HAPPY NEW YEAR’S EVE TO THE STREET

And welcome to our final issue of 2025!

We'd like to end the year by sincerely thanking you for your readership. It has been a strange, rollercoaster year on Wall Street, marked by uncertainty and volatility, but ultimately, triumph. The S&P 500 closed 2025 up 16%, its third straight year of double-digit gains. The Nasdaq Composite fared even better, riding the epic highs and lows of the AI trade to a surge of more than 20% year-to-date.

Impossible to say what 2026 has in store, but one thing is for sure: we are honored to help you navigate it. Happy New Year!

🟥 | US stocks finished 2025 on a bum note as year-end profit-taking clipped the Santa Claus rally.

📈 | One Notable Gainer: Nike $NKE ( ▼ 0.32% ) shares rose after board members and CEO Elliott Hill increased their stakes.

📉 | One Notable Decliner: Corcept Therapeutics $CORT ( ▲ 1.69% ) plunged after the FDA declined approval of a key drug.

— Brooks & Cas

Sponsored by Venture Trader

Microcaps move fast. Most traders react late. “Genetic AI” has arrived right on time.

This new model from a 25-year market quant does the heavy lifting before the market opens. It scans millions of data points, tests thousands of strategies, and builds a rules-based plan for each stock it tracks.

Meanwhile, you get to sit back, see only the clearest signals, and learn a smarter and faster way to trade with speed and precision. With net 8% returns in the last 2 months*, it’s a development you don’t want to miss.

