HAPPY FRIDAY TO THE STREET

Stan Kroenke already owns the Rams. Now he owns more land than anyone else, too. A nearly 1 million–acre ranch purchase just made the billionaire America’s largest private landowner. That means plenty of dirt to rub in those wounds, just in case Caleb Williams pulls off another impossible upset this weekend. Bear down!

🟥 | US stocks ticked down, closing a red week as President Trump’s escalating rhetoric muddied Fed succession and revived geopolitical jitters.

📈 | One Notable Gainer: ImmunityBio $IBRX ( ▲ 6.75% ) jumped after forecasting 700% revenue growth for its bladder cancer drug Anktiva.

📉 | One Notable Decliner: Amcor’s $AMCR ( ▼ 0.58% ) ADRs fell about 6% after completing a 1-for-5 reverse stock split.

— Brooks & Cas

Presented by Lateral Investment Management

Sophisticated capital tends to move two ways: early, and quietly. That means this movement is already happening, likely below the mega-fund tier. But you may not know it yet.

It’s time to tap in. Lower middle-market private equity is drawing increased attention from family offices and ultra-high-net-worth investors seeking differentiated return profiles.

That’s why Lateral Investment Management is hosting a private webinar on Wednesday, February 4, at 1:00 PM ET: to unpack how this counterintuitive segment may be positioned for success in 2026.

Exclusively for qualified purchasers, the session will cover structural market dislocations, attractive entry valuations, operational alpha opportunities, and much more.

Don’t miss your opportunity to tap into the growing trend while it’s still just a whisper behind closed doors.

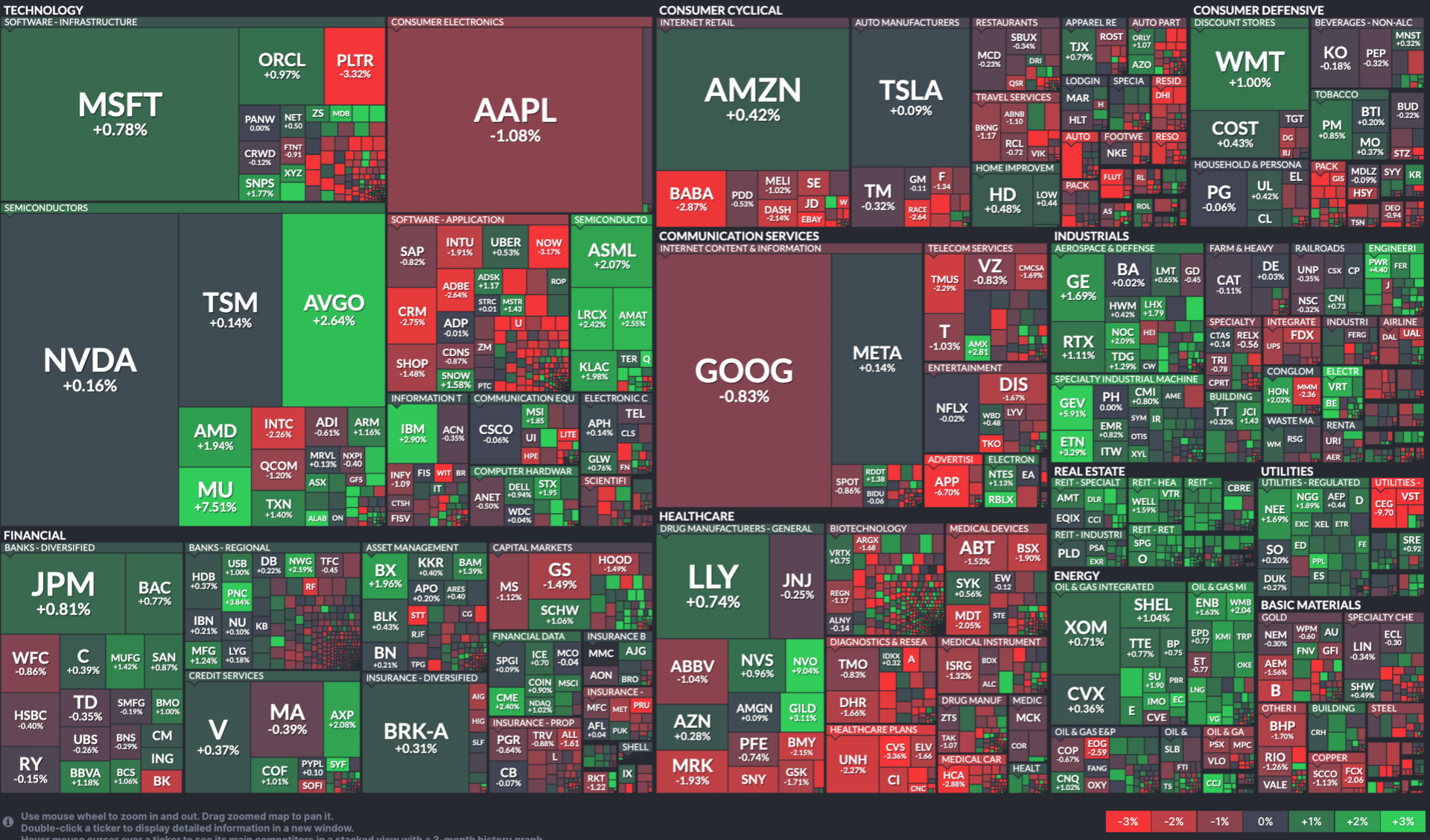

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

NOVO NORDISK, MICRON, HONEYWELL

Novo Nordisk $NVO ( ▲ 0.83% ) gained after strong early sales of its oral Wegovy treatment.

Micron $MU ( ▲ 0.07% ) board member Mark Liu disclosed a $7.8M open-market share purchase.

Honeywell $HON ( ▲ 1.83% ) rose after JPMorgan upgraded the stock to Overweight ahead of its planned breakup.

AST SpaceMobile $ASTS ( ▲ 9.76% ) was selected as a primary contractor for the US Missile Defense Agency’s SHIELD program.

PNC Financial Services $PNC ( ▲ 0.89% ) beat Q4 expectations and outlined revenue growth that topped analyst forecasts.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

COUPANG FINDS A FLOOR AFTER BRUTAL SELLOFF

Toxic Headlines

South Korea’s e-commerce champion Coupang $CPNG ( ▲ 3.93% ) has had a tough time coping lately.

A massive data breach triggered regulatory scrutiny, forced a $1.1 billion customer compensation agreement, and reignited concerns about government pressure on dominant platforms. The stock slid about 32% over the last six months, erasing much of its earlier momentum.

But Deutsche Bank $DB ( ▼ 3.36% ) now says the damage is largely reflected in the price.

Why The Storm May Be Passing

The firm upgraded Coupang to Buy from Hold, arguing that the market has already discounted the worst-case outcomes. While the bank trimmed its price target to $25, it still sees 18% upside from current levels.

Analyst Peter Milliken acknowledges that regulatory pressure will not disappear overnight. Coupang was fined more than $100 million in 2024 for alleged monopoly violations, and oversight remains tight.

Still, Deutsche Bank believes these headwinds will slow growth, not derail it. Milliken notes that customers tend to be forgiving after one-off disruptions, and so far, there is little evidence of lasting user damage.

He also points out that, while regulators may push back, permanently sidelining a national tech champion in favor of foreign competitors is unlikely.

Volatility, With A Bias Higher

Deutsche Bank expects Coupang shares to remain choppy, and even raised its volatility assumptions. That said, the firm believes the stock is now priced for a future that is too pessimistic.

With user engagement holding up and regulatory risks increasingly understood, Coupang’s long-term rise in Korean retail looks slowed, not stopped.

For investors willing to tolerate bumps along the road, Deutsche Bank sees this stretch of bad news as more rearview mirror than roadblock.

Presented by Augment Capital

See which pre IPO companies drew the most activity last quarter, and how concentration shifted across sectors, valuations, and market signals.

Built by Augment, a marketplace for accredited investors to buy and sell shares of pre-IPO companies. Follow tomorrow’s trends, and, potentially, capitalize on them.

OVERHEARD ON THE STREET

CNBC: OpenAI said it would test labeled ads at the bottom of ChatGPT responses for US free users, as well as its newly launched Go tier.

Bloomberg: President Trump proposed allowing 401(k) savers to use retirement funds for home down payments, raising retirement readiness concerns.

Axios: Devon Energy $DVN ( ▲ 3.26% ) and Coterra Energy $CTRA ( ▲ 3.01% ) entered early merger talks that could create a major $40B shale producer.

Reuters: A federal judge allowed Dominion Energy $D ( ▼ 0.14% ) to resume its $11.2B Virginia offshore wind project amid Trump administration suspension.

ABC News: Taiwan hailed a US trade deal cutting tariffs to 15% in exchange for $250B in US tech investments.

THURSDAY’S POLL RESULTS

Are you bullish or bearish on F5 $FFIV ( ▲ 2.45% ) over the next 12 months?

▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “New leadership with positive direction, yet the threat of opposition remains. The scales are tipped to a bullish movement.”