HAPPY FRIDAY TO THE STREET.

Elon Musk shared a photo of the Tesla $TSLA ( ▲ 0.03% ) robotaxi coverage area shaped like, well, something NSFW. So, naturally, Waymo $GOOGL ( ▲ 4.01% ) responded the grown-up way: by tripling the size of its own Austin footprint.

Never thought I’d be nostalgic for the good old days of comparing spaceship sizes…

🟨 | US stocks wavered to end another record-setting week, following a Financial Times report that President Trump wants to levy 15-20% tariffs on imports from the European Union.

📈 | One Notable Gainer: Investors piled into Invesco $IVZ ( ▲ 0.42% ) after the firm made an administrative move in the hopes of unlocking profits from its famed tech ETF, QQQ.

📉 | One Notable Decliner: Sarepta Therapeutics $SRPT ( ▲ 1.56% ) sold off after the FDA paused shipments of its gene therapy treatment, which was linked to three patient deaths.

Finally, read to the end for the latest member of the $4T club…

— Brooks & Cas

ATTENTION: LAST CHANCE TO WIN $100

It takes less than one minute.

You’ll help keep The Street Sheet free.

Your story inspires other investors.

Five participants get $100.

Oh, and one final, bonus reason:

This is your LAST CHANCE.

Yup, today is the final day to submit your video testimonial and be part of something bigger.

No download. No subscription. No hassle. Just a simple recording that helps sustain the free financial content you trust.

Don’t miss out on your opportunity to give back — and maybe earn $100 while you’re at it.

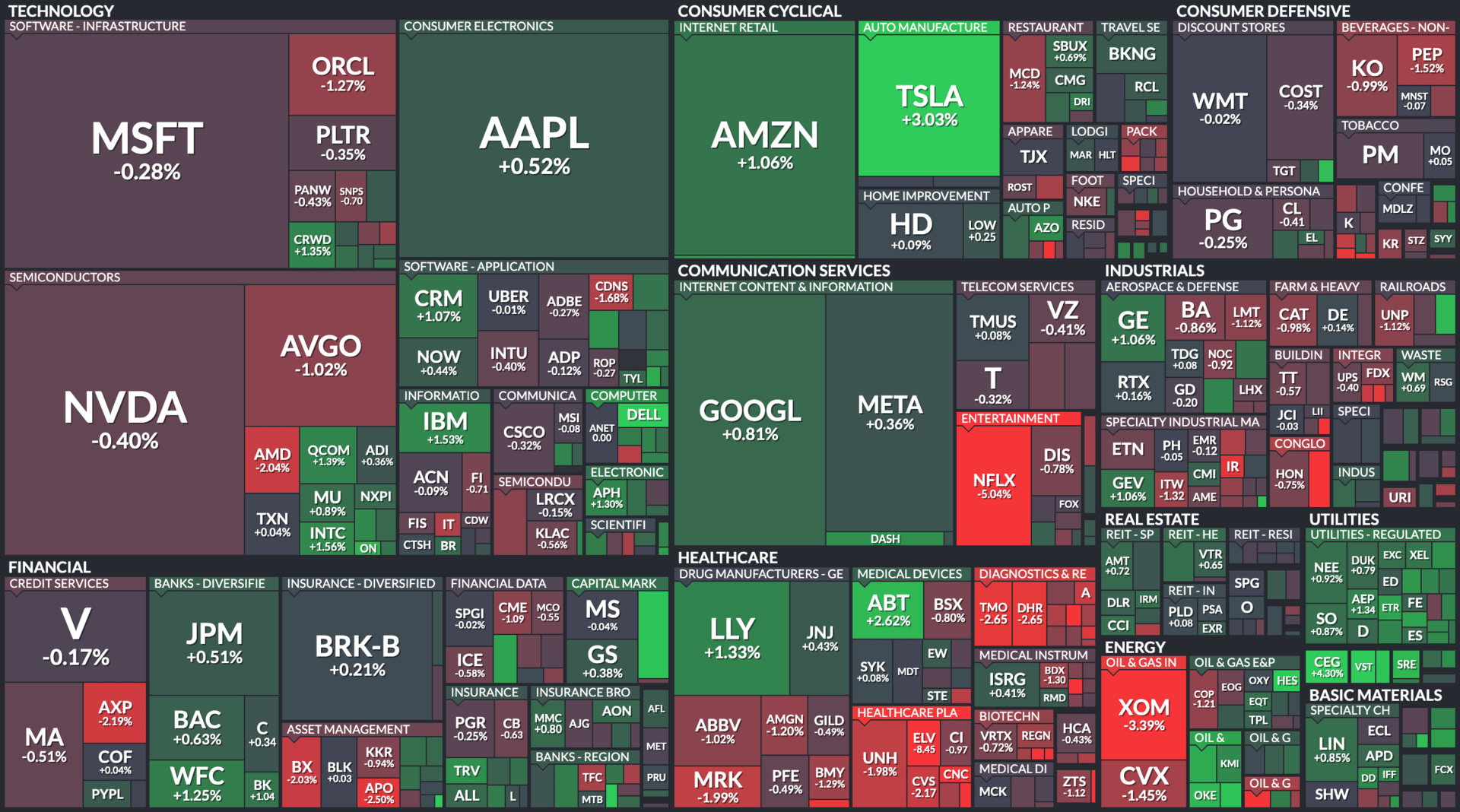

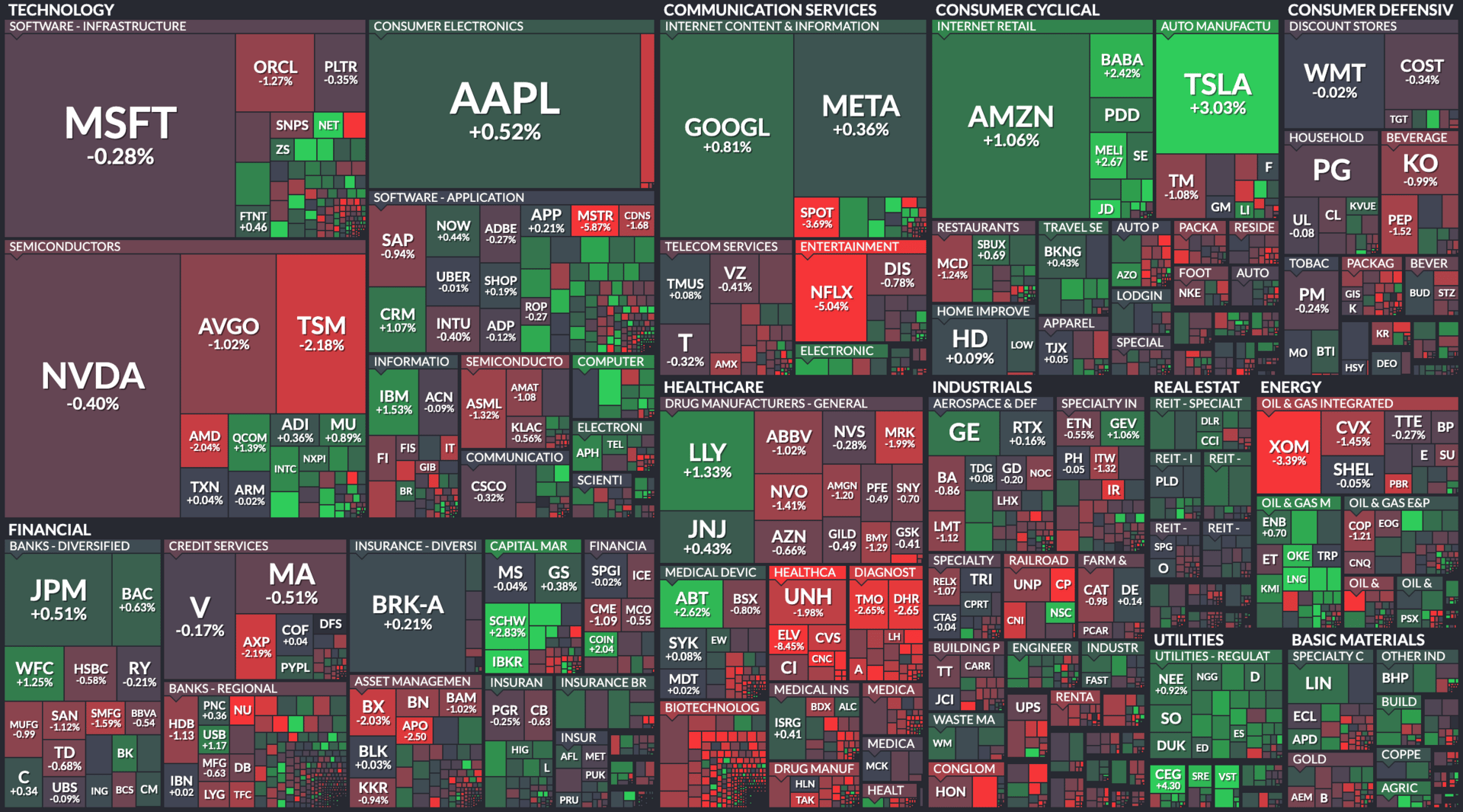

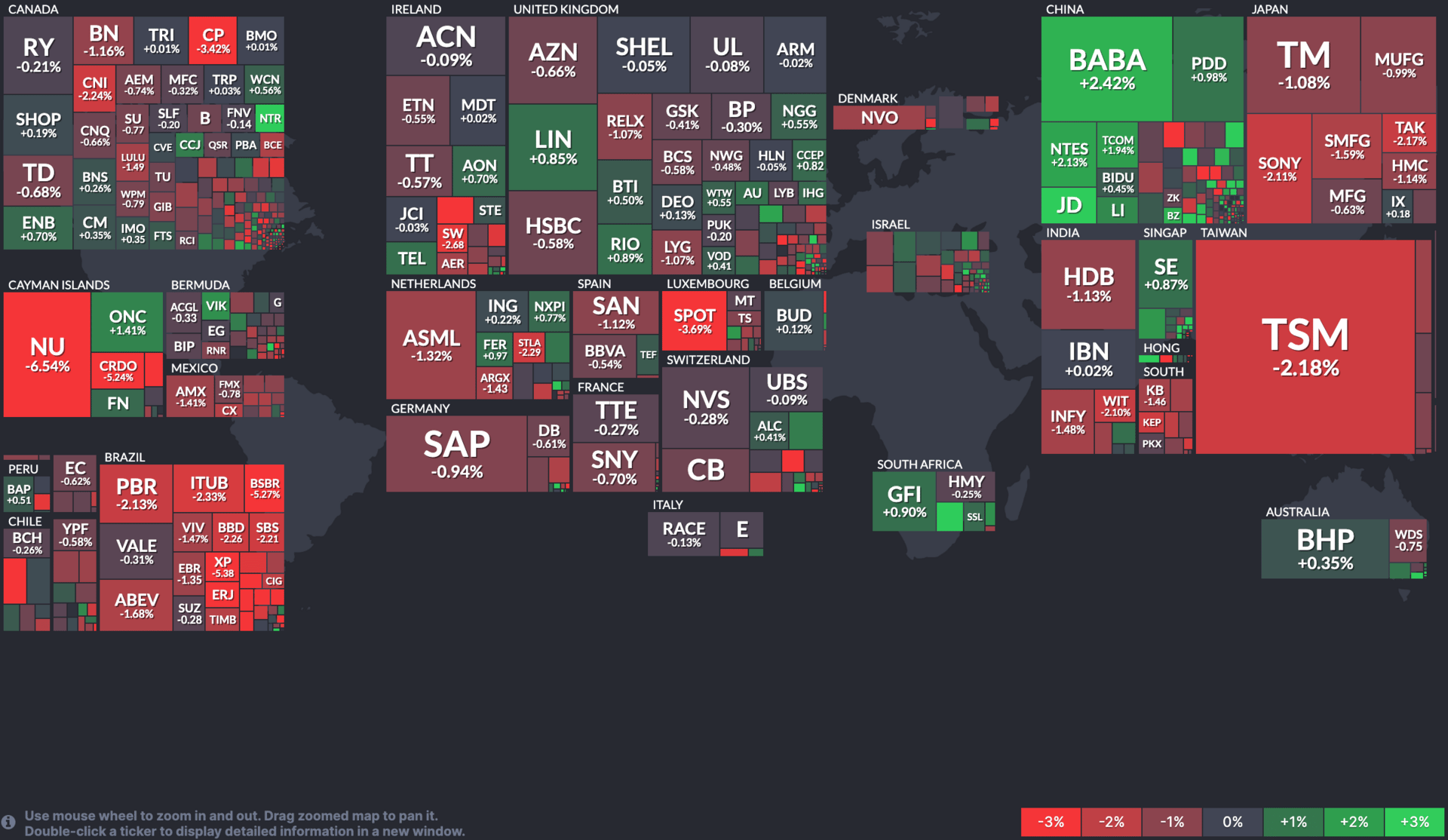

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

NETFLIX, COINBASE, CHEVRON

$NFLX ( ▲ 2.17% ) Netflix earnings top estimates but stock slips on 'elevated expectations' (YF)

$COIN ( ▲ 3.26% ) Coinbase Eyes Regulatory Win as Trump Pushes Crypto-Friendly Legislation (WSJ)

$CVX ( ▼ 0.46% ) Chevron completes Hess acquisition after defeating Exxon in dispute over Guyana oil assets (CNBC)

$TLN ( ▲ 0.58% ) Talen Stock Soars on Plant Purchases. Why the Market Is Excited About the Nuclear Play’s Bet on Gas. (Barron’s)

$MMM ( ▲ 1.22% ) Why 3M’s stock turned red despite an earnings beat and raised outlook (MarketWatch)

OVERHEARD ON THE STREET

CNBC: Consumer sentiment hit a five-month high in July. Inflation expectations fell to their lowest levels since before recent tariff hikes.

AP: Union Pacific $UNP ( ▲ 1.19% ) and Norfolk Southern $NSC ( ▲ 0.69% ) are in talks to merge and form the largest railroad in North America.

CNN: CBS $PARA ( ▼ 2.1% ) will cancel The Late Show with Stephen Colbert next year, citing financial losses, three days after Colbert criticized parent firm Paramount.

Bloomberg: Fed Governor Christopher Waller, a potential successor to Fed Chair Jerome Powell, made the case for a rate cut this month.

Fortune: Powell defended the central bank’s headquarters renovations in a detailed letter to the White House.

Tomorrow's Trade Idea, Today

COULD COREWEAVE UNRAVEL?

Fragile Revenue Model

HSBC $HSBC ( ▲ 1.51% ) initiated coverage of CoreWeave $CRWV ( ▼ 8.12% ) at a Reduce rating and $32 price target. That suggests a price per share plummet of nearly 75%.

Analyst Abhishek Shukla cited its dependence on a small group of major clients — like Microsoft $MSFT ( ▼ 0.31% ) and Nvidia $NVDA ( ▲ 1.02% ) — as a limit to its competitive edge. Microsoft alone accounted for 72% of CoreWeave’s revenue in Q1 of this year.

Another crucial sticking point: hose companies use CoreWeave’s infrastructure, but not its software. The bank says that this undercuts its value proposition and weakens long-term customer retention.

Overvaluation

After going public just a few months ago, CoreWeave gained massive popularity as a Nvidia derivative play. Its stock has gained more than 200% since then.

But HSBC believes it is now significantly overvalued. According to Shukla, investor sentiment does not match up with CoreWeave’s fundamentals, citing things like high borrowing costs and low asset turnover.

This skepticism is present across Wall Street. 17 of 23 analysts covering the stock give it a Hold rating, and only 4 believe CRWV is a Buy or Strong Buy. Two expect it to Underperform.

Mounting Long-Term Costs

CoreWeave’s business model faces another major hurdle in terms of sustained capital expenditure. Shukla warned that the short shelf life of GPUs, which must be replaced every 6-7 years, will lead to ongoing costs. This high capex burden could persist well beyond its rapid growth phase, limiting profitability in the future.

These long-term financial questions cast doubt over whether or not it can sustain its momentum. HSBC, for one, is convinced the ‘Weave could soon unravel.

ATTENTION: LAST DAY TO WIN $100

For the past week, your fellow Street Sheet readers have been sharing short video testimonials about why our free newsletter matters to them.

Today’s your final chance to join them.

It’s the last day to submit your story, support the newsletter you rely on, and become part of a community that’s becoming smarter, stronger, and largera.

There’s no software to install, and no pressure. Just speak from the heart. And remember: 1 in 5 submissions will receive $100.

Clock’s ticking. Don’t miss your moment.

ON OUR RADAR

AP: AP reporting shows Trump’s family businesses have earned hundreds of millions post-election through deals linked to his presidency.

WSJ: Obamacare insurers are proposing double-digit premium hikes for 2026, with some plans increasing over 20%.

CNBC: Delta $DAL ( ▲ 2.97% ) and United $UAL ( ▲ 2.71% ) are outperforming rivals by focusing on premium seats and strong international demand.

Reuters: Hedge funds saw $37.3B in inflows during the first half of 2025, their strongest showing since 2015.

Fortune: OpenAI flagged its new ChatGPT Agent as posing a “high” bioweapon risk.

STREET TWEET

Guess the $4T club isn’t so exclusive after all.

Just days after Nvidia $NVDA ( ▲ 1.02% ) became the first-ever company to breach a $4T market cap, the crypto sector reached the same milestone.

Granted, it helps to have dozens of major companies and thousands of meme coins helping you get there, but hey. Whatever keeps the degens partying…

THURSDAY’S POLL RESULTS

Will the meme stock party last through 2025?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Yes, but not long after that.”

🐻 Bearish — “Life goes on... people move on to new excitement.”