Happy Wednesday afternoon to everyone on The Street. Here's a snapshot of where markets ended the trading session, plus tomorrow's trade idea delivered to you today.

🟩 | US stocks rose on Wednesday. The Dow closed higher by more than 100 points as Wall Street rebounded after a big Tuesday sell-off.

📈 | One Notable Gainer: Shares of Lyft spiked 35% after the company announced better-than-expected Q4 earnings. ICYMI: the ride-share company made a major typo in its earnings release.

📉 | One Notable Decliner: Airbnb stock fell 2% even though the company beat top-line expectations in its latest quarter. Some traders are concerned that room-night booking growth could moderate in 2024.

3️⃣ | Tomorrow's Trade: Goldman’s 3 ‘Attractive’ Value Stocks. Scroll down for more.

YESTERDAY’S POLL RESULTS

🟨🟨🟨🟨⬜️⬜️ 🐂 Bullish

🟩🟩🟩🟩🟩🟩 🐻 Bearish

S&P 500 Heatmap. Credit: Finviz

All stocks on US exchanges. Credit: Finviz

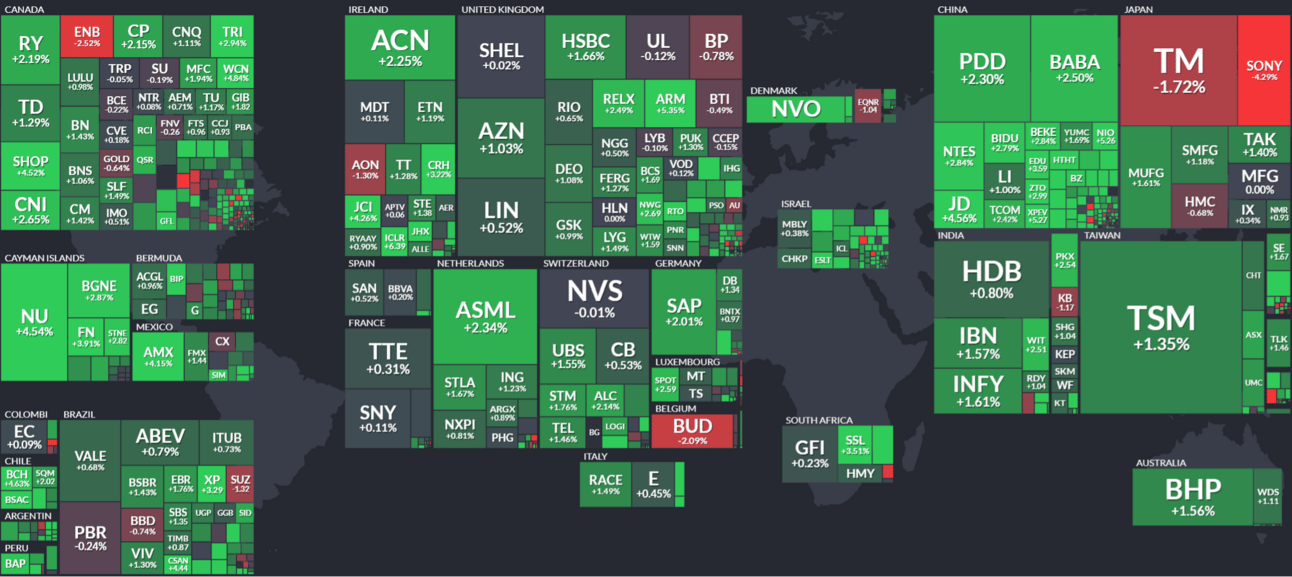

Global ADR snapshot. Credit: Finviz

MARKET MOVERS

UBER: Uber's stock surged by 15% to reach a new 52-week high following the announcement of a $7 billion share repurchase program. The company also projected mid to high-teens growth in gross bookings over the next three years.

HOOD: Robinhood Markets' stock rose 13% after reporting unexpected earnings and revenue beats, with earnings per share at 3 cents compared to an expected loss of 1 cent per share. Revenue was $471 million, exceeding analysts' $457 million expectations.

