Happy Friday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

🟩 | US stocks moved higher Friday. Major averages got a boost from large-cap tech names. Speaking of which…

📈 | One Notable Gainer: Meta Platforms, the parent company of Facebook and Instagram, surged 20% after a threefold increase in Q4 profit. It also announced its first dividend, payable in late March. Here’s how much CEO Mark Zuckerberg will take home annually with this new dividend.

📉 | One Notable Decliner: Skechers' stock fell 10% following mixed Q4 results and weaker full-year guidance.

🏆 | Tomorrow's Trade: Goldman’s Small Cap Picks. Scroll down for more.

Plus, unlock the strategic hiring tactics of corporate giants.

YESTERDAY’S POLL RESULTS

🟩🟩🟩🟩🟩🟩 🛒 Walmart (WMT)

🟨🟨⬜️⬜️⬜️⬜️ 💰 Dollar General (DG)

🟨⬜️⬜️⬜️⬜️⬜️ 🔧 Advance Auto Parts (AAP)

🟨⬜️⬜️⬜️⬜️⬜️ 🛢️ Cracker Barrel Old Country Store (CBRL)

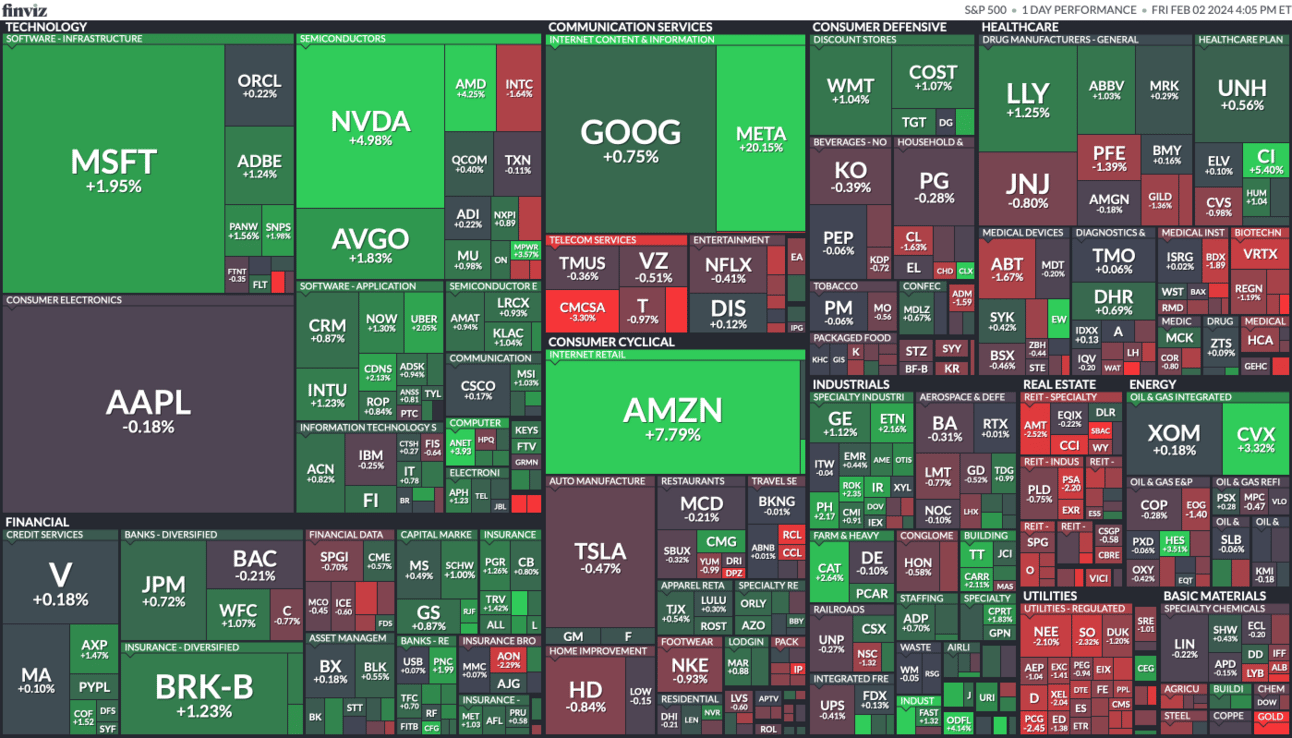

S&P 500 Heatmap. Credit: Finviz

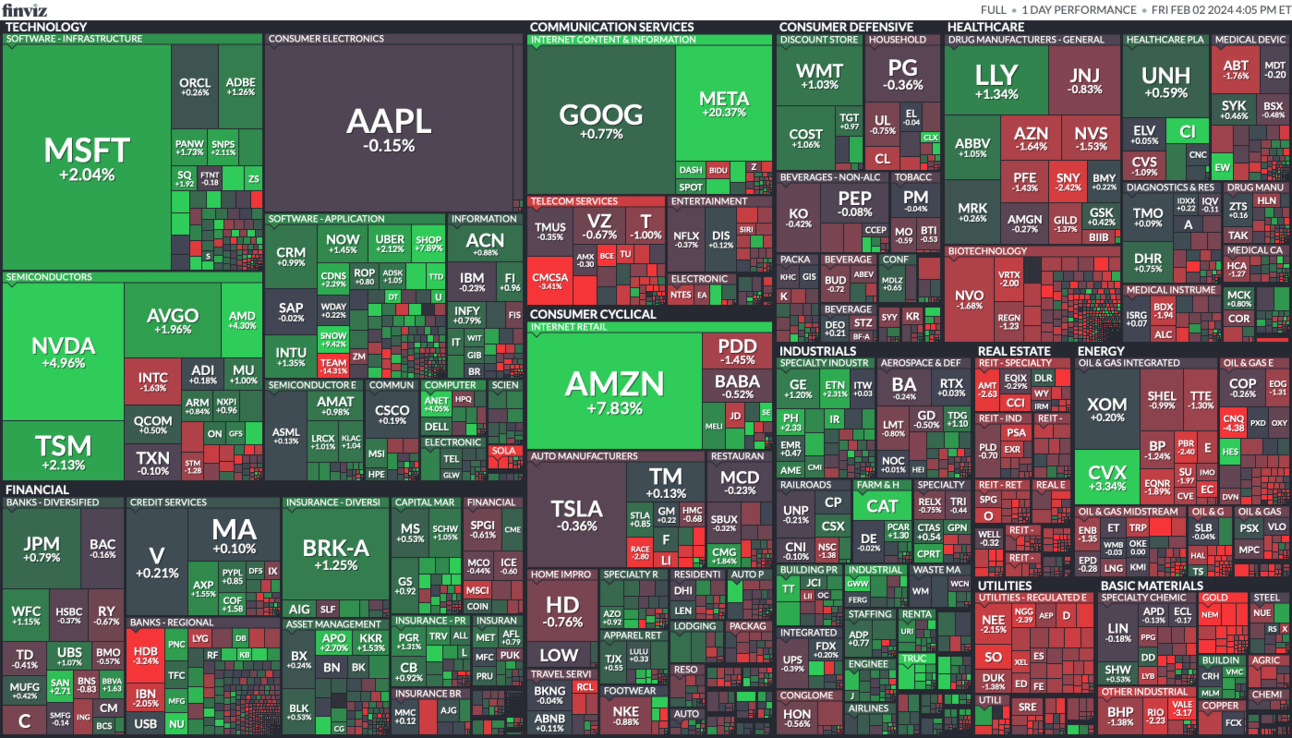

All stocks on US exchanges. Credit: Finviz

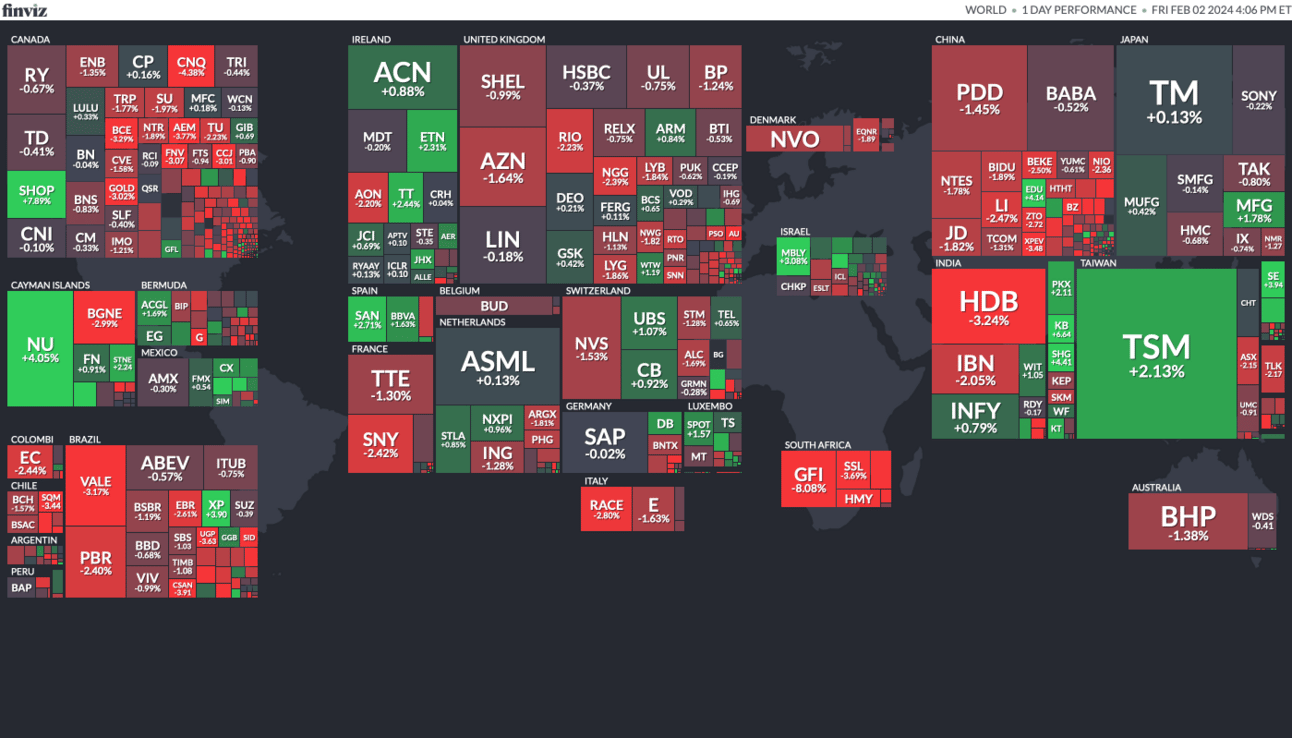

Global ADR snapshot. Credit: Finviz

MARKET MOVERS

AMZN: Amazon shares rose over 7.8% after surpassing Q4 earnings and revenue expectations, with $1 earnings per share on $169.96 billion in revenue, versus the forecasted 80 cents on $166.21 billion.

DECK: Deckers Outdoor's shares surged 14% after exceeding fiscal Q3 estimates and naming a new CEO, prompting analysts to raise their price targets.

CI: Cigna's stock rose over 5% following a Q4 earnings and revenue beat, with upbeat full-year guidance.

MAT: Mattel's shares increased 4% after Barington Capital acquired an undisclosed stake and advocated for the sale of the American Girl and Fisher-Price units.

INTC: Intel's stock dropped below 2% following a Wall Street Journal report that the chipmaker is delaying its $20 billion Ohio factory construction due to market challenges.

TOGETHER WITH FRACTION

Fractional hiring allows businesses to tap into specialized expertise without the long-term commitment or expense of a full-time hire.

In 2024, as businesses navigate the complexities of talent acquisition, exploring fractional roles provides a unique advantage. Unlike traditional hires, fractional arrangements offer flexibility, scalability, and cost-effectiveness.

With Fraction, you can access the best US-based senior developers, designers, and product managers at offshore rates, without committing to a long-term contract.

Try Fraction risk-free and see if fractional hiring is right for your team. If a hire doesn't work out, they'll replace them at no charge.

