HAPPY TUESDAY TO THE STREET

The “enshittification” of the internet just got a surprising new poster boy: Don Draper.

HBO Max’s $WBD ( ▲ 0.18% ) 4K Mad Men remaster was supposed to signal an upgrade. Instead, viewers got mislabeled episodes, stray crew members on screen, and the unmistakable sense that digital quality control keeps getting worse, not better.

The streamer claims Lionsgate $LGF.B ( ▲ 1.14% ) bears responsibility for sending the wrong files. Or maybe smoke just got in their eyes. Culprit aside, the real story is a familiar one: platforms cutting corners, raising prices, and delivering sloppier products in the process.

🟩 | US stocks rose as Bitcoin rebounded and AI tech bounced.

📈 | One Notable Gainer: Boeing $BA ( ▼ 2.31% ) secured a $104.4M Navy repair contract and issued upbeat 2026 free cash flow guidance.

📉 | One Notable Decliner: Instacart-parent Maplebear $CART ( ▲ 0.49% ) fell after Amazon $AMZN ( ▲ 0.98% ) began testing 30-minute “ultra fast” grocery delivery in two cities.

— Brooks & Cas

Sponsored by US Gold Corp

Gold sits near record highs. US policy is shifting toward critical minerals. That backdrop puts US Gold Corp (NASDAQ: USAU) in the spotlight.

The CK Gold Project in Wyoming is fully permitted and moving toward construction in 2026. It is designed to deliver more than 100,000 gold-equivalent ounces annually at roughly $800 all-in sustaining costs. A recent land purchase in Cheyenne strengthens logistics, workforce access, and community buffers.

USAU also controls exploration upside across Keystone in Nevada and Challis in Idaho, two of America’s most proven mining regions. Policy momentum toward domestic copper and gold supply adds further tailwinds.

With analysts targeting $15 to $23.50 and a leadership team built for development, US Gold Corp aligns rising gold prices with America’s drive for mineral independence.

