HAPPY SUNDAY TO THE STREET

Pantone doesn’t publish economic forecasts. But its color choices might be filling the void. (Or, rather, reflecting it.)

The color-naming company’s top shade for 2026 is “Cloud Dancer,” an almost-not-there white. It lands after two years of increasingly neutral picks.

It’s a palette that The Verge argues mirrors the slow drip of soft demand, belt-tightening, and consumer retreat.

In other words, Pantone’s color of the year might just be the recessionary indicator that federal-data-starved investors have been waiting for.

If fashion is the first derivative of consumer mood, 2026 is looking markedly pale.

— Brooks & Cas

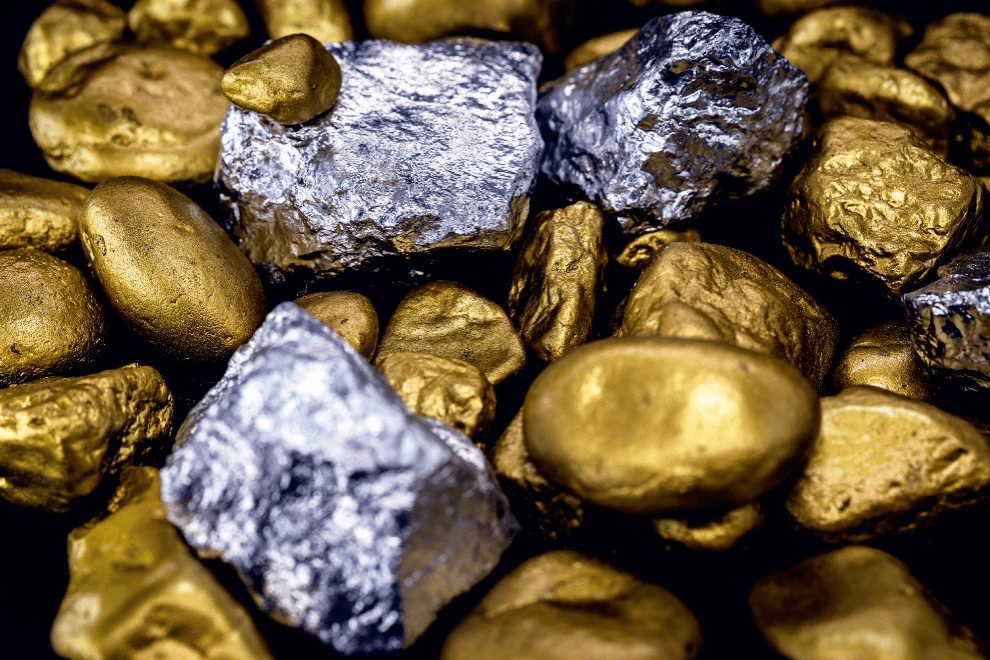

Sponsored by Power Metallic

Power Metallic Mines Inc (PNPNF) is gaining attention after releasing 2025 drill results from one of the most significant, high-grade platinum group metals discoveries in recent memory: the Lion Zone at Nisk.

With gold near record highs, silver above $50, and copper and battery metals advancing, PNPNF’s polymetallic deposits align with demand across precious and industrial metals.

Fully funded through 2026, the company is expanding high-grade zones and pursuing new discoveries across Nisk, Lion, and Tiger. Nisk provides diversified exposure to nickel, copper, cobalt, PGEs, gold, and silver from a stable jurisdiction.

Tightening supply and expectations for lower rates strengthen the case for ethically sourced North American metals. Supported by industry veterans and institutional capital, PNPNF may be positioned to benefit from the emerging polymetallic cycle.

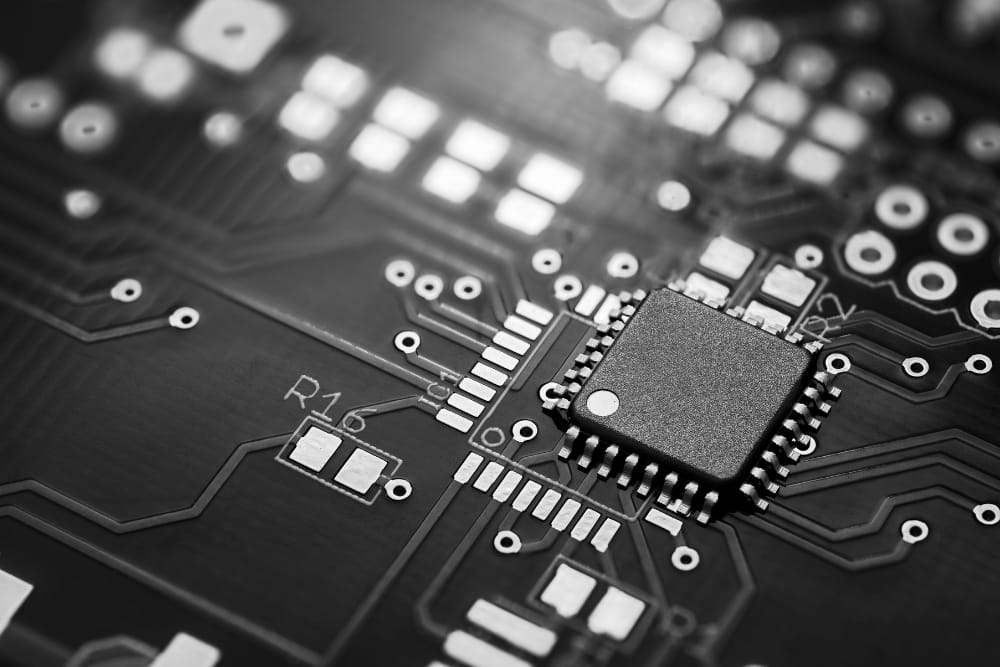

THE CASE FOR ASML’S NEXT LEG HIGHER

A Clear Favorite for 2026

Bank of America’s $BAC ( ▲ 0.55% ) top semiconductor idea heading into 2026 isn’t Nvidia $NVDA ( ▲ 1.02% ), AMD $AMD ( ▼ 1.58% ), TSMC $TSM ( ▲ 2.82% ), or really any one of 2025’s headline-dominators.

It’s ASML $ASML ( ▲ 0.73% ).

Analyst Didier Scemama argues that the firm is positioned to gain meaningful share as lithography intensity turns upward. That metric tracks how much of global wafer fab equipment spending goes toward lithography tools: technology that prints small, complex circuit patterns onto silicon wafers using light.

After more than a year of debate about whether it would fall, BoA believes the narrative is shifting. Shares have already surged more than 50% this year. But the firm says the move does not fully capture what could come next.

A Turning Point in Lithography Demand

ASML dominates the market for advanced lithography, especially EUV systems.

Scemama sees the company’s DRAM market share rising to roughly 26% by 2028. He cites several easing risks. Samsung $SSNLF ( ▲ 55.02% ) is regaining competitiveness. Micron $MU ( ▲ 2.59% ) is accelerating EUV adoption. Intel $INTC ( ▼ 1.14% ) is stabilizing. Leading-edge AI chipmakers are moving to nodes that require more advanced tools.

China’s contribution also looks steadier. BoA expects it to normalize in the low-to-mid 20% range of sales. That reduces fears of abrupt export disruptions or a sharp demand drop. According to the analyst, these dynamics form the basis for stronger long-term mix, which could widen ASML’s gross margins starting in 2027.

A Re-Rating Story in Motion

BoA believes investors will begin to view ASML less as a simple wafer fab equipment play and more as a premium growth story.

The firm forecasts about 500 basis points of margin expansion by 2030 and an 18% earnings CAGR over five years.

With market share gains, fading headwinds, and a stronger profitability outlook, analysts say ASML still has room to climb even after a strong year.

BITCOIN SNAPS BACK. IS THE WORST OVER?

Steep Drop, Sharp Rebound

Bitcoin $BTC.X ( ▲ 0.05% ) has had a turbulent month, sliding sharply before regaining some ground this past week.

The volatility reopened a long-running debate. Is this the start of another crypto winter or just another mid-cycle shakeout?

Analysts see evidence for both scenarios. The sharp pullback mirrored drawdowns seen before deeper bear markets. But it also resembled the consolidation periods that occurred mid-cycle in prior rallies.

Crypto investors now find themselves weighing short-term price pressure against fundamentals that look stronger than in past cycles.

What the Cycles Suggest

Some analysts warn that history argues for more downside. Bitcoin fell between 75% and 80% in the 2018 and 2022 bear markets. It’s currently down a little more than 10% over the past month.

Kyle Rodda of Capital.com noted that a true crypto winter usually lasts far longer than a few weeks. He believes bitcoin could fall precipitously, should more headwinds compound. With leading bitcoin bull Michael Saylor indicating he could sell some of his reserves in the near-term, that could materialize sooner than later.

But others see a very different picture. Ryan Li, CEO of Surf, said bitcoin’s latest drop aligns closely with mid-cycle corrections in past bull runs. He believes the structure of the decline, the rebound, and on-chain metrics all point to consolidation rather than collapse.

Li also noted that institutional adoption may be stretching each expansion cycle beyond the traditional four-year rhythm.

Fundamentals Still Look Strong

Even as prices wobble, some analysts highlight strengthening underpinnings. Corporate and sovereign adoption continues to grow. Regulatory clarity has improved. The network remains robust.

Sam Callahan of OranjeBTC said periods where prices weaken while fundamentals strengthen have often been attractive moments to build long-term positions. Investors looking past the volatility may see echoes of that setup again.

Sponsored by Power Metallic

Power Metallic Mines Inc (PNPNF) has released standout drill results from the Lion Zone at the Nisk Project, including 4.40 meters of 12.18% copper within 20.40 meters of 2.91% Cu. With gold above $4,300, silver over $50, and copper and battery metals climbing, PNPNF sits at the center of rising precious and industrial metals demand.

The fully funded 100,000-meter drill program through 2026 targets high-grade expansion across Nisk, Lion, and Tiger zones, giving investors rare exposure to ethically sourced polymetallic resources. The Nisk Project offers low costs, shallow deposits, proximity to Hydro-Québec power, and strong alignment with green mining initiatives.

As supply tightens and metals strengthen, PNPNF’s nickel, copper, cobalt, PGEs, gold, and silver position it as a potential North American leader in critical minerals.

CAN CRE BOUNCE BACK AS AI STOCKS COOL?

A Rare Reset Takes Shape

Commercial real estate has spent years in the penalty box.

In the wake of the pandemic, office vacancies climbed, apartment values deflated, and rising rates hammered returns. Since late 2019, private real-estate funds have gained just a fraction of the S&P 500’s performance. Many institutional investors responded by pulling back. Allocations fell. Deal activity slowed to a crawl.

Now, the Wall Street Journal wonders if the sector may have served its time.

Where Value Is Hiding

Green Street estimates that US commercial-property values are still down roughly 17% from 2022 peaks. Offices and apartments sit even deeper below their highs. Only twice in the past half century have prices fallen this far.

Historically, those resets have presented opportunities. Indeed, CBRE notes that real-estate stocks are the cheapest relative to US equities in two decades. Private-market spreads vs. corporate bonds also suggest that property is fairly valued.

Some investors are already stepping in. RXR is buying Manhattan offices at discounts of 30% to 50% from peak levels. Blackstone $BX ( ▼ 3.57% ) has closed deals in San Francisco. Sellers include institutions that no longer want to invest in aging properties, and would rather exit than fund the capital needed to retenant buildings.

A Hedge Against an AI Hangover

Higher construction costs add another wrinkle. New builds are far less economical. Mortenson data shows costs up more than 40% since 2020. With little supply coming online, landlords with quality assets should theoretically gain pricing power as demand recovers.

The AI trade has drawn capital away from slower, income-focused assets. That was true during the dot-com era as well. But when growth stocks reset, real estate became a haven.

If momentum in high-flying tech names fades, analysts think CRE could shift from overlooked to sought-after. For value-oriented investors, the sector may finally offer a margin of safety not seen in years.

LAST WEEK’S POLL RESULTS

Which stock do you think will outperform in December 2025?

▇▇▇▇▇▇ ⚙️ Broadcom

▇▇▇▇▇▇ 💊 Eli Lilly

▇▇▇▇▇▇ 💄 Estée Lauder

And, in response, you said:

⚙️ Broadcom — “It takes sales to grow. Of these three, Broadcom has the greatest potential growth market and the most essential products with open-ended market demand. Lilly & Lauder don't match Broadcom in importance to national (and even international) growth potential.”

Are you bullish or bearish on Dominion Energy $D ( ▲ 0.76% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐻 Bearish — “D has not been a go-getting machine for years… It takes actual results to drive bullishness.”

Are you bullish or bearish on Alphabet $GOOGL ( ▲ 4.01% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “All of the elements appear to be in place for continued upside, barring some unknown or unforeseen 'event'.”

17(b) Disclosure: This message is a paid advertisement for Power Metallic Mines Inc (PNPNF). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Power Metallic Mines Inc (PNPNF) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, Power Metallic Mines Inc (PNPNF) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.