Happy Thursday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

🟥 | US stocks fell today as NVIDIA’s earnings beat failed to impress investors enough to overcome tariff fears.

📈 | One Notable Gainer: Warner Bros Discovery’s (WBD) stock added nearly 5% after showing a surprising surge in Max subscribers. Well, I’m not surprised. The White Lotus alone is worth the price of admission.

📉 | One Notable Decliner: Shares of eBay (EBAY) sold off faster than a Gretzky rookie card. The company jumped on the bandwagon of major retailers issuing lackluster forecasts, sending its stock some 8% lower.

Sponsored by VantagePoint

The eBook that traders can’t stop talking about is free for a limited time! Learn how to quickly find high-probability trades with AI-powered forecasts 1–3 days in advance. This step-by-step guide simplifies trade selection and removes emotional decision-making.

🔍 What’s Inside?

✅ How money flows between sectors

✅ AI’s role in smarter trade decisions

✅ When to enter, wait, or exit

Deciding what to trade from thousands of assets can be daunting. Learn the secrets to how over 47,000 traders around the world are benefitting from industry leading accuracy powered by dual-patented intermarket analysis.

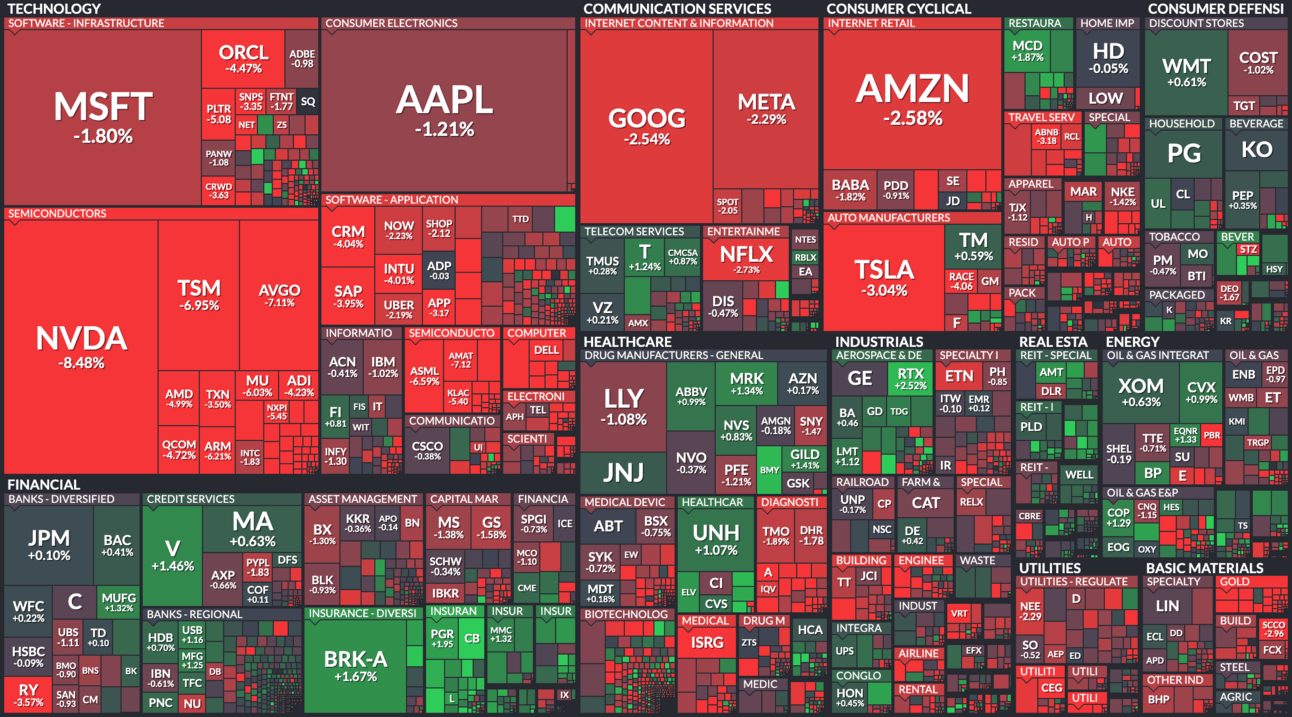

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

MARKET MOVERS

NVIDIA, Snowflake, Super Micro

NVDA (-8.5%) Nvidia stock dips as earnings beat has investors 'yawning' (YF)

SNOW (+4.5%) Snowflake’s stock soars as revenue and guidance cheer up investors (MarketWatch)

SMCI (-16%) Super Micro Stock Dives. Why Nvidia Earnings Aren’t Boosting SMCI.(Barron’s)

WBA (+1.7%) Walgreens Boots buyout to lay groundwork for three-way split of group (FT)

TFX (-21.7%) Teleflex Hits 52-Week Low On Plan To Split Into Two Companies, Reports Mixed Q4 Earnings (Benzinga)

OVERHEARD ON THE STREET

YF: NVIDIA beat earnings expectations, but by the smallest amount in two years, leaving Wall Street with lingering concerns about future margins.

Reuters: US GDP growth slowed to a 2.3% annualized rate in the fourth quarter, down from 3.1% in the previous quarter.

