HAPPY THURSDAY TO THE STREET

“Drop the ‘verse’. It’s cleaner.”

Meta $META ( ▲ 1.69% ) is preparing to slash billions from Reality Labs, the “metaverse” unit that has racked up more than $60 billion in cumulative losses since 2020. Some cuts hit contractors. Others may hit headcount. All point to the same reality: Meta is shifting capital from virtual worlds to the AI arms race.

INB4 the company rebrands to “AI Platforms” in a year or so. Mark Zuckerberg is nothing if not chronically late to the party.

🟨 | US stocks were little changed as investors warily eyed next week’s Fed decision.

📈 | One Notable Gainer: Investors cheered Meta’s above-mentioned plan. Employees, not so much.

📉 | One Notable Decliner: Intel $INTC ( ▼ 1.14% ) sank on news that the chipmaker plans to sell its networking unit.

— Brooks & Cas

Sponsored by Venture Trader

Microcaps move fast. Most traders react late. “Genetic AI” has arrived right on time.

This new model from a 25-year market quant does the heavy lifting before the market opens. It scans millions of data points, tests thousands of strategies, and builds a rules-based plan for each stock it tracks.

Meanwhile, you get to sit back, see only the clearest signals, and learn a smarter and faster way to trade with speed and precision. With net 8% returns in the last 2 months*, it’s a development you don’t want to miss.

*IMPORTANT DISCLAIMERS: Educational Publisher Notice: Venture Trader is an educational publisher—not a broker-dealer or investment adviser. We provide educational content and trading insights for informational purposes only. Risk Warning: Micro-cap stocks can be highly volatile and illiquid. Only invest capital you can afford to lose. Trading stocks involves risk, and you should carefully consider your investment objectives, level of experience, and risk appetite. Performance Disclaimer: Results reflect fixed trading rules tested on historical market data. These are hypothetical, not live trades, and real results may vary. Past performance is not indicative of future results. Individual results will vary. Not Financial Advice: Nothing on this page should be considered personalized financial advice. Always consult with a licensed financial professional before making investment decisions.

