HAPPY MONDAY TO THE STREET

Target $TGT ( ▼ 0.55% ) tried to revive the in-store Black Friday rush with a 6 AM swag-bag giveaway. Social media was not impressed. It didn’t help that said bag consisted mostly of fun-size candy, shampoo samples, and a deck of UNO $MAT ( ▼ 3.25% ) cards.

Lowe’s $LOW ( ▼ 2.8% ), by contrast, became an unlikely hero. The DIY retailer handed out buckets packed with drill bits, mugs, and coupons for appliances worth up to $2,000.

Another sign that shoppers are over Black Friday deals… unless they provide real value.

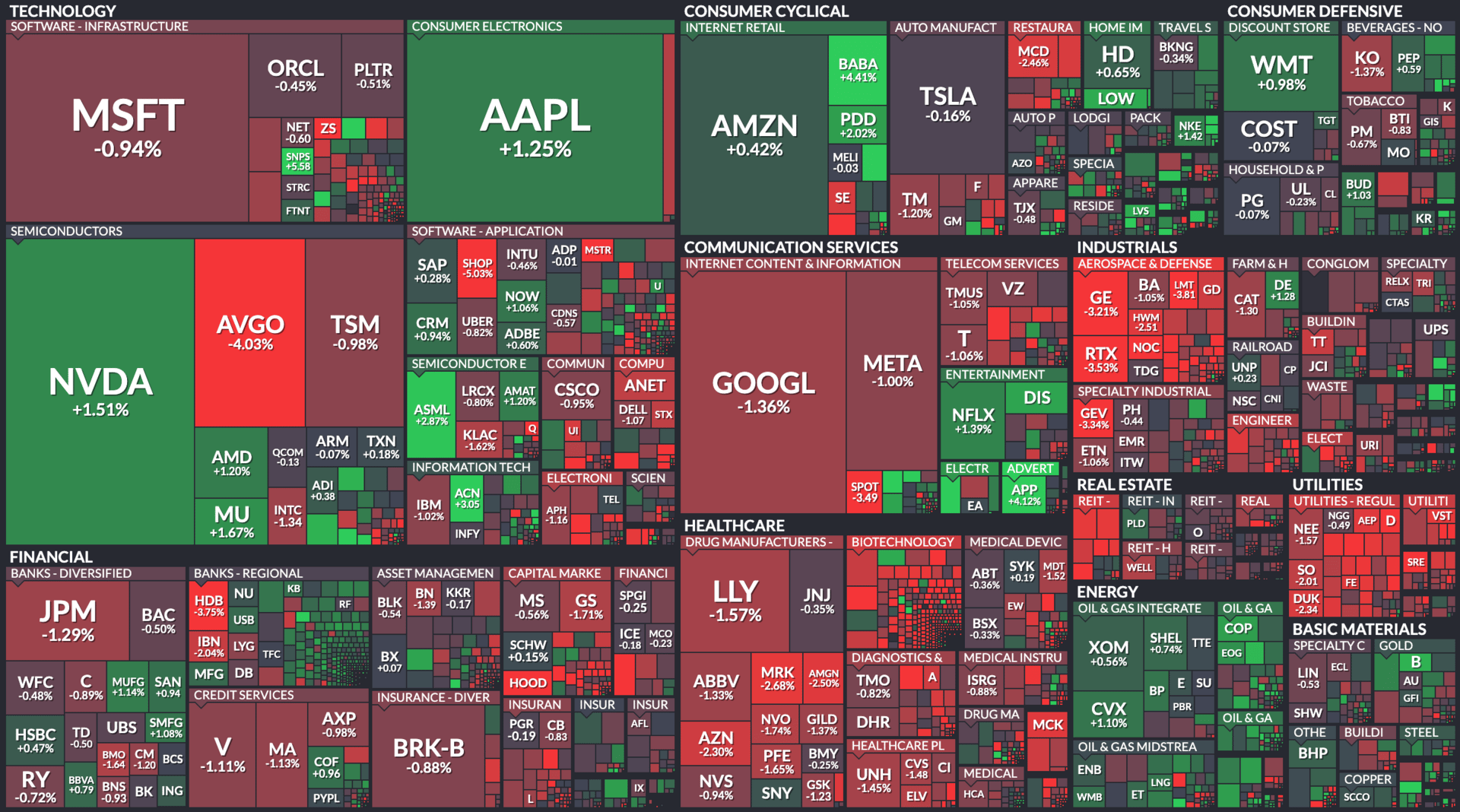

🟥 | US stocks slipped to start December as Bitcoin’s drop and AI profit-taking weighed on sentiment.

📈 | One Notable Gainer: Synopsys $SNPS ( ▲ 2.58% ) rose after Nvidia $NVDA ( ▲ 2.99% ) invested $2B in its shares as part of a new strategic partnership.

📉 | One Notable Decliner: Moderna $MRNA ( ▼ 1.35% ) fell following a scathing, unsubstantiated FDA memo.

— Brooks & Cas

Sponsored by Safe & Green Development Co

Safe & Green Development Corp. (NASDAQ: SGD) trades in true microcap territory. But it could potentially be poised for major gains.