OVERHEARD ON THE STREET

WSJ: Spotify has reached a new $250m deal with star podcaster Joe Rogan that will allow his hit show to be distributed broadly.

Reuters: Chevron Corp delivered a record 867,000 barrels per day (bpd) in the fourth quarter. There was a 10.7% annual gain from the Permian Basin, its top shale-producing region.

Bloomberg: Jeff Bezos plans to sell as many as 50 million shares of Amazon.com Inc. over the next 12 months, potentially cashing in on a stock surge that’s put him within reach of becoming the world’s richest person.

Unusual Whales: “If you yoloed into the $485 $META calls for Feb 23, you'd be up 25,000%! If you put in $1000, you'd have $250,000.”

Fortune: Millennials are the most educated generation in history, with Gen Z closely following behind. Yet their financial prospects and chances of getting hired are significantly dimmer than those of Gen X graduates.

TOMORROW’S TRADE IDEA, TODAY

Buying at a Discount

Analysts are bullish on small caps’ prospects this year. According to Goldman Sachs, these stocks are positioned well to benefit from what is projected to be a strong economic landscape in 2024.

Did you see the nonfarm payroll report this morning? The US economy added 353,000 jobs in January, coming in much hotter than the Dow Jones estimate of 185,000. And even though they might not come as soon as Wall Street wants, Fed rate cuts would only add fuel to the fire.

All of this, coupled with their relatively cheap valuations, make small caps an attractive play for investors, according to Goldman.

Don’t Call It a Comeback

Small caps finished 2023 relatively strong, but the Russell 2000 has found itself down 3.9% since January 1st while the S&P has gained 1.6% over the same time frame.

Analysts are pointing to investors' fears that interest rates may stay elevated for longer than previously anticipated as the driving force behind small caps lagging behind the broader market.

The underperformance has left many of them undervalued, and Goldman has come out with a list of stocks based on a minimum 5% upside to their target price, strong free cash flow generation, and are available for purchase at a discount of at least 5% of their historical multiples.

The List

Opera (OPRA) is first on the list. According to Goldman, the browser builder should enjoy a growing operating margin in the year ahead. Increased market share and integrating AI into its products should provide a tailwind as well. The firm believes its shares could rise 50% or more over the next twelve months.

Shoals Technologies (SHLS), a solar equipment manufacturer, is another company Goldman is bullish on. The stock is down over 52% over the past year, but the firm believes it now has a 95% upside.

Dating app Bumble (BMBL) made the list as well, due to its strong free cash flow margins that are expected to grow 25% by the end of 2025. The firm’s price target gives Bumble a 41% upside.

Some other big names that made the list were Yelp (YELP), TripAdvisor (TRIP), and Vertx (VERX). We’ll see where the year ends, but if the economy stays hot, some of these small caps could bring big gains.

Which company do you think is the biggest underdog?

TOGETHER WITH FRACTION

In the realm of hiring, businesses are rethinking the conventional approach. Fractional roles offer a flexible and cost-effective alternative to the traditional full-time hires. This paradigm shift prioritizes expertise over employment, allowing companies to access seasoned professionals without the commitment of a full-time role.

Embrace the future of hiring with Fraction. Explore profiles of the best-vetted US-based senior developers, designers, and product managers at offshore rates, without the full-time cost.

Plus, enjoy their risk-free trial – if you’re not satisfied with a hire, they’ll replace them at no additional cost.

ON OUR RADAR

ZeroHedge: The Treasury Department announced that they expected to increase the national debt by a whopping $760 billion this quarter alone… and another $202 billion next quarter.

Mishtalk: Payrolls are up by 5.77 million since May of 2022, but full-time employment is up only 457-thousand.

WSJ: The Child Tax Credit, if approved, will boost refunds for millions of low-income families with incomes up to $40,500, according to the Urban-Brookings Tax Policy Center.

FOX Business: Trump stated he would not reappoint Fed Chair Powell, criticizing him as 'political'.

CRB: This week saw a 2.1% increase in new listings compared to last year, marking the 14th consecutive week of year-over-year growth in newly listed homes.