HAPPY MONDAY TO THE STREET.

It’s been a volatile year for IPOs. AI chipmaker Cerebras is opting to skip the drama altogether.

The firm withdrew its IPO registration last week after raising more than $1B in its latest funding round, with Donald Trump Jr. among the backers. Now, its CEO is defending the call, arguing it will “allow potential investors to better understand the value of the business.”

Considering the whiplash-inducing prices of recently IPO’d stocks, maybe investors could use that extra time…

🟨 | US stocks were mixed today as M&A buzz lifted the S&P and Nasdaq toward records while the Dow slipped.

📈 | One Notable Gainer: Figma $FIG ( ▲ 0.89% ) rose after OpenAI’s Sam Altman announced direct ChatGPT integration within conversations.

📉 | One Notable Decliner: Starbucks $SBUX ( ▲ 1.76% ) fell after closing stores and cutting jobs in North America under its Project Bloom turnaround.

Finally, read to the end for the trillion-dollar feedback loop...

— Brooks & Cas

Sponsored by Miso Robotics

Elon Musk: “Robots Will…Do Everything Better”

And it’s already happening.

Just look at fast food. Miso Robotics is already delivering an AI-powered fry-cooking robot that can cook perfectly 24/7. With the restaurant industry desperately grappling with 144% employee turnover rates and skyrocketing minimum wages, it’s no surprise major brands like White Castle are turning to Miso.

Now, after selling out the initial run of their first fully commercial Flippy Fry Station robot in one week, Miso is scaling production to 100,000+ U.S. fast food locations in need.

New manufacturing’s already begun. They’re partnered with NVIDIA and Uber’s AI team.

And you can join today. Just don’t wait. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