CNBC: Pending home sales fell 4.6% in January to their lowest level since 2001, with weather possibly influencing the decline.

Bloomberg: New US jobless claims rose to 242,000 last week, the highest level of 2025, likely reflecting federal layoffs.

WSJ: President Trump said the US will impose an additional 10% tariff on Chinese imports next week, doubling the previous tariff.

TOMORROW’S TRADE IDEA, TODAY

Citi Shines the Light on a Dark Horse

Bright Idea

There’s a dark horse in the telecom industry — but Citi (C) believes it’s poised to shine bright.

Lumen Technologies (LUMN) has struggled lately, down 15% since the start of 2025. The CenturyLink-parent’s February guidance came in below expectations, and its shares dropped sharply as a result.

Citi sees that as an attractive entry point into a promising stock. The bank recently upgraded the telecom stock to Buy, with a roughly 44% upside.

Positive Catalysts

According to analyst Michael Rollins, Lumen’s stock price is protected from AI-related volatility, due to its long-term deals with big tech companies.

Additionally, Rollins believes it will be able to increase its value by selling off assets, improving business operations, and boosting its core sales.

The analyst expects Lumen to announce another $3.5 billion in private connectivity fabric deals over the next six months, on top of its already secured $8.5 billion.

Divesting Some Assets

Rollins says Lumen is likely to sell only its fiber assets, which he believes may attract buyers like AT&T (T), T-Mobile (TMUS), or Verizon (VZ).

The company is aiming to reduce its annual costs by $1 billion, which could serve to boost the stock price as well.

Contrary to its name, not all analysts see a bright future for Lumen. Only 2 of 14 analysts covering the stock have given it a Buy rating.

But its average price target of $5 per share suggests most think its price will rise from its $4.51 close today. And at least one analyst believes it won’t be long before the stock is back in the spotlight.

Investors are increasingly worried that US equities’ record run may be in the rearview. But one asset’s record run might just be getting started.

Gold hit another all-time high on Monday, as it draws ever nearer to the $3,000 mark. With the broader market looking increasingly uncertain, the safe haven precious metal could only get more appealing.

However, not everyone has $3,000 to invest, no matter how surefire the bet may seem. That’s where First Nordic Metals (OTC: FNMCF) comes in. This small-cap company could offer premium exposure to gold at a discount price.

ON OUR RADAR

AP: In addition to the higher tariffs on China, Trump reiterated that the suspended 25% tariffs on Canada and Mexico will take effect next Tuesday.

The Guardian: The FBI said North Korea was behind the $1.5B hack of Dubai-based crypto exchange ByBit, the largest cyber-heist in history.

CNBC: The world’s largest ocean carriers are facing a sharp decline in pricing power due to the frontloading of cargo shipments ahead of anticipated tariffs.

CNN: The CFPB dropped cases against several companies accused of harming consumers, including Capital One and Rocket Mortgage affiliates.

The Verge: The reviews of Apple’s new budget iPhone 16E are in. Simply put? Meh.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on BGC Group (BGC) over the next 12 months?

🟩🟩🟩🟩🟩🟩 🐂 Bullish

🟨🟨🟨⬜⬜⬜ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “It's been on the rise the last several years; and the Trump dereg scenario should be advantageous.”

🐻 Bearish — “It’s not going anywhere, just going to float around.”

This message includes a paid advertisement for First Nordic Metals Corp (OTC: FNMCF). The Street Sheet (SS) receives a flat fee totaling up to $1,500 from Sideways Frequency LLC. Other than the compensation received for this advertisement sent to subscribers, The Street Sheet and its principals are not affiliated with First Nordic Metals Corp. The Street Sheet and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information provided in this newsletter is not guaranteed as to the accuracy or completeness. Each user of SS chooses to do trades at their sole discretion and risk. SS is not responsible for gains/losses that may result in the trading of these securities. This newsletter includes paid advertisements. The source of all third-party content in which SS receives some sort of compensation is clearly and prominently identified herein as "ad", "Sponsored", or “Together With”. Although we have sent you these advertisements, SS does not specifically endorse any third-party product nor is it responsible for the content, the accuracy, or the completeness of the advertisement or the experience with the third-party advertiser. Furthermore, we make no guarantee or warranty about what is in the advertisement. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. This communication from The Street Sheet is for informational purposes only. It is not intended to serve as a recommendation to buy, sell, or hold any security and is not an offer or sale of a security. Information contained within should not be perceived as a research report and is not intended to serve as the basis for any investment decision. Any third-party views reflected herein do not reflect the opinion of The Street Sheet. All investments involve risk and the past performance of a security does not guarantee future results or returns. There is always the potential for financial loss when investing in securities or other financial products. The information contained in this newsletter is subject to change without notice, and we do not undertake any obligation to update it. Readers are encouraged to conduct their own research and due diligence and seek advice from licensed professionals regarding their specific financial needs and circumstances. By reading this newsletter, you agree to hold us harmless from any and all losses, liabilities, costs, or expenses arising from your use or reliance on the information provided. There is no warranty as to the accuracy or completeness of the factual matters included in any advertisement or sponsored content in the newsletter. You have not performed any research on any entity, or its business, that advertises or submits any sponsored content. The Street Sheet is reader-supported. When you buy through links on our site, we may earn a commission.