MODG: Topgolf Callaway's shares advanced 12% after reporting a narrower-than-expected adjusted loss for the fourth quarter, with revenue of $897 million surpassing estimates.

MGM: MGM Resorts International's shares dropped 6% despite better-than-expected fourth-quarter results, as the U.S. regional casino segment was impacted by a strike in Detroit and labor costs.

KHC: Kraft Heinz's stock fell over 5% after fourth-quarter revenue missed expectations, reporting $6.86 billion compared to the projected $6.99 billion, with adjusted earnings per share of 78 cents slightly above analyst estimates.

PRESENTED BY CBOE

OVERHEARD ON THE STREET

BBG: Elon Musk’s Starlink won a license to operate in Israel and parts of the Gaza Strip after agreeing to a series of measures to prevent Hamas from getting access to its satellite internet services.

POLITICO: Federal Reserve Chair Jerome Powell told House Democrats that the U.S. needs a legislative framework for stablecoins, Politico reported.

Reuters: Nvidia briefly overtook Google-parent Alphabet's stock market capitalization to become the third-biggest U.S. company on Wednesday.

Investing: UBS says the S&P 500 is on track to hit its bull-case forecast of 5300.

Street Insider: Bitcoin’s best days are yet to happen as the ETF-driven market fuels fears of missing out (FOMO), Bernstein analysts Gautam Chhugani and Mahika Sapra said in a note. In this context, they believe BTC is well-placed to soar to new record highs.

TOMORROW’S TRADE IDEA, TODAY

The Price Doesn’t Match the Potential

If you’re looking for capital appreciation, Goldman Sachs has you covered.

The investment firm recently released 3 “attractive” value stocks it feels could see at least 50% share price appreciation over the next 12 months. All three are European companies.

According to Goldman, each of these stocks feature cheap valuations in comparison to their earnings growth potential. So much so that the firm feels it puts them head-and-shoulders above other European stocks in terms of value.

Flying Under the Radar

The companies include International Consolidated Airlines Group (ICAGY), CNH Industrial (CNHI), and Philips (PHG).

International Consolidated Airlines Group is the parent company of British Airways. Patrick Creuset, Goldman’s airline analyst, listed the stock as a “buy” in January after the price did not rise following increased earnings estimates. Cruset believes the stock has a 64% upside from the current price.

The stock is down 2.16% YTD despite a strong rally in late January.

Don’t Sleep On These Stocks Either

Philips, a Dutch conglomerate, could see its price rise as much as 51% over the next 12 months, per Goldman. The firm believes it has “robust margin progression” in store for 2024. These margin improvements will come on the backs of cheaper manufacturing costs and softer pricing pressure. The company is also looking to expand AI technology throughout its healthcare arm.

Goldman also has CNH rated as a “buy” with shares expected to hit $19, a 57% increase. Analysts are confident that the stock was oversold due to investor fears surrounding the agriculture equipment market. The investment bank is confident the company can improve margins through cost cutting.

If Goldman is right, investors looking for undervalued companies may find exactly what they’re looking for across the pond this year.

PRESENTED BY CBOE

ON OUR RADAR

The Hill: Rep. Mike Turner, an Ohio Republican, the head of the House Intelligence Committee, said Wednesday he had information about a serious national security threat and urged the administration to declassify the information so the U.S. and its allies can openly discuss how to respond.

BI: The average millennial has seen their net worth double in the last five years, from about $54,000 to $115,000, according to The Federal Reserve.

WSJ: China's baby bust is happening faster than many expected, raising fears of a demographic collapse. “China will have just 525 million people by the end of the century. That’s down from their previous forecast of 597 million and a precipitous drop from 1.4 billion now.”

BI: A stock market correction appears imminent after the S&P 500 rallied 21% over a period of 14 weeks, according to Fundstrat's Tom Lee.

YF: An informal poll of Tesla (TSLA) institutional investors done by Morgan Stanley found many are bearish and expect the stock to underperform over the next six months.