The firm acquired Resource Group US Holdings and now converts organic waste into commercial soil and mulch products.

SURGRO gives it a proprietary foothold in a $30 billion space under pressure to replace peat.

Management raised $9 million and eliminated convertible debt to strengthen execution.

SGD now enters 2026 with capital, clarity, and a sharp focus on scale. This small name bringing green back might just be a big opportunity to bring in greenbacks.

MARKET SNAPSHOT

All Stock Heatmap. Credit: Finviz

Market Movers

DOORDASH, JOBY, DISNEY

DoorDash $DASH ( ▼ 0.03% ) rose after Sequoia’s Alfred Lin bought more than 514K shares worth about $100M.

Joby Aviation $JOBY ( ▲ 2.09% ) fell after Goldman Sachs initiated coverage with a Sell rating.

Disney $DIS ( ▼ 1.61% ) gained after Zootopia 2 delivered strong Thanksgiving weekend box office results.

Coupang $CPNG ( ▲ 3.93% ) disclosed a data breach affecting more than 33M customers.

Wynn Resorts $WYNN ( ▼ 4.39% ) climbed after Goldman Sachs added the stock to its conviction buy list.

To monitor hot stocks in real time, check out The Street Feed.

Tomorrow's Trade Idea, Today

A NEW EV AVIATION NAME WITH BIG UPSIDE

High-Risk, High Altitude

Electric aircraft manufacturer Beta Technologies $BETA ( ▲ 5.32% ) has had a volatile start since its November debut. The stock has dropped sharply from IPO levels, but major banks believe it’s still taxiing on the runway.

Goldman Sachs $GS ( ▲ 0.78% ), Morgan Stanley $MS ( ▲ 0.29% ), Bank of America $BAC ( ▼ 0.04% ), and Citi $C ( ▲ 1.14% ) have all initiated coverage with Buy ratings. Citi came out the gates the most bullish, setting a target of $41, implying nearly 60% upside from recent levels.

A Different Path for Electric Aviation

Analysts argue that the pullback has created an appealing entry point in a company still early in its commercial journey.

Beta raised more than $1 billion in its IPO. It is now moving toward a series of FAA certifications that could open real revenue channels before the decade ends.

Goldman says Beta is best positioned among emerging electric aircraft manufacturers. Early execution and a focused strategy stand out.

Many electric aircraft concepts hinge on commercial passenger service, which brings regulatory and operational hurdles. Beta is taking a different route. The company is targeting military, medical, and cargo missions. Citi says this sidesteps the most complex risk factors in early-stage aviation adoption.

Positioned for Liftoff

Beta also has an infrastructure edge. The company has built a national charging network with more than 80 sites. That network supports both the CX300, a traditional takeoff aircraft, and the A250, a vertical takeoff model.

But the biggest long-term story may be aftermarket services. Citi notes that maintenance and battery replacement can generate far more lifetime profit than the aircraft sale itself. Beta has designed its aircraft portfolio around that margin model.

With certification milestones on the horizon, a charging network already in place, and early interest from defense and medical operators, analysts think Beta is engineered for long-term profitability. For investors looking to take on a high-risk, high-reward sector, Wall Street says Beta is an alpha player.

Presented by Street Sheet Research

If you read The Street Sheet, you consider yourself a serious investor.

If you subscribe to Street Sheet Research, you’ll be one.

And, today only, you can get in at an unbeatable entry point.

Street Sheet Research, our premium tier, provides institutional-grade equity research for everyday investors. And through midnight tonight, you can sign up for 70% off: just $59 for your first year.

It’s never taken less money to make money. So, if you’ve been considering taking your investing to the next level, now is your last chance.

OVERHEARD ON THE STREET

AP: Bitcoin $BTC.X ( ▲ 4.46% ) fell to just above $85K, extending a two-month slide that also pulled Coinbase $COIN ( ▲ 5.34% ), Robinhood $HOOD ( ▲ 3.86% ), and Riot Platforms $RIOT ( ▲ 0.86% ) lower.

Bloomberg: OpenAI took an ownership stake in Thrive Holdings and will partner with it to accelerate AI adoption in business services.

CNBC: Eli Lilly $LLY ( ▼ 3.23% ) cut Zepbound vial prices on LillyDirect to $299-$449 a month starting Dec. 1.

USA Today: The Supreme Court will hear Cox’s $1B piracy case, a ruling that could reshape ISP liability and internet access nationwide.

WSJ: Starbucks $SBUX ( ▼ 1.29% ) agreed to a $38.9M NYC settlement, including $35.5M to over 15K workers and $3.4M in penalties.

FRIDAY’S POLL RESULTS

Are you bullish or bearish on Roblox $RBLX ( ▼ 1.78% ) over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

17(b) Disclosure: This message is a paid advertisement for Safe & Green Development Corp. (NASDAQ: SGD). The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Safe & Green Development Corp. (NASDAQ: SGD) is a client of Interactive Offers who has contracted Tag The Flag LLC dba The Street Sheet. Through Interactive Offers, Safe & Green Development Corp. (NASDAQ: SGD) agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $3,000 fee in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.