MARKET SNAPSHOT

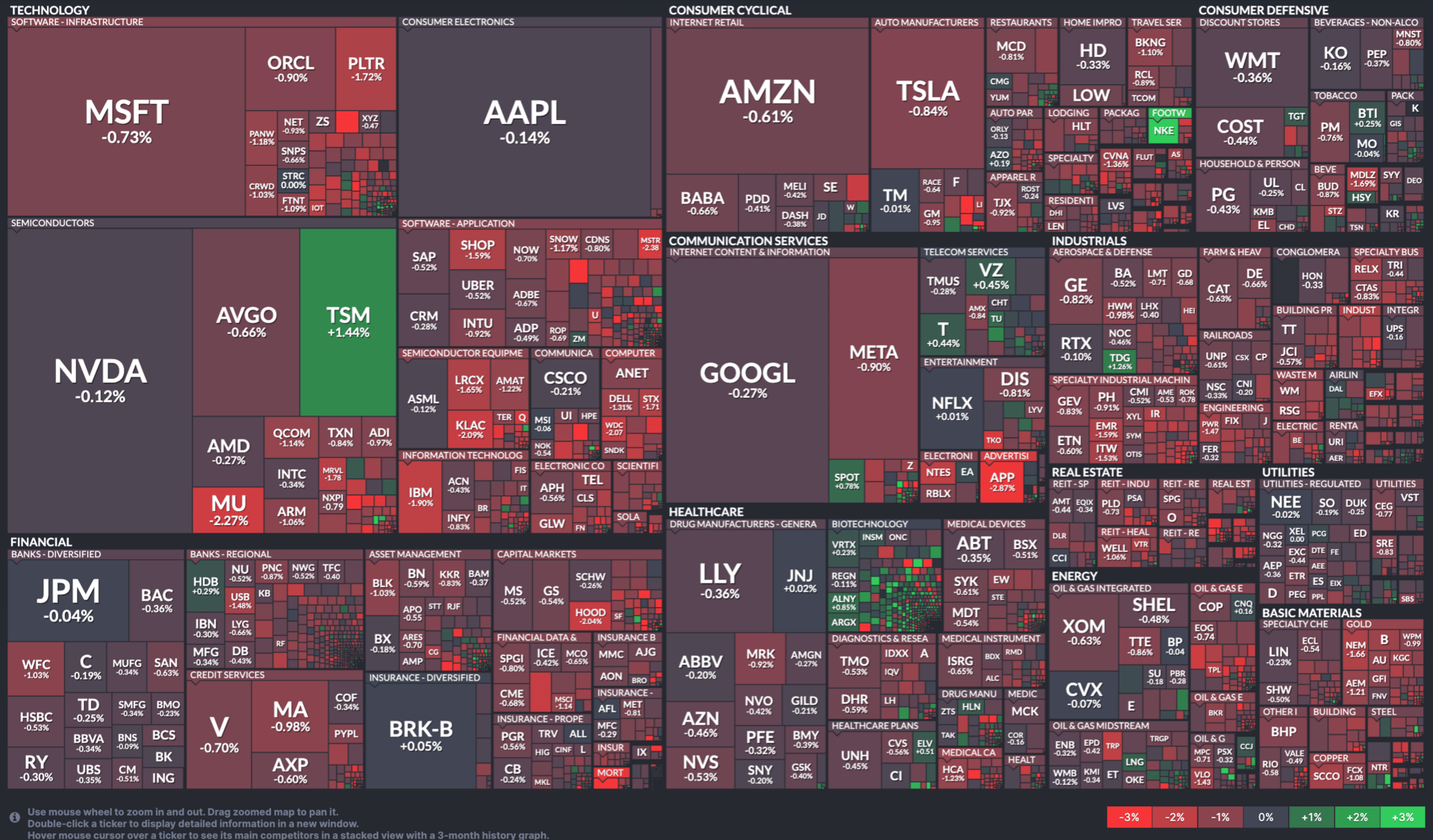

All Stock Heatmap. Credit: Finviz

Market Movers

MOLINA, NVIDIA, VANDA

Molina Healthcare $MOH ( ▲ 1.86% ) continued its Michael Burry-boosted surge.

Nvidia $NVDA ( ▲ 1.02% ) extended its strong year-to-date performance.

Vanda Pharmaceuticals $VNDA ( ▼ 5.57% ) surged on an FDA approval.

TSMC $TSM ( ▲ 2.82% ) was reportedly asked by Nvidia to boost H200 chip production.

Hyatt Hotels $H ( ▲ 2.31% ) trimmed its 2025 outlook following hurricane-related disruptions.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

MIDTERMS MAY SHAKE THE MARKET

Strong Setup Meets Midterms

Wall Street enters 2026 in a good mood. Stocks are riding strong momentum, and many strategists still expect another positive year. But politics could complicate that calm.

The midterm elections arrive alongside other market stress points. A new Federal Reserve chair looms. The Supreme Court is expected to rule on the legality of President Trump’s tariffs. A partial government shutdown also sits on the table if Congress fails to extend key ACA subsidies.

Stack those together, and volatility starts to look less theoretical. As Aptus Capital Advisors’ David Wagner put it, the political backdrop adds another layer of uncertainty to markets already juggling big transitions.

Why Midterm Years Feel Rougher

History backs up the nerves. Midterm election years tend to be the most volatile part of the four-year presidential cycle. Data from Aptus shows the average intra-year drawdown for the S&P 500 reaches about 19% in midterm years, compared with roughly 12% in the other three years.

Past performance doesn’t necessarily reflect future results, but historically, the pressure tends to show up early.

Strategists note that the first half of a midterm year often disappoints as markets price in growth ahead of reality. Then, should lackluster growth data settle and Treasury yields rise, stocks can see even sharper pullbacks.

The Late Year Sweet Spot

In that environment, Aptus notes, investors often rotate toward defense.

Meanwhile, healthcare has posted the best historical midterm performance over the past three decades, followed by consumer staples and utilities. However, policy risk around healthcare could complicate that usual playbook.

However, the firm also notes that, historically, markets tend to bottom around October of a midterm year, once election uncertainty starts to clear. That period often marks the start of a stronger run into the following year.

Most analysts still expect the S&P 500 to extend its green streak in 2026. But Aptus’ history lesson is worth considering all the same. Fortune favors the prepared.

Presented by Venture Trader

Better trades start with better information.

Genetic AI delivers premarket signals built on deep overnight analysis. The system evaluates microcaps across millions of data points and highlights setups with real potential.

You simply get a plan for the day: when to enter, when to exit, how to manage risk. A disciplined, data-driven structure for everyday investors.

And, in the last 2 months, Genetic AI users have also netted 8% returns.*

If you want more clarity and fewer surprises, Genetic AI fits the way you trade.

OVERHEARD ON THE STREET

YF: Warren Buffett will formally step down as Berkshire Hathaway $BRK.B ( ▲ 0.25% ) CEO tomorrow, amid broader retail leadership shakeups.

FT: Trump Media & Technology Group $DJT ( ▼ 4.35% ) announced plans to distribute a new cryptocurrency token to shareholders.

TipRanks: Meta $META ( ▲ 1.69% ) was sued by the US Virgin Islands, alleging child safety failures and profiting from scam advertising.

Investing.com: Brookfield $BAM ( ▲ 0.98% ) launched a cloud business to lease AI chips, tied to a $10B fund and Radiant.

TechCrunch: Investors warned AI adoption would impact enterprise workforces in 2026, as studies showed nearly 12% of jobs were already automatable.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on Burlington $BURL ( ▲ 0.79% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐻 Bearish — “The quality of goods offered has dropped.”