HAPPY MONDAY TO THE STREET.

After the bell today, Palantir $PLTR ( ▲ 0.26% ) posted $1B in quarterly revenue for the first time, raised its full-year outlook, and saw commercial US growth nearly double.

In a subsequent letter to shareholders, CEO Alex Karp wrote that skeptics have been “defanged and bent into a kind of submission.”

Guess the Lord of the Rings inspiration goes beyond the name. For a cutting-edge spy tech company, it sure knows how to get medieval.

🟩 | US stocks bounced back today in a relief rally following Friday’s sharp sell-off.

📈 | One Notable Gainer: Newly minted meme stock American Eagle $AEO ( ▲ 1.24% ) found its wings again after President Trump expressed support for its ad campaign starring Sydney Sweeney.

📉 | One Notable Decliner: Berkshire Hathaway $BRK.B ( ▲ 0.25% ) slipped after earnings. The conglomerate was a net seller of stocks for the 11th quarter in a row, while its cash pile remains near a record high.

Finally, read to the end for the most volatile non-meme stock out there…

— Brooks & Cas

Sponsored by Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

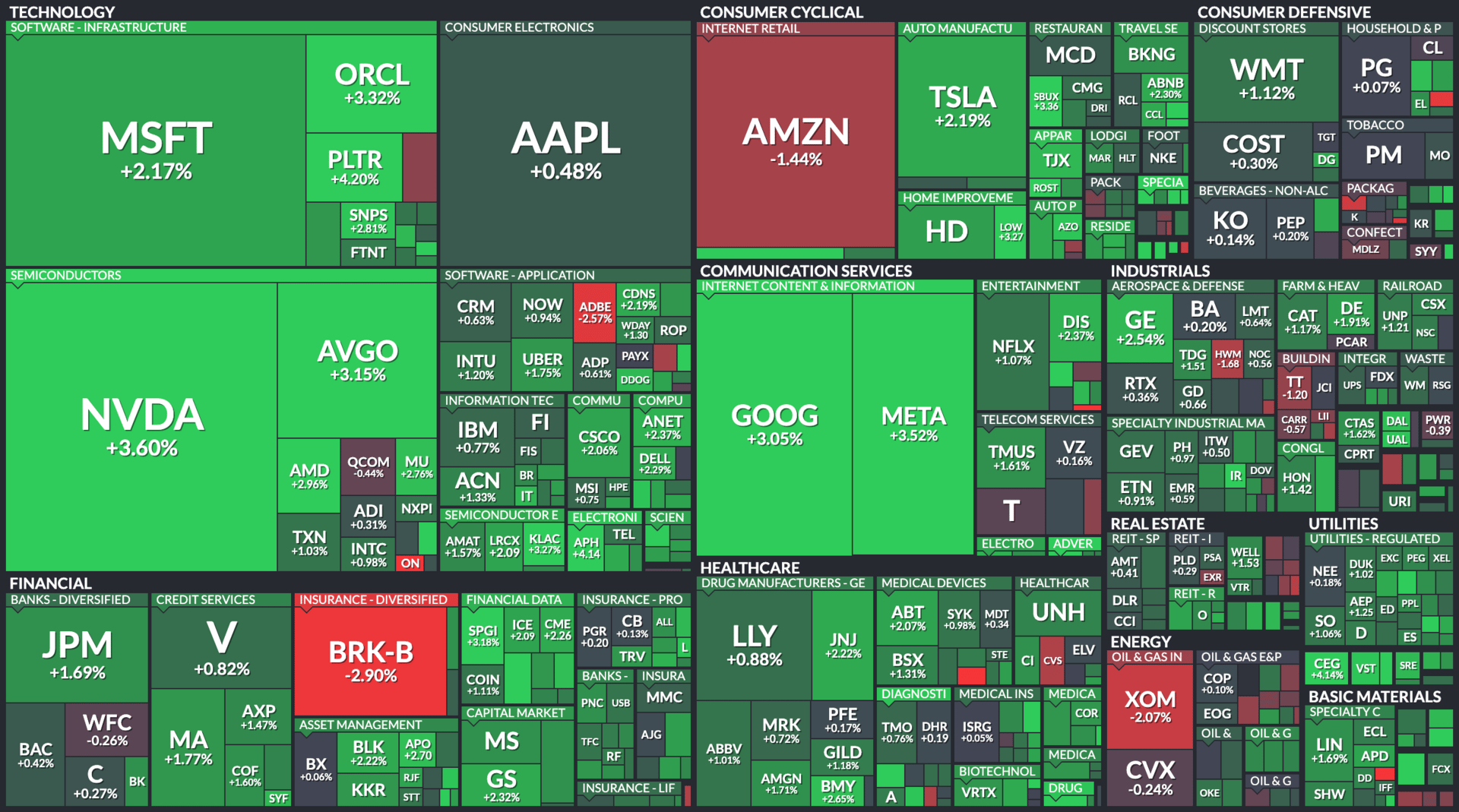

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

SPOTIFY, FIGMA, JOBY AVIATION

$SPOT ( ▲ 1.09% ) Spotify to raise premium subscription price in select markets from September (Reuters)

