HAPPY MONDAY TO THE STREET

This weekend may have been bearish for Tender, but it’s looking pretty bullish for Netflix $NFLX ( ▲ 2.29% ). If the streamer’s acquisition of HBO $WBD ( ▼ 0.35% ) goes through, it may have already found a successor for Stranger Things.

In case you missed it, season 4 of HBO’s Industry premiered on Sunday. And it wasted no time serving up a generous helping of finance speak, trading desk tension, and episode titles we can’t print.

Starting to think big banks are better at minting content creators than financiers. (Not that we’re biased or anything.)

🟩 | US stocks rose as markets looked past the Trump administration’s criminal investigation into Federal Reserve Chair Jerome Powell.

📈 | One Notable Gainer: Albemarle $ALB ( ▼ 5.59% ), Lithium Argentina $LAR ( ▼ 5.02% ), and peers rose after Scotiabank upgraded lithium stocks to outperform.

📉 | One Notable Decliner: Duolingo $DUOL ( ▲ 5.2% ) shares fell about after CFO Matt Skaruppa said he would step down effective February 23.

— Brooks & Cas

Presented by Stock Investor Accelerator

Most stock pickers focus on price moves and narratives. Professionals focus on business quality and metrics that compound over time.

This live masterclass breaks down the gaps that quietly hold investors back.

You will learn which signals actually matter, which numbers mislead, and how Wall Street insiders filter opportunities before they ever place a trade.

Hosted by Henry Chien, alongside The Street Sheet, this free session is also your chance to ask questions and see if the deeper course is right for you.

Thursday 1/22 at 4:30 PM ET.

