HAPPY WEDNESDAY TO THE STREET

For a decade, Michael Saylor has preached one message: never sell your Bitcoin. Markets are testing that religion.

Strategy $MSTR ( ▼ 3.61% ) shares have been cut in half since October. A rule change could force up to $8 billion of index selling.

Now, even Saylor acknowledges that selling BTC is on the table. If that happens, Fortune argues it could be the first domino for the entire crypto complex.

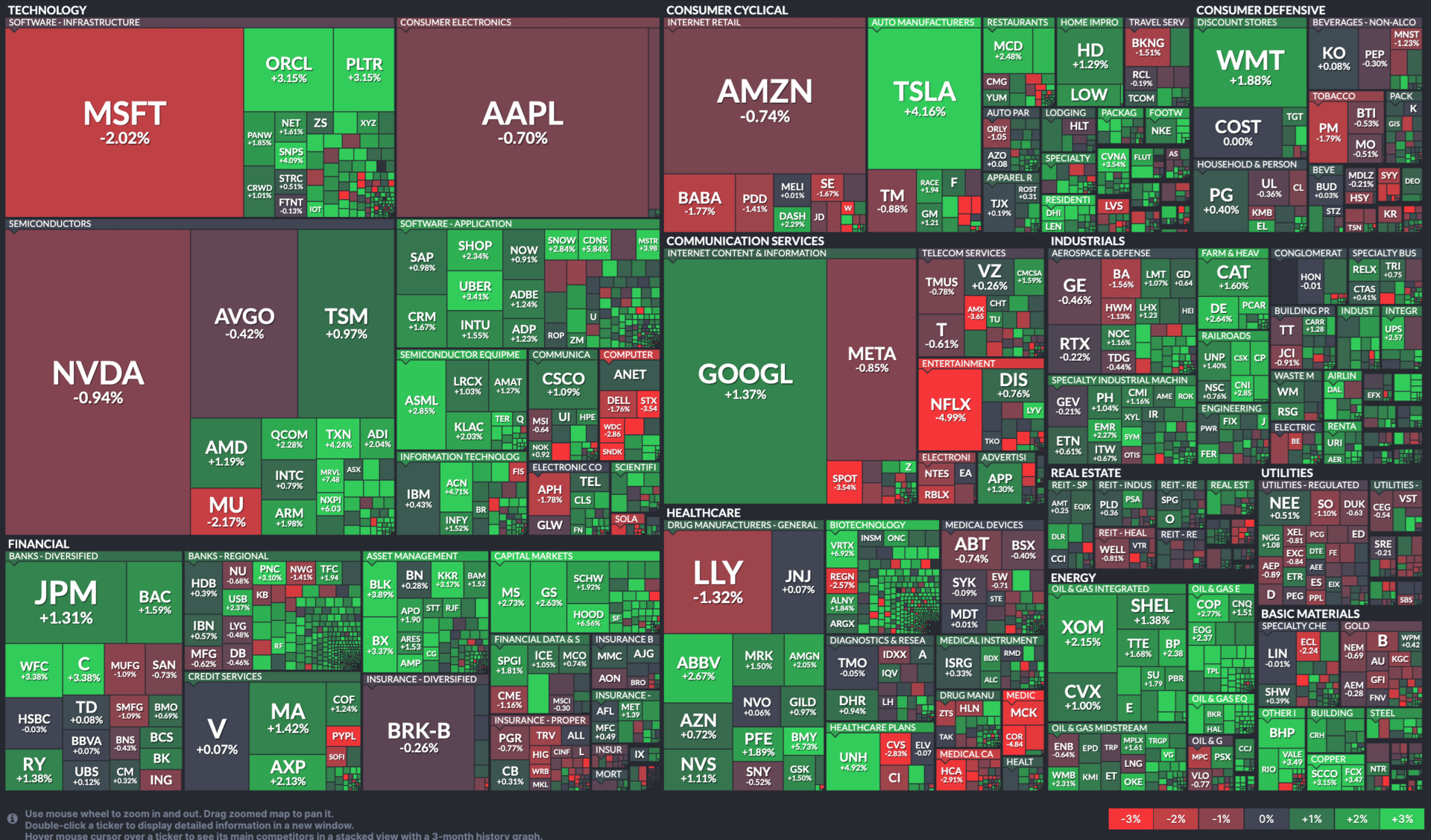

🟩 | US stocks rose as a surprise ADP jobs drop boosted hopes for a Fed cut next week.

📈 | One Notable Gainer: Microchip Technology $MCHP ( ▼ 3.93% ) paced the S&P 500 after boosting its guidance due to strong bookings.

📉 | One Notable Decliner: GitLab $GTLB ( ▲ 1.95% ) fell after cutting its 2026 EPS outlook.

— Brooks & Cas

Sponsored by NNVC

NanoViricides (NYSE: NNVC) is nearing a critical inflection point.

Its lead antiviral, NV-387, is moving into Phase 2 trials for MPox with potential US biodefense applications. NV-387 has shown broad antiviral activity in preclinical models across measles, influenza, RSV, and orthopoxviruses, supported by NNVC’s proprietary nanomedicine platform.

