Happy Thursday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

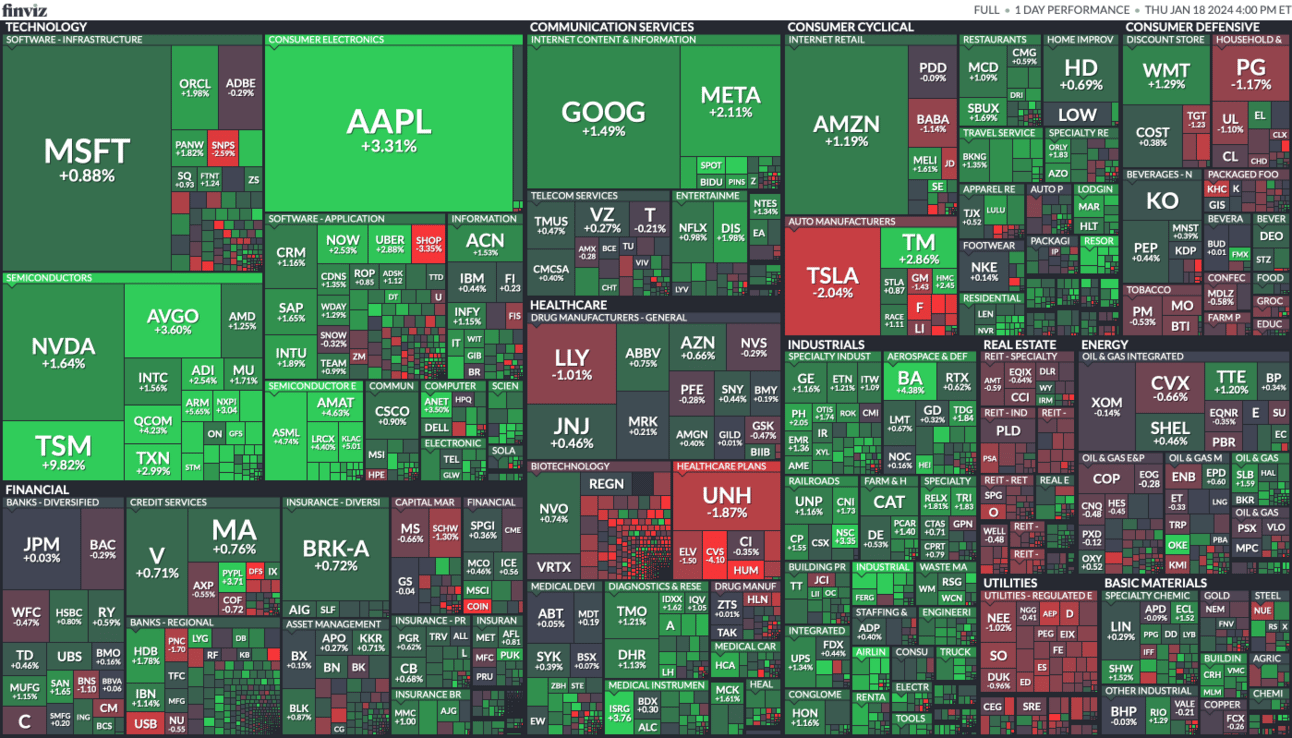

🟩 | US stocks rose Thursday. Major averages were boosted by a strong performance from the tech sector. Apple shares specifically rose after BoA upgraded the stock and said it sees 20% upside over the next year.

📈 | One Notable Gainer: M.D.C. Holdings Inc shares gained 18% after the company disclosed a merger deal with Japan’s Sekisui House.

📉 | One Notable Decliner: PlugPower shares fell over 11% after the company filed for an offering of up to $1 billion.

🛸 | Tomorrow's Trade: A Jetsons stock with a 140% upside. Scroll down for more.

YESTERDAY’S POLL RESULTS

🟩🟩🟩🟩🟩🟩 Bullish

🟨🟨⬜️⬜️⬜️⬜️ Bearish

S&P 500 Heatmap. Credit: Finviz.

All stocks listed on US stock exchanges. Credit: Finviz.

Foreign ADR stocks on NYSE, NASDAQ, AMEX. Credit: Finviz.

MARKET MOVERS

SAVE: Shares of Spirit Airlines plummetted again Thursday, dropping 7% after a judge blocked JetBlue’s planned $3.8 billion takeover. The company is now looking at refinancing options.

HUM: Humana's stock dropped 8% after the company said higher-than-projected medical costs could impact its 2024 forecast.

HTZ: Shares of Hertz popped over 7% after Morgan Stanley upgraded the rental car company. Morgan Stanley applauded Hertz's decision to sell about 20,000 electric vehicles from its fleet.

BIRK: Birkenstock's stock flopped over 7% after the company said its global expansion could impact earnings.

GRAB: Grab Holdings shares jumped shy of 3% after JPMorgan upgraded the ride-hailing and food delivery app, citing improving delivery margins and an attractive valuation.

TOGETHER WITH WILDGRAIN

Add warmth into your winter nights with Wildgrain! Get artisanal sourdough, fresh pasta, and pastries delivered straight to your home.

Bring fresh baked flavor to your table in just 25 minutes - no thawing required! Order now and elevate your meals this season with Wildgrain.

OVERHEARD ON THE STREET

Reuters: Social media platform Reddit has drawn up detailed plans to launch its initial public offering (IPO) in March.

CNBC: 56 million Americans have been in credit card debt for at least a year.

BI: Federal Reserve data shows that while the 56 million Americans over 65 make up just 17% of the population, they hold more than half of America's wealth — $96.4 trillion.

Redfin: The rental vacancy rate rose to 6.6% in the third quarter—the most recent period for which data is available—the highest level since the first quarter of 2021.

Tech Crunch: Hyundai plans to launch an electric air taxi business in 2028.

TOMORROW’S TRADE IDEA, TODAY

Forget Uber, The Future is Flying Taxis

You see a flying car, Deutsche Bank (DB) sees an opportunity.

The German bank is bullish on Archer Aviation (ACHR) over the next twelve months. Archer is currently developing a flying car in the hopes of using it for a taxi service in the sky.

According to analyst Edison Yu, Archer is one of the firm's top stock picks in 2024 for investors looking to get into the aerial mobility space. Shares are trading in the $4-5 range. DB slapped a $12 price target on the stock.

Cutting Through the Red Tape

One thing that could hinder Archer’s stock from taking flight this year is regulation. The company is essentially at the mercy of the Federal Aviation Administration and will be impacted by how the bureaucrats choose to regulate flying cars.

According to Yu, Archer stands out because it has been advancing much faster than its competition, and has been able to monetize its products better as well. It is set to make its first delivery to none other than the US Air Force in Q1 of this year.

Defying the Short Sellers

Deutsche Bank wants investors to know that the aerial mobility industry is volatile, and Archer’s stock price has been no different.

Currently, around 39 million of their outstanding shares have been sold short.

Much to the short sellers’ dismay the stock was up an impressive 230% in 2023. Despite that, Deutsche thinks it still has plenty of room to fly.

TOGETHER WITH WILDGRAIN

As the temperature drops, warm up with Wildgrain’s artisanal breads, pasta, and pastries.

Whether it's a hearty loaf to accompany your favorite soup or a flaky pastry to sweeten your afternoons, each bite is a reminder to enjoy the present moment. Picture yourself nestled in a blanket, a cup of hot tea in hand, and the delightful aroma of freshly baked breads and pastries filling your home.

Winter is a season to slow down, and Wildgrain helps you do just that with convenient, fresh flavors delivered right to your door.

Did we mention they’re offering new customers free croissants for life? You don’t want to miss this delicious deal.

ON OUR RADAR

Reuters: Saudi Arabia is still considering an invitation to become a member of the BRICS bloc of countries after being asked to join by the group last year.

BI: China's trying to manage its property crisis so the sector's troubles don't spill over. However, history shows that credit-fueled real-estate booms nearly always end with a major banking crisis, said an analyst.

CNBC: 62% of adults age 50 and older have not used professional help to plan for retirement.

NPR: “Americans are sour on Biden's handling of the economy. The media may be to blame”

WaPo: The global economy will slow in 2024 for the third straight year and appears headed for its weakest half-decade since the early 1990s, according to the World Bank.