MARKET SNAPSHOT

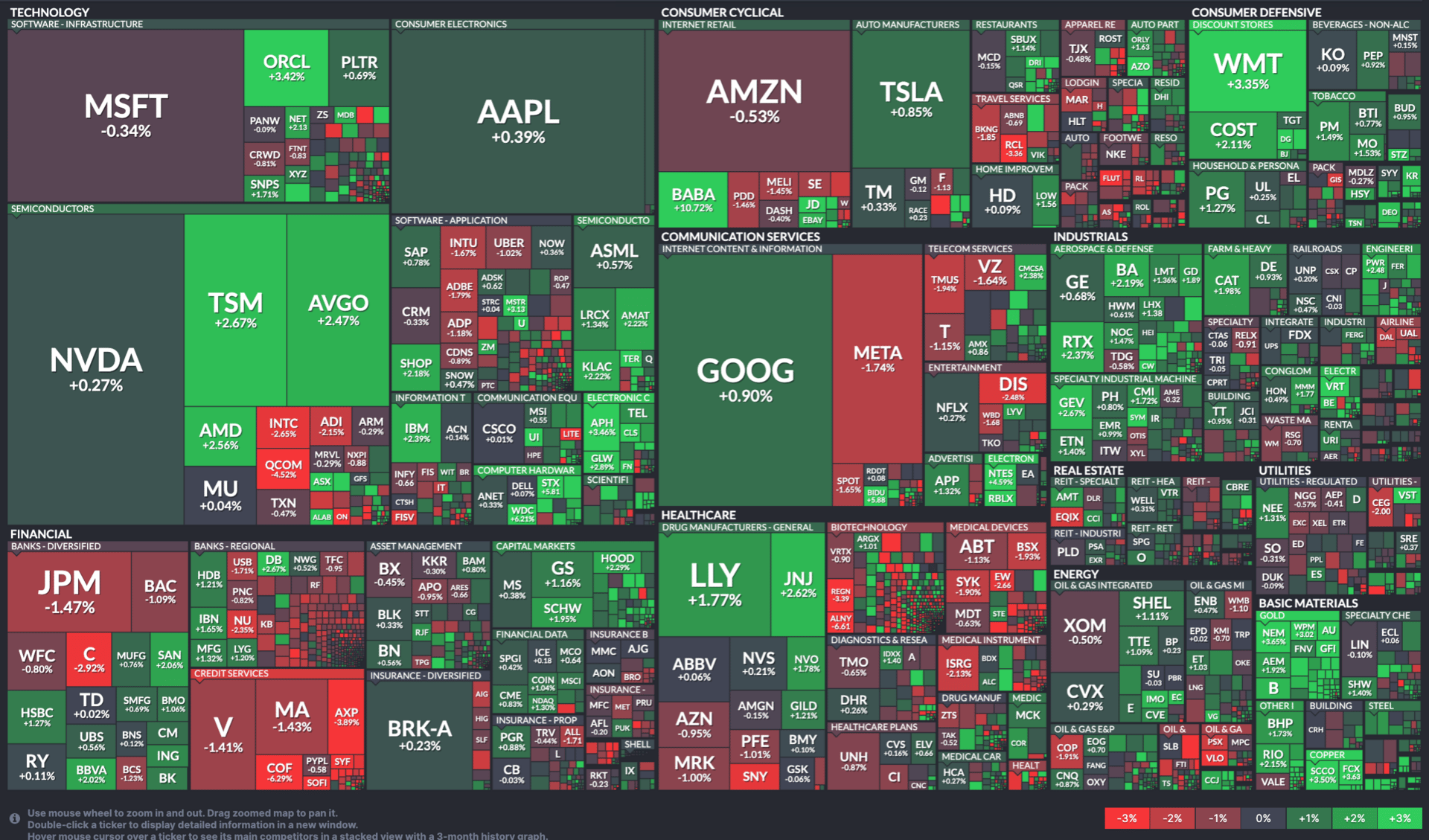

All Stock Heatmap. Credit: Finviz

Market Movers

WALMART, EXXON MOBIL, DEXCOM

Walmart $WMT ( ▼ 1.06% ) will be added to the Nasdaq 100 later this month.

Exxon Mobil $XOM ( ▼ 0.35% ) slipped after President Trump threatened to block the company from Venezuela’s oil market.

Dexcom $DXCM ( ▲ 1.67% ) preannounced Q4 results and outlined 2026 revenue growth expectations.

Beam Therapeutics $BEAM ( ▼ 2.33% ) reached FDA alignment that could support accelerated approval of its lead program.

Vistra $VST ( ▲ 0.83% ) announced a private debt offering tied to its Cogentrix acquisition.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

AKAMAI MAY BE AT A TURNING POINT

A Rare Double Upgrade Gets Attention

Akamai Technologies $AKAM ( ▼ 0.14% ) has struggled to excite investors since the pandemic boom faded. Growth slowed, the story went quiet, and the stock drifted, while flashier cyber names took center stage.

But Morgan Stanley $MS ( ▲ 2.16% ) is doubling down… or rather, up.

The firm double-upgraded Akamai to Overweight, arguing the market has misread where the business is headed. Shares trade around 11x expected 2027 earnings, a level the bank views as disconnected from Akamai’s improving setup.

Growth Engines Are Finally Lining Up

Post-COVID, Akamai’s revenue growth stalled in the mid-single digits. Earnings followed a similar path, reinforcing the perception of a mature, slow-moving business.

Morgan Stanley believes that’s changing now, and points to three drivers. First, Akamai’s core content delivery business appears to be stabilizing after years of pressure. Second, its security segment continues to grow at a high single-digit pace. Third, the compute business is accelerating into the high teens.

The latter matters most to MS. The firm argues it gives Akamai exposure to AI-driven workloads without chasing hyperscaler economics, which could lift overall growth above its recent ceiling.

Valuation Leaves Room For Upside

Morgan Stanley sees implied upside of 26% from current levels if execution follows through.

According to the firm, Akamai does not need to become a new cloud giant to work. It just needs to show that the next chapter grows faster than the last.

If that inflection arrives, the stock may finally get the rerating Morgan Stanley expects.

Presented by Stock Investor Accelerator

Most investors rely on headlines, gut feel, or tips from social media. Professionals do not. They use a repeatable framework to evaluate businesses, manage risk, and stack the odds in their favor.

In this free live masterclass, equity research analyst Henry Chien walks through how pros actually pick stocks. It’s your chance to ask questions to a Wall Street insider live and see how real analysis works.

The session takes place on Thursday, 1/22 at 4:30 PM ET. Spots are limited and early access matters.

OVERHEARD ON THE STREET

Bloomberg: Meta $META ( ▲ 0.51% ) formed a senior team to oversee massive AI data center investments.

CNBC: Alphabet $GOOGL ( ▼ 1.76% ) became the fourth $4T company, joining Microsoft $MSFT ( ▲ 0.28% ), NVIDIA $NVDA ( ▼ 5.46% ), and Apple $AAPL ( ▼ 0.47% ).

Reuters: Meta $META ( ▲ 0.51% ) launched Meta Compute to oversee AI infrastructure and global data centers.

Axios: Mattel $MAT ( ▲ 1.37% ) launched its first autistic Barbie, developed with advocates, expanding inclusive toys nationwide.

CNN: Apple $AAPL ( ▼ 0.47% ) will use Google Gemini $GOOGL ( ▼ 1.76% ) to power Siri updates under a multiyear AI and cloud agreement.

FRIDAY’S POLL RESULTS

Which stock will outperform over the next 12 months?

▇▇▇▇▇▇ Shopify $SHOP ( ▲ 4.68% )

▇▇▇▇▇▇ ServiceNow $NOW ( ▲ 4.86% )