Orphan drug submissions and dual-track clinical plans position the company to pursue multiple markets with a first-of-its-kind broad-spectrum therapy. Zacks Small Cap Research cites NV-387’s safety record, strong animal-model efficacy, and regulatory path as key drivers behind its $7 valuation.

Zacks also highlights upside tied to government stockpile procurement, orphan incentives, and possible BARDA support. With these catalysts ahead, NNVC could emerge as a meaningful player in global antiviral preparedness.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

AMERICAN EAGLE, THOR INDUSTRIES, MARVELL

American Eagle $AEO ( ▼ 1.16% ) raised its Q4 outlook and beat Q3 earnings expectations.

Thor Industries $THO ( ▼ 5.56% ) fell after its fiscal 2026 guidance failed to impress investors.

Marvell Technology $MRVL ( ▼ 4.14% ) gained after posting a Q3 earnings and revenue beat.

Pure Storage $PSTG ( ▼ 5.78% ) issued mixed Q3 results that fell short of investor expectations.

Genius Sports $GENI ( ▲ 1.57% ) unveiled ambitious 2028 revenue and free cash flow targets.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

ONE ANALYST BELIEVES BOEING COULD DOUBLE

A Pullback That Creates Opportunity

Boeing’s $BA ( ▼ 2.45% ) stock has steadily risen in altitude this year, but not enough to shake off concerns after a disastrous couple of years.

The aircraft manufacturer sold off following its third-quarter earnings report, driven by accounting charges tied to the 777X and slower-than-expected 737 deliveries. But Rothschild & Co Redburn believes that was an overreaction. Analyst Olivier Brochet reiterated a Buy rating and set a near-term price target of $255, implying 26% upside from today’s close.

But his longer-term models suggest the potential for a far larger move. Under his 2030 sum-of-the-parts valuation and price-to-cash-flow framework, according to Brochet, “the stock could double from here to the end of the decade.”

Short-Term Headwinds, Long-Term Stability

The issues that pressured the stock relate primarily to timing. The 777X charge surprised investors. The 737 ramp has been slower than expected. Both forced earnings cuts and a modest target-price trim.

But Brochet notes that out-year forecasts did not change. Risk management is improving. With each certification milestone and product update, another uncertainty fades.

Brochet believes the next major catalyst will be FAA approval of the 737-7 and -10. He says conditions look increasingly under control, with fewer variables that could spark fresh earnings shocks. Even with the near-term noise, the analyst argues, Boeing’s long-cycle demand remains intact.

A Path Back to Higher Cash Flow

The free cash flow story is another potential driver.

Once Boeing updates its long-term cash flow targets, likely after its new CFO is fully in place, the company could signal a higher baseline. Brochet sees room for production increases to lift Boeing’s free cash flow outlook by more than $2.5 billion.

For investors looking through short-term turbulence, Brochet believes Boeing’s decade-long rebuild is still in its earliest stages.

Sponsored by Money Pickle

Many retirees are surprised to learn how much taxes can eat into their income, even after they stop working. But with the right planning, it doesn’t have to be that way.

Money Pickle connects you with fiduciary financial advisors who specialize in retirement tax strategy. These advisors offer a free second opinion on your current plan, including how to reduce unnecessary tax burdens on your Social Security, RMDs, or investment withdrawals.

You’ll get objective insights, not a sales pitch. And because they’re fiduciaries, they’re required to act in your best interest, not push products.

A small change in how you withdraw or allocate funds could save you thousands.

OVERHEARD ON THE STREET

AP: Delta $DAL ( ▲ 0.55% ) said the record 43-day shutdown cost it about $200M as bookings fell and the FAA ordered airlines to cut flights by up to 6%.

YF: The FTC said Boeing must divest major Spirit AeroSystems $SPR ( ▲ 0.23% ) assets to address competition concerns in its $8.3B acquisition.

Investing.com: OpenAI agreed to acquire Neptune in a stock deal to integrate its AI training analysis tools into OpenAI’s development pipeline.

CNBC: Microsoft $MSFT ( ▲ 1.35% ) denied lowering AI sales targets after a report said few Azure teams met Foundry growth goals.

Reuters: Micron $MU ( ▼ 7.99% ) dissolved its consumer business amid global memory shortages.

TUESDAY’S POLL RESULTS

Are you bullish or bearish on Cava Group $CAVA ( ▼ 1.81% ) over the next 12 months?

▇▇▇▇▇▇ 🐻 Bearish

▇▇▇▇▇▇ 🐂 Bullish

And, in response, you said:

🐂 Bullish — “My local CAVA is always crowded near dinner time, and it's the choice of local police officers and the sheriff's department.”

🐻 Bearish — “The chart says this hype train is over, barring some huge fundamental catalyst. It goes lower.”

17(b) Disclosure: This message is a paid advertisement for NanoViricides (NYSE: NNVC). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. NanoViricides (NYSE: NNVC) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, NanoViricides (NYSE: NNVC) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.