HAPPY TUESDAY TO THE STREET.

Wall Street came looking for rate cut hints. Jerome Powell brought capital requirements instead.

The Federal Reserve chair kicked off a major conference today, amid an intensifying feud with the US president and growing calls for his resignation. So, naturally, he had a lot to say about… banking supervision.

As for monetary policy? No change in tone. Inflation’s still sticky. Labor’s still strong. Data-driven approach. Leave it to Powell to use a keynote speech to say nothing at all.

🟨 | US stocks were mixed today, but the S&P 500 just managed to scrape out a daily rise to another record close.

📈 | One Notable Gainer: Kohl’s $KSS ( ▼ 2.49% ) exploded as the stock gained favor among so-called meme traders after going viral on Reddit’s $RDDT ( ▲ 2.77% ) r/WallStreetBets.

📉 | One Notable Decliner: Not all meme stocks are created equally. Real estate platform Opendoor $OPEN ( ▲ 7.53% ), another newly minted Reddit fav, popped intraday but ultimately closed sharply in the red.

Finally, read to the end for the AI company immune to Meta’s $META ( ▲ 1.69% ) charm…

— Brooks & Cas

Sponsored by Insider Authority

Remember “Who Wants to Be a Millionaire?” When untold riches were a mere “phone a friend” away?

When it comes to trading, Insider Authority wants to be that friend — the one you go to for advice when making key investment decisions that could transform your portfolio.

Insider Authority is Wall Street’s No. 1 source for insider trading information. The platform uses intel from politicians, C-level execs, hedge fund gurus, and other experts to help investors track, follow, and benefit from institutional order flow.

In addition to a weekly dispatch chock-full of insider scoops, Insider Authority offers extras like Elite Insider, an all-in-one software dashboard and scanner that tracks political, corporate, and hedge fund insider trading activity.

It’s like having an expert on speed-dial 24/7.

