HAPPY WEDNESDAY TO THE STREET.

America just crossed the $37 trillion mark. Apparently, the national credit limit comes with free overnight shipping. After Trump’s “Big Beautiful Bill,” the CBO now projects bigger deficits through 2034 as revenues fall faster than spending cuts, even as the White House insists a surplus will materialize by then. The debt clock’s sprinting at roughly $59K a second, and debt-to-GDP is already hovering around ~119%, per recent analyses. Translation: the tab’s growing faster than the check can clear.

🟩 | US stocks rose as rate-cut optimism kept indexes near record highs, with the Dow leading.

📈 | One Notable Gainer: Paramount Skydance $PSKY ( ▼ 2.1% ) soared to its best day ever, as the newly merged company readies an L.A. presser with CEO David Ellison.

📉 | One Notable Decliner: Cava $CAVA ( ▲ 2.44% ) sank as Q2 revenue $280.6M misses $285.6M, same-store sales and guidance cut.

— Brooks & Cas

Sponsored by MONEY MARKETERS

Most advisor marketing platforms promise you the tools to succeed. Money Marketers promises you success, guaranteed.

Our Advisor Suite was built for independent RIAs who want to scale without hiring a full-time marketing team. We combine lead generation, email nurturing, shortform video, and compliance-ready content — all in one efficient, repeatable workflow.

Oh, and did we mention, you also get a feature in this very newsletter? Your content will be created by the same team behind The Street Sheet, and your firm will be invited into our established media ecosystem, with the tools to nurture and convert.

You stay focused on serving clients. We’ll bring you more of them.

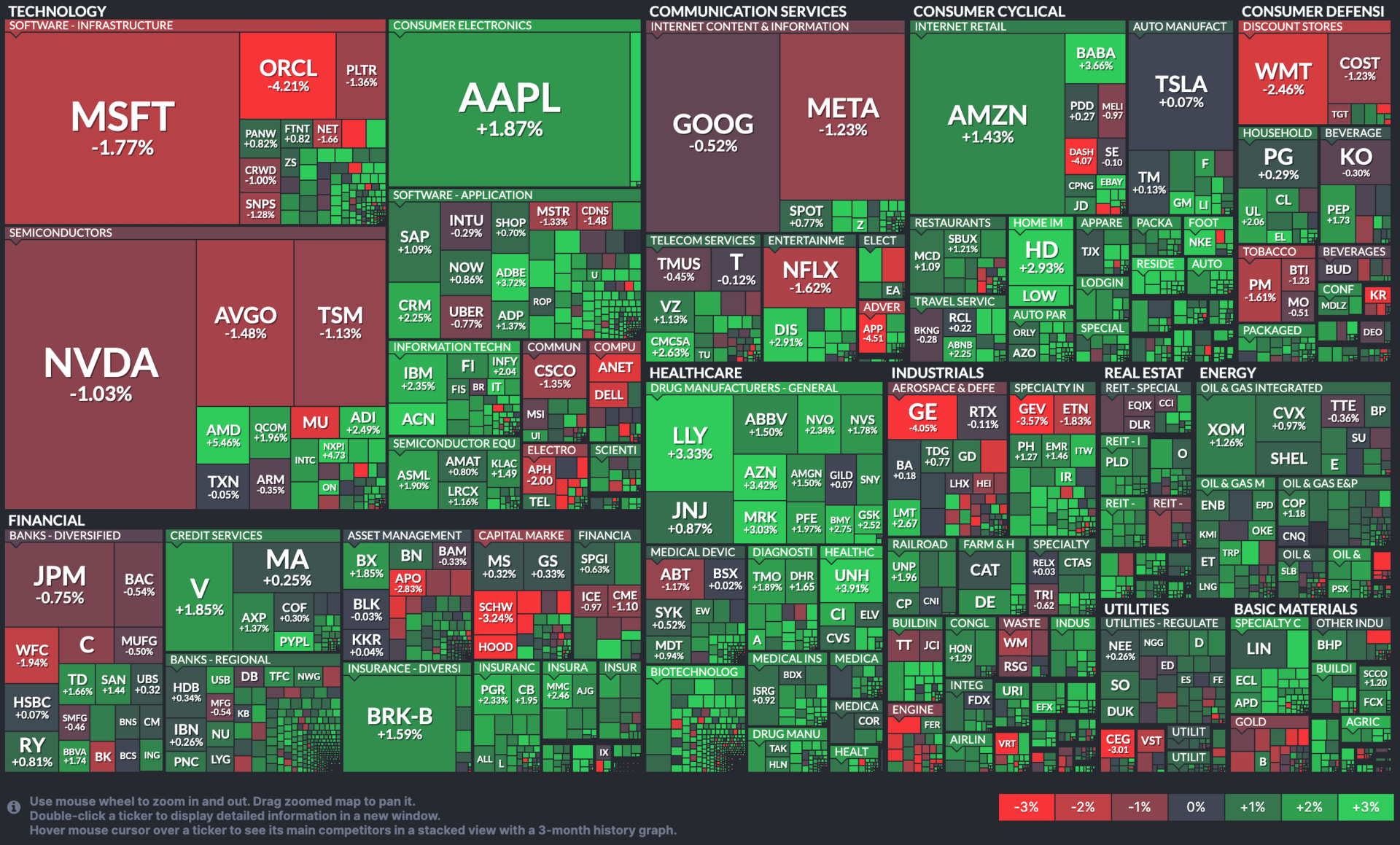

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

COREWEAVE, HANESBRANDS, V2X

$CRWV ( ▼ 8.12% ) CoreWeave shares drop even as revenue and guidance top estimates (CNBC)