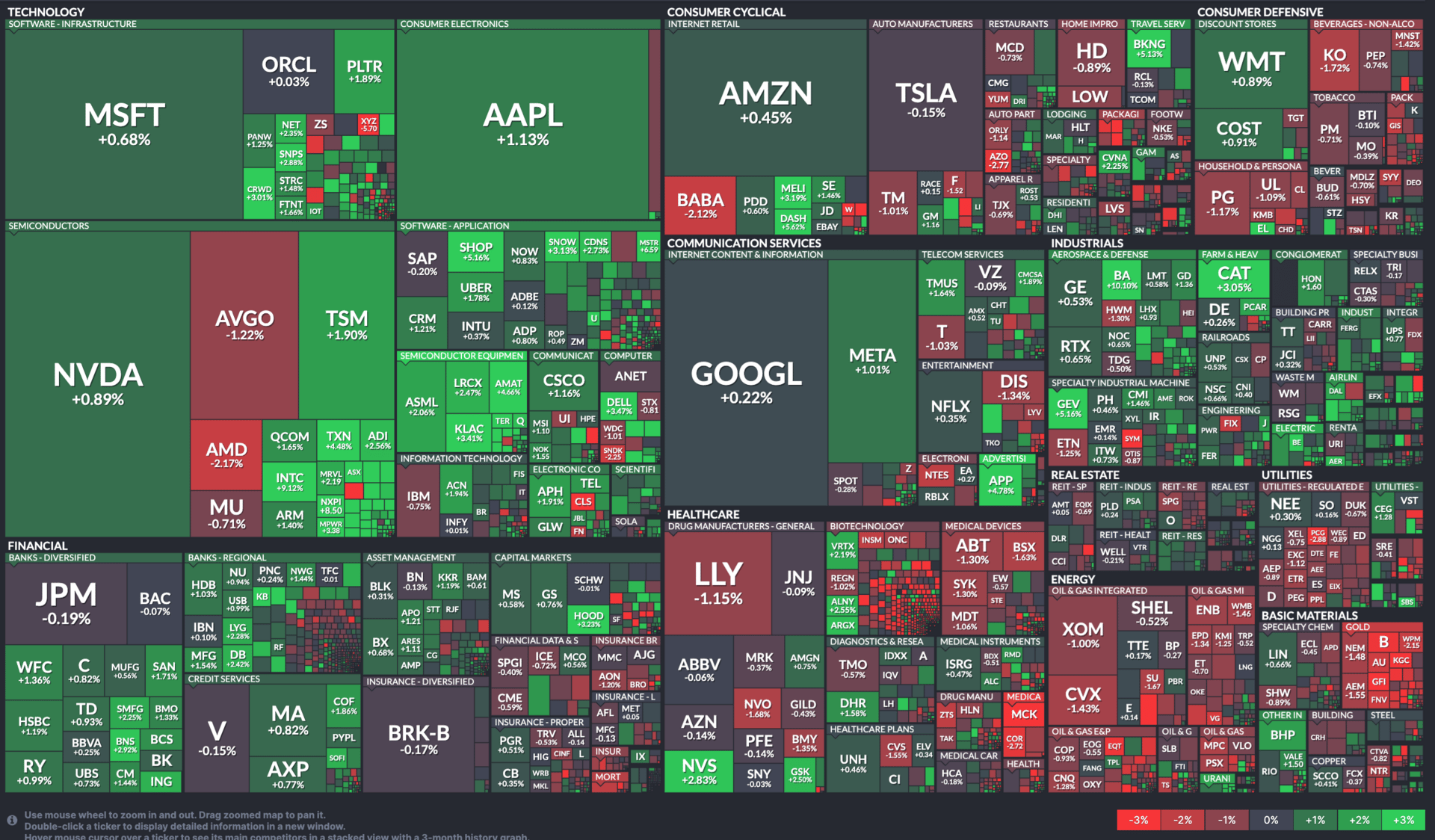

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

CLOUDFLARE, UNITED NATURAL FOODS, SIGNET

Cloudflare $NET ( ▲ 3.45% ) rose after Barclays initiated coverage with an Overweight rating and a $235 price target.

United Natural Foods $UNFI ( ▼ 1.38% ) beat Q1 earnings and reaffirmed full-year guidance.

Signet Jewelers $SIG ( ▼ 2.07% ) issued weak Q4 revenue guidance, despite a Q3 beat.

Six Flags $FUN ( ▲ 4.66% ) gained after Truist upgraded the stock to Buy.

Bausch + Lomb $BLCO ( ▼ 2.49% ) rose after Morgan Stanley upgraded it to Overweight.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

THE SLOP BOWL STILL HAS PLENTY OF FANS

Menu Shift or Meltdown?

Fast-casual restaurant chains have hit a rough patch.

After years of riding a wellness wave, so-called “slop bowl” names like Chipotle $CMG ( ▲ 0.95% ), Cava $CAVA ( ▼ 0.19% ), and Sweetgreen $SG ( ▲ 3.98% ) have seen, well, sloppier results. Stocks reset as younger consumers tightened budgets and cooked from home again.

Student-loan payments, higher rents, and a weaker job market have driven that change, according to the Wall Street Journal. When younger customers retrench, fast casual feels it first. About 3 in 4 of their diners are Gen Z and millennials.

Ergo, it’s no surprise to see shorter lines and slower comps in the near term. But, WSJ argues, the long-term picture is different.

Why Analysts Still Like Cava

Slop bowls still hit the sweet spot between value and quality. These chains cost only slightly more than fast food and meaningfully less than a sit-down meal. That mix has expanded the customer base far beyond office workers, to students, tradespeople, and delivery drivers.

After a sharp pullback, Cava looks like the group’s most compelling story, per the publication. The stock has fallen back near its post-IPO levels, following guidance cuts for same-store sales and profitability. Management called out the “honeymoon effect” that fades after new openings.

But, meanwhile, business has grown. Revenue is on pace to rise more than 20% this year. Store count keeps climbing. And new units have been opening with annual sales well ahead of targets.

Looking Past the Near-Term Noise

In other words, Cava seems to have a stronger footing now than when it went public. If it executes, analysts see it scaling well past 1,000 locations. Some predict a path closer to 2,000, based on density in core markets.

The stock may never be the cheapest lunch in town. But for long-term investors, analysts say Cava still looks like a solid value menu.

Sponsored by US Gold Corp

Gold is nearing all-time highs. US mineral policy is tightening. In this environment, US Gold Corp (NASDAQ: USAU) is emerging as a standout domestic name in gold and copper.

The CK Gold Project in Wyoming is fully permitted and advancing toward 2026 construction. It holds 1.44 million gold-equivalent ounces in proven and probable reserves and sits on a streamlined regulatory path with no federal approvals. Recent land acquisitions bolster operations and local integration.

Keystone in Nevada and Challis in Idaho add long-term exploration leverage in top US jurisdictions. Meanwhile, policy support for critical minerals and investor demand for gold and copper create a strong setup for near-term producers.

With solid analyst confidence and a disciplined leadership team, US Gold Corp sits at the intersection of rising commodity demand and America’s resource strategy.

OVERHEARD ON THE STREET

CNBC: Costco $COST ( ▼ 2.4% ) sued the Trump administration in US trade court to recover IEEPA tariffs.

Axios: President Trump unveiled “Trump accounts,” a tax-advantaged child fund with a $1,000 Treasury seed for 2025–28 births. Contributions start July 4, 2026.

Reuters: San Francisco sued Kraft $KHC ( ▲ 0.79% ), Mondelez $MDLZ ( ▼ 0.87% ), Coca-Cola $KO ( ▼ 1.37% ), and others, alleging tobacco-style tactics to addict consumers.

Bloomberg: Warner Bros. Discovery received second-round bids, including a mostly cash offer from Netflix $NFLX ( ▲ 0.52% ).

AP: OpenAI’s Sam Altman declared “code red” as chatbot competition intensifies.

MONDAY’S POLL RESULTS

Are you bullish or bearish on Beta Technologies $BETA ( ▼ 4.75% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “The parts seem to be in place for a very possible upside. Only time will tell if the investment picture coalesces into a profitable outcome.”

🐻 Bearish — “Batteries are still a problem for electric aviation, but for military and medical applications, this may matter less.”

17(b) Disclosure: This message is a paid advertisement for U.S. Gold Corp. (NASDAQ: USAU). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. U.S. Gold Corp. (NASDAQ: USAU) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, U.S. Gold Corp. (NASDAQ: USAU) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.