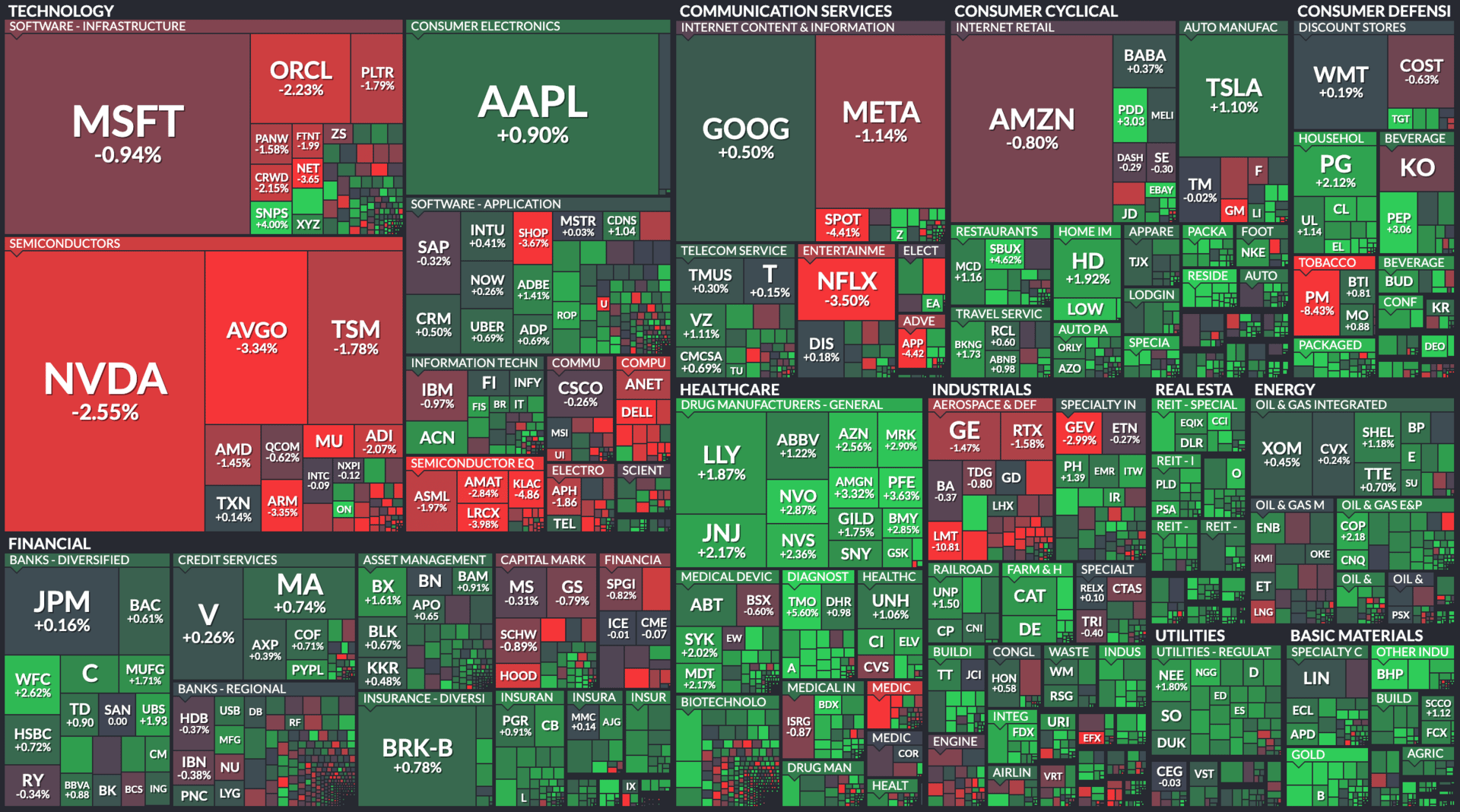

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

GENERAL MOTORS, DR HORTON, LOCKHEED MARTIN

$GM ( ▲ 0.05% ) General Motors takes $1.1 billion tariff hit, dinging profit and sending stock reeling (MarketWatch)

$DHI ( ▲ 0.21% ) D.R. Horton Jumps on Profit Beat Despite Soft Housing Market (Bloomberg)

$LMT ( ▼ 1.24% ) Lockheed Martin Stock Stumbles as Defense Contractor Cuts Forecast (YF)

$MEDP ( ▲ 1.64% ) This Clinical Trials Stock Just Soared 50%. What Caused It to Pop. (Barron’s)

$EFX ( ▲ 1.11% ) Equifax Shares Dip as Weaker Hiring and Tariffs Temper Guidance (PYMNTS)

OVERHEARD ON THE STREET

CNN: President Trump announced a trade deal with the Philippines, which will levy 19% tariffs against the island nation and eliminate tariffs on US exports.

Reuters: Indonesia will eliminate tariffs on over 99% of US trade and face a 19% tariff on exports to the US under another new trade deal.

CNBC: Economist Mohamed El-Erian urged Fed Chair Jerome Powell to resign early, breaking from Wall Street’s consensus.

Fortune: Coca-Cola $KO ( ▲ 1.18% ) confirmed it will launch a cane sugar version of its flagship soda in the US, after Trump endorsed the idea on social media.

AP: The billionaire owner of the Los Angeles Times announced plans to take the newspaper public within the next year.

Tomorrow's Trade Idea, Today

FOLDABLE FORTUNE OR FUNGIBLE SUPPLIER?

33% Upside from Apple Coattails?

Apple $AAPL ( ▲ 1.54% ) much-anticipated foldable phone could be launched as soon as 2026, according to UBS $UBS ( ▲ 0.57% ) analysts. When (or if) it comes, the launch could potentially drive earnings growth for one little-known tech stock.

For now, Apple has not announced who will provide the “ultra thin glass” that would cover the phone’s display panel. But analysts from Citi $C ( ▲ 0.39% ) name Lens Technology (which is only listed on the Shenzhen Stock Exchange) “one of the key beneficiaries of [the] foldable supply chain.”

The bank recently raised its price target on mainland-traded shares to 32 yuan, which would be a more than 33% gain from today’s close of just under 24 yuan.

Connecting the Dots

Steve Cohen evidently sees potential in the stock too. The billionaire hedge fund manager (and inspiration for Bobby Axelrod in Billions) took a stake of more than 8% in the company, according to filings with the Hong Kong stock exchange.

Neither Apple nor Lens Technology has confirmed a contract. But the latter did disclose that its largest customer has been a Nasdaq-listed US multinational founded in 1976. It doesn’t take a software engineering manager to make the connection.

Even so, Lens Technology has been reducing its reliance on its biggest contract. The company, which recently went public, named a “Nasdaq-listed American company founded in 2003 that designs and sells smart vehicles” as its “Customer B.” Tesla $TSLA ( ▲ 0.03% ) was founded in 2003.

Cautionary Tale

No one today can know if analysts’ bullishness on Lens Technology’s potential upside will be vindicated. But recent history shows how contractors can underperform, even when their services are essential to the iPhone itself.

In 2006, the late Apple CEO Steve Jobs personally reached out to the CEO of Corning $GLW ( ▲ 7.32% ), asking him to help develop “Gorilla Glass” for screens ahead of the iPhone’s 2007 launch.

Despite the time crunch, Corning was able to invent a scratch-resistant glass that had never been manufactured before, and Gorilla Glass became one of its main revenue drivers, notching $11.5 billion in gross sales in 2019.

