HAPPY TUESDAY TO THE STREET

Stranger Things is ending. Netflix’s $NFLX ( ▲ 2.66% ) follow-up? Bigger and Better Things.

The streamer built its early growth on giant, monoculture hits. But today, it seems to be playing a different game: pricing, ads, and global churn management.

In other words? This long-awaited finale may be a big milestone. But it’s probably not a make-or-break moment.

🟩 | US stocks rose, with the Dow leading, on rising odds of a December Fed cut.

📈 | One Notable Gainer: Alphabet $GOOGL ( ▼ 0.19% ) and Broadcom $AVGO ( ▼ 1.47% ) rose on reports that Meta $META ( ▲ 0.32% ) is weighing multibillion-dollar purchases of Alphabet’s AI chips.

📉 | One Notable Decliner: Nvidia $NVDA ( ▲ 0.68% ) fell on the same news.

— Brooks & Cas

Presented by Street Sheet Research

You can’t put a price on million-dollar ideas.

(Well, sure, okay, by definition, you can. We, in fact, did. But, to our credit, it’s a lot less than $1 million.)

Street Sheet Research delivers top-shelf market reports to your inbox each week, plus an additional deep dive into one unsung stock every month.

You know the reports you imagine a BlackRock or JPMorgan Private Bank client reading behind closed boardroom doors, while an investment banking analyst intern fixes them an Old Fashioned? These are those.

But you don’t need a $1 million net worth, $200,000 paycheck, or any other route to SEC-accredited investor status to access these ideas. Usually, a year’s worth of institutional-grade research costs $199. A steal, admittedly. But it gets better.

For less than one week, through Cyber Monday…

A full year of Street Sheet Research costs just $59.

Yup. You read that right. $1 million ideas, for less than $100/year.

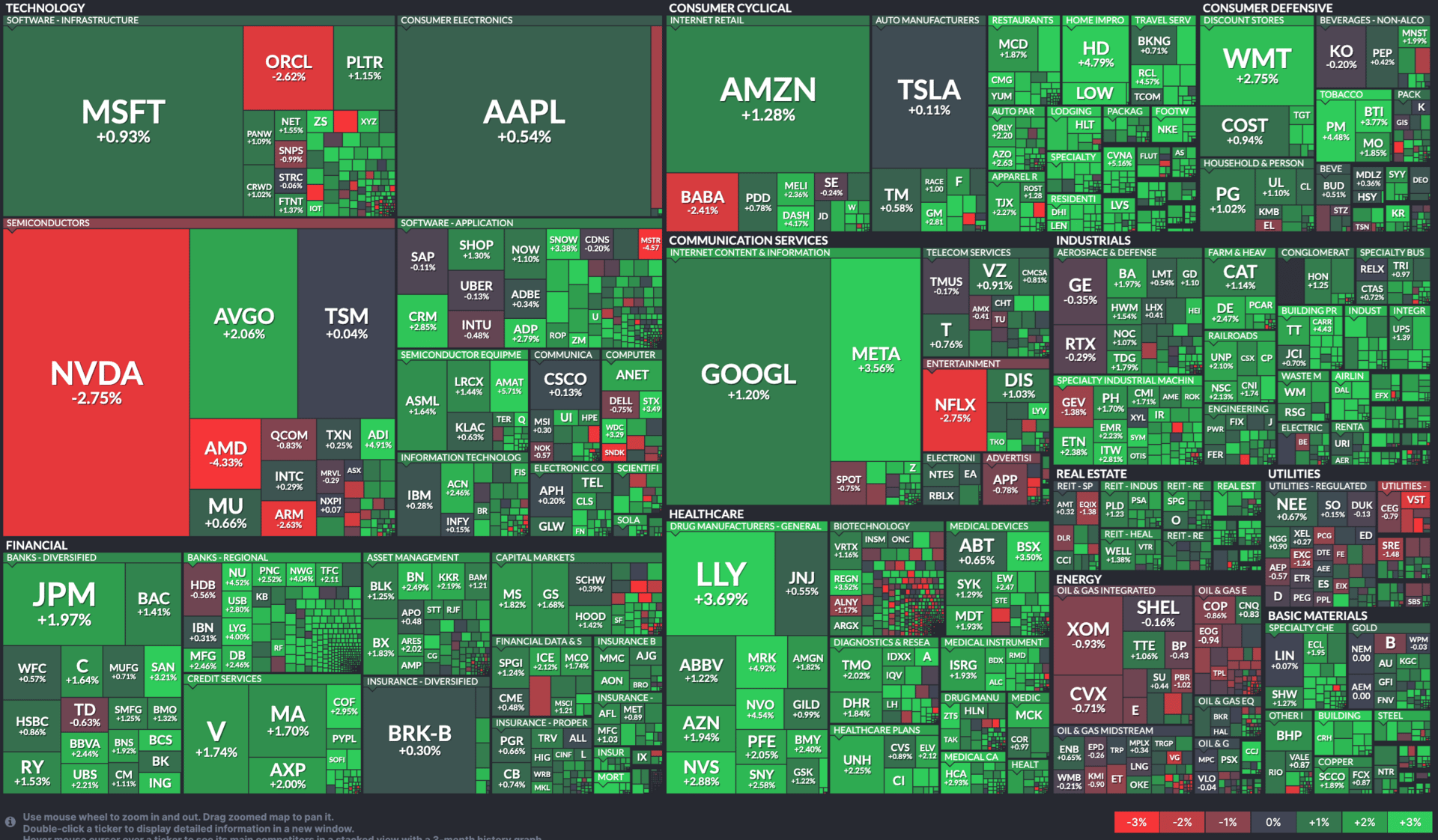

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

KOHL’S, ESTEE LAUDER, ZOOM

Kohl’s $KSS ( ▼ 2.37% ) beat Q3 earnings and revenue expectations.