$FIG ( ▲ 0.89% ) Figma's stock sinks more than 20% after last week's IPO pop (CNBC)

$JOBY ( ▼ 3.71% ) Joby Aviation to buy Blade Air Mobility’s rideshare business (TechCrunch)

$ON ( ▲ 1.5% ) onsemi plunges on Q2 results despite signs of market 'stabilization' (SeekingAlpha)

$W ( ▲ 2.34% ) Wayfair Stock Jumps on Earnings. Is the Covid-Era Furniture Boom Back? (Barron’s)

OVERHEARD ON THE STREET

CNBC: The EU will delay its planned retaliatory tariffs on the US for six months to allow more time for trade negotiations.

Reuters: Global mergers and acquisitions have reached $2.6T so far in 2025, up 28% from last year.

AP: Thousands of Boeing $BA ( ▼ 0.72% ) workers have gone on strike at three Midwest plants that manufacture fighter jets and weapons.

Bloomberg: Morgan Stanley $MS ( ▲ 0.6% ) and Deutsche Bank $DB ( ▲ 2.57% ) warned the S&P 500 is poised for a near-term drop, given high valuations and weakening data.

WSJ: Tesla $TSLA ( ▲ 0.03% ) awarded Elon Musk a $23.7B stock package to keep him focused on the company for at least two more years.

Tomorrow's Trade Idea, Today

COIN Toss

Rally Runs Into Resistance

Crypto’s summer surge may be running out of gas.

After a breakout July for bitcoin and ether, a variety of headwinds are weighing on sentiment, including new tariffs and weak jobs data. At least one industry insider called the blue-chip coins “deceptively active in terms of positioning”, per CNBC reporting.

A downturn for the alternative assets could mean downward pressure on at least traditional asset too: crypto stocks.

Compass Says Sell Coinbase

Compass Point downgraded crypto leader Coinbase $COIN ( ▲ 3.26% ) to Sell and cut its price target to $248. That implies a 22% downside from today’s close.

Analyst Ed Engel said Q2 earnings confirmed weakening momentum, even in the middle of a crypto bull market. The company’s EPS beat estimates, but revenue fell short — especially on the all-important transaction side.

Engel noted that Coinbase still trades at 44x forward earnings, nearly double the S&P 500 multiple. In a slowing environment, he sees limited room for that valuation to hold up.

Choppy Waters Ahead

Additionally, the analyst warned that August and September tend to bring weak seasonality for crypto in particular.

Meanwhile, with a slew of new meme stocks stealing the spotlight, retail interest in crypto-related equities is fading, according to Engel. Stablecoin competition is another headwind, the analyst added, and transaction revenue could stay soft if trading volumes dry up.

Coinbase is up nearly 24% this year. But looking to the future, Compass Point, for one, is pointing down.

Sponsored by Money Pickle

Many retirees are surprised to learn how much taxes can eat into their income — even after they stop working. It doesn’t have to be that way.

In mere minutes, Money Pickle can connect you with fiduciary financial advisors who specialize in retirement tax strategy. Take a quick survey for a simple, FREE second opinion on your current plan — including how to reduce unnecessary tax burdens on your Social Security, RMDs, or investment withdrawals.

You’ll get objective insights, not a sales pitch. Fiduciaries are legally required to act in your best interest, not push products. A small change in how you withdraw or allocate funds could save you thousands.

ON OUR RADAR

CNBC: Trump called the latest weak jobs report "rigged" as the White House defended firing the Bureau of Labor Statistics chief.

Bloomberg: The US will increase tariffs on Indian goods in response to India’s continued purchases of Russian oil.

AP: Meanwhile, China rejected US demands to stop purchasing oil from Iran and Russia, calling the move coercive.

WSJ: China is also restricting exports of critical minerals essential to Western defense manufacturing.

Fortune: The Asian nation’s hawkish economic moves may be a long-term move. China’s low birth rates could slow its GDP growth to below 2% by the 2050s.

STREET TWEET

Are you buying the dip on $UNH — or still waiting for the bottom?

FRIDAY’S POLL RESULTS

Are you bullish or bearish on Hesai Group $HSAI ( ▼ 1.28% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Seems like a bullish trend; given the potential for growth in the industry, and subsequent sales, assuming there are no major unseen 'roadblocks' in the way.”

🐻 Bearish — “Believe first jump about over... good to follow... big gains if it remains the leader late-2025, mid-2026.”