HAPPY TUESDAY TO THE STREET.

According to Starbucks $SBUX ( ▲ 1.76% ), its turnaround is still brewing. I smell something fishy — or, rather, burning-coffee-beans-y.

After all, it’s been “brewing” for six straight quarters. Post-close, the coffee giant reported declining quarterly same-store sales, as it has for the past year and a half.

But CEO Brian Niccol says, Don’t worry! At least, when they finally call your name, they’ll draw a little smiley face on the cup.

🟥 | US stocks slid today, following another slew of earnings reports, many lackluster.

📈 | One Notable Gainer: Chart Industries $GTLS ( ▲ 0.1% ) popped on news that the gas equipment company will be acquired by Baker Hughes $BKR ( ▼ 0.56% ) in a $13.6B deal.

📉 | One Notable Decliner: Tough day for home appliance manufacturers. AC-maker Carrier Global $CARR ( ▲ 1.94% ) and HVAC firm Johnson Controls $JCI ( ▲ 0.76% ) both fell on lackluster sales forecasts. Have their executives stepped outside recently?

Finally, read to the end for a staffing chart that looks more like a scoreboard…

— Brooks & Cas

Sponsored by Timeplast

This Startup Is Making Plastic Obsolete

Timeplast created a plastic that dissolves in water, leaving no waste. Their tech could revolutionize the $1.3T plastic industry. That’s why 7,000+ people have already invested, and you have only a few days left to join them. Invest in Timeplast by July 31 at midnight.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

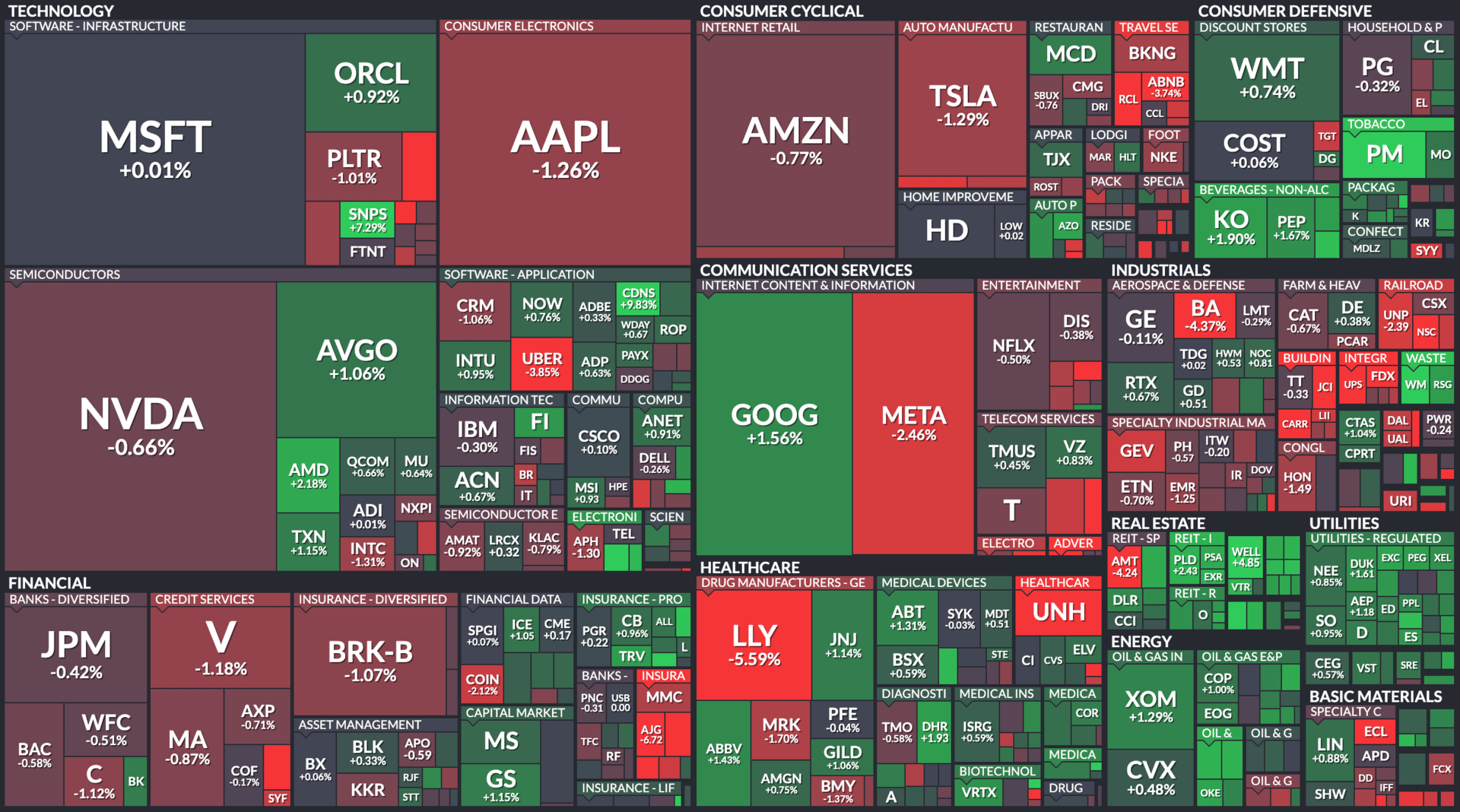

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

PAYPAL, SPOTIFY, UNITEDHEALTH

$PYPL ( ▼ 0.19% ) Why PayPal Stock Is Down After Solid Earnings (Barron’s)