Estee Lauder $EL ( ▲ 2.01% ) fell after Rothschild downgraded the stock to Sell.

Zoom $ZM ( ▲ 1.69% ) posted a Q3 beat and issuing stronger Q4 guidance.

Pony AI $PONY ( ▼ 1.7% ) reported strong Q3 results and plans to expand its robo-taxi fleet in China.

Burlington $BURL ( ▼ 1.06% ) slipped after mixed Q3 results, with revenue coming in just below forecasts.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

BLACK FRIDAY 2025: ONLINE AND OFF-PRICE

A Season of Selective Spending

With Black Friday approaching, Wall Street is narrowing in on what holiday shopping patterns are emerging, and which retailers stand to come out on top.

Goldman Sachs $GS ( ▲ 1.12% ) surveyed 1,000 US consumers and found a cautious backdrop. Fewer shoppers plan to spend the same or more than last year. Optimism is now concentrated in higher-income households, while value-seeking behavior is rising across the board.

That shift, the firm argues, plays into the hands of online marketplaces and off-price retailers. Goldman expects Amazon $AMZN ( ▲ 1.6% ) and Walmart $WMT ( ▲ 0.75% ) to be the top shopping destinations, while value retailers like TJX Companies $TJX ( ▼ 0.02% ) , Burlington $BURL ( ▼ 1.06% ), Five Below $FIVE ( ▲ 0.96% ), and Ross Stores $ROST ( ▼ 0.66% ) are also well-positioned.

Value & Convenience

Goldman’s survey shows online-only and discount channels remain dominant. Even so, both categories saw slight share declines, as some consumers plan to avoid shopping entirely. Among active shoppers, the firm found, value is king. Promotions matter more. Prices feel higher. Trade-down behavior is gaining momentum.

The Street seems to think that sets up Amazon particularly well for this season.

JPMorgan’s $JPM ( ▼ 0.12% ) Doug Anmuth named the tech giant his top idea, pointing to expected 7% growth in US e-commerce holiday sales. He also noted Amazon’s wide selection, competitive pricing, and strength in one-day delivery and advertising. The company holds roughly 46% share of US e-commerce.

What to Watch This Week

UBS $UBS ( ▼ 0.8% ) analyst Jay Sole also expects overall holiday spending to be lackluster. But he sees a near-perfect setup for off-price retailers. Consumer uncertainty often pushes shoppers toward bargains, and off-price chains tend to shine when budgets tighten.

Black Friday will deliver the first major read on spending trends. Wall Street expects cautious wallets but strong market-share gains for retailers that combine convenience with value. Analysts say those players already have momentum heading into the season.

Which sector will outperform over the 2025 holiday shopping season?

Sponsored by Banzai

Banzai International, Inc. (NASDAQ: BNZI) is scaling faster than nearly any player in the AI marketing space. Revenue is up 205%. ARR surged 182%. Margins hit 83%.

BNZI now serves more than 140,000 customers, including Cisco and New York Life, thanks to a connected suite spanning AI newsletters, high-ROI webinars, and enterprise-grade video creation.

Its stock price has yet to reflect this growth. But that may not be the case forever. Act now and discover how BNZI is turning AI-powered marketing into a profit-generating machine — before it kicks into high gear.

OVERHEARD ON THE STREET

Reuters: US Treasury Secretary Scott Bessent said Trump would likely name a new Fed Chair before Christmas as Kevin Hassett emerged as the frontrunner.

AP: US consumer confidence fell in November as shutdown aftershocks, weak hiring, and persistent inflation darkened Americans’ economic outlook.

TechCrunch: Warner Music $WMG ( ▼ 3.72% ) settled its lawsuit with AI startup Suno, struck a partnership deal, and sold Songkick as Suno prepares licensed models for 2026.

CNBC: Nvidia $NVDA ( ▲ 0.68% ) insisted its Blackwell chips remained a generation ahead following reports that Meta might adopt Google’s TPUs.

SeekingAlpha: Klarna $KLAR ( ▲ 9.36% ) unveiled a stablecoin, KlarnaUSD, aiming to cut cross-border payment costs.

MONDAY’S POLL RESULTS

Are you bullish or bearish on Baidu $BIDU ( ▼ 0.23% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

17(b) Disclosure: This message is a paid advertisement for Banzai International (NASDAQ: BNZI). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Banzai International (NASDAQ: BNZI) is a client of Sideways Frequencies who has contracted Tag The Flag LLC dba The Street Sheet. Banzai International (NASDAQ: BNZI) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.