HAPPY MONDAY TO THE STREET.

Tesla $TSLA ( ▲ 0.03% ) shareholders are being told to pay up — or risk losing the guy who calls proxy advisors “corporate terrorists.”

Board Chair Robyn Denholm says Elon Musk’s $1T compensation plan isn’t really about money, but about “voting influence.” The plan would give him 423 million more shares and near-total control of Tesla’s future, from Full Self Driving to his Optimus robot army.

That’s one way to ensure job security. Build robots first, then negotiate with them.

🟩 | US stocks jumped to record highs as US-China tensions cooled and chip gains lifted the S&P and Nasdaq.

📈 | One Notable Gainer: Dyne Therapeutics $DYN ( ▼ 2.43% ) jumped after Novartis $NVS ( ▼ 0.76% ) announced a $12B cash deal to acquire its RNA therapy rival Avidity Biosciences $RNA ( 0.0% ).

📉 | One Notable Decliner: Organon $OGN ( ▲ 7.71% ) plunged after CEO Kevin Ali resigned following an internal probe into improper sales practices.

Plus, what’s driving a slew of price target hikes across the crypto sector? Scroll down for more.

— Brooks & Cas

Presented by Venture Trader

In a head-to-head test against the S&P 500, one AI system outperformed the market by 6X — the creation of a 25-year market quant who taught his model to think like a trader.

This “Genetic AI,” trained on decades of data, pressure-tests thousands of trading rules until only the strongest survive — delivering fewer, smarter setups, cleaner entries, and measurable market edges that separate signal from noise.

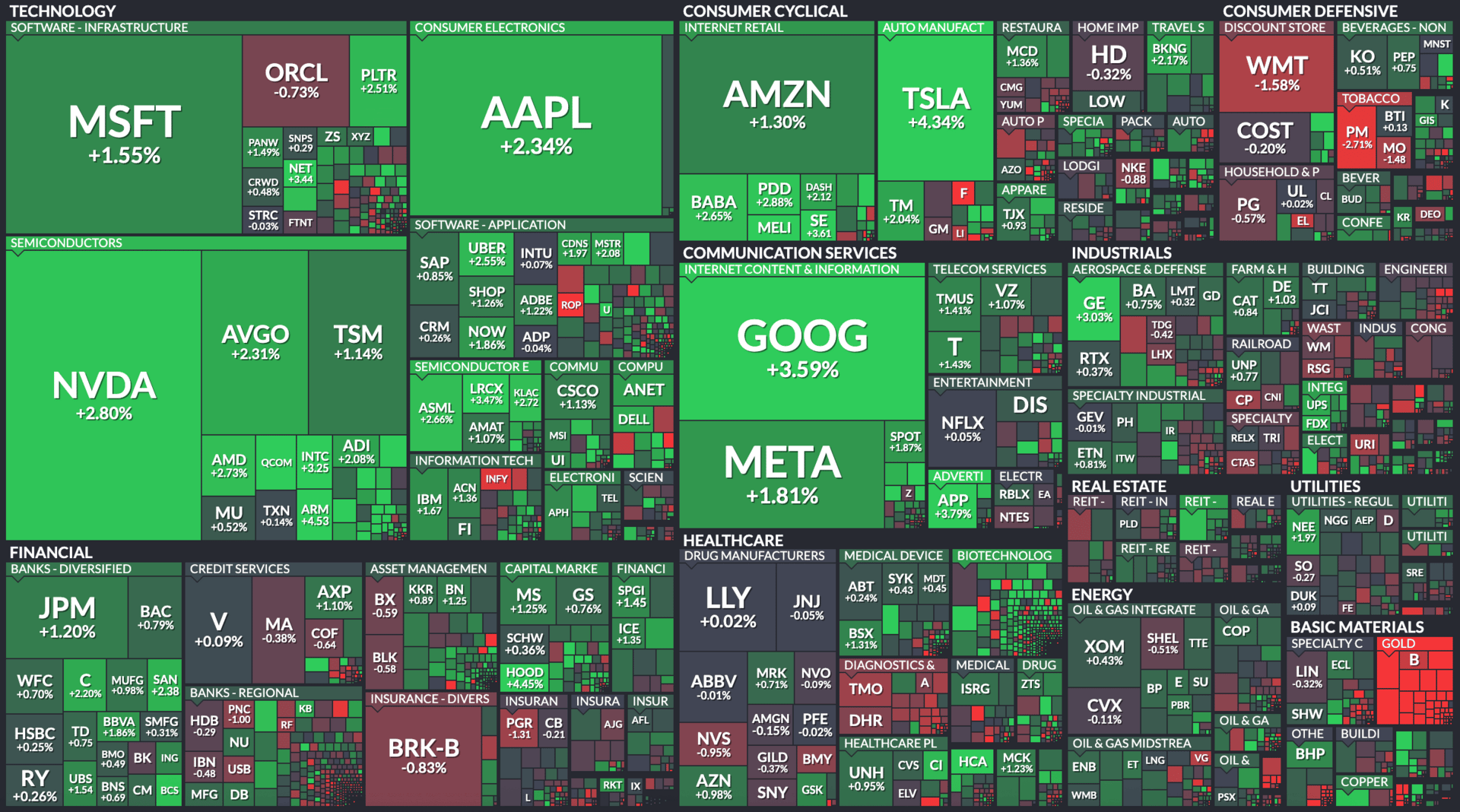

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

QUALCOMM, FERMI, HARLEY-DAVIDSON

Qualcomm $QCOM ( ▲ 1.14% ) unveiled new AI chips aimed at competing with AMD $AMD ( ▼ 1.58% ) and Nvidia $NVDA ( ▲ 1.02% ).

Fermi $FRMI ( ▼ 4.6% ) briefly rallied before giving back gains as several banks initiated coverage with bullish price targets following its recent IPO.

Harley-Davidson $HOG ( ▼ 0.84% ) fell after Morgan Stanley downgraded the stock on concerns over pricing power and long-term demand.

Doximity $DOCS ( ▲ 1.27% ) rose after Bank of America upgraded it to Buy, citing faster revenue growth potential.

Keurig Dr Pepper $KDP ( ▲ 1.51% ) topped Q3 sales estimates and raising full-year guidance.

To monitor hot stocks in real time, check out The Street Feed.

UPGRADES & DOWNGRADES

📈 Upgrades

JPMorgan raised Five Below $FIVE ( ▲ 1.91% ) to Overweight from Neutral

Stephens upgraded nCino $NCNO ( ▼ 2.38% ) to Overweight

Guggenheim lifted Neumora Therapeutics $NMRA ( ▼ 2.59% ) to Buy from Neutral

📉 Downgrades

Plymouth Industrial REIT $PLYM ( 0.0% ) downgraded to Neutral from Buy

Guggenheim cut Intellia Therapeutics $NTLA ( ▼ 3.07% ) to Neutral from Buy

Janney Montgomery Scott lowered Essential Utilities $WTRG ( ▼ 1.05% ) to Neutral

This is just a fraction of the calls we feature all day on The Street Feed. Street Sheet Research Subscribers can see why the analysts upgraded or downgraded the stocks above and updated price targets. Get immediate access today.

Tomorrow's Trade Idea, Today

BERKSHIRE’S BUFFETT PREMIUM FADES

Hibernation Wake-Up Call

Warren Buffett’s Berkshire Hathaway $BRK.B ( ▲ 0.25% ) isn’t exactly bear country. The man is one of the most successful investors in history, and as such, almost all interest in his conglomerate has been bullish. Until now.

Keefe, Bruyette & Woods $KBWB ( ▲ 0.97% ) just hit Buffett’s empire with a rare Sell call. The firm downgraded Berkshire Hathaway to Underperform and cut its price target on Class A shares to $700,000, implying marginal downside from today’s close.

The real kicker: it’s not just Buffett’s looming succession giving analysts pause. KBW’s Meyer Shields cited “many things moving in the wrong direction” for the longtime poster-boy of pristine track records.

Earnings Face Crosswinds

The report warns that Berkshire’s earnings could face simultaneous pressure across insurance, energy, and transportation units in the year ahead.

Berkshire’s operating profit fell 4% last quarter to $11.16 billion, dragged by weaker insurance underwriting. KBW expects that trend to continue as Geico cuts rates to regain market share, while mild weather dampens reinsurance pricing.

Energy, once a bright spot, may not escape unscathed either. KBW says the phase-out of clean-energy tax credits under the One Big Beautiful Bill Act could erode profitability for the firm’s energy business.

Losing the Buffett Premium

KBW also sees softer investment income ahead as declining short-term rates reduce returns on Berkshire’s record $344 billion cash pile. Finally, the downgrade called out “inadequate disclosure” around succession planning, which could deter investors once Buffett officially exits at year-end.

Berkshire shares have trailed the S&P 500 this year, falling by double digits from record highs since Buffett confirmed his coming retirement. Without the Oracle of Omaha’s steady hand and with multiple divisions under strain, KBW believes Berkshire’s next chapter will start with more questions than answers.

Sponsored by Venture Trader

One quant trader spent decades studying human behavior in the markets before building an AI that learns like a trader — spotting patterns, testing reactions, and adapting in real time.

“What used to take me weeks to find the right setup,” he says, “this AI now finds in minutes — sometimes seconds.”

The result? A “Genetic AI” that thinks with discipline and trades with machine speed — turning chaos into clarity and data into measurable edges.

OVERHEARD ON THE STREET

Reuters: Amazon $AMZN ( ▲ 2.56% ) will cut up to 30,000 corporate jobs, about 10% of its white-collar workforce, its largest layoff since 2022.

WSJ: Exxon Mobil $XOM ( ▼ 2.44% ) sued California to block new climate disclosure rules, arguing they violate free speech and unfairly target large companies.

Bloomberg: Lululemon $LULU ( ▲ 2.42% ) announced its first NFL apparel deal with Fanatics, launching gear for all 32 teams starting Oct. 28.

CNBC: Airbnb $ABNB ( ▲ 1.65% ) will again use anti-party tech this Halloween to block high-risk bookings, after preventing over 44,000 last year.

Barron’s: iRobot $IRBT ( ▼ 67.11% ) warned it may not find a buyer and could default on loans if it fails to secure new funding by Dec. 1.

Join Street Sheet Research

RESEARCH REVIEW: WHIPSAWING SENTIMENT

Didn’t receive our Street Sheet Research report last weekend?

Here are some of the pressing questions we answered:

What’s driving a slew of price target hikes across the crypto sector?

Why did munis have their best month in nearly two years?

Can their momentum continue?

And many more. Get these answers, along with instant access to our source for real-time investing info, The Street Feed, and our first-ever Equity Research Report, An Aging America. Sign up for Street Sheet Research today.

STREET TWEET

Apple sell signal?

The Pelosis sold up to a quarter-million in $AAPL ( ▲ 1.54% ) last week.

The political power couple had a pretty great track record when Nancy Pelosi served in Congress…

Will the same be true in retirement? 🤔

FRIDAY’S POLL RESULTS

Are you bullish or bearish on municipal bonds (munis) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Could well be; just depends on the specific bond, and what it's tied to.”

🐻 Bearish — “Cities are having trouble collecting expected revenues. How long will they be able to keep meeting interest payment obligations?”