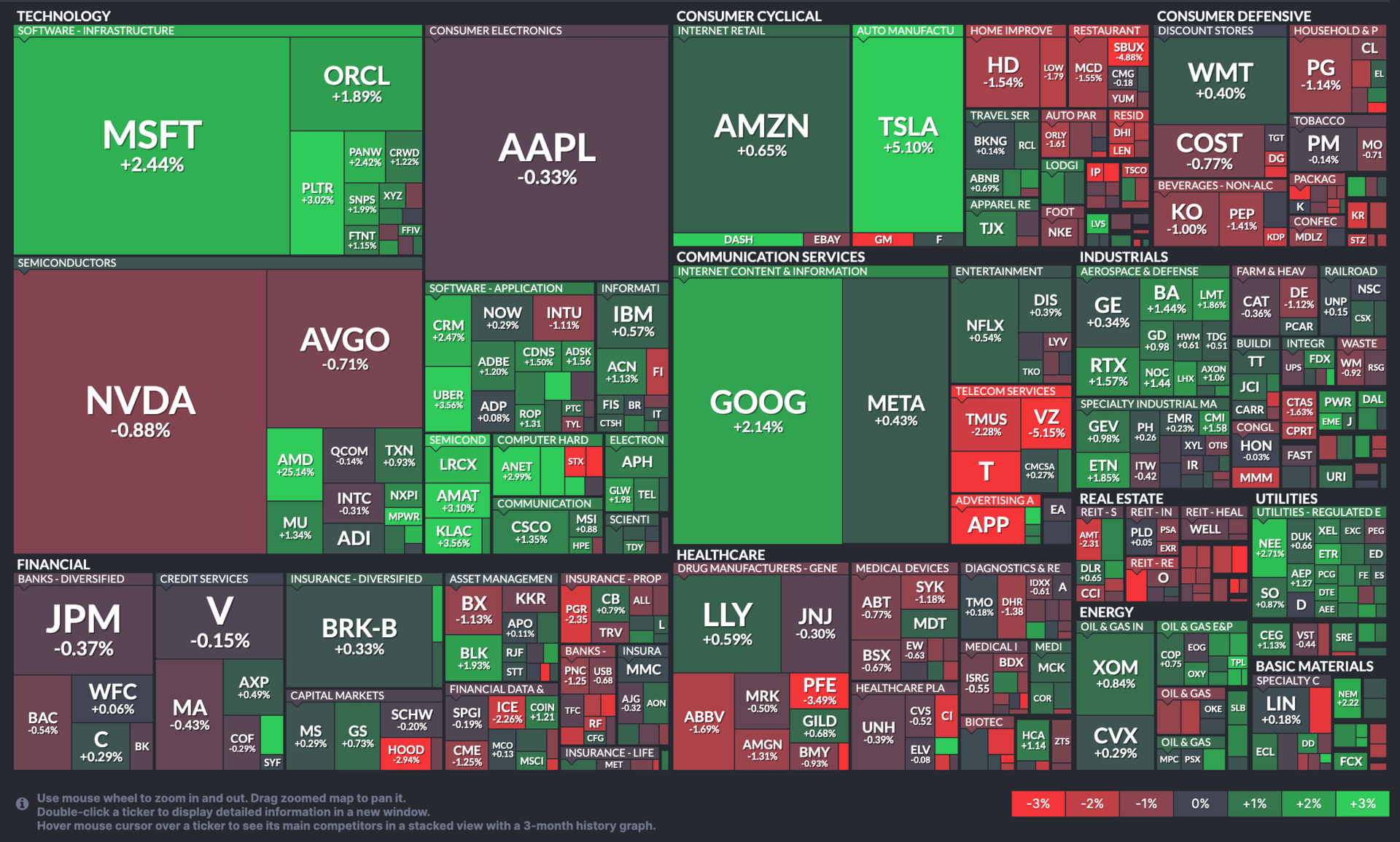

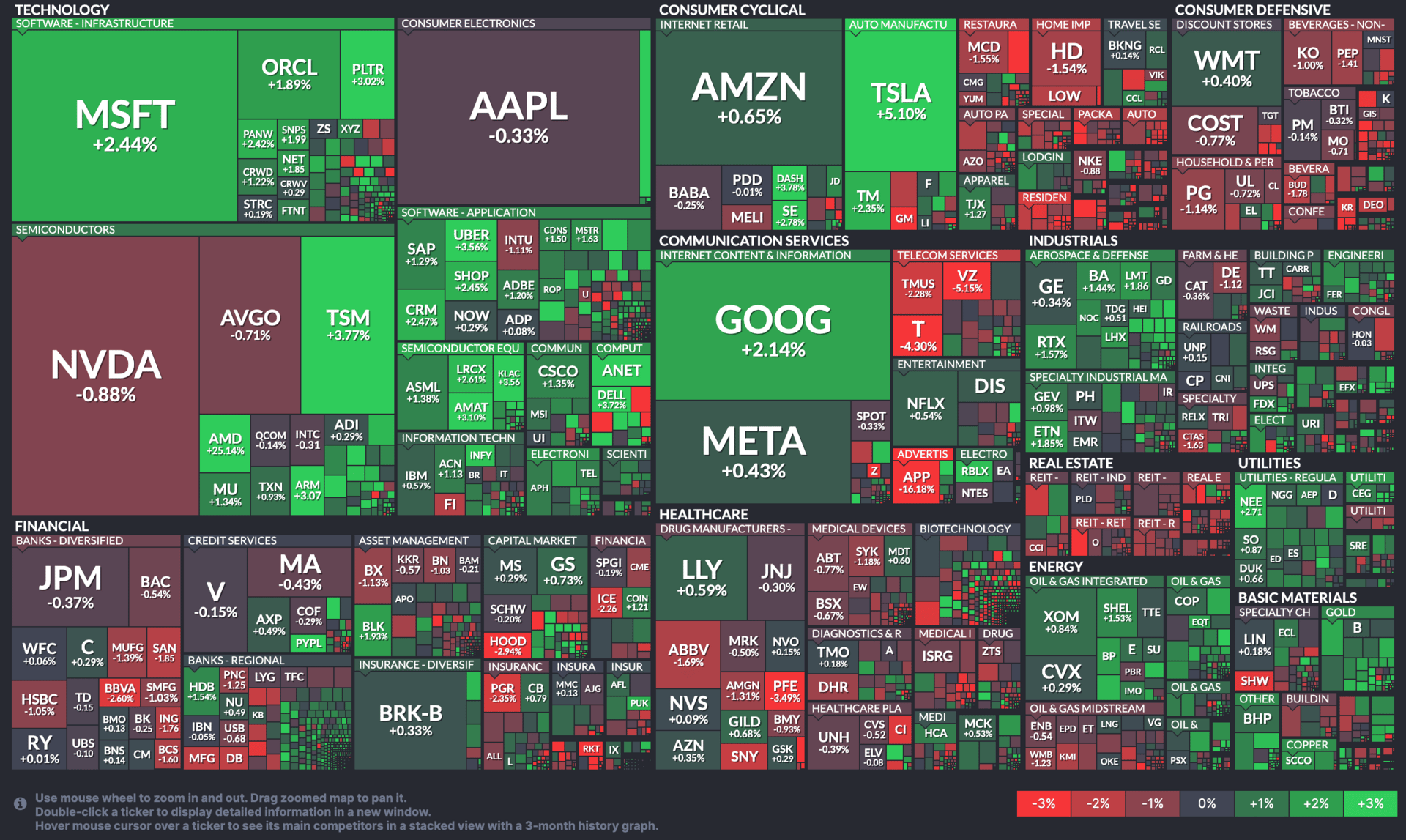

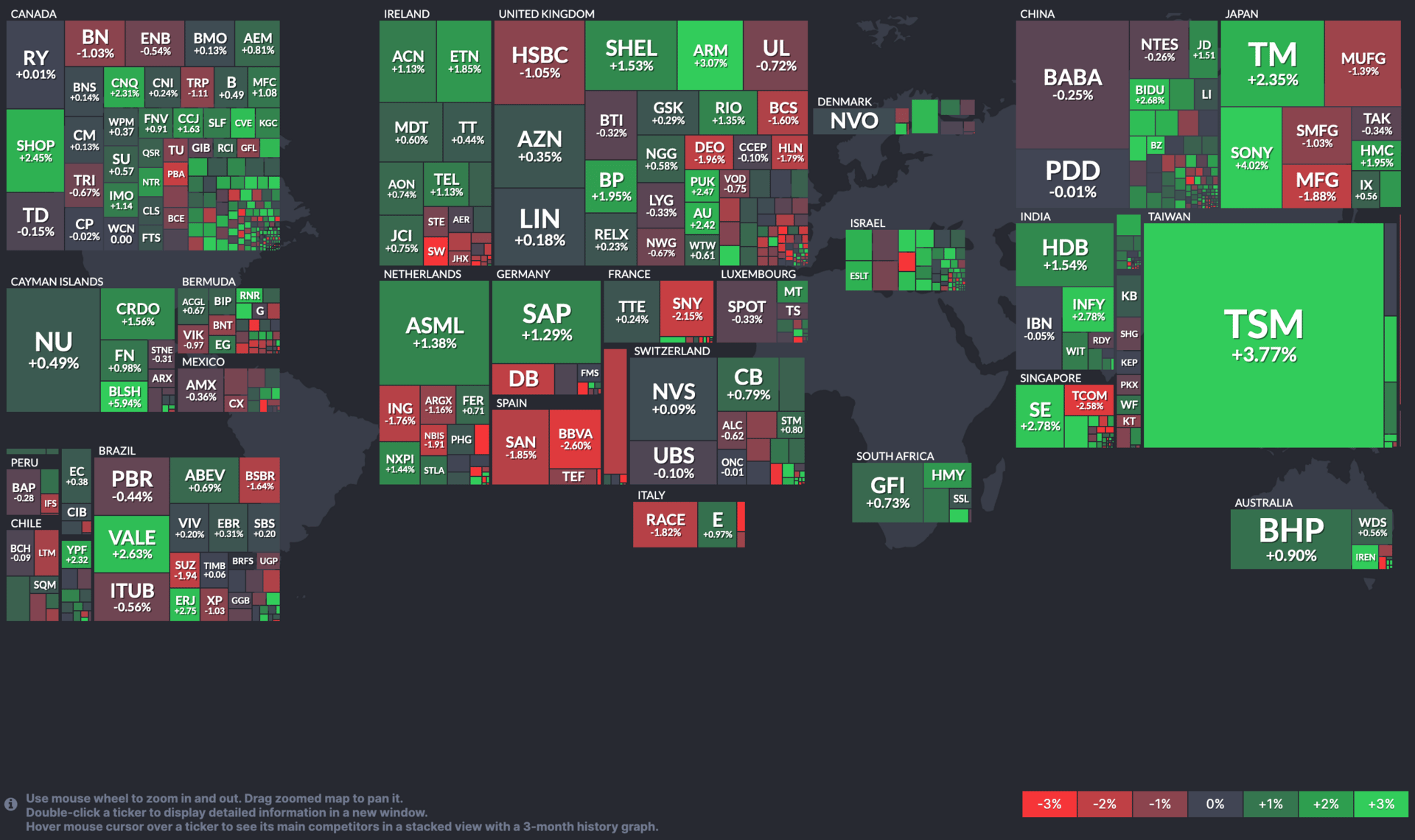

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

AMD, APPLOVIN, TESLA

$AMD ( ▼ 1.58% ) AMD stock skyrockets 30% as OpenAI looks to take stake in AI chipmaker (CNBC)

$APP ( ▲ 1.62% ) AppLovin stock tanks on report SEC is investigating company over data-collection practices (CNBC)

$TSLA ( ▲ 0.03% ) Tesla teases Tuesday announcement with social media videos (FOX Business)

$VZ ( ▲ 1.25% ) Verizon taps Dan Schulman as new CEO with company at 'critical juncture' (YF)

$MU ( ▲ 2.59% ) Micron Stock Hits Record High After Bullish Report (IBD)

OVERHEARD ON THE STREET

AP: Fifth Third Bancorp $FITB ( ▲ 1.36% ) agreed to buy Comerica $CMA ( ▼ 4.51% ) for $10.9B in stock, creating the 9th largest US bank with $288B assets.

CNBC: Instagram $META ( ▲ 1.69% ) launched a new “Rings” award giving 25 creators gold rings and profile badges instead of cash payouts.

CNN: Parmaount $PSKY ( ▼ 2.1% ) bought Bari Weiss’s The Free Press for about $150M and named Weiss editor-in-chief of CBS News.

CBS News: Costco $COST ( ▼ 0.26% ) began selling Ozempic and Wegovy for $499 a month through its pharmacies under a new partnership with Novo Nordisk $NVO ( ▼ 2.13% ).

TechCrunch: Microsoft $MSFT ( ▼ 0.31% ) bought 100 MW of solar capacity from Japan’s Shizen Energy to power data centers as it invests $2.9B locally.

Tomorrow's Trade Idea, Today

WALL STREET LOVES THIS NEW FINTECH DEBUT

A Strong Start for the Swedish Fintech

Klarna $KLAR ( ▼ 5.56% ) is barely a month into its life as a public company, but the analyst reviews are encouraging. The Swedish buy now, pay later (BNPL) pioneer priced its IPO at $40 a share, giving it a $15 billion valuation. Shares popped 15% on day one, closing at nearly $46, before easing back to about $40 in recent sessions.

The company, long known for financing short-term purchases, has recently pivoted toward becoming a broader digital retail bank. That shift has caught analysts’ attention as they weigh its ability to profit from global e-commerce growth while managing credit exposure.

Despite the pullback from its post-IPO highs, several major banks see Klarna’s valuation as attractive for investors with a longer time horizon.

Big Banks Turn Bullish

UBS $UBS ( ▲ 0.57% ), Deutsche Bank $DB ( ▲ 2.57% ), and JPMorgan $JPM ( ▲ 0.89% ) all initiated coverage this week with Buy or Overweight ratings.

UBS called Klarna “an attractive entry point” as the BNPL market expands its share of global commerce. Deutsche Bank cited strong margin potential by 2026 and Klarna’s accelerating US presence as catalysts for growth, emphasizing that the company remains the largest global player in the space.

Meanwhile, JPMorgan analyst Tien-tsin Huang described Klarna as “a fintech pioneer” connecting over 110 million users to nearly 800,000 merchants, noting its discounted valuation relative to Affirm and its push toward longer-term, higher-margin lending.

Expanding the Credit Universe

Bank of America $BAC ( ▲ 0.55% ) and Goldman Sachs $GS ( ▲ 0.61% ) echoed that optimism. The latter’s Street-high price target of $55 implies 30% upside from today’s close.

Both cited Klarna’s expanding product mix, growing merchant network, and potential to capture a share of what BofA estimates could be a $2.9 trillion market by 2030. Goldman called Klarna a “consistent share gainer,” particularly in Europe, where network effects could compound over time.

As we said up top, IPOs this year have seen a lot of volatility. But the consensus on Wall Street seems to be that, for Klarna, any sharp swings should be to the upside.

Partner Content

If you’ve got $5,000+ in savings, stop settling for low interest.

Find high-yield accounts that pay you more, fast.

Tap here or below to compare rates and boost your savings today.

ON OUR RADAR

AP: Paramount $PSKY ( ▼ 2.1% ) bought Bari Weiss’s The Free Press and named her as the new editor-in-chief of CBS News.

Forbes: President Trump is considering a $10B aid package for US farmers funded partly by tariff revenue amid his ongoing trade war.

QZ: Olive Garden introduced smaller, lower-priced meals as cost-conscious diners drove demand and boosted sales.

Axios: OpenAI unveiled new ChatGPT apps using the Model Context Protocol, letting users summon tools like Figma, Spotify $SPOT ( ▲ 1.09% ), and Canva by name.

WSJ: About 100K federal workers left payrolls this week amid the shutdown, deepening weakness in the US labor market.

STREET TWEET

Trillion-dollar circle of life.

AI’s biggest players are now passing trillion-dollar valuations around like a hot potato. Google $GOOGL ( ▲ 4.01% ), Meta, OpenAI, and Anthropic all owe their market caps to Nvidia $NVDA ( ▲ 1.02% )… which owes its own to them.

I guess the perpetual motion machine isn’t physically impossible after all.

Right? Right?! 😅

FRIDAY POLL RESULTS

Are you bullish or bearish on Gilead Sciences $GILD ( ▲ 0.19% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish