HAPPY TUESDAY TO THE STREET.

From courtrooms to capital gains, it was tech’s week.

Alphabet $GOOGL ( ▲ 4.01% ) jumped after dodging a breakup, Apple $AAPL ( ▲ 1.54% ) climbed on its coattails, and an underrated chipmaker landed a $10B customer. Add it up, and the eight trillion-dollar megacaps are now worth $21T combined.

That’s more than a third of the S&P 500. Hope you like concentration risk!

🟥 | US stocks slipped today after labor data came in well below expectations for the second month in a row, raising both job market fears and rate cut hopes.

📈 | One Notable Gainer: Broadcom $AVGO ( ▼ 0.4% ) beat the broader S&P 500 after reporting better-than-expected earnings — and a mega-deal with OpenAI to produce its own AI chips.

📉 | One Notable Decliner: Analysts gave Lulu $LULU ( ▲ 2.42% ) lemons (in the form of at least seven downgrades) after the retailer reported a disappointing quarter, blemished by tariff shocks and slowing demand.

Finally, read to the end for a shockingly honest meme stock shill…

— Brooks & Cas

Sponsored by Pacaso

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from Maveron, Greycroft, and more. They even reserved the Nasdaq ticker PCSO.

And you can join them for just $2.90/share. Just don’t wait. Pacaso’s opportunity officially ends September 18.

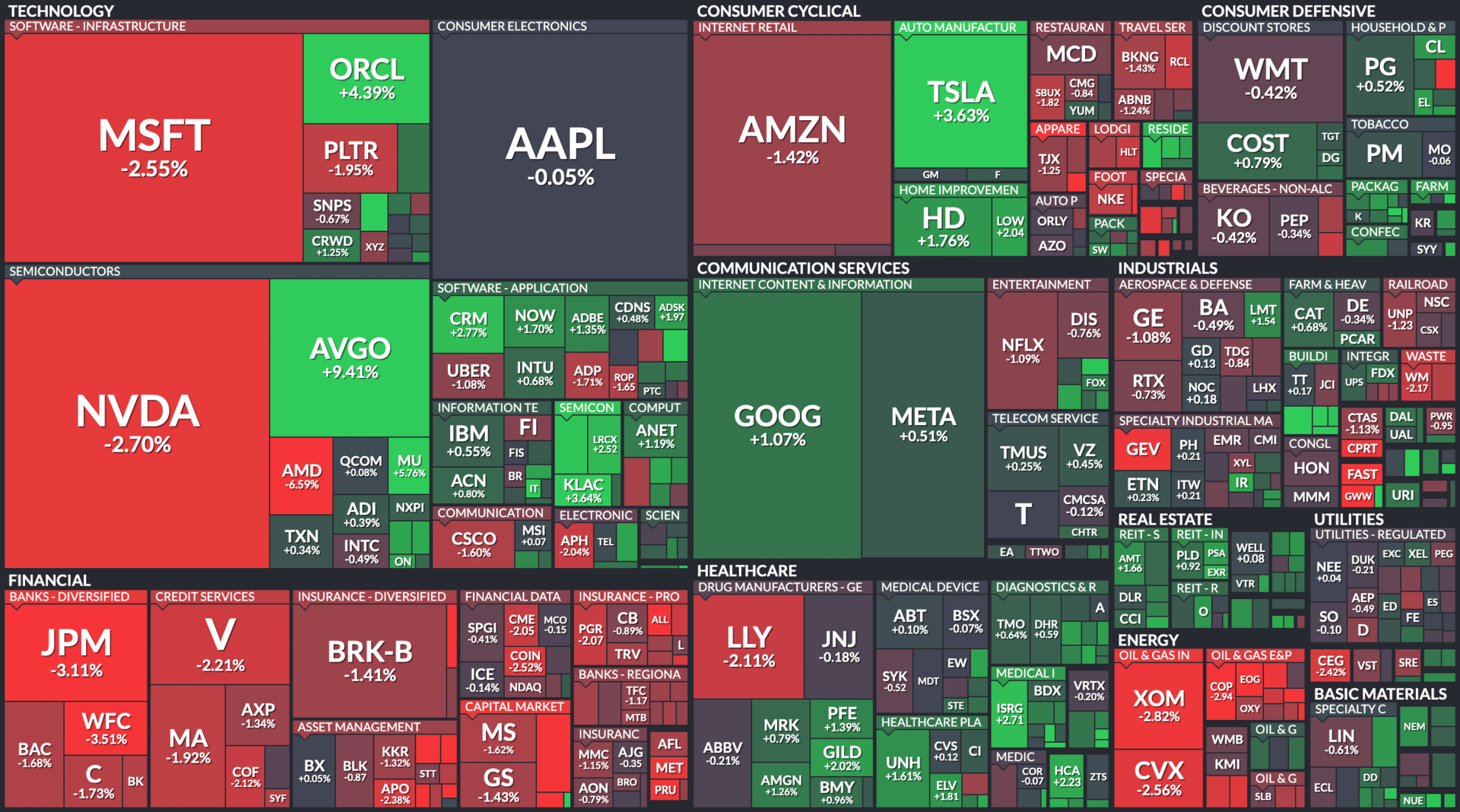

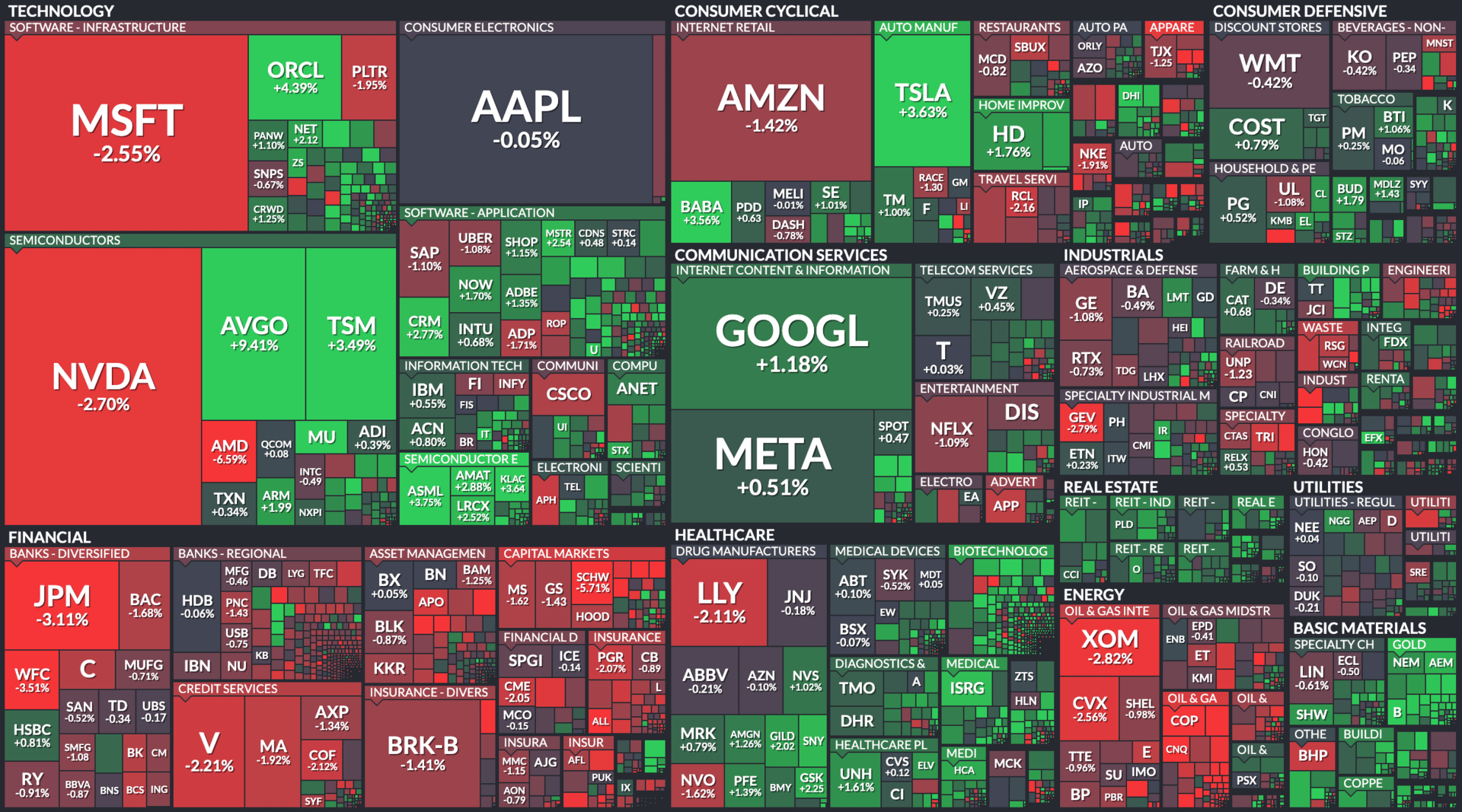

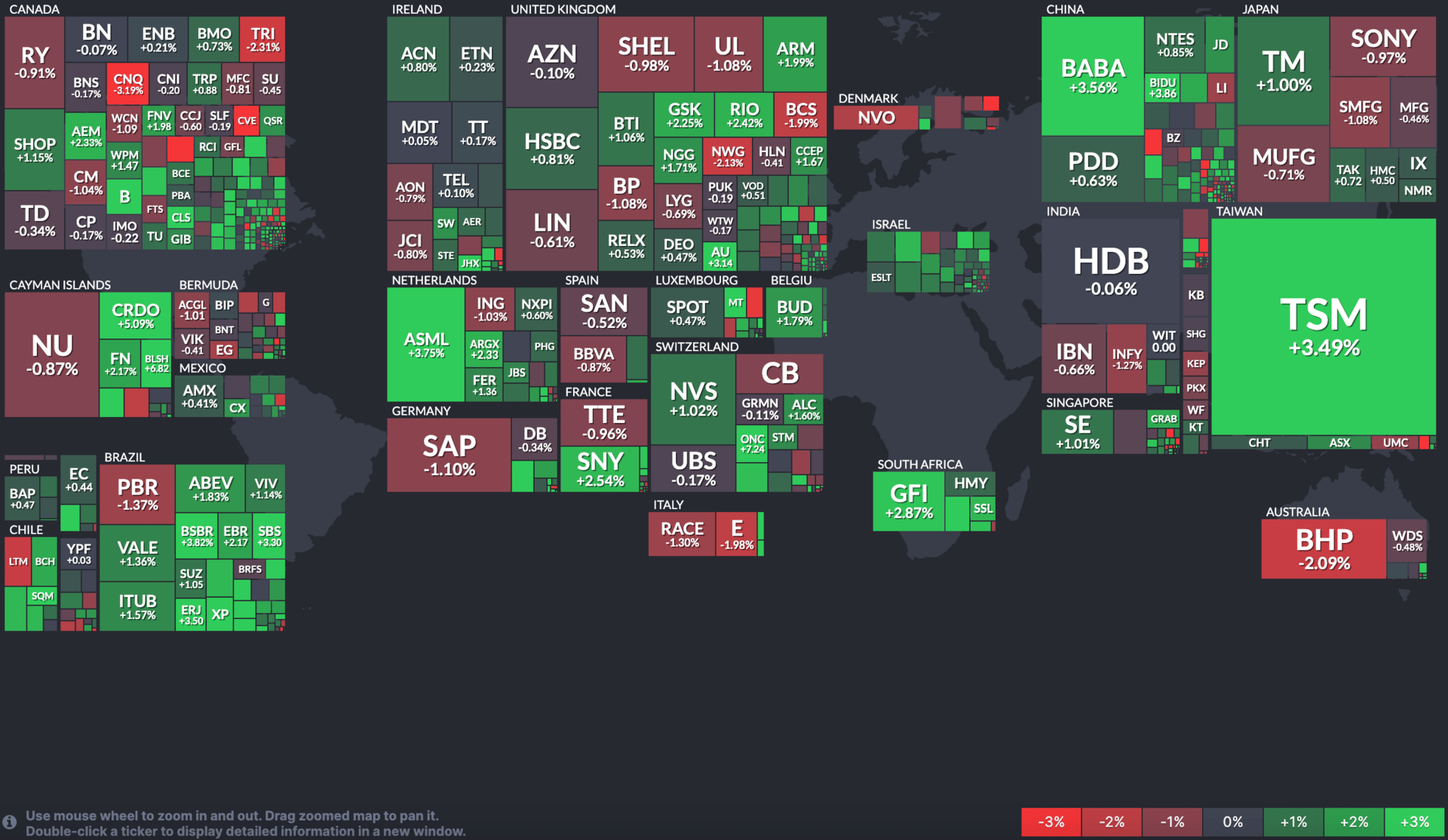

STOCK HEATMAPS

S&P 500 Heatmap. Credit: Finviz

All Stock Heatmap. Credit: Finviz

Global ADR snapshot. Credit: Finviz

Market Movers

NVIDIA, BILL.COM, KENVUE

$AMD ( ▼ 1.58% ) / $NVDA ( ▲ 1.02% ) AMD, Nvidia slump as Broadcom gets new customer for AI chip (SeekingAlpha)

$BILL ( ▼ 0.92% ) Starboard built big stake in BILL Holdings, plans to nominate directors (Reuters)

$KVUE ( ▲ 0.32% ) Kenvue Sinks on Report RFK Jr. Will Link Tylenol to Autism (Bloomberg)

$IOT ( ▼ 0.04% ) Samsara Stock Soars on 'Internet of Things' Firm's Results, Outlook (Investopedia)

$NX ( ▲ 1.85% ) Quanex Building Products misses Q3 2025 EPS forecast (Investing.com)

OVERHEARD ON THE STREET

CNN: The US added just 22K jobs in August, well below expectations of 75K, as unemployment rose to 4.3%, the highest rate since 2021.

Reuters: Tesla’s $TSLA ( ▲ 0.03% ) board proposed a $1T pay package for Elon Musk, the largest in history, tied to ambitious AI and robotics goals.

CNBC: The 30-year mortgage rate fell 16 basis points to 6.29%, its biggest one-day drop in more than a year.

Bloomberg: Here’s everything Apple $AAPL ( ▲ 1.54% ) will unveil at its Sept. 9 “Awe Dropping” event, including the iPhone 17, new smartwatches, and more.

AP: The EU fined Google $GOOGL ( ▲ 4.01% ) $3.5B for antitrust violations in ad tech and ordered it to end self-preferencing practices.

Tomorrow's Trade Idea, Today

E.L.F. BEAUTY IS ON THE RHODE TO RICHES

Outshining the Competition

The “Lipstick Index” dictates that beauty sales spike in times of economic downturns. The opposite may be true, too.

As the broader market continues to rally, cosmetics stocks have stumbled over the past year, weighed down by slowing growth and shifting consumer demand. But E.l.f. Beauty $ELF ( ▲ 3.17% ) is proving to be the exception to the rule.

The brand has gained market share for 26 straight quarters, largely due to the strength of its social media marketing and discount pricing. TD Cowen $TD ( ▲ 1.23% ) analyst Oliver Chen called E.l.f. a “structural growth story,” and argued its small size relative to larger peers may leave room for faster growth.

Rhode to Riches

In the June quarter, sales grew 9% year-over-year to $354 million, about twice the industry pace. International revenue jumped 30%, still less than a fifth of the total, while US sales rose 5%.

Deutsche Bank $DB ( ▲ 2.57% ) analyst Stephen Powers noted that second-quarter growth could reach 20% or more, aided by the acquisition of Rhode, Hailey Bieber’s skin-care line.

E.l.f. has also broadened its retail footprint, partnering with Dollar General $DG ( ▼ 0.76% ) to reach first-time customers in rural areas. Aggressive TikTok campaigns continue to boost awareness, with digital investments rising 5% year-over-year to $78 million in the quarter.

The Price of Popularity

The brand is not immune to tariff pressures. Gross margin slipped to 69.1% from 70.8% a year earlier, and management guided to further near-term impact.

However, the company offset that by raising prices by $1 on select products this summer, and reported steady demand since. Jefferies $JEF ( ▲ 0.49% ) analyst Ashley Helgans expects sales momentum to remain strong, despite the hikes.

Looking ahead, FactSet forecasts project annual sales growth of 18% through 2027, with earnings per share increasing more than 20% a year. Whether those targets hold may depend on how well E.l.f. balances rising costs with its low-price brand promise.

Sponsored by Pacaso

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, up 89,900%. No wonder thousands are taking the chance on Pacaso.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay also backed Pacaso.

And you can join them as an early-stage investor for just $2.90/share.

Just don’t wait. Pacaso’s opportunity officially ends September 18.

ON OUR RADAR

WSJ: US authorities arrested 475 people, including over 300 South Koreans, in an immigration raid at a Hyundai $HYMTF ( ▼ 7.44% ) site in Georgia.

The Verge: Top tech CEOs praised President Trump’s AI policies at a White House dinner, pledging major US investments and support.

AP: Fox News $NWSA ( ▲ 1.24% ) remains the top-rated US network two years after its $788M Dominion settlement.

Reuters: The US plans new rules restricting imports of Chinese drones and heavy-duty vehicles, citing national security concerns.

CNBC: The mystery of former Fed Governor Adriana Kugler’s abrupt resignation deepened after records showed conflicting details about her residence.

STREET TWEET

Sounds an awful lot like the "bigger fool theory" to me.

But then again, that is the go-to business model for cults, isn’t it?

Truth in advertising!

THURSDAY’S POLL RESULTS

Are you bullish or bearish on sports betting stocks over the next 12 months?

▇▇▇▇▇▇ 🐂 Bullish

▇▇▇▇▇▇ 🐻 Bearish

And, in response, you said:

🐂 Bullish — “Owner of ticker SRAD, growing nicely pre-World Cup.”

🐻 Bearish — “Football pool 40 years ago — never bet on sports since. Who bets on sports?”

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals. Past performance is not indicative of future results. Comparisons to other companies are for informational purposes only and should not imply similar success.

17(b) Disclosure: This message is a paid advertisement for Pacaso. The Street Sheet investor awareness services, including newsletters, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in The Street Sheet publications or presentations, including web content subject to change. The Street Sheet and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. The Street Sheet is a research service not owned or managed by registered brokers and therefore this site does not make any investment recommendations. The information contained herein is not intended to be used as the basis for investment decisions and should not be construed as advice intended to meet the particular investment needs of any investor. The information contained herein is not a representation or warranty and is not an offer or solicitation of an offer to buy or sell any security. To the fullest extent of the law Tag The Flag LLC dba The Street Sheet our specialists, advisors, and partners will not be liable to any person or entity for the quality, accuracy, completeness, reliability or timeliness of the information provided, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information provided to any person or entity (including but not limited to lost profits, loss of opportunities, trading losses and damages that may result from any inaccuracy or incompleteness of this information). Stock market investing is inherently risky. Tag The Flag LLC dba The Street Sheet is not responsible for any gains or losses that result from the opinions expressed in newsletters, publications or presentations, including web content that it publishes electronically or in print. We strongly encourage all viewers to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca. Pacaso is a client of Dealmaker who has contracted Tag The Flag LLC dba The Street Sheet. Through Dealmaker, Pacaso agreed to pay Tag The Flag LLC dba The Street Sheet a one-time $10,000 in exchange for this advertisement, sent to its subscribers. Programs provided to subscribers and Companies by Tag The Flag LLC dba The Street Sheet are designed to help small-cap companies communicate their investment characteristics. Tag The Flag LLC dba The Street Sheet investor awareness services include newsletters, publications or presentations, including web content.