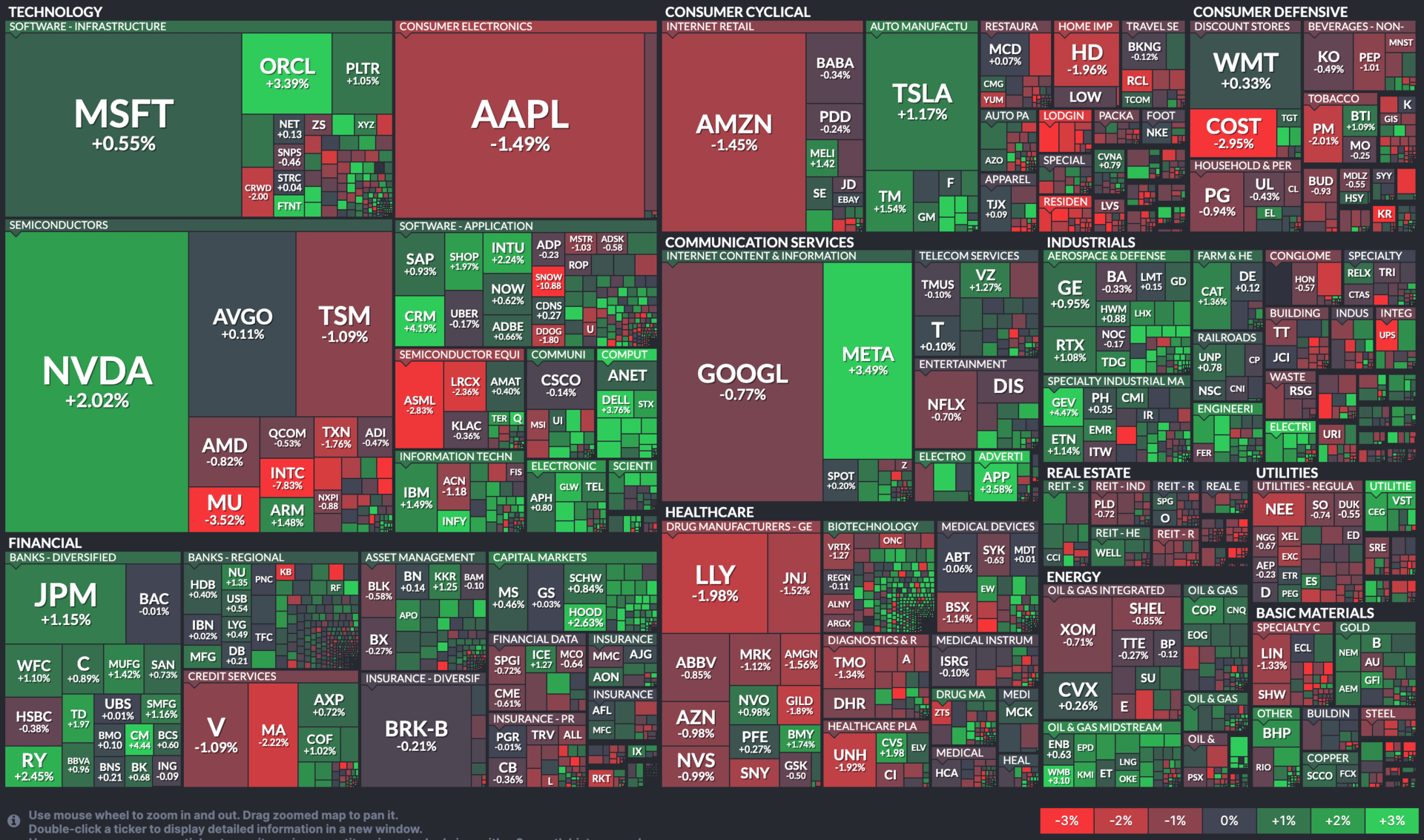

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

HORMEL, PVH, DOLLAR GENERAL

Hormel $HRL ( ▲ 1.79% ) hinted at a potential earnings turnaround next year despite weaker revenue.

PVH $PVH ( ▲ 3.59% ) issued soft Q4 guidance below analyst expectations.

Dollar General $DG ( ▼ 0.76% ) raised full-year earnings guidance and topping Q3 estimates.

Salesforce $CRM ( ▼ 0.07% ) lifted its Q4 revenue outlook.

Snowflake $SNOW ( ▼ 3.74% ) issued a weaker product revenue outlook despite a Q3 beat.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

A CONTRARIAN BET ON THE “SILVER POUND”

A Big Call on a Niche Brand

A UK hedge fund is making a striking claim about Saga Cruises (SAGA.L), the travel and financial services company focused on customers over 50.

Kernow Asset Management says the stock could rise more than 400% over the next five years. Co-founder Alyx Wood calls Saga “materially undervalued” and an “investor’s dream,” estimating fair value at roughly £2.2 billion.

Saga Is Just Beginning

Saga has been a messy story in recent years. Its mix of cruises, holidays, insurance, and financial services scared off investors.

But Wood argues the company is far more coherent than it might look on the surface. He sees a unified consumer brand that speaks directly to the fastest-growing and wealthiest demographic in the UK.

By 2030, the analyst expects people in their “Saga years” to account for roughly 60% of UK consumer spending. Saga’s brand loyalty, targeted offerings, and deep familiarity with its core audience give it a structural tailwind that most companies would envy.

Recent management moves strengthen the case. CEO Mike Hazell has unwound past strategic missteps, including ordering two cruise ships delivered during the pandemic. The company also sold its underwriting arm to Ageas. That lifted returns, reduced volatility, and lowered leverage from nearly 12x to around 4x.

A Value Story Hiding in Plain Sight

Deutsche Bank $DB ( ▲ 2.57% ) analysts said Saga’s latest results beat expectations, citing strong momentum in cruises and holiday bookings.

Saga still carries reputational baggage from the pandemic era. But Wood argues that investors are missing a cleaner, more focused business with rising earnings quality.

With the brand positioned squarely in front of a massive demographic shift, the hedge fund believes Saga’s rerating is only beginning.

For contrarians, this is the kind of asymmetry they look for.

Sponsored by NNVC

NanoViricides (NYSE: NNVC) is drawing investor focus as NV-387 advances toward Phase 2 MPox trials, a pivotal step for both emerging viral threats and U.S. biodefense. NV-387’s nanoviricide technology neutralizes viruses before infection and protects vital organs, creating a differentiated profile versus traditional antivirals.

Dual-track clinical plans, including basket-style trials for respiratory pathogens, expand NV-387’s reach across measles, influenza, RSV, and coronaviruses. Zacks Small Cap Research assigns a $7 valuation, citing NV-387’s potential for government procurement, orphan drug exclusivity, and BARDA funding.

With Phase 1 safety confirmed and broad preclinical efficacy, NNVC has a clear path toward key regulatory milestones. Positive Phase 2 data for MPox could also support FDA approval under the Animal Rule for Smallpox and open a $1 billion Strategic National Stockpile opportunity.

OVERHEARD ON THE STREET

CBS: US employers announced over 1.1M job cuts through November, a 54% jump from last year and the highest since 2020.

CNBC: Microsoft $MSFT ( ▼ 0.31% ) will raise commercial and government Office subscription prices on July 1, including a 33% hike for its lowest-tier plan.

TipRanks: Google $GOOGL ( ▲ 4.01% ) formed a multi-year partnership with Replit as the startup pushes its vibe coding tools.

TechCrunch: Elon Musk said Tesla’s $TSLA ( ▲ 0.03% ) new FSD update allows texting while driving, even though the practice is illegal in most US states.

Axios: A survey showed most young knowledge workers use AI but want highly personalized tools that match their writing and integrate their work data.

WEDNESDAY’S POLL RESULTS

Are you bullish or bearish on Boeing $BA ( ▼ 0.72% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “They can hardly do worse than they have over the past few years. That said, managerial idiocy unconstrained by engineering knowledge may well be unbounded.”

🐻 Bearish — “Transportation is too accident-prone to be gambling on.”

17(b) Disclosure: This message is a paid advertisement for NanoViricides (NYSE: NNVC). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. NanoViricides (NYSE: NNVC) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, NanoViricides (NYSE: NNVC) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.