

NYC recently passed a new law requiring landlords to pay for broker fees, instead of tenants.

The plus side? NYC renters will save money on move-in day, as these fees are usually 10-15% of the annual rent. (So, hundreds, at least.) The caveat? Landlords are already raising rents to make up for the loss.

Didn’t know NYC rents could get any higher.

— Brooks & Cas

Sponsored by Proton Pass

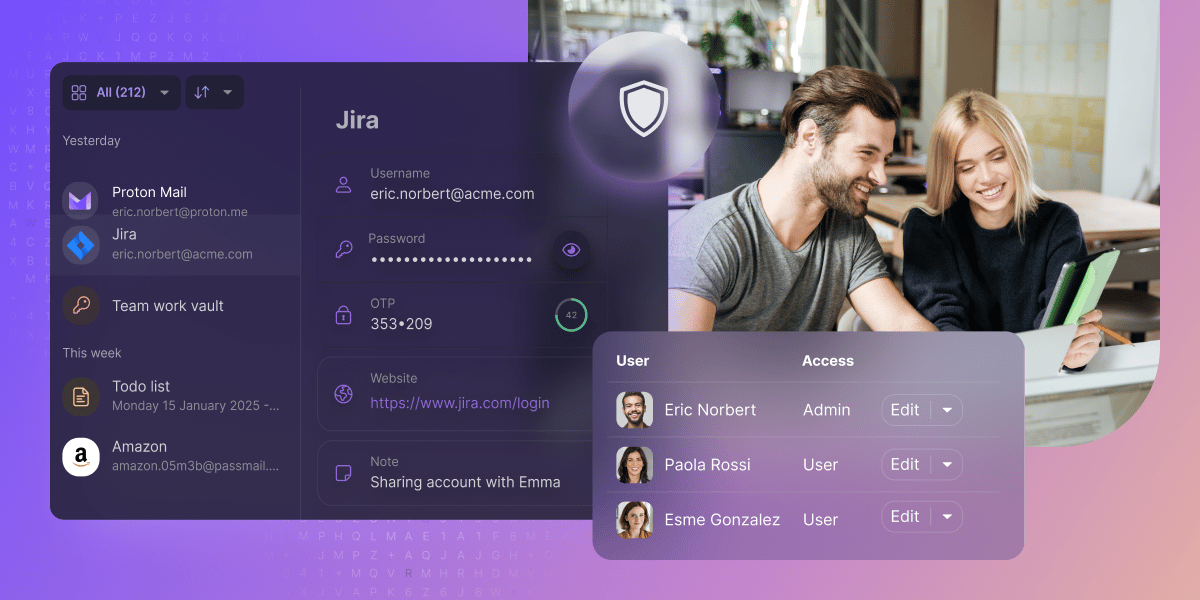

Organizations that need security choose Proton Pass

Proton Pass Business helps teams securely share passwords, manage access, and simplify onboarding.

Trusted by 50,000+ businesses and featured in The Verge and TechCrunch, Pass was built by the teams behind Proton Mail’s and SimpleLogin for startups, nonprofits, and enterprises alike. Secure your accounts, no training required.

MARKET REVIEW

Reassuring economic reports helped soothe Americans’ nerves this week.

Inflation continued to slow in May, coming in at 2.4%, below expectations. It was yet another signal President Trump’s on-again-off-again trade war policy hasn’t had an outsized impact on prices… at least not yet.

Markets didn’t react much, implying that investors expected this news. Consumers, on the other hand, were thrilled.

Consumer sentiment jumped by the most in more than a year, with consumers now expecting inflation to hit 5.1% over the next year. Still high, but lower than last month’s reading of 6.6%.

A Friday selloff following escalating tensions in the Middle East erased the week’s mild gains, with all three major indexes finishing down 1% or less for the week.

MARKET PREVIEW

On Monday, the NY Empire State Manufacturing Index will be released.

Tuesday will feature a handful of reports, including retail sales, export/import prices, industrial production, business inventories, and the NAHB Housing Market Index.

Wednesday will feature the week’s marquee event: the Federal Reserve’s interest rate decision. There will also be plenty of housing market data released, including updates on building permits, housing starts, and the 30-year fixed mortgage rate.

Thursday will bring the Philadelphia Fed Manufacturing Index.

On Friday, three S&P Global PMIs will be released, as well as an update on existing home sales.

Who’s excited for liquid glass?!

Not Apple $AAPL ( ▲ 1.54% ) investors, apparently. The tech giant’s flagship developer conference, WWDC, was this week.

This highly anticipated event could’ve featured any number of much-anticipated updates. A Siri update? Delayed until 2026. Broad ambitions for AI. Not really highlighted? An entirely new Apple product? Crickets. Instead, investors got… a new display for iOS 26! Yup. Even “liquid glass” is not as cool as it sounds.

Overall, investors were underwhelmed with WWDC. Apple stock dropped 3.5% for the week, bringing its total YTD loss to more than 20%. Woof.

Adobe has overcome AI’s threat… so far.

Many analysts thought that AI’s ability to generate images might kill Adobe’s wildly popular suite of photo-editing software tools. But going off its annualized recurring revenue, the Photoshop-owner seems to be doing just fine.

Predicting the “Next Big Thing” is harder than it looks.

Even some of the most well-known investors have confidently made terrible predictions when it comes to tech & startups. A few highlights include:

That Quibi would dominate short-form video

That Clubhouse would become a $100B company

That FTX would acquire legacy finance companies

Hindsight is always 20/20 — especially when it comes to tech trends.

Sponsored by FinanceBuzz

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. Our credit card experts identified top credit cards that are perfect for anyone looking to pay down debt and not add to it.

The King of Meme Stocks is struggling.

GameStop $GME ( ▼ 1.97% ) has announced several major pivots since its short-squeeze days, hopping on almost every new trend, from NFTs to the metaverse. Now, it wants to start buying Bitcoin.

This strategy isn’t as out of left field as it might seem, as several prominent companies, most notably Michael Saylor’s Strategy $MSTR ( ▲ 1.24% ), already buy Bitcoin.

But it seems that investors were hoping for insight on how GME plans to make more fiat money, not digital money. The stock dropped 20% on the news.

Thursday’s crash offered a gentle reminder…

Did the gremlins come a knockin’ on Thursday? If so, you’re not alone.

It seemed like every other website on the World Wide Web was experiencing technical difficulties this week. But honestly, that shouldn’t come as much of a surprise.

With so much tech consolidation over the past decade, today’s internet infrastructure is heavily reliant on a handful of players. If one of them goes down, it can have a pretty insane ripple effect.