$SPOT ( ▲ 1.09% ) Spotify’s Crown Lies Heavy, but It’s Still the Streaming King (WSJ)

$UNH ( ▲ 0.02% ) UnitedHealth says 2025 earnings will be worse than expected as high medical costs dog insurers (CNBC)

$SRPT ( ▲ 1.56% ) Sarepta shares rebound after shipments of gene therapy Elevidys resume in US (Reuters)

$NVO ( ▼ 2.13% ) Novo Falls by Record as Wegovy Slumps and Insider Named CEO (Bloomberg)

OVERHEARD ON THE STREET

CNN: US-China trade talks ended without a deal to extend tariff relief, raising the risk that punitive duties will return on August 12.

Bloomberg: The S&P 500’s record rally faces a key test this week as four tech giants worth $11.3T report earnings over a critical two-day stretch.

AP: Union Pacific $UNP ( ▲ 1.19% ) officially proposed an $85B merger with Norfolk Southern $NSC ( ▲ 0.69% ) to form the first US transcontinental railroad.

Reuters: The US goods trade deficit shrank nearly 11% to $86B in June, boosting second-quarter GDP expectations.

WSJ: Palo Alto Networks $PANW ( ▼ 1.52% ) is nearing a deal to acquire Israeli cybersecurity firm CyberArk $CYBR ( ▼ 0.09% ) for more than $20B.

Tomorrow's Trade Idea, Today

BERKSHIRE BLUES

Bye Bye, Buffett Premium

Shares of Berkshire Hathaway $BRK.B ( ▲ 0.25% ) are down roughly 10% since the company’s May 3 meeting, when Warren Buffett announced he would step down as CEO in December.

The slump comes as investors rue the end of the “Buffett premium” — the extra price investors were willing to pay in return for Buffett’s guidance. But Barron’s points to other sources of consternation for Berkshire investors too: no buybacks in over a year, and modest (timid?) investment activity by management.

Investors have spent years eating at the all-you-can-eat Buffett. Is it finally time to ask for the check?

The Secret Sauce

According to several major analysts, not quite.

UBS’s $UBS ( ▲ 0.57% ) Brian Meredith has a Buy rating and notes that “Berkshire is no different than it was in April,” before the news. He sees upside ahead as the market gets reacquainted with Berkshire’s core strengths. JPMorgan $JPM ( ▲ 0.89% ) and Gamco Investors $GAMI ( ▲ 0.04% ) echoed similar sentiment, calling the stock increasingly compelling.

In particular, Barron’s characterized Berkshire’s balance sheet as one of the strongest in corporate America. The firm holds more than $330 billion in cash and is generating about $45 billion in annual operating earnings. More than a billion comes from dividends alone, which Buffett in 2022 called “the secret sauce”.

Buy the Berkshire Dip?

It may not be a coincidence that Berkshire shares have fallen out of favor at the same time that investors are turning away from defensive stocks. It’s not the first time it’s happened either.

We’ve seen an extreme example of this performance gap play out before. In 1999, amid the Dot.com mania, Berkshire shares lost 19.9% of their value, even as the S&P 500 returned 21%. The underperformance was so striking, Barron’s published an article titled “What’s Wrong, Warren?” warning that “Buffett may be losing his magic touch.”

But while Buffett’s approach fell out of favor, it didn’t stay down for long. The following year, Berkshire shares rose 26.5%, even as the Dot.com bubble burst. Barron’s believes the time to buy the Berkshire dip may have arrived once again.

Sponsored by iTrustCapital

Why choose between digital innovation and time-tested security? With iTrustCapital, you don’t have to.

iTrustCapital is one of the only platforms where you can invest in both cryptocurrencies and physical gold or silver — all within a tax-advantaged IRA.

That means you can diversify your retirement savings with assets that align with both modern and traditional financial strategies.

Trade over 70 crypto assets or allocate part of your IRA to precious metals, all in one account.

You get the potential of crypto growth and the reliability of metals, backed by institutional custodianship and 24/7 access.

ON OUR RADAR

Bloomberg: A gunman opened fire on a building in NYC’s business district, killing four, including a Blackstone $BX ( ▼ 3.57% ) executive.

CNBC: Senator Josh Hawley (R-MO) introduced a bill to send $600 tariff rebate checks to Americans.

Reuters: Kering $PPRUY ( ▲ 0.86% ) reported a 15% drop in Q2 revenue and warned of weaker luxury sales across all markets.

AP: The Trump administration moved to repeal the legal foundation for federal climate regulations.

Fortune: The world’s top 500 firms generated nearly $42T in combined revenue last year. Here’s who made the list.

STREET TWEET

Apple’s $AAPL ( ▲ 1.54% ) AI brain drain continues.

That’s four top researchers in a month heading to Meta. This time it’s Bowen Zhang, Apple’s lead multi-modal expert. The project name “Superintelligence” feels a bit on the nose. But maybe that’s the point.

MONDAY’S POLL RESULTS

Are you bullish or bearish on American Eagle $AEO ( ▲ 1.24% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish