HAPPY MONDAY TO THE STREET LEAF

Snow met sand, and Canada walked away with US$50 billion.

Prime Minister Mark Carney wrapped his UAE visit with a sweeping investment pledge covering energy, AI logistics, mining, and more, plus an in-the-works $1 billion plan to boost critical-minerals processing at home. In other words, a big boon for a country wrestling with US tariffs and lagging productivity.

Carney now says Canada can more than double bilateral trade with the UAE within a decade. The cheque size suggests Abu Dhabi agrees.

— William D.

Presented by Street Sheet Research

You can’t put a price on million-dollar ideas.

(Well, sure, okay, by definition, you can. We, in fact, did. But, to our credit, it’s a lot less than $1 million.)

Street Sheet Research delivers top-shelf market reports to your inbox each week, plus an additional deep dive into one unsung stock every month.

You know the reports you imagine a BlackRock or JPMorgan Private Bank client reading behind closed boardroom doors, while an investment banking analyst intern fixes them an Old Fashioned? These are those.

But you don’t need a $1 million net worth, $200,000 paycheck, or any other route to SEC-accredited investor status to access these ideas. Usually, a year’s worth of institutional-grade research costs US$199. A steal, admittedly. But it gets better.

For one week only, through Cyber Monday…

A full year of Street Sheet Research costs just US$59.

Yup. You read that right. $1 million ideas, for less than US$100/year.

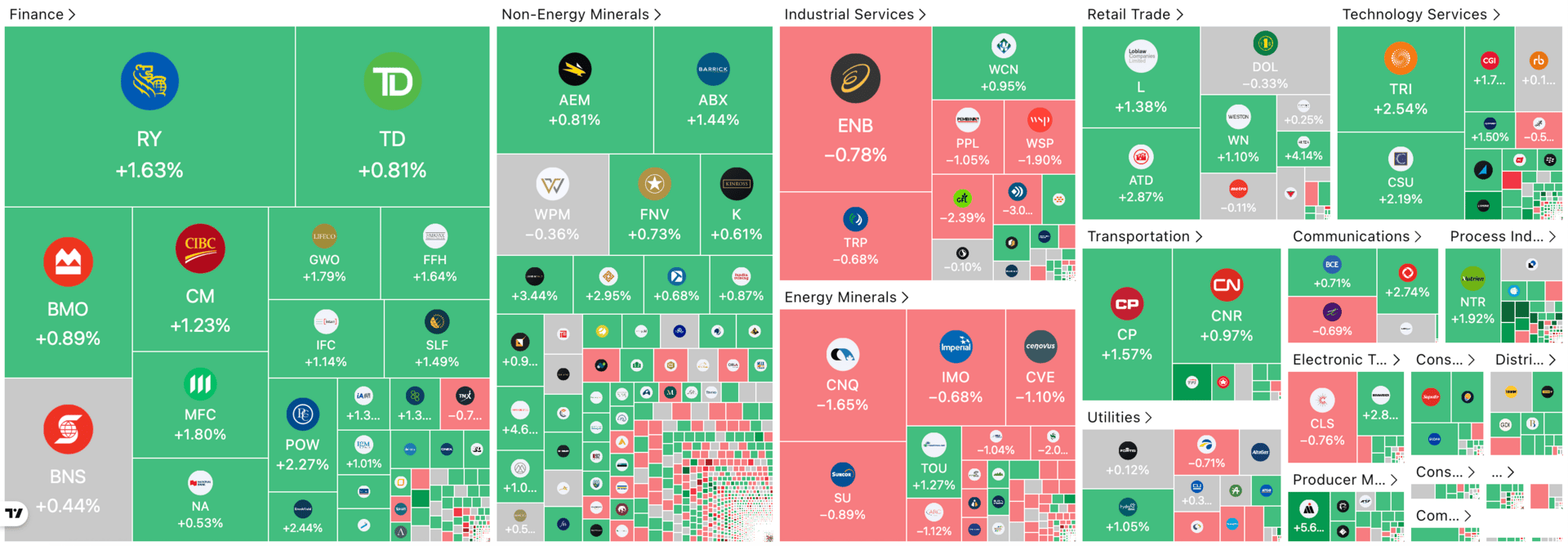

CANADIAN STOCK HEATMAP

Credit: TradingView

OVERHEARD ON BAY STREET

BNN Bloomberg: Canada is seeing surging uranium demand as global utilities seek long-term supply, while producers like Cameco $CCO.TSX ( ▲ 2.03% ) remain cautious on ramping output.

IE: Canada signed an investment protection pact with the UAE and opened trade talks as PM Carney courted Emirati AI and energy investors.

The Globe and Mail: Dye & Durham’s $DND.TSX ( ▲ 1.94% ) stock turmoil deepened as brothers Matt and Tyler Proud launched rival bids and board challenges, including a new $5.72 a share go private offer from Matt.

One Trend To Watch

‘BUY CANADA’ GOES SUPERSONIC

Prime Minister Mark Carney’s “Buy Canada” policy may get an international buyer.

Swedish defense company Saab $SAABF ( ▲ 1.24% ) and Toronto-based Bombardier $BBD.B.TSX ( ▲ 3.41% ) have entered talks on building Saab’s Gripen fighter jet in Canada.

The stakes are high, with 10,000 jobs expected to be created should the deal come through. Not coincidentally, Sweden’s King Carl XVI Gustaf and Queen Silvia visited Canada last week as the talks continued.

Ultimately, it will be Ukraine’s fledgling air force buying the planes. But Canada’s ramped-up military spending has already helped power Bombardier shares to a 120% rally year-to-date.

So are shares a Buy at these levels? Recent optimism around a possible deal has pushed the stock higher, and it now carries a price-to-earnings (PE) ratio of 36, well above the average PE ratio of 19 on the Toronto Stock Exchange.

That said, this company’s sales growth has surprised analysts on the upside in each of the last four quarters.

With both Ukraine and its deep-pocketed Western allies anxious to build, it could potentially see another catalyst sooner rather than later.

Presented by Street Sheet Research

But, for one week at least, it won’t take much.

Street Sheet Research gives investors like yourself access to the in-depth market reports typically reserved for institutions.

And, for this week only, you can invest in an annual subscription at an unbeatable entry point.

Get a year’s worth of institutional-grade research for 70% off: now just US$59.

How’s that for enterprise value?

This Week’s Trade Idea

THE 1,900% PAYOUT STORY

The Secret Sauce

Legendary investor Warren Buffett once called continuously growing dividends “the secret sauce” to Berkshire Hathaway’s success.

In his 2023 letter to investors, he pointed to serial dividend growers like Coca-Cola $KO ( ▲ 0.2% ) and American Express $AXP ( ▼ 0.24% ) as major contributors to Berkshire’s returns. The firm collected over $700 million in annual dividends from each investment, after a $1.3 billion investment in the 1990s. That’s a yield of around 50%.

These dividend hot streaks call to mind what one Montreal-based firm has accomplished more recently.

1,900% Dividend Growth Since 2015

Headquartered in Montreal, Canada, Quebecor $QBR.TSX ( 0.0% ) is a $12 billion telecommunications firm with an attention-grabbing record of rewarding shareholders.

The company is on a dividend hot streak, having grown payouts from $0.0175 per share in 2015 to $0.35 today. That’s a 1,900% growth rate.

In other words, if you invested CAD$1,000 in 2015 and held on, you would today collect a 17% annual yield on the initial investment.

These payout increases are, alas, in the past. For investors acting today, the company sports a 2.7% yield. That may not be life-changing on its own. But it is more than twice the average 1.2% yield of S&P 500 firms.

Can this dividend growth continue?

Well-Supported by Cash Flow and Earnings

The company used just 23% of its cash flow last year to sustain its dividend, an encouraging sign. Its payout ratio of 38% means it spends only that percentage of net income towards covering its payouts, also signaling its dividend is sustainable.

On top of that, Quebecor grew earnings by 25% year-over-year last quarter, which similarly suggests that another hefty dividend hike next year is possible.

On the other hand, the stock has a debt-to-equity ratio of 290%, which is on the high side. Should this debt become more expensive to service as a result of higher interest rates, the dividend may be impacted.

LAST WEEK’S POLL RESULTS

Are you bullish or bearish on Nouveau Monde Graphite $NOU.TSX ( ▲ 4.75% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish