HAPPY MONDAY TO THE STREET LEAF

When we scan the global markets right now, one theme keeps standing out: money is getting cheaper almost everywhere.

Central banks from Europe to Asia are trimming rates, and traders expect the U.S. Fed to follow suit in September.

In Canada, the BoC is pausing for now, but even Governor Macklem has hinted he’s ready to cut again if needed. Lower borrowing costs may sound like a dry policy detail, but they ripple into every corner of the market. One sector in particular could benefit from this structural shift. We have more on that below, but first, a few quick housekeeping items:

This week’s sponsor is Pacaso, a real estate disruptor — founded by a former Zillow exec — which is disrupting a $1.3T market. You can read more and invest here.

Here are five things to watch for in the Canadian business world in the coming week. Number five will be interesting.

Scroll to the end to take our poll and let us know if you liked this newsletter or not.

— William D.

Sponsored by Pacaso

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from Maveron, Greycroft, and more. They even reserved the Nasdaq ticker PCSO.

And you can join them for just $2.90/share. Just don’t wait. Pacaso’s opportunity officially ends September 18.

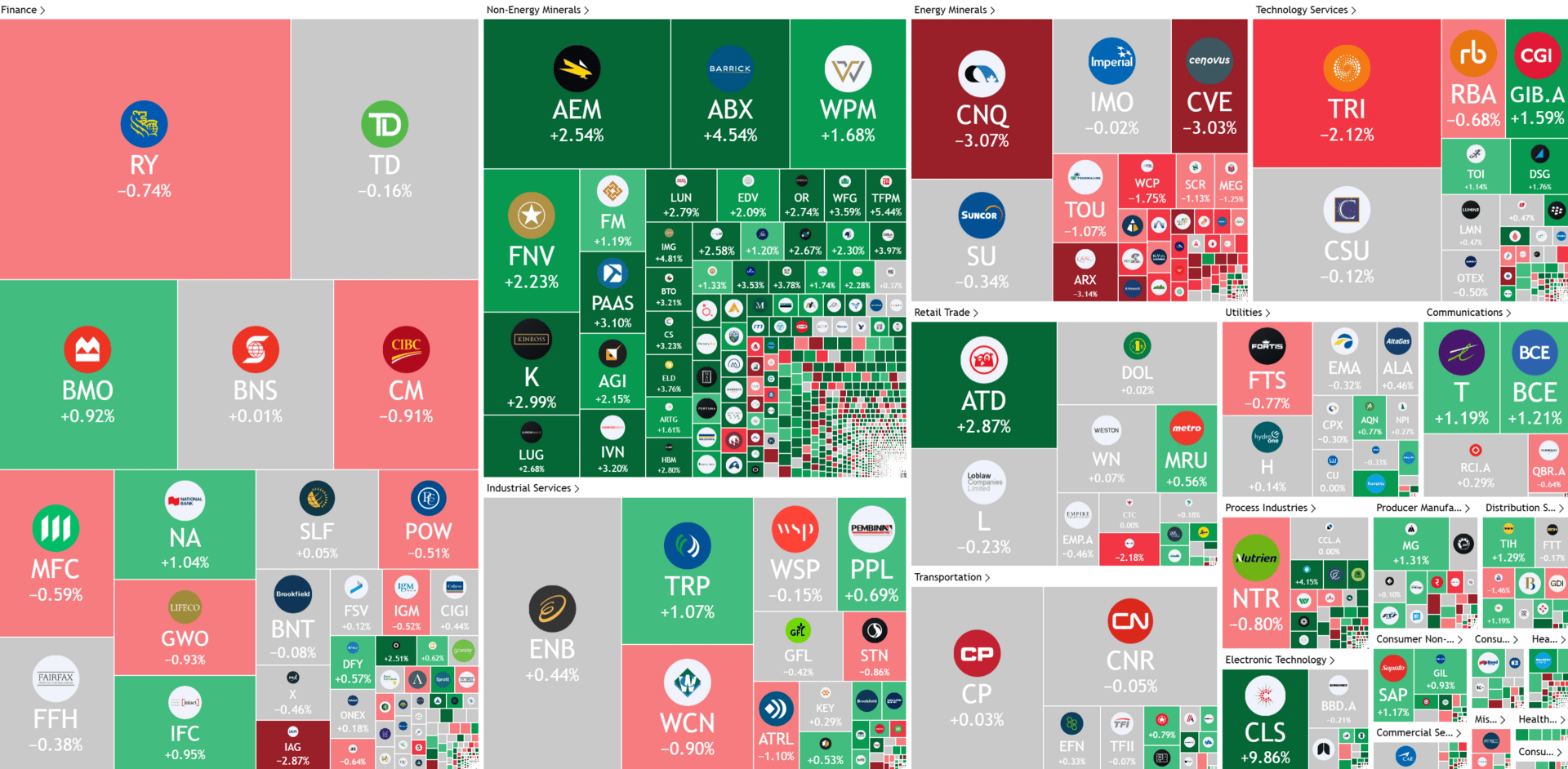

CANADIAN STOCK HEATMAP

Credit: Tradingview

OVERHEARD ON BAY STREET

Canadian salary increases projected to slow to 3.1% in 2026 as employers tighten budgets (Yahoo!Finance)

Canada’s youth face bleak employment market as economy slows (Financial Times, Subscription Required)

Carney pushes for 'Buy Canadian' policy and pauses EV targets for 2026 (BBC)

China delays final ruling in canola dispute with top supplier Canada (Reuters)

A Canadian Whisky Brand May Move Bottling to the U.S. A Union Blames Trump. (New York Times, Subscription Required)

Carney Unveils Billions in Aid for Canada’s Tariff-Hit Firms (Bloomberg)

This Week’s Trade Idea

CHEAPER MONEY, PRICIER METALS

The Trend: Rate Cuts Go Global

The Bank of Canada is holding interest rates steady at 2.75% for now, but Governor Tiff Macklem left the door open to a third rate cut this year, calling the BoC “ready to respond to new information.”

Globally, the trend toward lower rates is much clearer. Traders have priced in an overwhelming likelihood that the U.S. Federal Reserve will lower rates by 25 basis points in its September 17 meeting.

Last month, the Bank of England cut rates to 4%, their lowest level in two years. The European Central Bank cut rates to 2% in June, and the People’s Bank of China cut its key interest rate to 1.4% in May. In July, the Swiss National Bank cut rates to zero, and India’s central bank cut rates by 50 basis points in June.

This near-universal global trend towards cheaper money could stimulate economic activity by lowering borrowing costs.

The Stock: Toronto’s Precious Metals Powerhouse

Agnico Eagle Mines $AEM is based in Toronto, Canada, but it has an excellent portfolio of gold-producing assets spanning the world.

The $74.2 billion company operates gold, silver, zinc, and copper-producing mines in Canada, Australia, Finland, and Mexico, with developmental activities being conducted in Canada, Europe, Latin America, and the U.S.

Formerly Agnico Mines, the company acquired Eagle Gold in 1972, taking both names as it charted out a path to success. In 1998, Sean Boyd became CEO and took Agnico Eagle from a single gold-mining operation to a precious metals powerhouse with international operations.

In August, the company delivered a triumphant earnings report, announcing record free cash flow of $1.3 billion and CA$100 million in share buybacks. The company also returned $200 million to shareholders in the form of dividends in Q2.

These results could largely be attributed to the enormous headwind of gold prices, which rose by $400 per ounce last quarter. But Agnico Eagle has taken important steps to make the most of the boom. It has kept costs to a modest $30 per ounce increase in the same time frame, meaning the gold boom has outstripped their growth in expenses by more than 13-to-1.

The company produced 866,000 ounces of gold in Q2, at a total cash cost of $933 per ounce. With gold prices pushing past $3,500 per ounce, it’s not surprising that Agnico Eagle’s operating margins have hit a formidable 58.58%. The company also has $1.57 billion in cash on hand, compared to $733 million in debt.

Despite strong fundamentals and record free cash flow, management has kept the dividend at $1.60/share for 13 straight quarters. This amounts to a yield of 1.11%, which is slightly below the S&P 500 average. In its August earnings call, management implied it has no imminent plans to raise the dividend, as they prefer to invest cash in new operations amid the ongoing gold boom.

The company also has a record of surprising analysts on the upside. In the last four quarters, it has beaten earnings estimates by 11.54%, 7.57%, 10.72%, and 9.87%.

Despite having risen by 84% year-to-date, AEM shares are still attractively priced, with a forward price-to-earnings ratio of 24.5. This is below the average S&P 500 company, which trades at 29.96x earnings.

A caveat to note on AEM’s $1.3 billion record cash flow is that $500 million of it comes from a one-off $500,000,000 in tax deferrals. Excluding that, cash flow still came in above the $594 million achieved in Q1.

The Catalyst: Permits, Projects & Paydays

In Q4/2024, a technical evaluation of the company’s Upper Beaver gold-copper project located in Ontario showed that the site had much more gold and copper than previously thought.

The site has estimated mineral reserves of 2.8 million gold ounces and 54,930 tons of copper. The project could produce approximately 210,000 ounces of gold per year and 3,600 tons of copper annually over a 13-year mine life. At today’s gold prices, that could yield additional revenue of more than $745 million. And that’s before taking into account that copper prices hit a record high last month, nearing $10,000 per ton.

But the company has an even bigger iron in the fire. Its 80-km-long Hope Bay greenstone belt has three gold deposits, which are expected to yield 400,000 ounces of gold per year between them. With key permits and approvals to construct and mine the deposits already in place, the company is actively exploring the Hope Bay property.

All told, these assets represent about 1.3-1.5 million potential new ounces in annual production. Management has not given estimates of when these mining sites may begin production. However, they are in regions where the company has been operating for decades, in most cases with infrastructure that is already in place. In the years ahead, these mines coming into operation could be a powerful catalyst for Agnico Eagle.

Sponsored by Pacaso

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, up 89,900%. No wonder thousands are taking the chance on Pacaso.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay also backed Pacaso.

And you can join them as an early-stage investor for just $2.90/share.

Just don’t wait. Pacaso’s opportunity officially ends September 18.

WEEKLY POLL

What did you think of today's newsletter?

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals. Past performance is not indicative of future results. Comparisons to other companies are for informational purposes only and should not imply similar success. 17(b) Disclosure: This message is a paid advertisement for Pacaso. The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Pacaso is a client of Dealmaker who has contracted Tag The Flag LLC dba The Street Sheet. Through Dealmaker, Pacaso agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $10,000 in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.