$HBI ( ▼ 1.82% ) Gildan to acquire Hanesbrands in $4.4B deal, creating apparel powerhouse and ending era in Winston-Salem (TBJ)

$VVX ( ▼ 3.22% ) This Defense Contractor Stock Shot Up 9% Today: Here’s Why (Stockwits)

$SAIL ( ▼ 9.45% ) SailPoint upgraded to Overweight from Neutral at JPMorgan (TipRanks)

$EAT ( ▼ 2.72% ) Chili's Parent Slashes Gains While Cava Crashes. Here's Why. (IBD)

OVERHEARD ON THE STREET

AP: McDonald’s $MCD ( ▲ 0.65% ) braces for rush as Pokémon Happy Meal cards lure collectors.

TechCrunch: Apple $AAPL ( ▲ 1.54% ) rejects Musk’s claim App Store favors OpenAI over rival AI apps.

CNBC: Walmart $WMT ( ▼ 1.51% ) expands employee grocery discounts across U.S. stores.

AP: Amazon $AMZN ( ▲ 2.56% ) rolls out perishable Prime grocery to widen Fresh offerings.

Reuters: GE $GE ( ▲ 2.53% ) Appliances to invest $3B in U.S. manufacturing push, adding plants and jobs.

Tomorrow's Trade Idea, Today

CLEAR SKIES FOR CLEARWATER

Analysts See 70% Upside

Analysts at Goldman Sachs $GS ( ▲ 0.61% ) upgraded the accounting software firm Clearwater Analytics $CWAN ( ▼ 0.13% ) to a Buy, citing 20% annual growth in its core business.

According to Goldman analyst Gabriela Borges, momentum in Clearwater’s core business could drive 20% growth over the next three to five years, as the company’s cloud-native solution takes market share from legacy solutions and more specialized point products.

Goldman’s price target of $27 implies upside of over 40% from Tuesday’s closing price. But other firms are even more bullish.

Every Wall Street analyst covering Clearwater rates the stock a Buy, with an average price target of $31 that would imply roughly 70% upside for the stock.

A Catalyst Coming September 3

Goldman Sachs pointed to the upcoming Analyst Day on September 3, when company leaders will present their vision and tout progress to a conference of investors.

Attendees will likely be reminded of a few statistics from last week’s Q2 earnings report, from revenue rising 70.4% year-over-year, to gross margins for their platform exceeding 80%, a goal achieved years ahead of schedule.

Investors might also be reminded of a strategic partnership reached with Bloomberg, or that Germany’s largest public insurer recently selected Clearwater's platform to power its middle, back office, and risk functions, while the UK’s terrorism reinsurer overseeing billions of pounds in assets has chosen Clearwater’s risk products to modernize its investment management infrastructure.

Of course, nothing is guaranteed when it comes to investing — not even when analysts are universally bullish on an opportunity.

Fundamentals: A Look Under the Hood

Clearwater lost $24.2 million last quarter, compared to a net income of $0.3 million in Q2/2024. Gross margins also fell, and total operating expenses ramped up, including marketing costs.

Shares are down some 305% in 2025 so far, as concerns over Clearwater’s $1.5 billion acquisition of Enfusion weighed down the stock.

For a company reporting just $71.92 million in cash last quarter, the acquisition was a big bet to make. And while analysts have largely shrugged off their earlier concerns, their unanimous bullishness should make potential investors think twice.

With a forward price-to-earnings ratio of 32.47, Clearwater shares are expensive relative to the market. If it can continue growing its core business as analysts predict, then shares might be worth the premium. But it’s always possible that the company doesn’t live up to Wall Street’s sky-high expectations. In that latter scenario, shares could fall further.

Sponsored by MONEY MARKETERS

What if your wealth management firm didn’t have to chase the next opportunity?

For RIAs looking to grow, Money Marketers guarantees 1–2 prospect calls every month — then supports those leads with pre-built nurture sequences, market summaries, blog content, and shortform videos tailored to your voice and brand.

Your next client may already be looking for someone like you. Make it easier for them to find you.

ON OUR RADAR

CNBC: Older borrowers see rising student loan delinquencies as collections resume.

Axios: U.S. drinking hits record low levels, with health concerns driving the decline.

Reuters: Crypto exchange Bullish soars to nearly $132B valuation in blowout NYSE debut.

ArsTechnica: OpenAI restores GPT-4o model access after user backlash.

QZ: Treasury’s Bessent signals Fed rate cuts may be needed as tariffs strain growth.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on Paramount Global (PARA) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐻 Bearish — “WOKE is WOKE, they will go broke!”