Yet its shares have returned roughly 220% since the iPhone’s mid-2007 launch, compared to 320% for the S&P 500 in that time frame. It’s a reminder that there’s no guaranteed path to glory — even for Apple’s most important suppliers.

Sponsored by Atlas Lithium

Why Investors Should Pay Attention: Lithium Has a Critical Role in the Energy Transition & ATLX’s Unique Growth Trajectory Could Place it at the Forefront.

Lithium demand is expected to skyrocket over the next decade as electric vehicles (EVs) and renewable energy storage reshape the global economy. The US government and industry leaders emphasize securing domestic and allied lithium supplies, placing companies like Atlas Lithium Corporation (NASDAQ: ATLX) in the spotlight.

The Lithium Valley in Brazil benefits from year-round mining, favorable infrastructure, and government fast-tracking — advantages that ATLX is uniquely positioned to exploit with its extensive mineral rights and fast-moving projects. The company’s key Neves Project has all permits in place and will leverage a cutting-edge, eco-friendly processing facility, promising a lean environmental footprint alongside operational efficiency.

ATLX’s projects also benefit from proximity to established lithium mines like Sigma Lithium’s $1.2 billion market cap operation, providing a clear benchmark for valuation growth. With growing global consolidation in lithium mining, strategic investments by industry titans, and an experienced, heavily invested management team, ATLX offers investors a compelling entry point before the company scales production and reaps the rewards of the lithium boom.

With analyst price targets ranging up to $30, the upside is significant for this emerging lithium leader!

Don’t miss the opportunity to add Atlas Lithium (NASDAQ: ATLX) to your portfolio as the lithium market heats up.

ON OUR RADAR

AP: Trump’s Labor Department proposed more than 60 rule changes to roll back workplace regulations.

Axios: OpenAI CEO Sam Altman warned of an imminent AI-driven fraud crisis, urging a major overhaul of account security for big banks.

CNBC: House Speaker Mike Johnson started August recess early to avoid votes on Democratic motions related to the Epstein files.

Bloomberg: SpaceX warned investors that CEO Elon Musk may reengage in US politics.

WSJ: Musk’s xAI is seeking up to $12B in private credit to buy Nvidia $NVDA ( ▲ 1.02% ) chips for a new data center amid mounting cash burn.

STREET TWEET

Has Mark Zuckerberg finally met a problem money won’t solve?

The AI startup’s CEO attributed the phenomenon to Anthropic’s “mission-driven” culture. The AI trade must be much more fun when you’re not working for Sam Altman.

MONDAY’S POLL RESULTS

Are you bullish or bearish on Vail Resorts $MTN ( ▼ 0.3% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Strong dividend; while waiting for share price appreciation.”

🐻 Bearish — “Global warming. Try CA.”

This message contains a paid advertisement for Atlas Lithium (NASDAQ: ATLX). The Street Sheet (SS) receives a flat fee totaling up to $2,000 from Sideways Frequency. Other than the compensation received for this advertisement sent to subscribers, The Street Sheet and its principals are not affiliated with Atlas Lithium. The Street Sheet and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information provided in this newsletter is not guaranteed as to its accuracy or completeness. Each user of SS chooses to do trades at their sole discretion and risk. SS is not responsible for gains/losses that may result in the trading of these securities. This newsletter includes paid advertisements. The source of all third-party content in which SS receives some sort of compensation is clearly and prominently identified herein as "ad", "Sponsored", or “Together With”. Although we have sent you these advertisements, SS does not specifically endorse any third-party product nor is it responsible for the content, the accuracy, or the completeness of the advertisement or the experience with the third-party advertiser. Furthermore, we make no guarantee or warranty about what is in the advertisement. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. This communication from The Street Sheet is for informational purposes only. It is not intended to serve as a recommendation to buy, sell, or hold any security and is not an offer or sale of a security. Information contained within should not be perceived as a research report and is not intended to serve as the basis for any investment decision. Any third-party views reflected herein do not reflect the opinion of The Street Sheet. All investments involve risk and the past performance of a security does not guarantee future results or returns. There is always the potential for financial loss when investing in securities or other financial products. The information contained in this newsletter is subject to change without notice, and we do not undertake any obligation to update it. Readers are encouraged to conduct their own research and due diligence and seek advice from licensed professionals regarding their specific financial needs and circumstances. By reading this newsletter, you agree to hold us harmless from any and all losses, liabilities, costs, or expenses arising from your use or reliance on the information provided. There is no warranty as to the accuracy or completeness of the factual matters included in any advertisement or sponsored content in the newsletter. You have not performed any research on any entity, or its business, that advertises or submits any sponsored content. The Street Sheet is reader-supported. When you buy through links on our site, we may earn a commission.